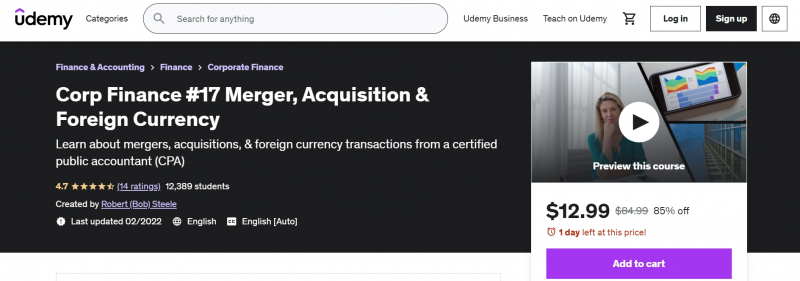

Corp Finance #17 Merger, Acquisition & Foreign Currency

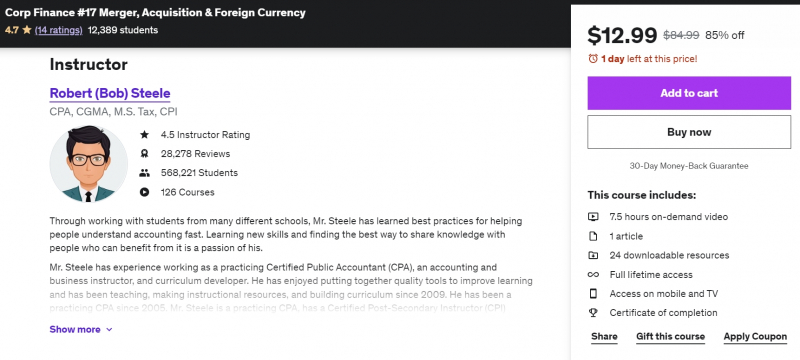

Standing at the second position on the list of the Best Online Mergers & Acquisitions Courses is Corp Finance #17 Merger, Acquisition & Foreign Currency Mergers and acquisitions, as well as foreign currencies, will be covered in this course. Many examples will be provided, both in the form of PowerPoint presentations and Excel worksheet problems. Along with the instructional films, the Excel worksheet presentations will contain a downloaded Excel workbook with at least two tabs, one with the solution and the other with a preformatted worksheet that may be filled in a step-by-step manner.

You will learn what acquisitions and mergers are and how they're structured, including cash and stock-for-stock transactions. The course will cover various company merger and acquisition procedures, as well as the concept of a tender offer. Learners will also be aware of some tax issues associated with purchases, such as those resulting from a tax loss carryover.

Learners will figure out how a merger will affect earnings per share. Foreign currency exchange rates and transactions will be covered in this course. Learners will learn how to compute foreign currency purchases and sells. Learners will also learn how to limit risk by using forward contracts as a hedge. Learners will be able to calculate forward contracts. Learners will go over how to use forward contracts for speculation. Learners will also talk about how forward contracts can be utilized to mitigate the risk of foreign currency volatility.

Requirements:

- An understanding of corporate finance fundamentals

Who this course is for:

- Business students

- Business professionals

Subtitles: English

Udemy Rating: 4.7/5.0

Enroll here: https://www.udemy.com/course/corp-finance-17-merger-acquisition-foreign-currency/