Top 8 Best Online Mergers & Acquisitions Courses

Are you wondering which remote classroom to attend? You have spare time and want to broaden your horizon about a specific field of study whilst just staying at ... read more...home. Thus, to satisfy the burgeoning demand for online yet qualifying courses, Toplist has complied a rundown of the Best Online Mergers & Acquisitions Courses offered by the prestigious universities, famous companies, top organizations and knowledgeable instructors across the globe for who in need!!!

-

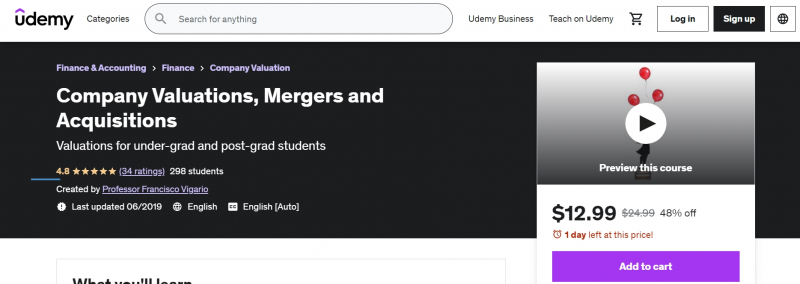

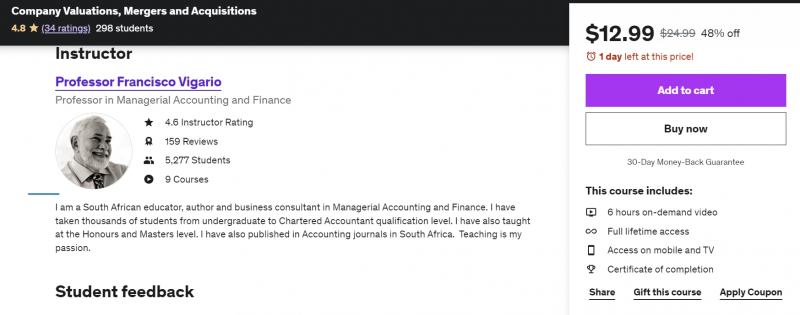

This course is for intended students who are studying Corporate Finance as an undergraduate or graduate student. Free cash flow values, dividend valuations, earnings valuations, and mergers & acquisitions are among the subjects covered.

During this course of Company Valuations, Mergers and Acquisitions, you are able to learn how to value a company for the purpose of a majority or a minority valuation, the fundamental application of valuation models, how to design templates to answer valuation questions, identifying and applying the planning period with the terminal value, valuation of Majority versus minority holdings, mergers and acquisition for companies in the same industries as well as conglomerate takeovers, how to read and answer examination questions, the instructor will take you through several valuation questions with increased difficulty, teaching you how to integrate other Finance topics into the solution.

Requirements:

- Financial Accounting first year course

Who this course is for:

- University and professional students that are studying Managerial Accounting and Finance

Subtitles:English

Udemy Rating: 4.8/5.0

Enroll here: https://www.udemy.com/course/company-valuations-mergers-and-acquisitions/

https://www.udemy.com

https://www.udemy.com -

Standing at the second position on the list of the Best Online Mergers & Acquisitions Courses is Corp Finance #17 Merger, Acquisition & Foreign Currency Mergers and acquisitions, as well as foreign currencies, will be covered in this course. Many examples will be provided, both in the form of PowerPoint presentations and Excel worksheet problems. Along with the instructional films, the Excel worksheet presentations will contain a downloaded Excel workbook with at least two tabs, one with the solution and the other with a preformatted worksheet that may be filled in a step-by-step manner.

You will learn what acquisitions and mergers are and how they're structured, including cash and stock-for-stock transactions. The course will cover various company merger and acquisition procedures, as well as the concept of a tender offer. Learners will also be aware of some tax issues associated with purchases, such as those resulting from a tax loss carryover.Learners will figure out how a merger will affect earnings per share. Foreign currency exchange rates and transactions will be covered in this course. Learners will learn how to compute foreign currency purchases and sells. Learners will also learn how to limit risk by using forward contracts as a hedge. Learners will be able to calculate forward contracts. Learners will go over how to use forward contracts for speculation. Learners will also talk about how forward contracts can be utilized to mitigate the risk of foreign currency volatility.

Requirements:

- An understanding of corporate finance fundamentals

Who this course is for:

- Business students

- Business professionals

Subtitles: English

Udemy Rating: 4.7/5.0

Enroll here: https://www.udemy.com/course/corp-finance-17-merger-acquisition-foreign-currency/

https://www.udemy.com

https://www.udemy.com -

Mergers & Acquisitions - M&A, Valuation & Selling a Company is among the Best Online Mergers & Acquisitions Courses. This will benefit you if you are an entrepreneur, a senior manager, or a business school student. In mergers and acquisitions, the difference between right and catastrophic can cost you a lot of money, perhaps millions of dollars. After finishing this course, you can better understand what is meant by Mergers and Acquisitions, Corporate Valuation and the role of Advisers and how to manage them, find out what is important to both sides in a Management Buyout (MBO), approach the sale of their company with greater confidence, gain valuable insights into the Sales Process to avoid making expensive mistakes, gain an introduction to Negotiation and Term Sheets.

Requirements:

- No prior knowledge is assumed

- No materials required

Who this course is for:

- Any Entrepreneur considering selling a business at some point in the future and wants to improve their knowledge of Mergers and Acquisitions

- Students of Investment Banking, Corporate Finance or Mergers and Acquisitions who want to gain insights not in their text books

- Professional Advisers who believe they can still learn a thing or two about Mergers and Acquisitions

- Senior Managers who need to improve their Corporate Finance and Mergers and Acquisitions knowledge

Subtitles:English

Udemy Rating: 4.5/5.0

Enroll here: https://www.udemy.com/course/how-entrepreneurs-can-maximise-value-when-selling-a-business/

https://www.udemy.com

https://www.udemy.com -

Possessing the second place on the list of the Best Online Mergers & Acquisitions Courses is The Complete Mergers & Acquisitions Master Class! The Complete Mergers & Acquisitions Master Class! Because all businesses are searching for synergies and partnerships to improve their market position. Mergers and acquisitions can help organizations grow in a safe way.

If you look around, read finance publications, and watch business shows, you'll see that mergers and acquisitions are closer than you believe. You would believe my words if you looked up historical Mergers and Acquisitions agreements. Examine the Chinese and American marketplaces to see how many transactions have previously been made and how many cases are currently being negotiated. It's time to brush up on M&A principles and prepare yourself with the abilities you'll need if your company decides to pursue mergers and acquisitions!

Requirements:

- Have an idea about business, Accounting and Finance

- Microsoft Excel basics

- You must have passion as well!

Who this course is for:

- Business & law students, Accountants, Finance officers, Finance managers, Business analysts,

- Financial analysts, Entrepreneurs, any one interested in business

- Enthusiasts and Aspirants in the field of Business, Law, Accounts, Finance, and Entrepreneurship

Subtitles: English

Udemy Rating: 4.3/5.0

Enroll here: https://www.udemy.com/course/the-complete-mergers-and-acquisitions-course-ma-made-easy/

https://www.udemy.com/

https://www.udemy.com/ -

As one of the top Best Online Mergers & Acquisitions Courses, Mergers and Acquisitions Modeling using Excel Course will help you to learn about the various terminology used in merger modeling and discuss numerous merger case studies in this course. You will also learn how the proposed merger would be funded. Various charges, such as financing costs, consulting fees, and purchase price allocation, would be calculated with the acquisition in mind. This course offers a primer on the theoretical aspects of mergers and acquisitions. You will go over all of the important topics in mergers and acquisitions by using real-life examples and case studies.

You will also go through the comprehensive merger model, where you will learn how to make an assumption sheet and calculate the acquisition price. You will also figure out how the merger will be paid for. Various charges, such as financing costs, consulting fees, and purchase price allocation, would be calculated with the acquisition in mind. The primary component of M&A modeling begins with the creation of the pro forma balance sheet and P&L, as well as the accretion/dilution analysis and the preparation of sensitivity tables. With the use of case examples, you will study merger modeling basics in these courses. You will gather information from the company's news releases and investor presentations, ensuring the accuracy of the data.

Requirements:

- Basic Accounting and MS Excel Knowledge

- A computer with MS Excel

Who this course is for:

- Students who are pursuing CFA, MBA (finance), CA

- Professionals in the field of investment banking/equity research

Subtitles: English

Udemy Rating: 4.3/5.0

Enroll here: https://www.udemy.com/course/a-beginners-guide-to-basics-of-mergers-acquisitions/

https://www.udemy.com

https://www.udemy.com -

This AltaClaro introductory course covers fundamental and intermediate legal ideas in M&A law (the buying, selling, and combining of different companies, their assets, and their businesses). It delves into the deal-making process and the three most prevalent M&A scenarios: asset purchases, stock purchases, and mergers. Using real-world examples, students will learn about basic ideas and language, business and regulatory drivers, and key differences across structures. You'll lay a solid foundation for learning topics covered in advanced courses.

Julie Ryan (Partner, Acceleron Law Group; law professor) is an AltaClaro expert educator, and Brian Reinthaler is the moderator (Certified Career Coach and Founder, Against the Grain Coaching).Requirements:

- Basic knowledge of business concepts

Who this course is for:

- Anybody who wants to know how M&A works

Subtitles: English

Udemy Rating: 4.2/5.0

Enroll here: https://www.udemy.com/course/introduction-to-mergers-acquisitions-ma/

https://www.udemy.com

https://www.udemy.com -

Business Valuation - Mergers and Acquisitions is designed for aspiring financial professionals and practicing accountants interested in learning more about mergers and acquisitions. It covers the fundamentals, as well as the many forms of mergers and acquisitions and how to evaluate synergies. The course is based on a variety of global M&A transactions. Learners will be able to compute the Share Exchange Ratio and appraise the value of firms. You also get Valuation Templates that you can download and use in your valuation engagements. After finishing this course, you are able to learn Business Valuation, Mergers and Acquisitions.

Requirements:

- Basic knowledge of accounting or commerce

Who this course is for:

- Post Graduate students

- Undergraduate students

- Finance students

- Finance professionals

- Senior business professionals

Subtitles: English

Udemy Rating: 4.3/5.0

Enroll here: https://www.udemy.com/course/valuation-for-mergers-and-acquisitions/

https://www.udemy.com/

https://www.udemy.com/ -

Mergers & Acquisitions - for Investment Bankers & Companies, one of the Best Online Mergers & Acquisitions Courses, is designed to provide you a hands-on approach to comprehending, designing, and executing real-world M&A deals. This course was inspired by his personal frustrations in attempting to discover a realistic and real-world guide to M&A while he was interviewing for an investment banking job and starting his career as an I-banker advising firms on multibillion-dollar transactions.

Even when the instructor quickly recognized that client-specific circumstances and transaction complexities, combined with ever-changing market conditions, frequently compel to either learn from my mistakes or seek help from senior directors. All of this prompted he to create a course based on "best practices," lessons learned, and real-world transaction experience to assist others entering this area.Requirements:

- No prior knowledge is required

Who this course is for:

- Students trying to break into the investment banking field

- Incoming investment bankers who are starting your role as a banker

- Management and founders of companies looking at acquiring or selling your business or assets

- M&A advisors such as lawyers, consultants, and accountants

- Anyone who wants to learn and gain insights on real world end-to-end M&A transaction execution

Subtitles: English

Udemy Rating: 4.3/5.0

Enroll here: https://www.udemy.com/course/mergers-acquisitions-for-investment-bankers-companies/

https://www.udemy.com

https://www.udemy.com