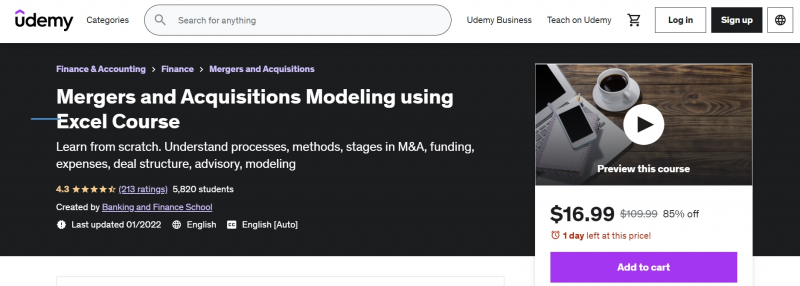

Mergers and Acquisitions Modeling using Excel Course

As one of the top Best Online Mergers & Acquisitions Courses, Mergers and Acquisitions Modeling using Excel Course will help you to learn about the various terminology used in merger modeling and discuss numerous merger case studies in this course. You will also learn how the proposed merger would be funded. Various charges, such as financing costs, consulting fees, and purchase price allocation, would be calculated with the acquisition in mind. This course offers a primer on the theoretical aspects of mergers and acquisitions. You will go over all of the important topics in mergers and acquisitions by using real-life examples and case studies.

You will also go through the comprehensive merger model, where you will learn how to make an assumption sheet and calculate the acquisition price. You will also figure out how the merger will be paid for. Various charges, such as financing costs, consulting fees, and purchase price allocation, would be calculated with the acquisition in mind. The primary component of M&A modeling begins with the creation of the pro forma balance sheet and P&L, as well as the accretion/dilution analysis and the preparation of sensitivity tables. With the use of case examples, you will study merger modeling basics in these courses. You will gather information from the company's news releases and investor presentations, ensuring the accuracy of the data.

Requirements:

- Basic Accounting and MS Excel Knowledge

- A computer with MS Excel

Who this course is for:

- Students who are pursuing CFA, MBA (finance), CA

- Professionals in the field of investment banking/equity research

Subtitles: English

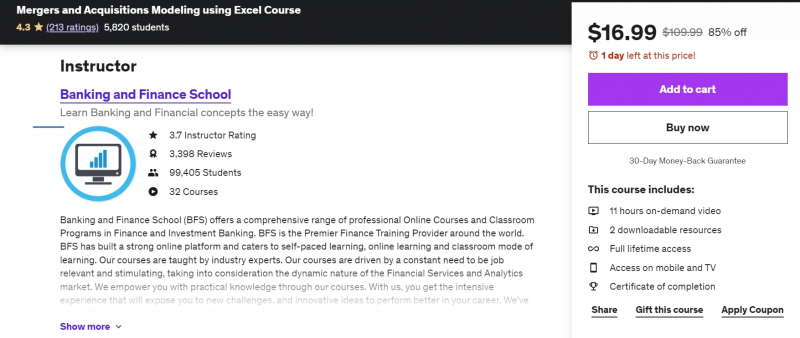

Udemy Rating: 4.3/5.0

Enroll here: https://www.udemy.com/course/a-beginners-guide-to-basics-of-mergers-acquisitions/