Fidelity

Fidelity Investments is a brokerage based in the United States that was created in 1946. It is overseen by top-tier regulatory bodies such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) (FINRA).

Fidelity is regarded as safe because to its extensive track record and regulation by top-tier financial regulators.

Fidelity is one of the largest stockbrokers in the United States, and it is regulated by top-tier authorities.

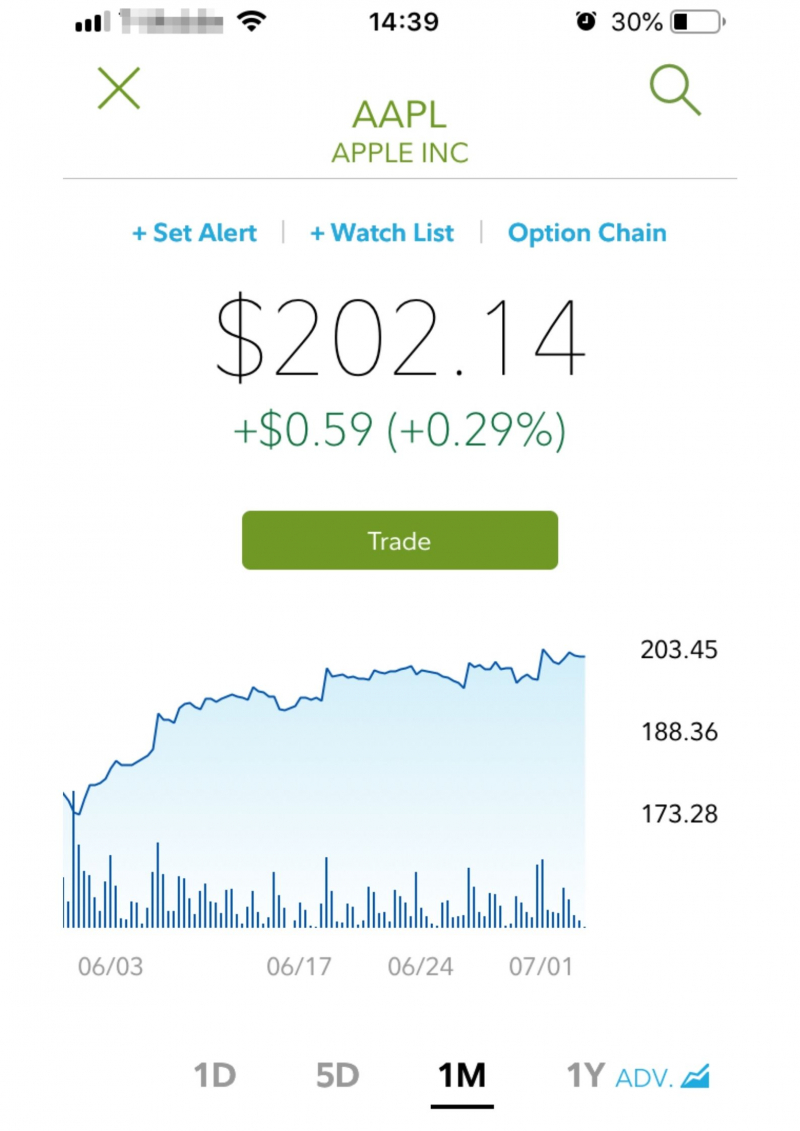

Fidelity provides no-commission US stocks and ETFs. The trading platforms and research are excellent, with several resources such as trade ideas and extensive fundamental data. The product offering covers worldwide stock exchanges in addition to the US market, which is unusual among US brokers.

Fidelity, on the other hand, has certain downsides. Some mutual funds have exorbitant fees, and margin rates are also exorbitant. You cannot trade cryptocurrencies or futures contracts.

Feel free to explore Fidelity's services because it features excellent research tools, an easy-to-use web trading interface, and no inactivity fee.

Recommended for investors and traders seeking quality research and excellent trading platforms.

Pros

• Commission-free US stocks and ETFs

• High mutual fund fees and margin rates

• Great trading platforms and research

Cons

• Slower account verification

• US and international stocks

• No crypto&futures

Fees score: 3.9

Website: www.fidelity.com