Zacks Trade

Zacks Trade is a discount broker established in the United States and a branch of LBMZ Securities. LBMZ Securities was established in 1978 and is governed by the top-tier US financial regulators, the SEC and FINRA.

LBMZ Securities' clearing and execution services are supplied by Interactive Brokers, a worldwide brokerage that is licensed by a number of top-tier financial regulators throughout the world.

If you're acquainted with Interactive Brokers' services, you'll see that many of Zacks Trade's offerings are similar. To summarize:

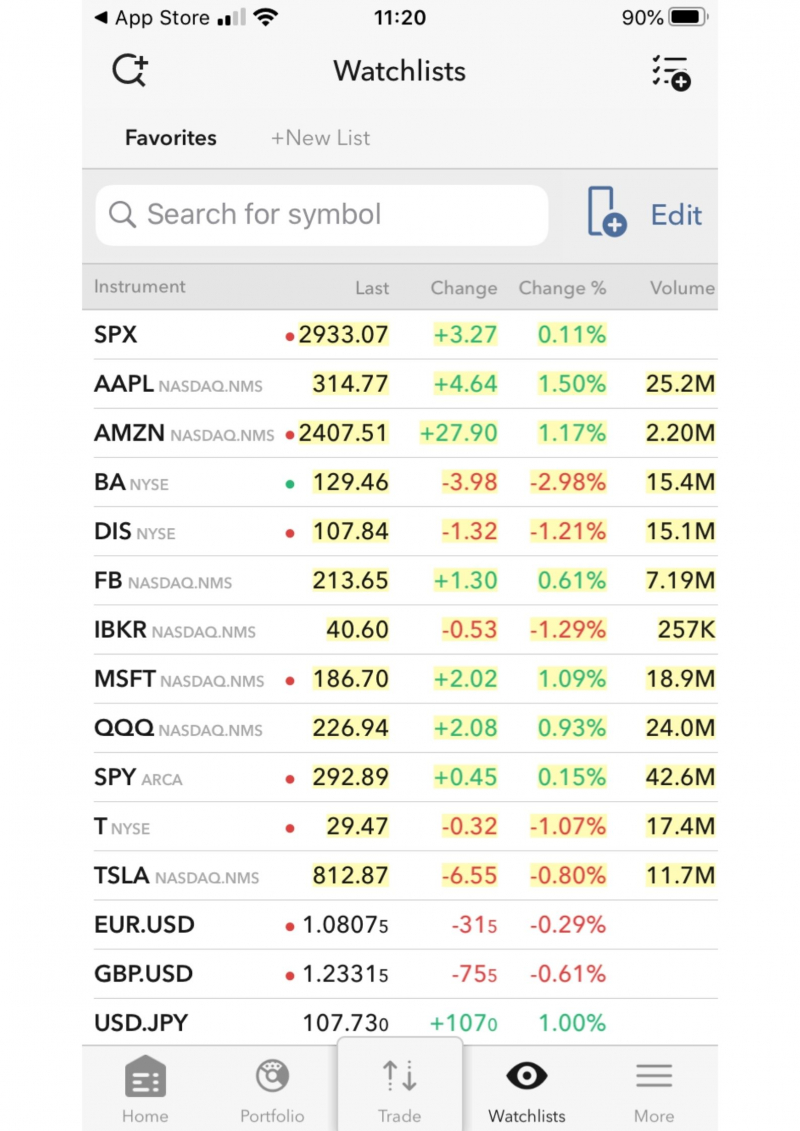

- Zacks Trade offers its own cost structure, product selection, instructional resources, and customer service. Trading FX, CFDs, and futures is not permitted, as it is at Interactive Brokers.

- The account opening and deposit/withdrawal methods, trading platforms, and research tools are all identical to those found at Interactive Brokers.

Zacks Trade is regarded as safe because to its extensive track record and oversight by top-tier regulators.

Why would someone prefer Zacks over Interactive Brokers, given that Zacks is more expensive? We discovered two probable explanations:

- Zacks is subject to SEC oversight, and all users are protected by SIPC, regardless of where they live.

- Zacks offers no-cost broker-assisted trading.

Zacks Trade is an excellent bargain broker in the United States. It is a branch of LBMZ Securities, which is regulated by the Securities and Exchange Commission and the Financial Industry Regulatory Authority (FINRA).

Zacks Trade, on the other hand, boasts reasonable costs, excellent stock and ETF selections, and excellent customer support.

However, there are certain limitations, such as the complexity of its desktop trading interface and research tools. The account opening process is difficult and time-consuming. Unlike Interactive Brokers, Zacks does not allow you to trade CFDs, futures, or cryptocurrency.

Feel free to give Zacks Trade a try because it offers a sample account and does not demand a minimum deposit.

Recommended for traders and investors searching for in-depth research tools, a diverse product offering, and affordable fees.

Pros

• Low fees

• Complex desktop platform and research tools

• Extensive stock and ETF selection

Cons

• Slow and complicated account opening

• Great customer service

• No futures and forex

Fees score: 4.2

Website: www.zackstrade.com