Top 5 Best Stock Brokers In The US

To assist you in locating the finest stock broker in the United States, we first picked high-quality brokers and then evaluated their trading and non-trading ... read more...expenses, with a particular emphasis on stock fees, inactivity fees, and withdrawal fees. Then we evaluated their stock choices, trading systems, and other aspects. Five brokers made it to the top of the list in the United States, and we highly suggest all of them to you. And now, without further ado, have a look at these.

-

Interactive Brokers, one of the largest bargain brokers in the United States, was formed in 1978. Several financial regulators throughout the world supervise the broker, including top-tier ones like the UK's Financial Conduct Authority (FCA) and the US Securities and Exchange Commission (SEC).

Interactive Brokers is regarded as safe due to the broker's several top-tier regulator licenses. The fact that it has a long track record, publicly reported financials, and is listed on a stock market all point to IB being a trustworthy service provider.

Interactive Brokers is one of the largest discount brokers established in the United States, and it is regulated by a number of top-tier authorities throughout the world. We suggest this broker for both skilled traders and regular individuals who want to trade in many stock markets.

On the bright side, IB charges relatively cheap fees, covers a wide range of markets and products, and provides a variety of research tools.

However, there are certain disadvantages. We were dissatisfied with the quality of customer support, and the account opening process is difficult. Unlike the web and mobile platforms, the desktop platform is sophisticated and difficult to grasp, particularly for novices.

If you're comfortable navigating sophisticated systems and like transparent, low-cost trading, Interactive Brokers is a good fit.Traders searching for extensive market access and a professional trading environment might choose this broker.

Pros

• Low trading fees

• Complicated account opening process

• Wide range of productsCons

• Complex desktop trading platform

• Many great research tools

• Understaffed customer serviceFees score: 4.5

Website: www.interactivebrokers.com

Video: Interactive Brokers

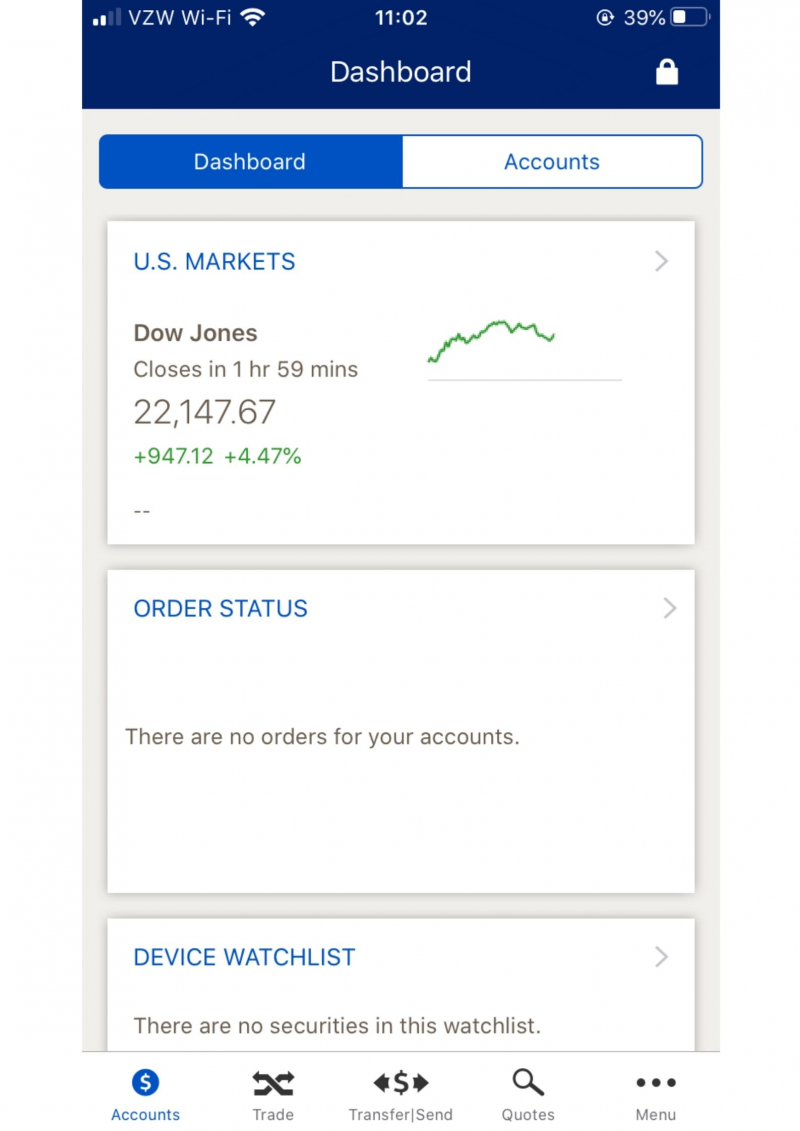

Interactive Brokers mobile trading platform - Photo: brokerchooser -

Fidelity Investments is a brokerage based in the United States that was created in 1946. It is overseen by top-tier regulatory bodies such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) (FINRA).

Fidelity is regarded as safe because to its extensive track record and regulation by top-tier financial regulators.

Fidelity is one of the largest stockbrokers in the United States, and it is regulated by top-tier authorities.

Fidelity provides no-commission US stocks and ETFs. The trading platforms and research are excellent, with several resources such as trade ideas and extensive fundamental data. The product offering covers worldwide stock exchanges in addition to the US market, which is unusual among US brokers.

Fidelity, on the other hand, has certain downsides. Some mutual funds have exorbitant fees, and margin rates are also exorbitant. You cannot trade cryptocurrencies or futures contracts.

Feel free to explore Fidelity's services because it features excellent research tools, an easy-to-use web trading interface, and no inactivity fee.

Recommended for investors and traders seeking quality research and excellent trading platforms.

Pros

• Commission-free US stocks and ETFs

• High mutual fund fees and margin rates

• Great trading platforms and researchCons

• Slower account verification

• US and international stocks

• No crypto&futures

Fees score: 3.9

Website: www.fidelity.com

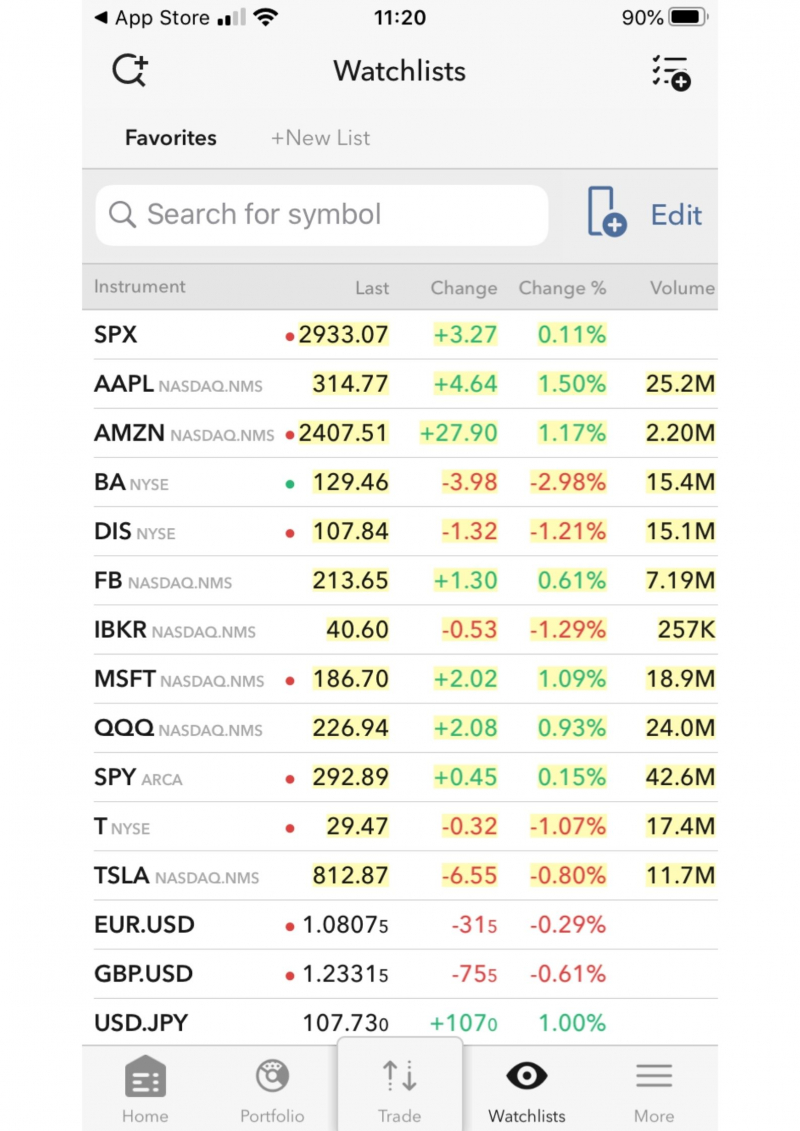

Fidelity mobile trading platform - Photo: brokerchooser Video: Fidelity Investments -

Zacks Trade is a discount broker established in the United States and a branch of LBMZ Securities. LBMZ Securities was established in 1978 and is governed by the top-tier US financial regulators, the SEC and FINRA.

LBMZ Securities' clearing and execution services are supplied by Interactive Brokers, a worldwide brokerage that is licensed by a number of top-tier financial regulators throughout the world.

If you're acquainted with Interactive Brokers' services, you'll see that many of Zacks Trade's offerings are similar. To summarize:

- Zacks Trade offers its own cost structure, product selection, instructional resources, and customer service. Trading FX, CFDs, and futures is not permitted, as it is at Interactive Brokers.

- The account opening and deposit/withdrawal methods, trading platforms, and research tools are all identical to those found at Interactive Brokers.

Zacks Trade is regarded as safe because to its extensive track record and oversight by top-tier regulators.

Why would someone prefer Zacks over Interactive Brokers, given that Zacks is more expensive? We discovered two probable explanations:

- Zacks is subject to SEC oversight, and all users are protected by SIPC, regardless of where they live.

- Zacks offers no-cost broker-assisted trading.

Zacks Trade is an excellent bargain broker in the United States. It is a branch of LBMZ Securities, which is regulated by the Securities and Exchange Commission and the Financial Industry Regulatory Authority (FINRA).

Zacks Trade, on the other hand, boasts reasonable costs, excellent stock and ETF selections, and excellent customer support.

However, there are certain limitations, such as the complexity of its desktop trading interface and research tools. The account opening process is difficult and time-consuming. Unlike Interactive Brokers, Zacks does not allow you to trade CFDs, futures, or cryptocurrency.

Feel free to give Zacks Trade a try because it offers a sample account and does not demand a minimum deposit.Recommended for traders and investors searching for in-depth research tools, a diverse product offering, and affordable fees.

Pros

• Low fees

• Complex desktop platform and research tools

• Extensive stock and ETF selectionCons

• Slow and complicated account opening

• Great customer service

• No futures and forexFees score: 4.2

Website: www.zackstrade.com

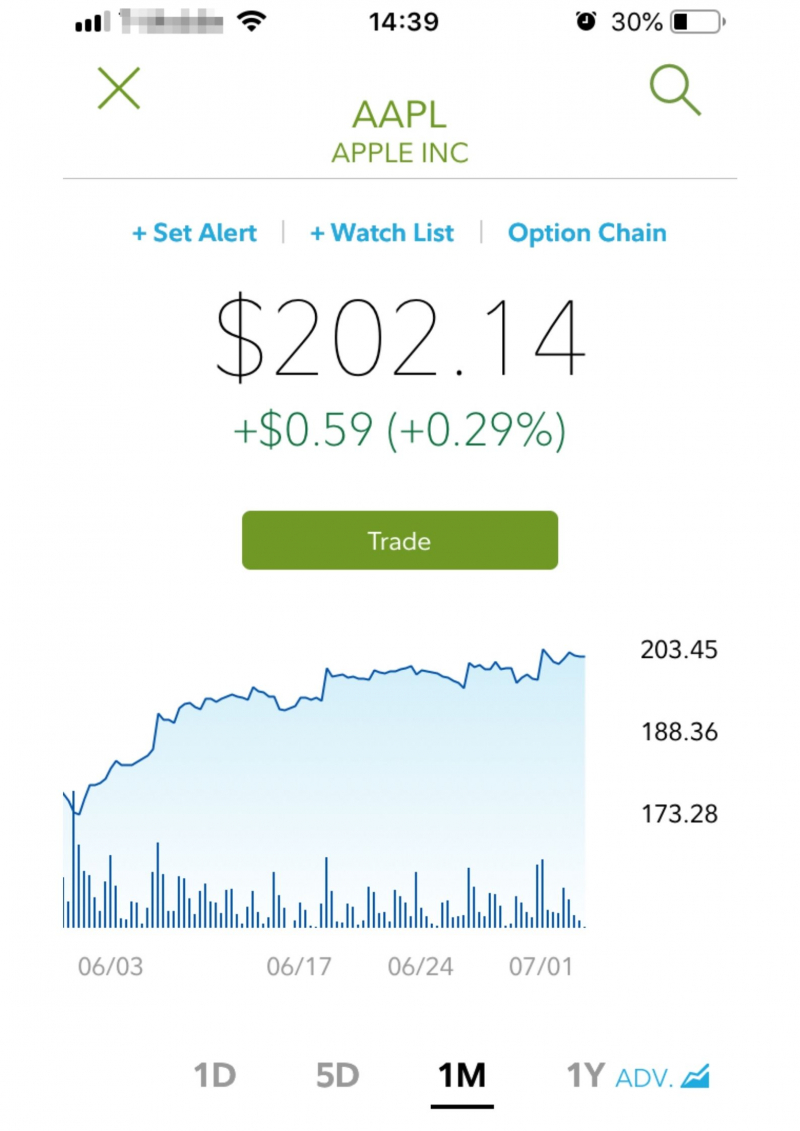

Handy Trader- Zacks Trade mobile trading platform - Photo: brokerchooser

Photo: zackstrade -

Charles Schwab is a discount broker based in the United States that was created in 1971 and is traded on the New York Stock Exchange.

It is overseen by numerous top-tier financial regulators, including the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

Charles Schwab is one of the largest discount brokers in the United States, and it is regulated by top-tier authorities.

Starting in late 2019, it was one of the first brokers to charge no charges on stock and ETF trading. Its research is excellent, including a wide range of tools such as trading ideas, Morgan Stanley analyst reports on securities, and extensive fundamental data. Customer service is excellent, with relevant responses provided in a timely manner.

It does, however, have significant downsides. Except for the approximately 4,000 free-to-trade mutual funds, mutual fund expenses are substantial, and the product selection exclusively covers the US and Canadian markets. Finally, the instructional platform is poorly organized.

Feel free to test Charles Schwab since trading and non-trading costs are normally inexpensive, research tools are excellent, and account creation is simple.

Investors and traders searching for strong research, minimal costs, and excellent customer service should consider this firm.

Pros

• Free stock and ETF trading

• High fees for some mutual funds

• Outstanding researchCons

• Only US/Canada markets available

• Great customer service

Fees score: 4.4

Website: www.schwab.com

Photo: Linkedin Video: Charles Schwab -

Merrill Edge is a brokerage located in the United States that was created in 2010 by Bank of America (BofA). During the 2008 financial crisis, BofA purchased Merrill Lynch, and the motivation for developing Merrill Edge was to combine its online investing arm with Merrill Lynch's investment experience. Merrill Edge provides stocks, ETFs, options, and bonds from the United States. The Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) oversee it (FINRA).

Merrill Edge is regarded as secure since its parent firm is a bank with a lengthy track record and a good reputation, it publishes its financials, and it is overseen by top-tier regulators.

Overall, Merrill Edge is a good, user-friendly trading platform developed by Bank of America, one of the top banks in the United States.

Merrill Edge received a great rating from us owing to its cheap costs, simple account establishing process, and security.

Limitations in product offers, research skills, and deposit/withdrawal possibilities are among the negatives.

Feel free to give it a go because the trading and non-trading costs are typically modest, the research tools are excellent, and the account setup process is simple.

Investors and traders searching for minimal costs, rapid account opening, and easy interfaces might consider this option.

Pros

• Low trading fees

• Limited to US clients and products

• Easy and seamless account openingCons

• No demo account

• Strong parent company

• Few options for deposit/withdrawal

Fees score: 4.3

Website: www.merrilledge.com

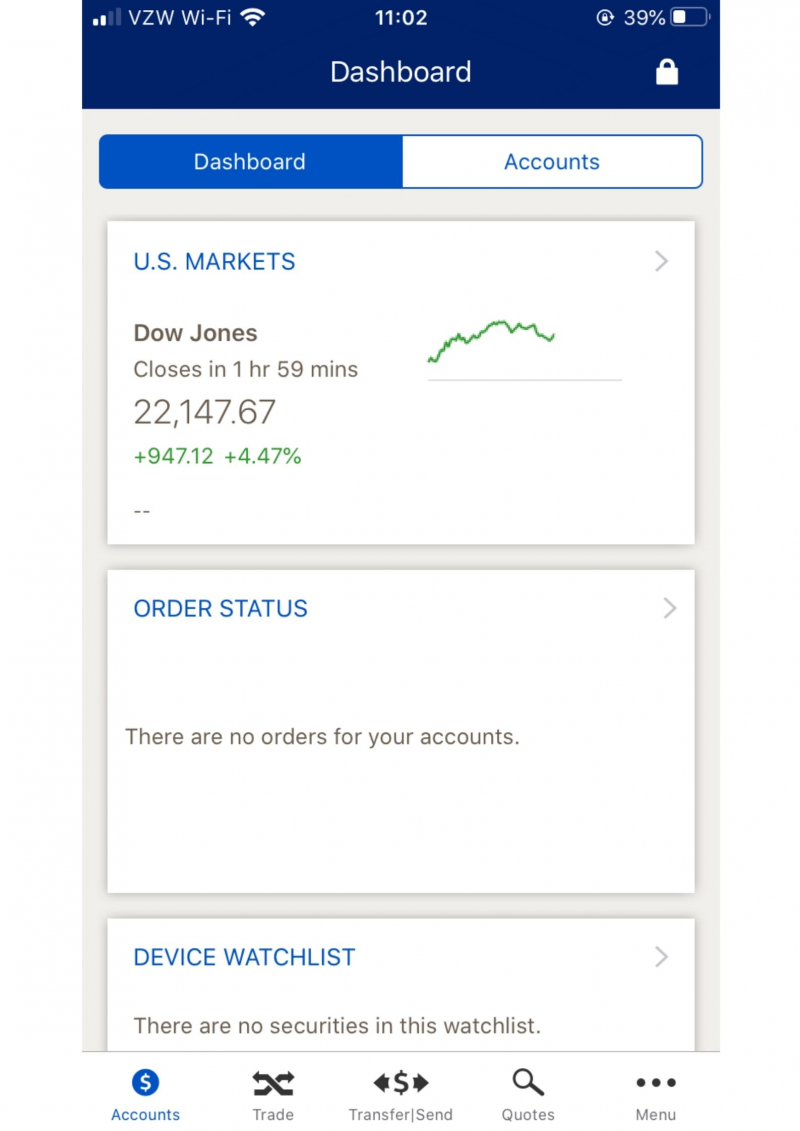

Merrill Edge mobile trading platform - Photo: brokerchooser Video: Merrill