Fundbox

Fundbox ranks 3rd in the list of best online business loans. Fundbox specializes in business credit lines and allows you to get prequalified online without a hard inquiry on your credit report. Because of their focus on business lines of credit, they are an expert in this type of small business funding. They provide decisions in minutes and funding as early as the next business day. Fundbox was selected as the lender with the best revolving line of credit, which allows you to qualify for a specific amount and borrow only what you need.

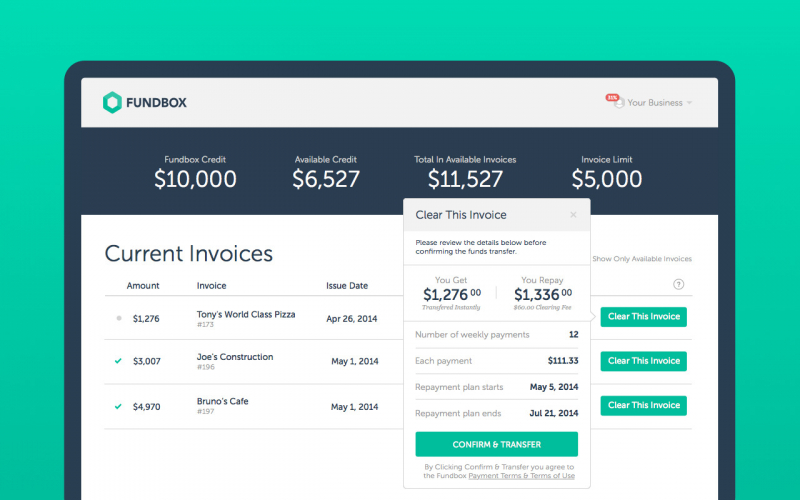

Fundbox was founded in 2013 and uses technology to facilitate its B2B lines of credit, with the goal of assisting small businesses in achieving significant success. Fundbox offers lines of credit in amounts up to $150,000, but you can get prequalified online without completing a full loan application. You can get a credit decision in minutes after applying, and you are under no obligation to accept the loan funds. Because Fundbox focuses on lines of credit, you can borrow only the amount you require.

Funds from your line of credit can be transferred to your business checking account as soon as the next business day. This provider allows you to save money by paying off your balances early and ahead of schedule without incurring any prepayment penalties. Fundbox lets you see your line of credit fees up front, and they'll automatically debit your bank account to pay your balance due so you don't have to think about it. You have the option of repaying your credit line over 12 or 24 weeks.

Pros

- Get prequalified online without a hard inquiry on your credit report

- Get a decision in minutes

- Only borrow what you need, unlike a small business loan that offers a lump sum

Cons

- Lines of credit are only available for up to $150,000.

Rating: 4.8/5.0

Enroll here: partner.fundbox.com/get-started-with-partner