Top 7 Best Online Business Loans

Small business loans are an important part of the business world because they allow owners to invest in new equipment or supplies, cover payroll, or manage ... read more...cash flow while they wait for a customer or customer to pay. A small business loan provides business owners and entrepreneurs with cash or a line of credit that they can use to stay afloat and grow their businesses for years to come. This is a list of the top seven best online business loans that you should not overlook.

-

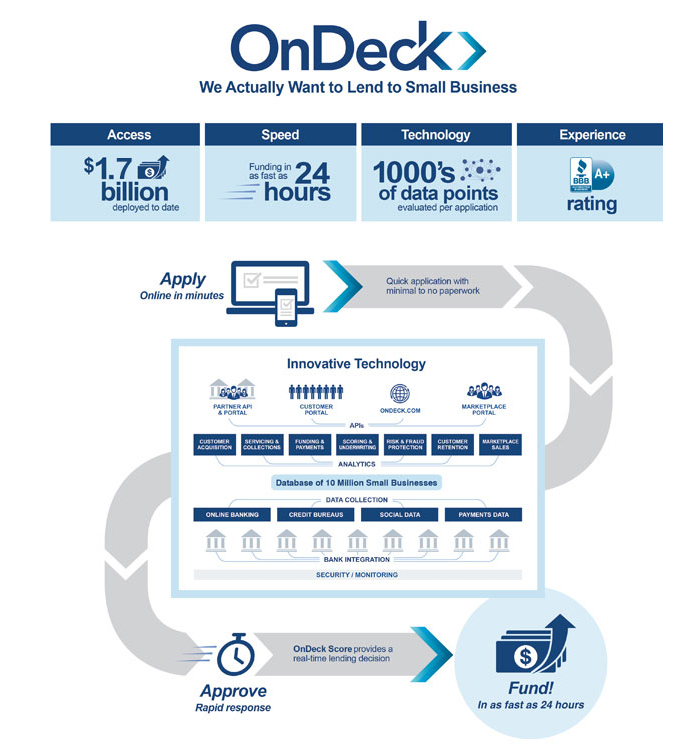

OnDeck ranks first in the list of best online business loans. OnDeck provides small business loans with funding as soon as the next business day. This can be critical for business owners who require immediate access to cash to meet business expenses or pay for an important piece of equipment. OnDeck has grown to become one of the most prominent small business lenders offering capital on the market today since its inception in 2006.

They selected OnDeck as the best option for same-day funding because of its simple online application process and quick approval and fulfillment of your small business loan. OnDeck makes it simple to qualify for a credit line ranging from $6,000 to $100,000 or a small business loan ranging from $5,000 to $250,000. Small business loans have repayment terms of up to 24 months, and you will benefit from transparent pricing and no prepayment penalties.

Meanwhile, you can repay one of OnDeck's lines of credit over a 12-month period, and you can borrow only what you need. Both options are viable for small business owners in need of capital, and both allow you to apply and receive a decision the same day. OnDeck lists some basic qualifications for a business loan, including a personal credit score of at least 600 for a long-term loan. To qualify, you must also have been in business for at least two years and have at least $250,000 in annual business revenue.

Pros

- Funding available as soon as the same business day

- Borrow up to $250,000 with a small business loan or up to $100,000 with a line of credit

- OnDeck is transparent about loan details and eligibility requirements.

Cons

- Minimum personal credit score of 600 required

- Applicants need at least one year in business with a minimum of $100,000 in annual business revenue.

Rating: 4.8/5.0

Enroll here: ondeck.com

softwareplatform.net

softwareplatform.net -

Fundera ranks 2nd in the list of best online business loans. Fundera is an excellent choice for consumers looking to qualify for an SBA loan, owing to the fact that it allows you to fill out a single application and compare multiple SBA loan options in one place. Fundera, which was founded in 2013, is a loan marketplace rather than a direct lender. This means that the company connects small business owners to the best small business loans and lines of credit available today, but it does not lend money.

Fundera, as a marketplace, can provide almost any type of business loan or line of credit available today. This includes Small Business Administration loans, which typically have flexible repayment terms and low interest rates. Loan amounts and repayment terms vary, but an SBA loan in the amount of $5.5 million is possible. You may also be able to repay your loan over a period of up to 25 years, though funding can take up to two weeks. It should be noted that SBA loans may require collateral, which is especially true for larger loan amounts.Pros

- Fundera offers an array of business loans and lines of credit, including loan offers through the SBA.

- Compare loan options through multiple lenders in one place

- Gauge your ability to qualify without a hard inquiry on your credit report

Cons

- Fundera is a small business marketplace and not a direct lender, meaning the company won’t actually fund your loan itself.

- Credit score of at least 550 required

- Collateral required for some SBA loans and loan amounts

Rating: 4.8/5.0

Enroll here: fundera.com

fintechfutures.com

techcrunch.com -

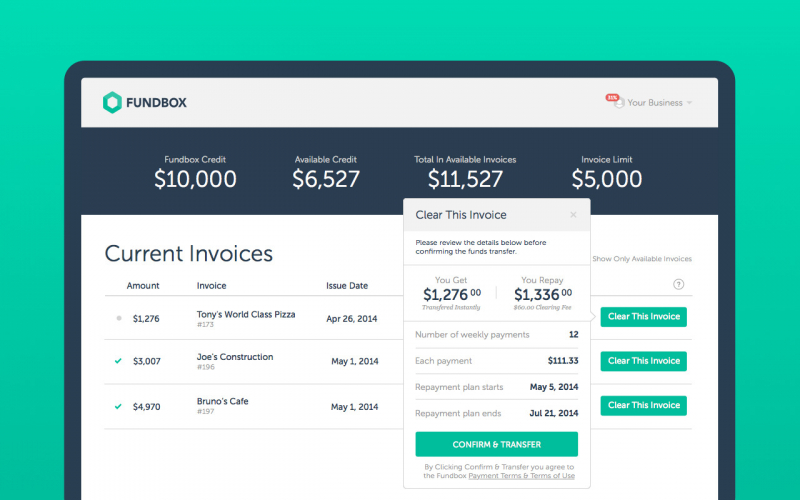

Fundbox ranks 3rd in the list of best online business loans. Fundbox specializes in business credit lines and allows you to get prequalified online without a hard inquiry on your credit report. Because of their focus on business lines of credit, they are an expert in this type of small business funding. They provide decisions in minutes and funding as early as the next business day. Fundbox was selected as the lender with the best revolving line of credit, which allows you to qualify for a specific amount and borrow only what you need.

Fundbox was founded in 2013 and uses technology to facilitate its B2B lines of credit, with the goal of assisting small businesses in achieving significant success. Fundbox offers lines of credit in amounts up to $150,000, but you can get prequalified online without completing a full loan application. You can get a credit decision in minutes after applying, and you are under no obligation to accept the loan funds. Because Fundbox focuses on lines of credit, you can borrow only the amount you require.

Funds from your line of credit can be transferred to your business checking account as soon as the next business day. This provider allows you to save money by paying off your balances early and ahead of schedule without incurring any prepayment penalties. Fundbox lets you see your line of credit fees up front, and they'll automatically debit your bank account to pay your balance due so you don't have to think about it. You have the option of repaying your credit line over 12 or 24 weeks.

Pros

- Get prequalified online without a hard inquiry on your credit report

- Get a decision in minutes

- Only borrow what you need, unlike a small business loan that offers a lump sum

Cons

- Lines of credit are only available for up to $150,000.

Rating: 4.8/5.0

Enroll here: partner.fundbox.com/get-started-with-partner

accountingtoday.com

techcrunch.com -

Lendio ranks 4th in the list of best online business loans. Lendio is another loan marketplace, so it will not lend you money directly, but they believe they excel in this category because they allow you to compare loan offers from over 75 lenders in the small business space. Having the opportunity to have lenders compete for your business is the best way to ensure you get the best rate and terms on a small business loan.

Lendio was founded in 2011, but it has expanded rapidly since then. They claim to have funded over 300,000 small business loans totaling more than $12 billion so far, and they have no plans to stop anytime soon. Lendio's small business loan program allows you to borrow between $25,000 and $500,000, depending on your needs. You can repay your loan over a period of one to five years, with an interest rate as low as 4.5 percent. 4 Lendio's application process takes only 15 minutes, and you can get a decision the same business day, making it an efficient place to shop for a loan.Pros

- Compare loan offers from more than 75 lenders

- Funding in as little as 24 hours

- Small business loans, SBA loans, and business lines of credit available

Cons

- Lendio does not lend money directly.

- Eligibility requirements vary, depending on the lender.

Rating: 4.7/5.0

Enroll here: lendio.com

greatplacetowork.com

greatplacetowork.com -

Lending Club ranks 5th in the list of best online business loans. The largest online peer-to-peer lender is Lending Club. It has made over $50 billion in personal and business loans since its inception in 2006. You can apply for credit in less than 10 minutes without affecting your credit score. Lending Club assigns you a client advisor based in the United States to help you find the best loan for you. If you qualify, you will be required to provide bank and tax statements, as well as other documentation, before receiving your funding (usually within two weeks). If you have good credit and income and can wait a few weeks for funding, Lending Club will get you better rates than the competition.

Make the most of your money with LendingClub, which was recently recognized on Newsweek's America's Best Banks list for its Best Cash Back Checking Account. Superior products and services, such as award-winning checking account, Rewards Checking, which offers 1% cash back, ATM rebates, and more, are designed to help you achieve financial wellness.

Pros

- Clarity: LendingClub’s terms are so clear, and their pattern of service so well established, that users can know what their experience will be before they even sign up. The exact dollar figure you’ll pay for the amount of loan you that received, across your 36 or 60 month term, will be listed to the cent before you ever commit to the loan. Other companies have hidden fees like prepayment penalties, but prepayment is free with LendingClub. All the information you need is easily accessible on their website.

- Speed and Reliability of Loan Financing: You can apply online and receive a pre-approved offer in minutes. That’s one point of difference between LendingClub and its major competitor, whose investors are not always willing to fully supply a loan (which is then rejected, though resubmission is allowed). For most users of the LendingClub system, finances are usually funded in less than 10 days. The site has some of the highest security provisions made available to borrowers on financial platforms, so users can be sure that these transactions will be safe.

- Affordable. LendingClub’s possible interest rate/APRs are somewhat lower than their competitor’s: From about 6% to about 30%. Users with pristine credit can enjoy extremely low APR levels, but even users with slightly lower credit scores can still find affordable money through this method, comparable to the APR of very affordable credit cards. As mentioned above, payments will be communicated in great detail before you ever commit to a loan, and there are no hidden fees or other costs.

- Availability Nationwide. Peer to peer lending companies must be approved at the state level, so LendingClub is not available in every state. But it is available in many more states than is its major competitor, making it the most accessible P2P borrowing option for Americans.

Cons:

- Application Requirements. Some users may be required to supply copies of tax documentation. This is a common requirement in this industry, but some users find it inconvenient.

- LendingClub Works Hard Against Default. If you miss a payment, LendingClub is quick to call you by phone. If the payment problem persists, you will probably find your account passed onto collections. Again, this is all in an effort to make default an infrequent occurrence, because LendingClub also has users who are investors! They have to strike a balance between service to both customer bases.

Rating: 4.5/5.0

Enroll here: lendingclub.com

fortune.com

funancial.news -

Kiva ranks 6th in the list of best online business loans. Kiva is the best option for small business owners who only require a small loan. Their microloans currently have a 0% interest rate and a loan amount of up to $15,000. They chose this lender as the best option for microloans because you can borrow money at 0% APR and repay it over three years. 2 Kiva, which was founded in 2005, aims to assist underserved communities and their members in qualifying for the small business funding they require to get their dreams off the ground. So far, 2.1 million Kiva lenders have funded over $1.74 billion in loans to over 4.3 million borrowers in 77 countries.

Kiva, interestingly, is not a bank but rather a peer-to-peer lending platform. Because Kiva loans are geared toward disadvantaged entrepreneurs, investors who lend money through the platform have the opportunity to help people all over the world. Kiva's loan product only allows you to borrow up to $15,000. You can apply online in 20 to 30 minutes and be able to advertise your funding project on their marketplace within 30 days; you can repay your loan over 36 months. Kiva also lists simple eligibility requirements, such as residing in the United States and being at least 18 years old. To qualify for a Kiva loan, you must also agree to use your loan solely for business purposes.

Pros

- Borrow money with no interest

- Get the chance to market your product to a growing community of Kiva lenders, currently 1.6 million strong

- Repay your loan for up to 36 months

Cons

- You can only borrow up to $15,000 with Kiva.

- It can take 30 days or longer for your loan to be funded.

Rating: 4.4/5.0

Enroll here: kiva.org

es.slideshare.net -

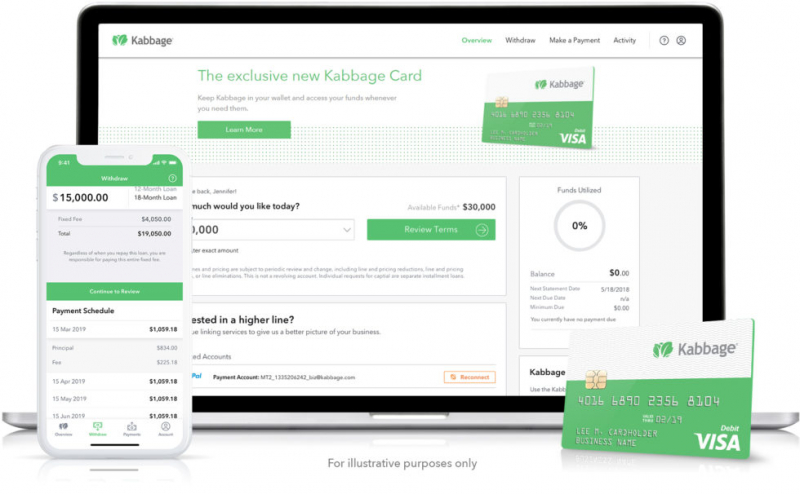

Kabbage ranks last on the list of best online business loans. Kabbage, a technology company founded in 2008, aims to provide cash flow to businesses of all sizes. While many online lenders specialize in small business lending, they believe Kabbage stands out due to its extensive selection of small business loan options as well as its additional features and benefits. Kabbage provides a variety of small business loans and credit line options, including both unsecured and secured options. You can also apply for loans tailored to specific industries such as trucking, pawn shops, and retail. Kabbage takes pride in its simple online application process and quick funding for those who are approved.

Kabbage loan amounts vary depending on the type of loan you apply for. Kabbage also provides up to $150,000 in business lines of credit and online loans ranging from $500 to $150,000. Other loan types may have higher loan limits. Depending on your needs, Kabbage Funding also offers repayment terms of six to twelve months. There are no hidden loan fees or prepayment penalties with Kabbage. You will be charged a monthly fee, but they will tell you up front.

Pros

- Transparent qualification requirements

- No application fees

- Multiple small business loan options available

- Access to a mobile app

- Business checking available

Cons

- You need to be in business for one year.

- You must have at least $4,200 in revenue each month (or $50,000 in annual revenue).

Rating: 4.2/5.0

Enroll here: supermoney.com/reviews/business-loan/kabbage-business-loan

nerdwallet.com

webprofits.com.au