OnDeck

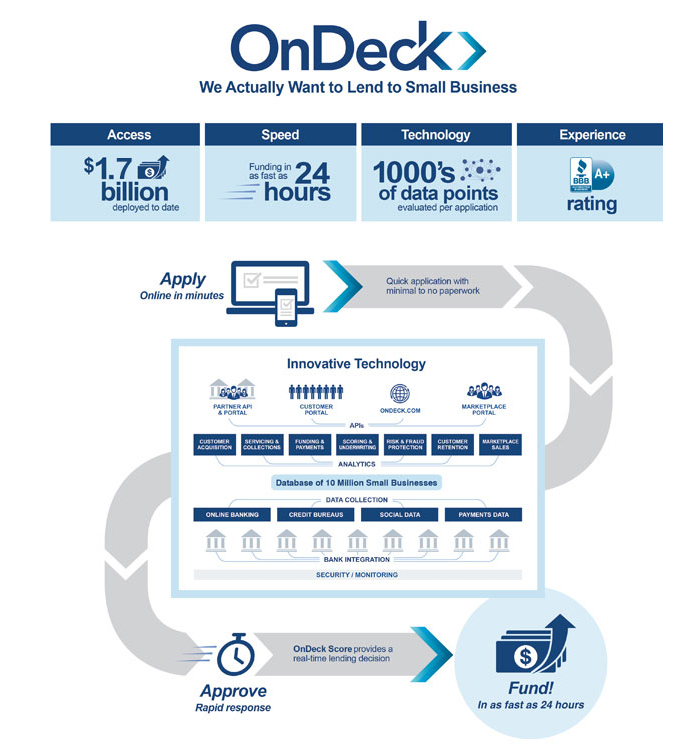

OnDeck ranks first in the list of best online business loans. OnDeck provides small business loans with funding as soon as the next business day. This can be critical for business owners who require immediate access to cash to meet business expenses or pay for an important piece of equipment. OnDeck has grown to become one of the most prominent small business lenders offering capital on the market today since its inception in 2006.

They selected OnDeck as the best option for same-day funding because of its simple online application process and quick approval and fulfillment of your small business loan. OnDeck makes it simple to qualify for a credit line ranging from $6,000 to $100,000 or a small business loan ranging from $5,000 to $250,000. Small business loans have repayment terms of up to 24 months, and you will benefit from transparent pricing and no prepayment penalties.

Meanwhile, you can repay one of OnDeck's lines of credit over a 12-month period, and you can borrow only what you need. Both options are viable for small business owners in need of capital, and both allow you to apply and receive a decision the same day. OnDeck lists some basic qualifications for a business loan, including a personal credit score of at least 600 for a long-term loan. To qualify, you must also have been in business for at least two years and have at least $250,000 in annual business revenue.

Pros

- Funding available as soon as the same business day

- Borrow up to $250,000 with a small business loan or up to $100,000 with a line of credit

- OnDeck is transparent about loan details and eligibility requirements.

Cons

- Minimum personal credit score of 600 required

- Applicants need at least one year in business with a minimum of $100,000 in annual business revenue.

Rating: 4.8/5.0

Enroll here: ondeck.com