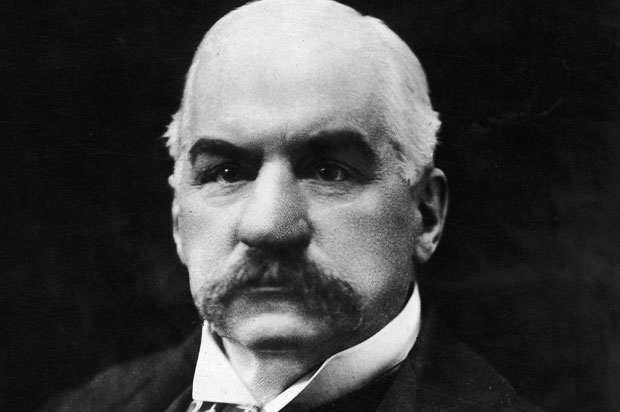

John Pierpont “J. P.” Morgan

J.P. (John Pierpont) Morgan (1837-1913), one of the most prominent financiers of his time, sponsored railroads and helped form U.S. Steel, General Electric, and other large enterprises. In the late 1850s, he followed his affluent father into the banking business, and in 1871 he formed a partnership with Philadelphia financier Anthony Drexel. In 1895, their firm was renamed J.P. Morgan & Company, the forerunner of today's banking behemoth JPMorgan Chase. Morgan utilized his clout to assist stabilize American financial markets during multiple economic downturns, including the 1907 panic. However, he was accused of wielding too much power and of manipulating the nation's financial system for his own gain. The Gilded Age tycoon spent a large chunk oSaveCancelf his fortune amassing a magnificent art collection.

Morgan was heavily involved in reorganizing and consolidating a number of financially troubled railroads during the late nineteenth century, a period when the United States railroad industry experienced rapid overexpansion and heated competition (the nation's first transcontinental rail line was completed in 1869). He obtained control of major amounts of these railways' stock in the process, eventually controlling an estimated one-sixth of America's rail networks. Titanic, owned by White Star, an IMM company, sank on her maiden voyage after colliding with an iceberg. Morgan, who had witnessed the ship's christening in 1911, had been scheduled to go on the fateful April 1912 journey but had to cancel.

Because the United States did not have a central bank during Morgan's time, he utilized his power to help save the country from calamity during many economic crises. Morgan led a banking syndicate that loaned the federal government more than $60 million in 1895, helping to save America's gold standard. During the 1907 financial crisis, Morgan convened a gathering of the country's leading bankers at his New York City home and persuaded them to bail out various failing financial firms in order to calm the markets.

Morgan was initially lauded for leading Wall Street out of the 1907 financial crisis; however, in the years that followed, the portly banker with the handlebar mustache and gruff demeanor faced mounting criticism from muckraking journalists, progressive politicians, and others that he wielded too much power and could manipulate the financial system for his own gain. Morgan was called to testify before a congressional committee chaired by U.S. Representative Arsene Pujo (1861-1939) of Louisiana in 1912, which was looking into the existence of a "money trust," a small cabal of elite Wall Street financiers, including Morgan, who allegedly colluded to control American banking and industry. The Pujo Committee hearings aided in the establishment of the Federal Reserve System in December 1913, as well as the passage of the Clayton Antitrust Act in 1914.