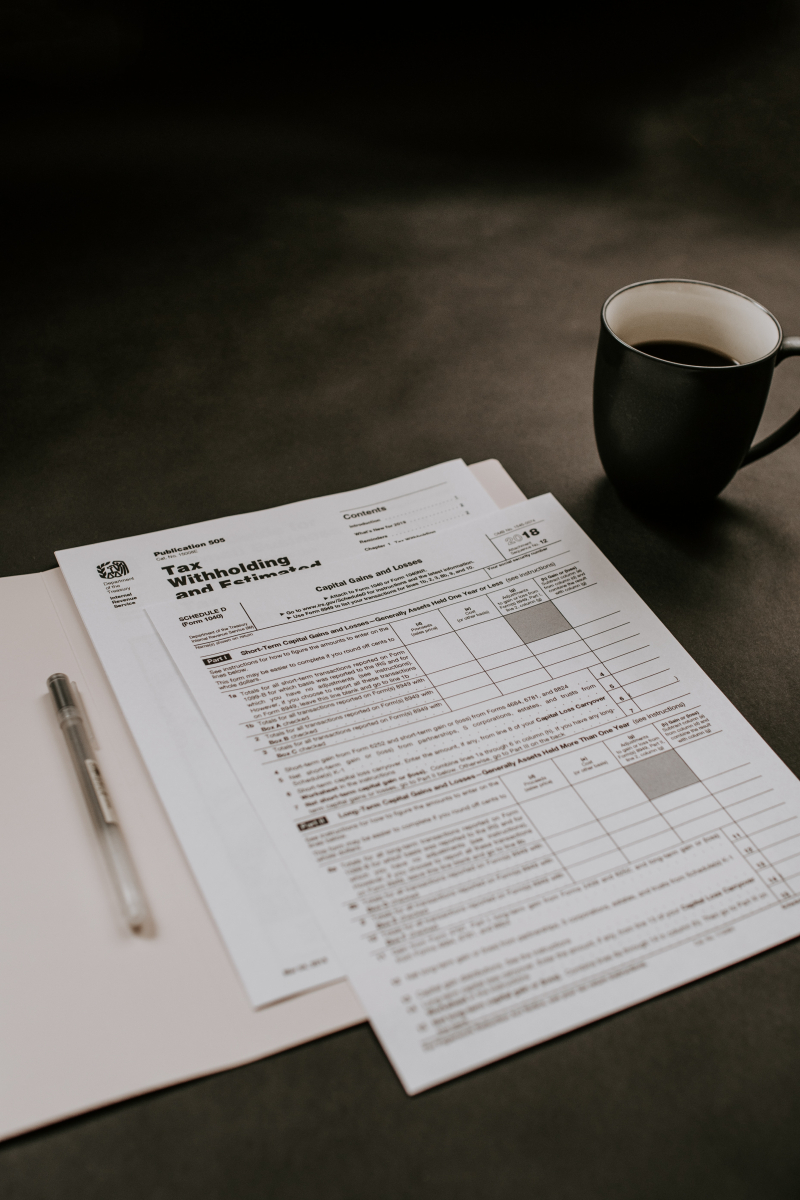

Top 10 Best Books On Taxation

If you're interested in learning more about taxation, whether it's for personal finance or business purposes, books can be a great resource. With so many ... read more...options available, it can be overwhelming to choose where to start. In this article, we've compiled a list of some of the best books on taxation to help guide your reading choices. From guides on tax preparation to in-depth analyses of tax policy, these books cover a wide range of topics related to taxation.

-

Tax-Free Wealth is a highly regarded book on taxation authored by Tom Wheelwright, a renowned tax expert, and CPA. The book provides readers with a comprehensive guide on how to legally reduce their taxes and increase their wealth. It is widely considered as one of the best books on taxation, providing practical and effective strategies for individuals and businesses alike.

Tom Wheelwright is the founder and CEO of WealthAbility®, a global tax and wealth consulting firm. He is a frequent speaker and commentator on tax topics, and has appeared on various media outlets such as Forbes, The Wall Street Journal, and CNBC. With over 35 years of experience in tax planning and accounting, Tom has helped thousands of clients save millions of dollars in taxes.

The book's introduction highlights the importance of understanding the tax code and how it can be used to create wealth. The author argues that taxes are not a burden, but an opportunity to create wealth and build a better future. By understanding how the tax code works, individuals and businesses can legally reduce their taxes and keep more of their hard-earned money.

Tax-Free Wealth covers a range of topics, from understanding the tax code to utilizing tax deductions and credits, to creating tax-free income streams. The book provides practical examples and case studies, making it easy for readers to understand complex tax concepts. It is an essential guide for anyone who wants to take control of their taxes and build wealth.

Author: Tom Wheelwright

Link to buy: https://www.amazon.com/dp/1937832058

Ratings: 4.5 out of 5 stars (from 757 reviews)

Best Sellers Rank: #51,742 in Books

#11 in Small Business Taxes (Books)

#19 in Personal Taxes (Books)

#50 in Small Business Bookkeeping (Books)

Photo by Kelly Sikkema on Unsplash

Photo by Tim Gouw on Unsplash -

How to Pay Zero Taxes, authored by Jeff Schnepper, is an essential guide for individuals and businesses looking to minimize their tax liability legally. The book provides practical tips and strategies that can help readers take advantage of deductions, credits, and other tax-saving opportunities.

Jeff Schnepper is a nationally recognized author, lecturer, and tax expert with over 40 years of experience in the field of taxation. He is a graduate of Georgetown University Law Center and has served as an adjunct professor of law at the University of Baltimore and as an instructor of taxation at the American Institute of Certified Public Accountants.

The book starts with a brief overview of the US tax system, including the different types of taxes, tax brackets, and filing requirements. It then goes on to provide readers with a comprehensive guide to tax planning and preparation, covering topics such as deductions, exemptions, credits, and audits.

One of the unique features of How to Pay Zero Taxes is its focus on tax planning for specific groups of people, including business owners, investors, retirees, and self-employed individuals. Each chapter provides specific advice and strategies tailored to the unique tax situations of these groups.

Author: Jeff Schnepper

Link to buy: https://www.amazon.com/dp/126046170X

Ratings: 4.4 out of 5 stars (from 465 reviews)

Best Sellers Rank: #62,883 in Books

#19 in Small Business Taxes (Books)

#25 in Personal Taxes (Books)

#65 in Small Business Bookkeeping (Books)

Photo by Alexander Grey on Unsplash

Photo by Nataliya Vaitkevich from Pexels -

J.K. Lasser's Small Business Taxes, authored by Barbara Weltman, is a comprehensive guidebook for small business owners who want to understand the intricacies of taxation. This book provides a step-by-step guide on how to navigate the complex world of taxation and is considered one of the best books on taxation in the market today.

Barbara Weltman, an experienced tax attorney and small business expert, is a nationally recognized speaker, author, and columnist. She has written over a dozen books on taxation and small business issues and is a regular contributor to publications such as The Wall Street Journal and Entrepreneur Magazine. Her expertise in taxation and small business makes her the perfect author for this book.

J.K. Lasser's Small Business Taxes is designed to help small business owners stay in compliance with tax laws while also taking advantage of tax deductions and credits that can help them save money. The book covers everything from choosing the right legal structure for your business to keeping track of expenses and filing tax returns.

In the book's introduction, Weltman sets the tone by emphasizing the importance of staying on top of tax laws as a small business owner. She also explains the book's structure and how it is organized to help readers easily find the information they need. With clear and concise language, Weltman makes tax law accessible and easy to understand for all readers.

Author: Barbara Weltman

Link to buy: https://www.amazon.com/dp/1119740053

Ratings: 4.5 out of 5 stars (from 220 reviews)

Best Sellers Rank: #740,480 in Books

#169 in Small Business Taxes (Books)

#184 in Personal Taxes (Books)

#748 in Small Business Bookkeeping (Books)

Photo by Nataliya Vaitkevich from Pexels

Photo by Nataliya Vaitkevich from Pexels -

Taxes can be a daunting topic, and many people find themselves overwhelmed and confused by the complex world of tax laws and regulations. That's where "Taxes Made Simple" by Mike Piper comes in - a concise and accessible guide to understanding taxes and how to navigate them.

Mike Piper is a certified public accountant and the author of several finance books, including "Accounting Made Simple" and "Investing Made Simple." In "Taxes Made Simple," Piper draws on his expertise and experience to break down the often-overwhelming world of taxes into clear and concise terms.

The book covers a wide range of tax-related topics, including understanding your tax forms, maximizing deductions, and navigating the tax implications of different life events, such as marriage, divorce, and retirement. Piper also explains key concepts like taxable income, capital gains, and the alternative minimum tax.

One of the strengths of "Taxes Made Simple" is its focus on practical advice and real-world examples. Piper uses clear and relatable scenarios to help readers understand complex concepts and offers actionable tips to help readers save money on their taxes.

Author: Mike Piper

Link to buy: https://www.amazon.com/dp/0981454216

Ratings: 4.6 out of 5 stars (from 850 reviews)

Best Sellers Rank: #1,089,161 in Books

#242 in Personal Taxes (Books)

#666 in Tax Law (Books)

#3,220 in Accounting (Books)

Photo by Karolina Grabowska from Pexels

Photo by Karolina Grabowska from Pexels -

475 Tax Deductions for Businesses and Self-Employed Individuals by Bernard B. Kamoroff C.P.A. is a comprehensive guide to maximizing tax savings for small business owners and self-employed individuals. As taxes can be a significant expense for any business, it is essential to understand the various deductions available to reduce taxable income. This book offers practical tips and advice on how to identify, claim and document every deduction allowed by law.

The author, Bernard B. Kamoroff, is a certified public accountant with over thirty years of experience in accounting and taxation. He has written numerous books on financial management and taxation, and his articles have appeared in various publications, including The Wall Street Journal, The New York Times, and Money Magazine. His expertise in taxation and his experience working with small business owners and self-employed individuals make him a trusted authority on tax deductions.

The book is divided into chapters that cover different categories of deductions, including home office, automobile expenses, travel expenses, education and training, retirement planning, and more. Each chapter provides a detailed explanation of the tax rules and regulations governing each deduction, as well as tips on how to maximize the deduction while staying within the law.

The book also includes examples and case studies that illustrate how small business owners and self-employed individuals have successfully taken advantage of various tax deductions. These real-life examples provide practical guidance on how to apply the tax rules to specific situations.

Author: Bernard B. Kamoroff C.P.A.

Link to buy: https://www.amazon.com/dp/1493040189

Ratings: 4.7 out of 5 stars (from 1147 reviews)

Best Sellers Rank: #3,695 in Books

#1 in Small Business Taxes (Books)

#2 in Personal Taxes (Books)

#2 in Small Business Bookkeeping (Books)

Photo by Monstera from Pexels

Photo by Monstera from Pexels -

J.K. Lasser's 1001 Deductions and Tax Breaks 2019, written by Barbara Weltman, is a comprehensive guide to maximizing deductions and reducing tax liability for both individuals and businesses. As the United States tax code is constantly changing, it can be difficult for taxpayers to keep up with all the available deductions and credits. This book provides readers with a wealth of information on tax-saving opportunities, including credits, deductions, exemptions, and loopholes.

Barbara Weltman is a highly respected tax expert and author who has written numerous books on taxation and small business. She is also a respected speaker and has appeared on various media outlets, including CNN, CNBC, and Fox News. In J.K. Lasser's 1001 Deductions and Tax Breaks 2019, Weltman draws on her years of experience to provide readers with practical advice on how to navigate the complex world of tax law.

The book is organized in an easy-to-use format, with each chapter covering a different area of tax law. The first chapter provides an overview of the tax system and includes tips on record-keeping and tax planning. Subsequent chapters cover specific deductions and credits, such as those for education, health care, and home ownership. The book also includes a section on tax planning strategies for businesses, including tips on structuring transactions and maximizing deductions.

Author: Barbara Weltman

Link to buy: https://www.amazon.com/dp/1119521580

Ratings: 4.3 out of 5 stars (from 162 reviews)

Best Sellers Rank: #1,051,675 in Books

#232 in Personal Taxes (Books)

#284 in Legal Self-Help

#3,100 in Accounting (Books)

Photo by Leeloo Thefirst from Pexels

Photo by Leeloo Thefirst from Pexels -

Corporate taxation is a complex and constantly evolving subject that is critical to understanding the functioning of modern economies. In this context, Cheryl D. Block's book "Corporate Taxation" provides a comprehensive and insightful guide to the topic, making it a must-read for students, professionals, and policymakers alike. The book is among the best books on taxation.

Cheryl D. Block is a Professor of Law at Washington University in St. Louis, where she teaches corporate and international taxation. With over two decades of experience in the field, she has published extensively on corporate tax policy and has advised governments, non-profits, and multinational corporations on taxation matters.

In "Corporate Taxation," Block offers a rigorous and nuanced analysis of the U.S. corporate tax system, covering both the theoretical foundations and the practical implications of corporate taxation. The book covers a wide range of topics, including the taxation of corporate income, the treatment of corporate equity and debt, and the taxation of cross-border transactions.

One of the book's key strengths is its clarity of writing, which makes complex concepts accessible to readers with varying levels of expertise. The author uses real-world examples and case studies to illustrate key points, helping readers to understand the practical implications of tax policy decisions.

Author: Cheryl D. Block

Link to buy: https://www.amazon.com/dp/0735588724

Ratings: 4.6 out of 5 stars (from 63 reviews)

Best Sellers Rank: #918,980 in Books

#95 in Tax Law (Books)

#164 in Corporate Law (Books)

#76,911 in Business & Money (Books)

Photo by RODNAE Productions from Pexels

Photo by Leeloo Thefirst from Pexels -

The Book on Tax Strategies for the Savvy Real Estate Investor, authored by Amanda Han and Matt MacFarland, is a must-read for anyone looking to maximize their profits and minimize their tax liabilities in real estate investing. This book offers a comprehensive guide to navigating the complex world of real estate taxation, providing readers with practical strategies and insights that can help them save money and achieve financial success.

Amanda Han and Matt MacFarland are both experienced real estate investors and tax professionals, with a combined 30 years of experience in the industry. As such, they bring a wealth of knowledge and expertise to the subject of real estate taxation, providing readers with valuable insights into the tax implications of various real estate transactions and investments.

The book begins with an overview of the basics of real estate taxation, explaining the different types of taxes that real estate investors may be subject to and outlining the key deductions and credits that are available to them. From there, it delves into more advanced topics such as entity structuring, 1031 exchanges, and cost segregation, providing readers with practical strategies for maximizing their tax savings and minimizing their liabilities.

Author: Amanda Han and Matt MacFarland

Link to buy: https://www.amazon.com/Book-Strategies-Savvy-Estate-Investor/dp/0990711765/

Ratings: 4.7 out of 5 stars (from 1311 reviews)

Best Sellers Rank: #9,713 in Books

#5 in Personal Taxes (Books)

#21 in Buying & Selling Homes (Books)

#26 in Real Estate Investments (Books)

Photo by Tara Winstead from Pexels

Photo by Tara Winstead from Pexels -

The United States tax code is one of the most complex and convoluted systems in the world, leaving many Americans struggling to understand how to optimize their tax strategy. However, there are resources available to help navigate this complexity and The Book on Advanced Tax Strategies by Amanda Han and Matt MacFarland is one of the best books on taxation to guide you through it.

Amanda Han and Matt MacFarland are both Certified Public Accountants (CPAs) and real estate investors with years of experience in tax strategy and planning. In their book, they share their expertise and provide actionable advice on how to take advantage of advanced tax strategies to save money and increase your wealth.

The Book on Advanced Tax Strategies covers a wide range of topics, including how to structure your business for maximum tax benefits, how to use retirement accounts and charitable giving to reduce your tax liability, and how to take advantage of the tax benefits of real estate investing.

What sets this book apart from others on the subject is its accessibility. The authors use clear and concise language to explain complex tax strategies, making it an invaluable resource for both experienced investors and those new to the world of tax planning. Additionally, the book includes practical examples and case studies to help readers understand how to apply these strategies in real-life situations.

Author: Amanda Han and Matt MacFarland

Link to buy: https://www.amazon.com/Book-Advanced-Tax-Strategies-Investors/dp/1947200224/

Ratings: 4.7 out of 5 stars (from 480 reviews)

Best Sellers Rank: #14,746 in Books

#8 in Personal Taxes (Books)

#16 in Small Business Bookkeeping (Books)

#39 in Real Estate Investments (Books)

Photo by Nataliya Vaitkevich from Pexels

Photo by Yan Krukau from Pexels -

The Tax and Legal Playbook by Mark J Kohler is a comprehensive guide to tax planning and legal strategies for small business owners, entrepreneurs, and investors. With over 20 years of experience in tax law and accounting, Kohler offers game-changing solutions to complex tax issues that can help readers save money and protect their assets.

The book is divided into two sections: tax planning and legal strategies. The tax planning section covers topics such as entity selection, deductions, retirement plans, and international tax issues. Kohler breaks down each topic in a clear and concise manner, providing examples and case studies to illustrate his points. He also offers practical tips and strategies for implementing these tax-saving measures.

The legal strategies section covers topics such as asset protection, estate planning, and contract negotiation. Kohler explains the legal concepts in plain English and provides real-world examples of how these strategies can be used to protect assets and minimize risk.

One of the strengths of The Tax and Legal Playbook is that it is written in a conversational tone that makes complex tax and legal concepts accessible to readers who may not have a background in these areas. Kohler also includes a variety of resources, including checklists, worksheets, and sample forms, that readers can use to implement the strategies outlined in the book.

Author: Mark J Kohler

Link to buy: https://www.amazon.com/Tax-Legal-Playbook-Game-Changing-Solutions/dp/1599186438/

Ratings: 4.7 out of 5 stars (from 854 reviews)

Best Sellers Rank: #15,541 in Books

#3 in Small Business Taxes (Books)

#18 in Small Business Bookkeeping (Books)

#34 in Retirement Planning (Books)

Photo by MART PRODUCTION from Pexels

Photo by Tara Winstead from Pexels