Top 7 Best Travel Insurance Providers

Travel insurance protects us against financial loss as a result of unforeseeable or unlikely situations such as medical evacuation, aircraft cancellation, or ... read more...luggage theft. But what does travel insurance do when a known incident, such as COVID-19, puts people's vacation plans in jeopardy? With all this in mind, here are top 7 best travel insurance providers.

-

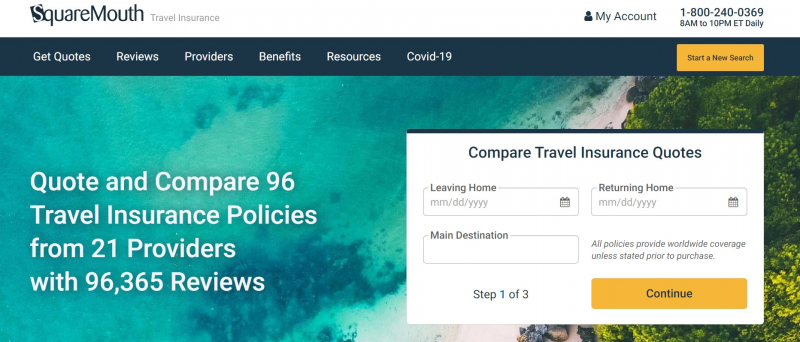

Squaremouth makes it simple for travelers to get a price, compare options, and purchase travel insurance. Their goal is to assist each customer in locating the most cost-effective policy for their trip. You will be given with a list of all available policies for your trip once you have entered your trip details and traveler information into their comparison engine. They recommend categorizing insurance from least to most costly and comparing them side by side with our side-by-side comparison tool to get the least expensive policy that meets your coverage needs.

While there are a few candidates for the title of best travel insurance marketplace, SquareMouth is the best for finding COVID-19 cancellation insurance. You'll notice a filter for 'coronavirus pandemic' when you start your search (alongside other popular filters like medical evacuation, pre-existing medical, and hurricane & weather). Insurers are continually modifying their policies in reaction to COVID-19, so knowing SquareMouth has all the most up-to-date information is reassuring.

Travelers acquire insurance for two reasons: to safeguard their financial investment through Trip Cancellation coverage, and to protect themselves from expensive medical bills in the case of an accident or emergency while on vacation. Squaremouth.com's policies, on the other hand, are comprehensive and tailored to cover a wide range of other traveler risks.Plans: 75% reimbursement

Medical Coverage: Up to $250,000Website: www.squaremouth.com

SquareMouth

SquareMouth -

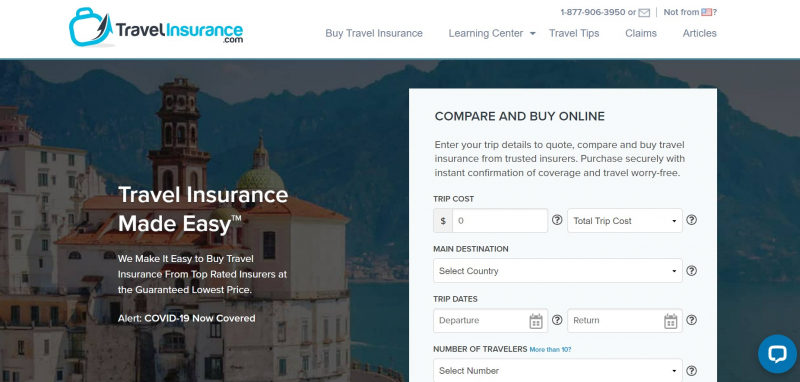

Another major travel insurance marketplace is TravelInsurance.com. It presently allows you to compare insurance from 11 different insurers, with five of them offering Cancel For Any Reason riders. The great thing about TravelInsurance.com is that it provides thorough information on each insurer's exclusions, so you don't have to waste time visiting different websites to obtain all the information you need. Under each insurer's logo on the search results page, you'll see a button labeled 'COVID-19 FAQs,' which gives you a description of what is and isn't covered.

When looking for travel insurance, it can be difficult to know where to start. An ideal policy provides adequate coverage at a reasonable cost. The quote process involves many different elements, and insurance companies have a number of policies and coverage levels to pick from. No one should go into this procedure without being well-informed and having a simple way to navigate the world of trip insurance.

Compare plans from the world's top travel insurance companies with TravelInsurance.com. When it comes to choosing the perfect travel insurance policy for your trip, our comparison engine makes it simple to understand plan perks and coverage. In just a few minutes, you can get a price, compare policies, and buy, and you'll get your policy confirmation and documentation by email.Plans: 75% reimbursement

Medical Coverage: Up to $250,000Website: TravelInsurance.com

TravelInsurance.com

TravelInsurance.com -

Nationwide is a well-known travel insurance provider that offers both single-trip and annual policies. It, too, has fared well in the face of the coronavirus pandemic. It includes coronavirus cancellation if you get COVID-19 before your travel, emergency medical coverage if you get COVID-19 while on the road, and CFAR coverage. To be eligible for a CFAR reimbursement, you must obtain coverage within 21 days of making your first trip deposit and cancel your trip at least 48 hours before the scheduled departure time.

Unexpected events can turn your vacation adventures upside down, despite your best efforts to avoid them. Even the most meticulously planned trip can be derailed by accidents, sickness, injuries, canceled flights, misplaced luggage, and severe weather. However, whether it's a weekend trip to a luxury spa, a golf getaway to your favorite out-of-state course or a cross-country tour abroad that's taken years to save for, travel is a part of your life. Easily navigate's Nationwide travel obstacles with one of our flexible travel insurance plans.

Plans: 75% reimbursement

Medical Coverage: Up to $150,000Website: www.nationwide.com

Nationwide

Nationwide -

In 180 countries, HTH Worldwide maintains a global network of exceptional English-speaking medical specialists. As a result, if you ever find yourself in the regrettable situation of needing medical assistance while traveling abroad — whether for COVID-19 or another reason – you'll be glad you have HTH coverage. In addition, HTH provides CFAR coverage. To be eligible for a CFAR reimbursement, you must obtain coverage within 15 days after making your first trip deposit and cancel your trip at least 48 hours before the scheduled departure time.

They have a variety of travel health insurance policies available that cover hospitalization, surgery, office visits, prescription medicines, and medical evacuation. Travel the world with confidence, knowing that you can reach out to our global network of trustworthy English-speaking doctors in over 180 countries. When you Get A Quote, you'll see which travel health insurance packages are available in your area for the brand.Plans: 75% reimbursement

Medical Coverage: Up to $500,000Website: www.hthtravelinsurance.com

HTH Worldwide

HTH Worldwide -

AXA is a prominent travel insurance provider that offers three different types of policies: Silver, Gold, and Platinum. Platinum customers have the option to add CFAR coverage to their policies. To be eligible for a CFAR reimbursement, you must obtain coverage within 14 days of making your first trip deposit and cancel your trip at least 48 hours before the scheduled departure time.

They are number one for the tenth year in a row. AXA has been named the #1 Global Insurance Brand by INTERBRAND once again. It's a tremendous accomplishment for all of their AXA colleagues around the world. AXA offers travel insurance policies that include travel aid services to help you not only compensate for your insured loss, but also to support you during and after it.Plans: 75% reimbursement

Medical Coverage: Up to $100,000Website: axatravelinsurance.com

AXA

AXA -

AIG Travel Guard is noted for its highly customizable and adaptable travel insurance packages that can be tailored to fit a variety of needs. As a result, it's no surprise that Travel Guard continues to provide CFAR coverage, which includes compensation for COVID-19-related cancellations. To be eligible for a CFAR reimbursement, you must obtain coverage within 15 days after making your first trip deposit and cancel your trip at least 48 hours before the scheduled departure time.

If you're a returning Travel Guard customer looking for their Platinum, Gold, or Silver trip insurance plans, you'll notice that they've added three additional options to our online store. The Deluxe, Preferred, and Essential plans are now available in select states, with new names, combined coverages, and several new upgrades like the Name Your Family® bundle, Adventure Sports coverage, and Destination Weddings coverage!

The Travel Guard Deluxe plan is their most comprehensive travel insurance plan, providing the most coverage, global travel support, and access to 24-hour travel assistance. Travel with ease with the Travel Guard Preferred Plan, our comprehensive travel insurance. This plan is the ideal travel companion, with new and enhanced coverage.Plans: 50% reimbursement

Medical Coverage: Up to $100,000Website: travelguard.com

AIG Travel Guard

AIG Travel Guard -

When you consider that it offers ten different types of plans, it's simple to see why it's the largest travel insurance company in the United States. Allianz has you covered whether you're going on a single trip, many excursions, or need year-round coverage. However, having so many options has the drawback of lower reimbursements. Even with the best policy, Allianz only covers you for $50,000 if you need emergency medical treatment for COVID-19 or other causes during your vacation.

Allianz've got your back with award-winning 24/7 assistance and a worldwide network of prescreened hospitals to help you get the right care. From protection for trip cancellation to medical bills abroad, their benefits are designed to help you explore reassured. Besides, from their TravelSmart app to proactive SmartBenefits, they innovate for the way you travel today - and tomorrow.

Plans: Not offered

Medical Coverage: Up to $50,000Website: Allianz.com

Allianz

Allianz