Top 10 Cheapest Travel Insurance Companies

There are many wise methods to cut costs when making travel arrangements, but skipping out on travel insurance isn't always one of them. You might not think ... read more...you want travel insurance if you're taking a road trip or organizing a low-cost staycation close to home. Some of the Best Travel Insurance Providers are listed below.

-

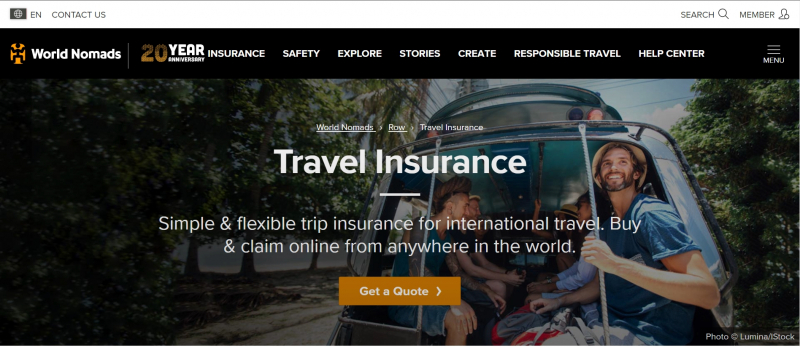

Travelers who purchase travel insurance from World Nomads can tailor their policies based on price and the level of coverage they require. Although there are many items in the insurance, World Nomads Travel Insurance stands out since their basic coverage automatically covers more than 200 adventure sports, including skydiving, scuba diving, ATV riding, zip line, snowmobiling, skiing, and snowboarding, among others. Extreme sports coverage is a requirement of several other travel insurance providers.

Inside World Nomads, there are two plans: Standard and Explorer. The Basic plan will be the most economical. It includes up to $750 for baggage delays on your outbound journey ($150 per day maximum), $2,500 worth of trip interruption or cancellation insurance, up to $1,000 worth of lost, stolen, or damaged baggage coverage, up to $100,000 worth of emergency medical insurance, and up to $300,000 worth of emergency medical evacuation transportation.

- Average cost of travel insurance across sample trips: $131

Website: https://www.worldnomads.com/row/travel-insurance

Screenshot via https://www.worldnomads.com/row/travel-insurance

Screenshot via https://www.worldnomads.com/row/travel-insurance -

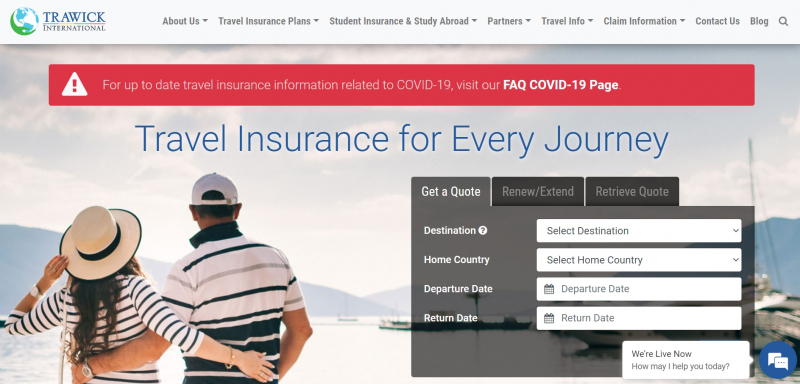

For all kinds of visitors, including tourists, students going abroad, businesspeople, families, groups, and more, Trawick International offers a wide range of insurance choices. Customers can choose from six different plan types offered by the travel insurance firm for trip protection and cancellation insurance, depending on what will work best for them.

The Safe Travels Voyager plan offers up to $250,000 in main medical coverage, covering COVID-19 medical costs, and up to $100,000 in trip cancellation insurance. Missed connections, vacation delays, lost and delayed luggage, rental car damage, emergency evacuation and repatriation coverage up to $1 million, and more are all covered by this plan. Moreover, a benefit enhancement that allows cancellation for any reason is optional.

The affordable Safe Travels Explorer plan is marketed as having "just the necessities," including trip cancellation and interruption coverage up to 100% of the insured vacation, up to $50,000 in medical coverage, up to $200,000 in emergency evacuation coverage, coverage for misplaced or delayed luggage, and coverage for missed flight connections.

Also, there are three choices for annual travel insurance trips. Along with offering a variety of plan options, Trawick International also offers student travel insurance for people going overseas to school, which is popular with those who have prior ailments.- Average cost of travel insurance across sample trips: $180

Website: https://www.trawickinternational.com/

Screenshot via https://www.trawickinternational.com/

Screenshot via https://www.trawickinternational.com/ -

For consumers who wish to pay more (or less) to acquire the proper amount of coverage, AXA Help USA offers three grades of travel insurance. With 100% coverage for trip cancellation and interruption, $100 per day of coverage for trip delays (up to a $500 maximum benefit), $500 in coverage for missed connections, $100,000 in coverage for emergency medical evacuation, and $25,000 in coverage for accidents and illnesses, the Silver Plan is the most affordable choice. This plan also includes $750 in coverage for baggage and personal possessions, as well as $200 in coverage for baggage delays.

With the Gold or Platinum Plans, however, you can pay for greater coverage and higher coverage limits. Even more specifically tailored coverage for active travelers is included in AXA's top-tier Platinum Plan, including coverage for lost ski days ($25 per day), lost golf rounds ($500), and sports equipment rentals ($1,000). The only AXA plan with this level of coverage also allows you to add a cancel for any reason rider to your policy, allowing you to get 75% of your trip costs reimbursed in the event that you decide to cancel your trip. (Note: For this coverage to be applicable, it must be acquired within 14 days of your original trip deposit.)

Also, keep in mind that the AXA Help USA plans provide a 10-day money-back guarantee. This implies that as long as you haven't begun your trip or submitted a claim, you can buy a plan, change your mind, and get your premiums reimbursed.- Average cost of travel insurance across sample trips: $199

Website: https://www.axatravelinsurance.com/

Screenshot via https://www.axatravelinsurance.com/

Screenshot via https://www.axatravelinsurance.com/ -

GoReady Insurance (formerly APRIL Travel Protection) provides annual plans for regular travelers who require protection for numerous travels throughout the year in addition to single-trip policies. Customers booking a single trip have access to a variety of travel insurance options, including a cruise-specific plan and a VIP plan. The VIP plan includes $1 million in coverage limitations for emergency airlift, 100% cancellation coverage, and 175% interruption compensation.

Travelers who select a single-trip plan for a cruise can purchase insurance with cancel for any reason coverage, which provides 100% coverage for trip cancellation and 150% compensation for trip interruption. In the event that the insured person, their traveling companion, or a member of their family contracts COVID-19, this plan also provides coverage for trip cancellation and interruption, travel delays, and emergency medical assistance. Also, the firm provides the GoReady Choice Plan, which enables you to pick the benefits you value the most. They include coverage for sports and business equipment, the financial collapse of a travel provider, cancellation due to business obligations, and more.

The GoReady Pandemic Plus Plan from this supplier is also one of the few travel insurance policies in the whole travel market that does not specifically exclude pandemics. The coverage included in this plan includes trip interruption and cancellation, emergency medical and dental expenses up to $50,000, emergency evacuation and repatriation expenses up to $500,000, trip delay coverage, baggage and personal effects coverage, accidental death and dismemberment coverage, and more. In the event that you need to cancel your vacation, you can get coverage that will reimburse you for 75% of your expenses.- Average cost of travel insurance across sample trips: $221

Website: https://goreadyinsurance.com/

Screenshot via https://goreadyinsurance.com/

Screenshot via https://goreadyinsurance.com/ -

Three travel insurance choices are provided by Generali Global Help, ranging from basic, cost-effective coverage to an enhanced, premium plan. In the Basic plan, travel interruption is covered up to 125% of the insured holiday cost and trip cancellation up to 100% of the insured vacation cost. Moreover, the Basic plan offers emergency dental treatment of up to $500 and medical coverage of up to $50,000, as well as compensation for missing connections, lost, and delayed luggage.

The company's two plans (Preferred and Premium) offer comparable products with higher coverage limits as well as more specialized coverage for preexisting ailments and situations including the financial instability of travel service providers. Moreover, Generali Global Help offers a few travel insurance alternatives designed especially for people who reserve a holiday rental.

- Average cost of travel insurance across sample trips: $245

Website: https://us.generaliglobalassistance.com/

Screenshot via https://us.generaliglobalassistance.com/

Screenshot via https://us.generaliglobalassistance.com/ -

From specialized rental vehicle and medical insurance to more conventional single-trip and annual travel insurance options, Allianz Travel Insurance offers a wide range of travel insurance policies. Two of Allianz's most affordable options are OneTrip Cancellation Plus and OneTrip Basic. OneTrip Cancellation Plus offers access to a 24-hour helpline for support along with trip cancellation and interruption coverage up to $5,000 and travel delay coverage up to $150 (this is the daily cap).

The OneTrip Basic policy includes emergency medical and dental coverage up to $10,000 ($500 for dental expenses), 24-hour hotline assistance, trip cancellation and trip interruption coverage up to $10,000, emergency medical transportation up to $50,000, and luggage loss, damage, and delay protection. If certain conditions are satisfied, preexisting conditions are covered under this plan.

The company's OneTrip Premier travel insurance program is touted as being its most well-liked. Higher coverage limits are included in this policy, as well as extra benefits like $100 per day for travel inconveniences (up to $100,000 for trip cancellation, up to $150,000 for trip interruption, up to $1,000 for baggage loss or damage, up to $500,000 in emergency medical transportation, and more).- Average cost of travel insurance across sample trips: $285

Website: https://www.allianztravelinsurance.com/

Screenshot via https://www.allianztravelinsurance.com/

Screenshot via Screenshot via https://www.allianztravelinsurance.com/ -

Cruise, single-trip, and annual or multitrip travel insurance policies are three of the three categories in which Nationwide specializes. The Single-Trip Essential Plan will probably be of interest to the majority of travelers. This choice covers trip cancellations (up to $10,000), travel delays ($150 per day, up to $600 in total), and trip interruptions (up to 125% of the entire trip cost), including delays or disruptions brought on by terrorism.

Also, travelers receive emergency dental coverage of $500, up to $75,000 in coverage for accidents and illnesses, and up to $250,000 in coverage for both emergency medical evacuation and repatriation of remains. Additionally, this plan includes coverage for lost or stolen personal belongings as well as delayed luggage.

Additionally, this plan includes coverage for lost or stolen personal belongings as well as delayed luggage. The Single-Trip Prime Plan is the better choice for those who want to upgrade their plan to include cancel for any reason coverage, increased policy coverage, and more advantages. Nevertheless, there are three annual plan options available for frequent travelers looking for coverage.

The company's cruise plans (there are three versions) also offer a range of safety nets, from conventional trip cancellation or interruption benefits to coverage of cruise-specific issues including schedule adjustments due to mechanical problems, missed excursions, and trip changes due to weather.- Average cost of travel insurance across sample trips: $307

Website: https://www.nationwide.com/

Screenshot via https://www.nationwide.com/

Screenshot via https://www.nationwide.com/ -

Seven Corners distributes medical insurance policies to foreign visitors as well as to Americans who live in the country. Seven Corners also provides special group travel insurance plans, student travel insurance, road trip insurance for journeys across the United States, Mexico, and Canada, and medical evacuation and repatriation coverage created especially for visa holders to help differentiate themselves from other providers. Also, you can buy annual travel insurance policies that include coverage for multiple trips throughout the year.

The RoundTrip Trip Cancellation Travel Insurance plan is the most popular option that Seven Corners provides. This coverage is for a single trip and is available to residents of the United States whether they are going domestically or abroad. RoundTrip Economical and RoundTrip Elite are the two grades offered.

The lowest-tier RoundTrip Economy plan includes emergency accident and sickness medical coverage up to $10,000, emergency dental coverage up to $750, emergency evacuation and repatriation coverage up to $100,000, and lost, stolen or damaged baggage coverage up to $500. Trip cancellation coverage up to $20,000, trip interruption coverage up to 100% of the cost of the trip, trip delay coverage worth $250, missed connection coverage worth $250, and trip delay coverage worth $250 are also included.- Average cost of travel insurance across sample trips: $310

Website: https://www.sevencorners.com/

Screenshot via https://www.sevencorners.com/

Screenshot via https://www.sevencorners.com/ -

IMG Travel Insurance offers a wide variety of insurance policies that you may purchase, including particular plans for travelers who are 65 years of age or older as well as policies for expatriates, business travelers, and students. But, there are three major levels of coverage available for general travel insurance plans: iTravelInsured Travel Lite, iTravelInsured Travel SE, and iTravelInsured Travel LX.

The most affordable option is the iTravelInsured Travel Lite plan, albeit the coverage limits aren't always low. This plan includes coverage for trip cancellation up to 100%, trip interruption coverage up to 125% of the trip cost, coverage for travel delay up to $500, and more. Along with acute illness, injury, and death, other covered risks include hijacking, terrorist activity, and the financial failure of a travel supplier, among others. You should be aware that this plan cannot cover previous conditions, and all coverage is secondary to any other insurance you may have.

The highest tier iTravelInsured Travel LX plan, on the other hand, will grant you a waiver for preexisting conditions and substantially higher coverage limits if you buy it within 24 hours of making your final travel payment. You can replace other insurance you already have with your travel insurance plan since coverage for it is primary as well.- Average cost of travel insurance across sample trips: $329

Website: https://www.imglobal.com/

Screenshot via https://www.imglobal.com/

Screenshot via https://www.imglobal.com/ -

Although American Express is a well-known brand in the credit card industry, you are not required to have an American Express credit card to buy travel insurance from the firm. American Express Travel Insurance offers customizable coverage as well as the Basic, Silver, Gold, and Platinum package options.

The Basic, Silver, or build-your-own plans are this company's most affordable choices. The Basic plan offers up to $1,000 in travel cancellation or interruption coverage, $5,000 in medical emergency coverage, up to $750 in dental emergency coverage, and $250 in lost baggage coverage. Unfortunately, this ordinary plan does not pay out for lodging, food, or missed connections due to travel delays. It also does not cover travel accidents that result in death or dismemberment.The Silver plan offers coverage for up to 100% of the cost of the trip in the event of cancellation or interruption, as well as up to $25,000 for medical emergencies, up to $100,000 for emergency evacuation and repatriation, up to $50,000 to $100,000 for protection against travel accidents (depending on the type of accident), $500 for lost luggage, and up to $150 per day for costs associated with a delayed trip.

You can choose the types of coverage you want with the "build-your-own" package. Choices include emergency medical and dental coverage, emergency evacuation, trip cancellation, delay, and interruption, and luggage protection.- Average cost of travel insurance across sample trips: $329

Website: https://aeti.americanexpress.com

Screenshot via https://aeti.americanexpress.com

Screenshot viahttps://aeti.americanexpress.com