Top 14 Largest Financial Service Companies in The UK

In this post, let's examine 14 of the largest financial services companies in The UK, ranked by market capitalization. Go directly to other related articles on ... read more...Toplist if you want to see more of the largest financial companies in other regions ranked by market capitalization.

-

The City of London, England, United Kingdom, is home to the London Stock Exchange (LSE), a stock market. In November 2021, the total market capitalization of all listed companies on the London Stock Exchange was £3.9 trillion. Its current location in London's City, near St. Paul's Cathedral, is at 1 Paternoster Square. It has been listed on the London Stock Exchange (LSE) since 2007 and is now a subsidiary of the London Stock Exchange Group (LSEG, LSE: LSEG).

From 2003 (when records began) until the fall of 2022, when the Paris exchange was momentarily larger, the LSE was the most valuable stock exchange in Europe. However, the LSE regained its position as Europe's largest stock market 10 days later. About 12% of UK residents reported having investments in stocks and shares in 2020, according to data compiled by the Office for National Statistics. In 2020, the Financial Conduct Authority (FCA) found that just about 15% of UK adults had stock or share portfolios.

The market capitalization of the London Stock Exchange is $54.26 billion as of April 2023. Based on its current market capitalization, the London Stock Exchange is the 298th most valuable corporation in the world. Recent financial filings with the London Stock Exchange reveal TTM revenues of $1.94 billion for the corporation. The company's revenue in 2021 was $9.05 billion, significantly higher than the $3.32 billion it made in 2020.

Founded: 30 December 1801

Headquarters: City of London, England, United Kingdom

Website: www.londonstockexchange.com

Screenshot via www.londonstockexchange.com

Screenshot via www.londonstockexchange.com -

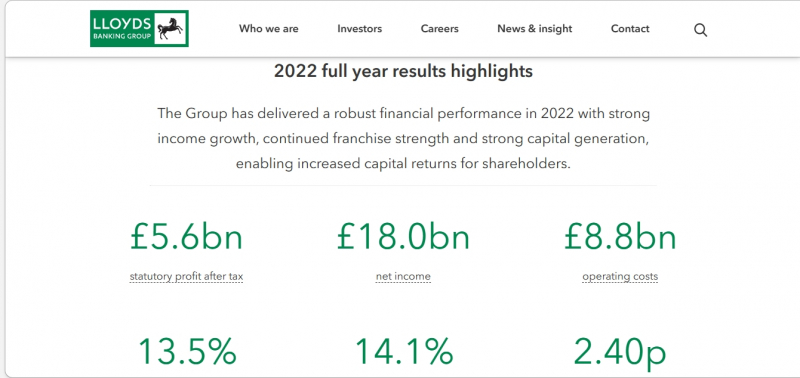

Lloyds Banking Group is a British financial firm that was created in 2009 when Lloyds TSB acquired HBOS. With 30 million customers and 65,000 staff, it is one of the largest financial services organizations in the UK. Lloyds Bank was established in 1765, but the group's history may be traced back to the 1695 establishment of the Bank of Scotland by the Parliament of Scotland.

While its official headquarters can be found at 25 Gresham Street in London's City, the group's registered office can be found on Edinburgh's The Mound. Office locations in Birmingham, Bristol, West Yorkshire, and Glasgow are also under its management. The United States, Europe, the Middle East, and Asia are just some of the places where the Group operates extensively. Berlin, Germany, serves as the company's EU headquarters.Lloyds Banking Group is worth $39.97 billion as of April 2023. In terms of market capitalization, this places Lloyds Banking Group at #437.The most recent financial records reveal that Lloyds Banking Group has annual revenues of $22.03 billion. The company's revenue in 2021 was $22.24 billion, up from $19.82 billion in the previous year.

Founded: 16 January 2009

Headquarters:- London, England, UK(operational headquarters)

- Edinburgh, Scotland, UK(registered office)

Website: www.lloydsbankinggroup.com

Screenshot via www.lloydsbankinggroup.com

Screenshot via www.lloydsbankinggroup.com - London, England, UK(operational headquarters)

-

The Edinburgh, Scotland-based NatWest Group plc is a British banking and insurance holding corporation. The banking brands run by the group include those that cater to individuals and small businesses as well as those that specialize in investment banking, insurance, and corporate financing. National Westminster Bank, Royal Bank of Scotland, NatWest Markets, and Coutts are its primary subsidiaries in the United Kingdom. As of 2014, the Royal Bank of Scotland was the only UK bank still printing £1 notes, and the group is responsible for issuing banknotes in both Scotland and Northern Ireland (see point #4).

The Group was briefly the largest bank in the world before its collapse in 2008 and the subsequent global financial crisis. It subsequently became the second-largest bank in the UK and Europe and the fifth-largest bank in the world. Although in 2009 it was temporarily the largest corporation in the world by both assets (£1.9 trillion) and liabilities (£1.8 trillion), it subsequently plummeted drastically in the rankings due to a plummeting share price and a major loss of confidence. The United Kingdom government bailed it out in 2008 with the UK bank rescue package.The market value of NatWest Group is $33.09 billion as of April 2023. Based on its current market capitalization, NatWest Group is the 539th most valuable corporation in the world. NatWest Group's current revenue (TTM) is $16.24 billion, as shown in the company's most recent financial reports. The company's revenue in 2021 was $14.20 billion, down from $14.26 billion in the previous year.

Founded: 25 March 1968

Headquarters: Edinburgh, Scotland, UK

Website: www.natwestgroup.com

Screenshot via www.natwestgroup.com

Screenshot via www.natwestgroup.com -

British International Universal Bank Barclays is based in London. Barclays consists of two main branches—the UK branch and the rest of the world branch—and a service company called Barclays Execution Services. Barclays was founded in 1690 as a goldsmith banking firm in London's City. In 1736, James Barclay was accepted as a partner at the company. In 1896, Goslings Bank, Backhouse's Bank, and Gurney, Peckover, and Company were among the twelve London and English provincial banks that merged to form Barclays and Co.

In April 2023, the value of Barclays was estimated at $30.56 billion. This places Barclays' market valuation at $586, making it the 586th most valuable firm in the world. The most recent financial reports for Barclays show that the company's revenue is $30.34 billion. The company's revenue in 2021 was $29.92 billion, up from $27.56 billion in the previous year.Founded: 17 November 1690

Headquarters: London, England, UK

Website: www.home.barclays

Screenshot via www.home.barclays

Screenshot via www.home.barclays -

Standard Chartered plc is a British international bank that provides personal, business, and treasury banking services. Although it is based in the UK, the majority of its revenue and customers are really located in Asia, Africa, and the Middle East.

Standard Chartered is included in the FTSE 100 Index and is primarily traded on the London Stock Exchange. It's also listed on the OTC Markets Group Pink exchange, as well as the Hong Kong Stock Exchange and the National Stock Exchange of India. Temasek Holdings, which is owned by the Singaporean government, is the company's main stakeholder. According to the Financial Stability Board, it is a key financial institution. Standard Chartered's Group Chairman is José Vials. Group Chief Executive Bill Winters is currently in charge.Standard Chartered is worth $22.32 billion as of April of 2023. Standard Chartered is now the 787th most valuable firm in the world. Standard Chartered has reported a TTM revenue of $16.17 B in its most recent financial report. The company's sales in 2021 was $14.63 B, down from the $14.91 B earned in 2020.

Founded: 18 November 1969

Headquarters: London, England, UKWebsite: www.sc.com

Screenshot via www.sc.com

Screenshot via www.sc.com -

Financial services provider Admiral Group plc is headquartered in Cardiff, Wales, and is a British public limited company. It is a member of the FTSE 100 Index and the London Stock Exchange; it promotes the auto insurance brands Admiral, Bell, Elephant, Diamond, and Veygo; and it created the pricing comparison websites Confused.com and Compare.com. More than ten thousand individuals are employed by the conglomerate's various labels.

David Stevens resigned as CEO on January 1, 2021, and was succeeded by Milena Mondini de Focatiis. Including its Cardiff-based price comparison website Confused.com, Admiral sold stakes to RVU in April 2021 for £508 million.In April 2023, the market value of Admiral Group was $8.22 billion. Based on its current market capitalization, Admiral Group is the 1705th most valuable business in the world. Revenue for the trailing twelve months (TTM) for Admiral Group is $2.08 billion, per the company's most recent financial filings. The company's revenue in 2021 was $2.08 billion, up from $1.76 billion in the previous year.

Founded: 1991

Headquarters: Cardiff, Wales, UK

Website: admiralgroup.co.uk

Screenshot via admiralgroup.co.uk

Screenshot via admiralgroup.co.uk -

British investment management firm St. James's Place plc (previously St. James's Place Capital plc). There are almost twenty additional locations throughout the UK in addition to the headquarters in Cirencester, Gloucestershire. It is an advisory, investment management, and life insurance firm all in one. It is included in the FTSE 100 Index and trades on the London Stock Exchange. It dominates the market in the UK; Its assets under management totaled £135 billion in 2021.

Fourteen retired football players filed a £15 million lawsuit against St. James's Place in November 2019, claiming the firm gave them bad advice on how to avoid paying taxes on money they invested in movies and offshore real estate. According to a representative from St. James's Place, "the partner who pointed the investors toward the plan did not have its authorization to do so, and St. James's didn't approve of the proposal."The partner had retired by the time several of the investments were made, while others were deposited through a self-invested personal pension by a third party, the spokeswoman added. A legal document states that £15 million (€17.5 million) is the value of the claim. St. James's, on the other hand, claimed that the claims were time-barred because the investments were made over a decade ago.

St. James's Place is worth $8.21 billion as of April of 2023. Based on its current market capitalization, St. James's Place is the 1708th most valuable company in the world. St. James's Place has reported a TTM revenue of $24.21 B as of the most recent quarter. The company's 2021 revenue of $24.21 B increased from the $10.86 B it earned in 2020.

Founded: 1991

Headquarters: Cirencester, England, UK

Website: www.sjp.co.uk

Screenshot via www.sjp.co.uk

Screenshot via www.sjp.co.uk -

Old Mutual Limited operates across the financial sectors of the African continent. It is traded on the Johannesburg Stock Exchange as well as those of Zimbabwe, Namibia, and Botswana. In 1845, John Fairbairn established it in South Africa; by 1999, it had been demutualized and listed on the London Stock Exchange and other stock markets.

In 2018, it adopted a new strategy known as "managed separation," which involved the spin-off of four of its businesses: Old Mutual Emerging Markets, Nedbank, Old Mutual Wealth (located in the United Kingdom), and Old Mutual Asset Management (based in Boston). Because of this, Quilter plc (previously Old Mutual Wealth) split off from its parent company and unbundled its shares in Nedbank. The company, which has primarily relocated to South Africa, contributes to bursaries and other forms of financial aid at schools there.

Old Mutual is worth $3.36 billion as of April 2023. Based on its current market capitalization, Old Mutual ranks 2,995th among all companies worldwide. The most recent financial reports reveal TTM revenue of $37.43 billion for Old Mutual. The company's revenue of $15.49 billion in 2021 was up from the $9.90 billion it made in 2020.

Founded: 17 May 1845

Headquarters: Johannesburg, South Africa

Website: www.oldmutual.com

Screenshot via www.oldmutual.com

Screenshot via www.oldmutual.com -

The British international insurance firm Prudential plc is headquartered in the capital city of London. It began in London in May 1848 as a source of credit for working people. Prudential is included in both the FTSE 100 Index and the London Stock Exchange. It also has a principal listing on the Hong Kong Stock Exchange. The New York Stock Exchange and the Singapore Exchange both feature it as a secondary listing.

Prudential announced the demerger of M&GPrudential from the group in March 2018. The demerger was finalized on October 21, 2019. Prudential stated in August 2020 that it would completely split Jackson off from the group. As of September 13, 2021, the demerger was finalized.

Prudential has a $39.98 billion market worth as of April 2023. With this market capitalization, Prudential is the 439th most valuable corporation in the world. Prudential has reported a TTM revenue of $129.28 B as of the end of the most recent reporting period. The company's 2006 revenue of $130.57 B was up from 2005's revenue of $109.62 B.

Founded: 1848

Headquarters: London, England, UK

Website: www.prudentialplc.com

Screenshot via www.prudentialplc.com

Screenshot via www.prudentialplc.com -

Scottish consumers and businesses alike rely heavily on The Royal Bank of Scotland plc (abbreviated RBS; Scottish Gaelic: Banca Roghail na h-Alba). Along with NatWest (in England and Wales) and Ulster Bank, it is a retail banking subsidiary of the NatWest Group.

Despite being based primarily in Scotland, the Royal Bank of Scotland has branches in several major English and Welsh cities and towns. The Royal Bank of Scotland is not affiliated in any way with the Bank of Scotland, another Edinburgh-based financial institution that was founded 32 years before the Royal Bank. The Royal Bank of Scotland was founded in 1724 as a financial institution with close ties to the Hanoverian and Whig governments.

The market value of Royal Bank of Scotland was $18.59 billion in April 2023. Based on its current market capitalization, Royal Bank of Scotland is the 901st most valuable corporation in the world. The latest financial reports reveal a TTM revenue of $16.23 billion for Royal Bank of Scotland. The company's 2019 revenue of $18.25 billion represents an increase from 2018's revenue of $17.75 billion.Founded: 1724

Headquarter: Edinburgh, Scotland, UK

Market cap: $18.59 Billion

Revenue in 2020 (TTM): $16.23 B

Website: www.rbs.co.uk

Screenshot via www.rbs.co.uk

Screenshot via www.rbs.co.uk -

Wise (previously TransferWise) was launched in January 2011 by Estonian entrepreneurs Kristo Käärmann and Taavet Hinrikus and is headquartered in London, United Kingdom. Company co-founder Taavet Hinrikus announced his impending resignation as chair in a prospectus released on July 2, 2021. David Wells was named as his successor, which was also announced.

Directly launching on the London Stock Exchange on July 7, 2021, Wise was valued at $11 billion at the time. The Financial Conduct Authority announced on June 27, 2022, that Wise CEO Kristo Käärmann had been penalized for willful failure to comply with tax obligations. From September 2021 onward, he would spend another year on the list. He allegedly owes the government £720,000 in unpaid taxes for the fiscal year 2017–2018.Founded: January 2011

Headquarters: London, United Kingdom

Website: wise.com

Screenshot via wise.com

Screenshot via wise.com -

Funding Circle is a business that offers loans. Initially, it was a marketplace where individuals could make loans to other individuals or small and medium-sized enterprises. Businesses can acquire financing at lower rates than they would get from a bank, and individuals can earn a return on their money by lending it out. As of March 2022, it was reported that the loan option for "retail investors" would be permanently terminated, a decision that had been in the works since 2020.

Funding Circle has helped small and medium-sized businesses access nearly £13.7 billion in loans as of March 2022. The stock of the corporation trades on the London Stock Exchange. Funding Circle announced the temporary suspension of their secondary market for loan components on April 9, 2020, saying, "We have taken the decision to pause the secondary market while we continue to evaluate the potential impact of COVID-19." The firm said it was leaving the P2P lending sector entirely on March 10, 2022, to focus solely on commercial lending.Founded: August 2010

Headquarters: Queen Victoria Street, London, EC4

Website: www.fundingcircle.com

Screenshot via www.fundingcircle.com

Screenshot via www.fundingcircle.com -

Hays plc is a British multinational corporation that operates in 33 countries, mostly by offering human resources and recruitment services. It's a part of the FTSE 250 Index and the London Stock Exchange. Hays is a multinational recruitment firm with headquarters in the United Kingdom and Ireland, as well as offices across Continental Europe (in German, the name is pronounced Hei(s), as health = Hei(l)), the Americas, and Asia. Its income is pretty evenly distributed between temporary and permanent placements, which helps it weather economic downturns. Hays has offices in 33 different nations.

Hays plc is worth $2.24 billion as of April 2023. Based on its current market capitalization, Hays plc ranks 3,583rd among all companies worldwide. Hays plc's current revenue (TTM) is $7.99 billion, as shown in the company's most recent financial reports. There was an increase in sales in 2022 compared to 2021, when the corporation brought in $7.81 billion.

Founded: www.haysplc.com

Headquarters: www.haysplc.com

Website: www.haysplc.com

Screenshot via www.haysplc.com

Screenshot via www.haysplc.com -

HSBC is now the Asia-Pacific division of the international HSBC banking corporation, which was its parent company until 1991. The largest bank in Hong Kong, HSBC has offices and branches all across the Indo-Pacific area as well as in other nations. Also, it holds one of the three commercial banks' licenses from the Hong Kong Monetary Authority to print Hong Kong dollar banknotes.

The Hongkong & Shanghai Bank was founded in British Hong Kong in 1865, became the Hongkong and Shanghai Banking Corporation in 1866, and has maintained its Hong Kong headquarters ever since (although it is now a subsidiary). In 1989, it underwent a name change to "The Hongkong and Shanghai Banking Company Limited."

Since 1990, it has served as the namesake and one of the top subsidiaries of HSBC Holdings PLC, a bank holding company with headquarters in London. It is a founding member of the HSBC group of banks and businesses. The company's operations include investment banking, private banking, and international banking, in addition to the typical High Street functions of retail banking, commercial banking, and corporate banking.

HSBC's market capitalization as of March 2023 was $136.40 billion. By market valuation, this places HSBC as the 86th most valuable firm in the entire world. The most recent financial reports from HSBC indicate that the company's current revenue (TTM) is $61.49 billion. The corporation generated $63.66 billion in revenue in 2021, an increase from $62.88 billion in revenue in 2020.

Founded: 3 March 1865

Headquarters: HSBC Main Building, 1 Queen's Road Central, Central, Victoria City, Hong Kong

Website: www.hsbc.com.hk

Screenshot via www.hsbc.com.hk

Screenshot via www.hsbc.com.hk