Top 10 Largest Financial Service Companies in Netherlands

If you're seeking for financial services in the Netherlands, check out this list of the top 10 largest companies offering those services.... read more...

-

Adyen, a Dutch payment provider with the status of an acquiring bank, enables companies to take payments from customers using their smartphones, tablets, and point-of-sale devices. It is traded on the Euronext Amsterdam stock exchange.

Adyen provides online services to merchants, so they can accept electronic payments made via wire transfers, real-time bank transfers based on online banking, credit cards, debit cards, and other payment methods. It links retailers to a variety of payment options, including global credit cards, regional cash-based payment options, and mobile payment options. The technological platform serves as both a payment gateway and a provider of payment services.The market capitalization for Adyen as of April 2023 is $47.75 billion. By market cap, this places Adyen as the 340th most valuable firm in the entire globe. The most recent financial reports from Adyen indicate that the company's current revenue (TTM) is $1.32 billion. The company generated $6.78 billion in revenue in 2021, an increase from $4.47 billion in revenue in 2020.

Founded: 2006

Headquarters: Amsterdam, Netherlands

Website: www.adyen.com

Screenshot via www.adyen.com

Screenshot via www.adyen.com -

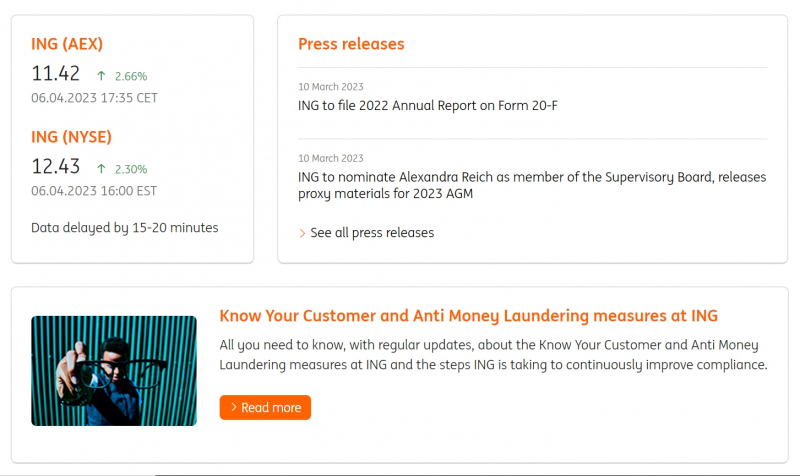

A worldwide Dutch banking and financial services company with its corporate headquarters in Amsterdam is known as The ING Group (Dutch: ING Groep). Retail banking, direct banking, commercial banking, investment banking, wholesale banking, private banking, asset management, and insurance services are some of its main lines of business. It is one of the largest banks in the world, consistently ranking among the top 30 largest banks globally, and has total assets of US$1.1 trillion. According to revenue, it ranks among the top ten largest European firms.

The Inter-Alpha Group of Banks, a cooperative organization comprising 11 renowned European banks, has ING as its Dutch representative. Since its founding in 2012, ING Bank has been included in the list of internationally significant banks.

ING's market cap as of April 2023 is $44.94 billion. By market cap, this places ING as the 373rd most valuable corporation in the world. The most recent financial reports from ING indicate that the company's current revenue (TTM) is $20.59 Billion. The company generated $21.49 billion in revenue in 2021, up from $20.35 billion in revenue in 2020.

Founded: 1991

Headquarters: Amsterdam, Netherlands

Website: ing.com

Screenshot via ing.com

Screenshot via ing.com -

The third-largest Dutch bank, ABN AMRO Bank N.V., has its corporate headquarters in Amsterdam. Algemene Bank Nederland (ABN) and Amsterdamsche en Rotterdamsche Bank, the first two Dutch banks that make up its name, merged to become it in 1991. (AMRO Bank).

Following ambitious global development, a group of European banks, notably Fortis, bought and broke up ABN AMRO in 2007–2008 with the intention of taking over its Benelux operations. The Dutch operations, specifically Fortis Bank Nederland and the previous ABN AMRO activities that Fortis had planned to absorb, were nationalized, reformed, and renamed ABN AMRO in mid-2010.Fortis experienced stress in the autumn of 2008 and was subsequently split up into distinct national companies. The company's shares were sold to the general public in an initial public offering (IPO) on November 20, 2015, when the Dutch government publicly relisted the business.

ABN AMRO's market capitalization as of April 2023 is $14.21 billion. ABN AMRO is now the 1128th-most valuable corporation in the world, according to market cap. The most recent financial reports for ABN AMRO show that the company's current revenue (TTM) is $8.26 billion. The company's revenue in 2021 was $8.47 billion, down from $8.85 billion in revenue in 2020.

Founded: September 21, 1991

Headquarters: Amsterdam, Netherlands

Website: www.abnamro.com

Screenshot via www.abnamro.com

Screenshot via www.abnamro.com -

Nationale-Nederlanden and NN Investment Partners are both owned by NN Group N.V. One of the biggest asset management and insurance firms in the Netherlands is called Nationale-Nederlanden. NN Group has its headquarters in The Hague, and its Rotterdam office is housed in the Gebouw Delftse Poort, a skyscraper that, until 2009, was the tallest in the Netherlands.

NN does not have any other main offices in the Netherlands aside from these two locations; instead, it mostly relies on independent intermediaries to market insurance. This office is located in Ede (formerly RVS). NN Group and rival Delta Lloyd Group came to an agreement on December 23 to buy each other for 2.5 billion euros.

The market capitalization of NN Group as of April 2023 was $10.42 billion. By market cap, this places NN Group as the 1423rd most valuable company in the world. The most recent financial reports from NN Group indicate that the company's current revenue (TTM) is $22.44 billion. The corporation generated $23.28 billion in revenue in 2018, an increase from $20.18 billion in revenue in 2017.

Founded: 1963

Headquarters: The Hague, Netherlands

Website: www.nn-group.com / www.nn.nl

Screenshot via www.nn-group.com

Screenshot via www.nn-group.com -

A pan-European exchange called Euronext provides a number of trading and post-trade services. Regulated stocks, exchange-traded funds (ETFs), warrants, certificates, bonds, derivatives, commodities, foreign exchange, and indices are examples of traded assets. Nearly 2,000 listed issuers with a market capitalization of €6.9 trillion were present as of December 2021.

Euronext, the largest global hub for debt and fund listings, also offers managed services and technologies to third parties. In addition to its primary regulated market, it also runs Euronext Growth and Euronext Access, which give small and medium-sized businesses access to listings. The Fish Pool and Nord Pool electric power exchanges are both part of Euronext's commodity market.

The market capitalization of Euronext as of April 2023 was $8.24 billion. By market cap, this places Euronext as the 1686th most valuable corporation in the world. The most recent financial reports from Euronext indicate that the company's current revenue (TTM) is $1.43 B. The company generated $1.48 billion in revenue in 2021, an increase from $1.04 billion in revenue in 2020.

Founded: 1285

Headquarters: Amsterdam, Netherlands

Website: www.euronext.com

Screenshot via www.euronext.com

Screenshot via www.euronext.com -

Specialized, independent wealth manager Van Lanschot Kempen N.V. offers private banking, investment management, and investment banking services to affluent people and institutions. The Netherlands Hertogenbosch serves as its administrative center. Van Lanschot Kempen, Van Lanschot, Evi, and Kempen are some of its brand names. It is one of the oldest independent financial organizations in the world and the oldest in the Netherlands, the Benelux region, with a history that dates back to 1737.

Van Lanschot Kempen's market cap was $1.24 billion as of April 2023. By market capitalization, Van Lanschot Kempen is now the 4350th most valuable corporation in the world. The most recent financial records for Van Lanschot Kempen show that the company's current revenue (TTM) is $0.60 billion. The company generated $0.63 billion in revenue in 2021, an increase from $0.51 billion in 2020.

Founded: 22 July 1737

Headquarters: Hooge Steenweg 29, 5211 JN 's-Hertogenbosch, North Brabant, The Netherlands

Website: https://www.vanlanschotkempen.com

Screenshot via https://www.vanlanschotkempen.com

Screenshot via https://www.vanlanschotkempen.com -

Dutch international banking and financial services provider Rabobank is based in Utrecht. The group consists of 89 regional Dutch Rabobanks (as of 2019), Rabobank Nederland, a central organization, and numerous specialized foreign offices and subsidiaries. The Rabobank Group's principal international concentration is in the food and agricultural industries. In terms of total assets, Rabobank is the second-largest bank in the Netherlands.

A 2013 incident that involved dishonest trading tactics, including global LIBOR currency rate manipulation, led to a $1 billion fine. As a result, CEO Piet Moerland resigned right away. The organization is one of the top 30 financial organizations in the world in terms of Tier 1 capital. Total assets were €681 billion as of December 2014, with a €1.8 billion net profit. Rabobank is ranked 25th on Global Finance's list of "the world's safest banks."Founded: 1895

Headquarters: Rabotoren, Utrecht, Netherlands

Website: www.rabobank.com

Screenshot via www.rabobank.com

Screenshot via www.rabobank.com -

Robeco, originally a Dutch asset management company created in 1929 as the Rotterdamsch Beleggings Consortium, has been a part of Orix since 2013. The business managed €246 billion in assets as of 2014. It was purchased by the Rabobank Group in 2001 and sold to the ORIX Corporation in 2013. Robeco provides both institutional and individual investors with asset management services. Private investors can access money through Robeco and other financial organizations.

Nearly 2 million guilders were invested at the company's founding, but by the middle of 1932, fewer than half remained. Through significant investments in the United States, the corporation was able to weather the Great Depression and expand during World War II. Nearly half of the portfolio was invested in the US between 1940 and 1945, the period of World War II. As a result, between 1939 and 1946, Robeco's assets expanded by over 90%. In 1953, Robeco developed a share-saving program that allowed those with fewer means to accumulate funds for Robeco shares.

Founded: 1929

Headquarters: Rotterdam, Netherlands

Website: robeco.com

Screenshot via robeco.com

Screenshot via robeco.com -

SNS REAAL was a Dutch insurance and banking company that catered to the individual market and small- to medium-sized businesses. After being nationalized in 2013 and 2017, it became owned by the government. SNS Bank and the insurance company provide the majority of the services to individual and business clients. SNS Bank provided client service via its own retail locations, unaffiliated middlemen, the internet, and the telephone. Exclusively using independent brokers, REAAL offered its goods and services for sale. Around 7,000 full-time equivalent employees and €132 billion in assets were the company's total assets as of 2011.

From May 18, 2006, through January 31, 2013, SNS was listed on Euronext Amsterdam. The "Foundation SNS REAAL" reduced its ownership of the business from 100% to 65.5% by selling a portion of its shareholding. The sale brought in about €950 million in revenue. SNS REAAL also distributed roughly 25 million additional shares during the flotation, generating a profit of €415 million. Each share of stock was sold for €17. SNS had a market value of €3.9 billion at the end of 2006. Later, the foundation's significance in SNS decreased to a little over 50%.

Founded: 1997

Headquarters: Utrecht, Netherlands

Website:https://srh.nl/

Screenshot via https://srh.nl/

Screenshot via https://srh.nl/ -

Up until 2010, Fortis Bank Nederland (Holding) N.V., a bank in the Netherlands, operated. The holding was created within the Fortis Group as a holding for the Dutch banks that Fortis had acquired. The Dutch government had intended to invest €4 billion in September–October 2008 in exchange for a nearly 50% stake in the company (in newly issued shares), but the deal was quickly canceled. Fortis Bank Nederland was valued at €5 billion when the Dutch government acquired all of Fortis' Dutch operations for a total of €16.8 billion.

Following that, Fortis Bank Nederland made headlines for losing €1 billion in the Madoff investment fraud. It stated in March 2009 that it generated an operational profit of €0.6 billion in 2008, excluding huge write-offs. The Dutch government incorporated Fortis Bank Nederland into the new ABN AMRO in February 2010 and sold off some of its components. The Fortis name was dropped on July 1 of that year, marking the official completion of the integration.

Founded: 2010

Headquarter: Netherlands

Website: https://www.bnpparibasfortis.com

Screenshot via https://www.bnpparibasfortis.com

Screenshot via https://www.bnpparibasfortis.com