Top 6 Largest Financial Service Companies in Korea

In this post, let's examine some of the largest financial services companies in Korea, ranked by market capitalization. Go directly to other related articles ... read more...on Toplist if you want to see more of the largest financial companies in other regions ranked by market capitalization.

-

South Korea’s banking sector consists of 20 domestic banks and 35 foreign bank branches. KB Kookmin Bank, Shinhan Bank, Hana Bank, and Woori Bank are among the largest commercial banks, not only in terms of total assets but also in terms of deposits and loans granted. In 2016, two digital banks, Kakao Bank and K Bank, were established and have since received national and international recognition. The third internet-only bank, Toss Bank, entered the race in 2021.

The former Kookmin Bank and the Housing & Commercial Bank merged to establish the current KB Kookmin Bank in December 2000. In the 1960s, the Korean government established them both for distinct goals. In 1995, Kookmin Bank, which catered to provide financial services to people with middle- and low-income levels, was privatized. Both banks bought other financially challenged banks during the Asian financial crisis.

The government policy to make banks bigger and more stable contributed to the merging of the two banks. Following the merger, KB bought a number of businesses, including credit card, insurance, and brokerage firms, and in 2008, it became the current financial conglomerate. After a financial watchdog discovered that Kookmin Bank had avoided paying $270 million in taxes, the bank announced in September 2004 that its 2003 and 2004 earnings would be restated.

Founded: 1 November 1963

Headquarter: Seoul, South Korea

Website: https://www.kbfg.com/

Screenshot via https://www.kbfg.com/

Screenshot via https://www.kbfg.com/ -

Commercial bank Hana Bank has its main office in Seoul, South Korea. It offers the broadest selection of foreign exchange products in South Korea since it was founded as Korea Exchange Bank in 1967. A government-owned bank that specializes in foreign exchange, Korea Exchange Bank, was founded in 1967. It was one of the earliest commercial banks in Korea and was privatized in 1989. KEB was the first bank in Korea to export Korean won to another country during the FIFA World Cup in 2002, sending bundles of 10,000 won notes to Japan.

Hana Financial Group's market capitalization as of March 2023 is $9.49 billion. By market cap, Hana Financial Group is now the 1525th most valuable corporation in the world. The most recent financial reports from Hana Financial Group show that the company's current revenue (TTM) is $9.05 Billion. The company generated $9.36 billion in revenue in 2021, an increase from $8.72 billion in revenue in 2020.

Founded: 1967

Headquarters: Seoul, South Korea

Website: kebhana.com

Screenshot via https://www.kebhana.com/

Screenshot via https://www.kebhana.com/ -

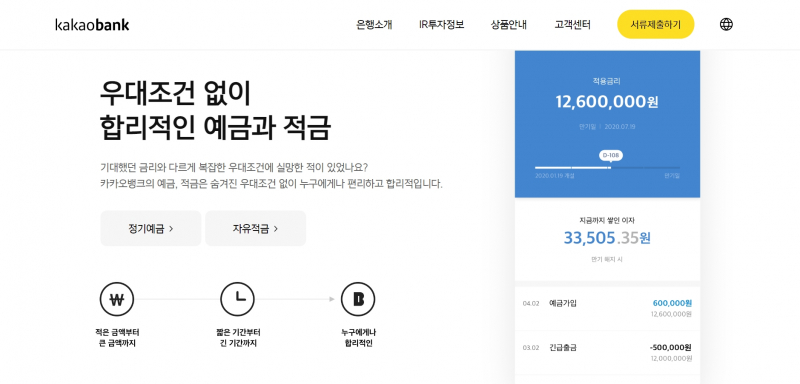

KakaoBank Corp. was founded in 2016 by Korea Investment Holdings and Kakao Corp. as a mobile-only bank and financial technology firm in South Korea. The financial service, which had gained a lot of attention for its unusual user interface and user experience before it went public in July 2017, finally got its big break that month. Within the first day of business, the bank had over 240,000 customers. As of July 11, 2019, the mobile app-based lender had more than 10 million customers.

Kakaobank had more than 14.2 million customers as of March 31, 2021. The largest neobank in South Korea was valued at roughly KRW 8.6 trillion in October 2020, with capital of KRW 750 billion raised from U.S. private equity firm TPG Capital and existing shareholders.Founded: January 22, 2016

Headquarters: Pangyo, Gyeonggi-do, South Korea

Website: www.kakaobank.com

Screenshot via https://www.kakaobank.com

Screenshot via https://www.kakaobank.com -

Seoul is home to the international Korean bank Woori Bank. It is one of the four biggest domestic banks in South Korea and has a significant presence in both corporate finance and commercial banking in the country. It was initially established in the 19th century and underwent numerous name changes and mergers before settling on its current moniker in 2002.

It is well-known that Woori Bank was the first South Korean bank to support web browsers other than Internet Explorer for online banking in Korea. With 311,852 billion USD in total assets as of the end of 2019, Woori is ranked 95 on the list of the largest banks in the world as of 2020.

Woori Financial Group's market cap was $6.34 billion as of March 2023. This places Woori Financial Group as the 156th most valuable company in the world by market cap in 2009. The most recent financial reports from Woori Financial Group show that the company's current revenue (TTM) is $8.82 Billion. The company generated $8.27 B in revenue in 2021, an increase from $6.86 B in revenue in 2020.

Founded: 30 January 1899

Headquarters: Jung-gu, Seoul, South KoreaWebsite: go.wooribank.com

Screenshot via https://go.wooribank.com/

Screenshot via https://go.wooribank.com/ -

State-owned Industrial Bank of Korea has its main office in Jung-gu, Seoul, South Korea. IBK was founded in accordance with the Industrial Bank of Korea Act in order to support small and medium-sized businesses and enhance their economic standing by offering a reliable lending system.

Industrial Bank of Korea (IBK) has a market worth of $6.47 billion as of March 2023. This places Industrial Bank of Korea (IBK) as the 79th most valuable firm in the world according to market cap. The most recent financial reports from Industrial Bank of Korea (IBK) show that the company's current revenue (TTM) is $7.47 Billion. The company generated $7.01 billion in revenue in 2021, an increase from $6.71 billion in revenue in 2020.

Founded: 1961

Headquarters: Seoul, South Korea

Website: global.ibk.co.kr

Screenshot via https://global.ibk.co.kr/

Screenshot via https://global.ibk.co.kr/ -

The South Korean tech company Kakao offers its customers a mobile payment and digital wallet service called KakaoPay.The service allows for NFC (near-field communication) and QR code-based contactless payments. KakaoTalk, the company's mobile instant chat, now includes the payment system KakaoPay.

On September 4, 2014, the service debuted alongside KakaoTalk, a chat software, allowing users to send and receive payments from others in their address books. Since its inception, Kakao has branched out into other areas of the financial sector by introducing Kakao Bank, an online bank, and the Kakao debit card. In order to manage the company's payment services, KakaoPay Co., Ltd. was founded in April 2017.

After 20 months in operation, KakaoPay had reached 10 million users. The service has expanded to allow users to remit money, submit invoices, and conduct business online, all from a mobile device. KakaoPay received a $200 million investment from Ant Financial, the parent firm of Alipay, a mobile payment service in China, due to the rapid growth of both its user base and transaction volume.Founded: September 5, 2014

Headquarters: Korea

Website: https://www.kakaopay.com

Screenshot via https://www.kakaopay.com

Screenshot via https://www.kakaopay.com