Top 8 Largest Financial Service Companies in the Philippines

In this post, let's examine 8 of the largest financial services companies in the Philippines, ranked by market capitalization. Go directly to other related ... read more...articles on Toplist if you want to see more of the largest financial companies in other regions ranked by market capitalization.

-

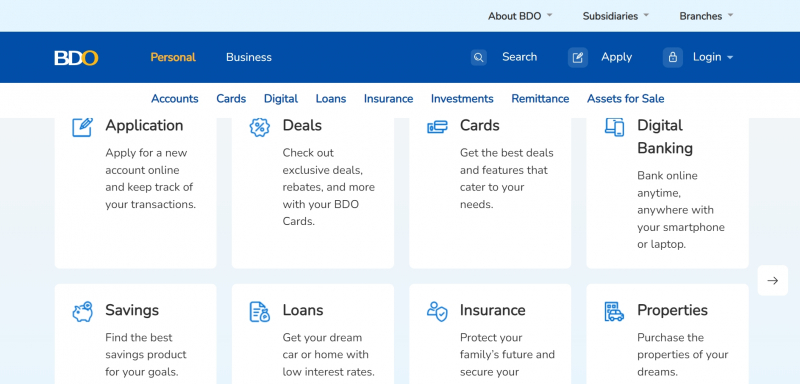

In terms of capital, deposits, loans, and assets under management, BDO is the top bank in the Philippines. It is a part of the SM Group of Enterprises, one of the biggest and most prosperous conglomerates in the nation. Almost 1,500 active branches are spread across the country for the largest bank in the Philippines. BDO claimed in October last year that its earnings had returned to pre-pandemic levels. In addition, the stock is once again in a favorable trend as investors grow more optimistic as a result of BDO's improved outlook.

BDO Unibank's market capitalization as of April 2023 is $12.13 billion. BDO Unibank is now the 1273rd-most valuable firm in the world according to market valuation. The most recent financial reports from BDO Unibank show that the company's current revenue (TTM) is $3.32 billion. The company generated $3.50 billion in revenue in 2021, an increase from $3.49 billion in revenue in 2020.

Founded: January 2, 1968

Headquarters: Manila, Philippines

Website: www.bdo.com.ph

Screenshot via www.bdo.com.ph

Screenshot via www.bdo.com.ph -

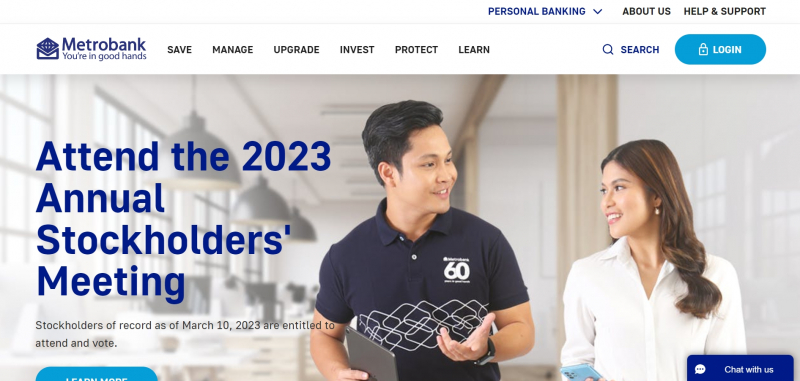

The fourth-largest bank in the Philippines is Metrobank, also known as Metropolitan Bank & Trust Corporation. It provides a range of financial services, including insurance and standard banking. It is a division of GT Capital Holdings Inc. that handles retail and commercial banking.

On September 5, 1962, a group of merchants opened Metropolitan Bank & Trust Corporation (Metrobank) in the Wellington Building in Binondo, Manila. The bank opened its first branch in Divisoria in August 1963. Metrobank opened its Davao branch, its first provincial location, four years later. In Taipei, Taiwan's capital city, Metrobank established its first overseas office at the start of the 1970s.

The market capitalization of Metropolitan Bank (Metrobank) as of April 2023 is $4.74 billion. By market capitalization, Metropolitan Bank (Metrobank) is now the 2465th most valuable company in the world. The most recent financial reports from Metropolitan Bank (Metrobank) show that the company's current revenue (TTM) is $1.97 billion. The company's revenue in 2021 was $2.02 billion, down from $2.45 billion in 2020.

Founded: 1962

Headquarter: Gil Puyat Avenue, Makati, Philippines

Website: www.metrobank.com.ph

Screenshot via www.metrobank.com.ph

Screenshot via www.metrobank.com.ph -

With a market value of over $491 billion, BPI is the second-largest financial company in the Philippines that is publicly traded. The BPI is the country's oldest bank. BPI was also the region's first bank when it opened its doors in 1851.

Why should I buy BPI stock? The Ayala Group of Enterprises, one of the richest businesses in the nation, has a banking division called BPI. BPI's financial sheet is solid, and its liquidity ratios are high. BPI is a reliable option if you prefer stocks that give out big dividends. 1.97% is the current dividend yield. Moreover, BPI has continued to build its customer base while concentrating on expediting its digital transition.As El Banco Espaol Filipino de Isabel II, BPI was established in the Philippines during the period of Spanish colonization. It created and issued the Filipino peso fuerte, a forerunner to the current Philippine peso, and gave the National Treasury credit.

Founded: 1851

Headquarter: Makati, Philippines

Website: bpi.com.ph

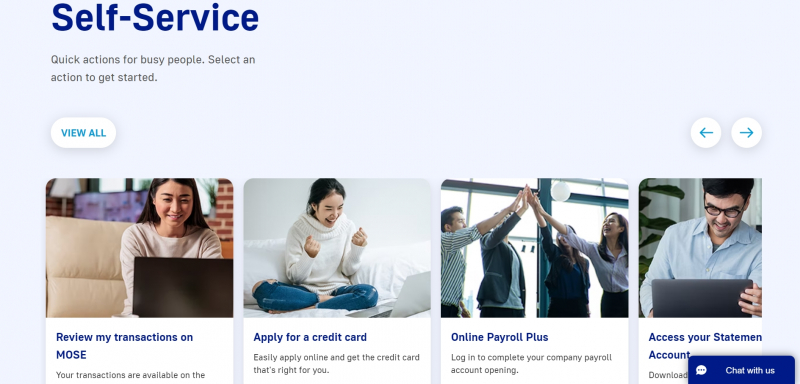

Screenshot via bpi.com.ph

Screenshot via bpi.com.ph -

Union Savings and Mortgage Bank was established in 1968. It changed into a commercial bank later in 1982. In terms of profitability and efficiency, Unionbank has consistently been ranked among the top universal banks among Asia's leading corporations.

Why buy stock in Union Bank? The bank that millennials prefer the most is UnionBank. It gained popularity for being one of the first to prioritize new financial technologies. UnionBank is now the top digital bank in the Philippines as a result of its digital transformation. UnionBank is the only "digital bank" licensed by the Bangko Sentral ng Philippines in 2021 among the top 8 banks in the nation.One of the first financial institutions in the Philippines to use cryptocurrency is UnionBank. In 2019, it was the first local lender to launch PHX, a stablecoin that enables better access to remittances and payments for rural banks. The bank also introduced cryptocurrency ATMs in 2019, enabling account holders with cryptocurrency wallets to withdraw converted cryptocurrency as well as trade immediately.

Founded: August 16, 1968

Headquarters: UnionBank Plaza, Ortigas Center, Pasig, Philippines

Website: www.unionbankph.com

Screenshot via www.unionbankph.com

Screenshot via www.unionbankph.com -

At Binondo, the oldest Chinatown in the world, on Quintin Paredes Street, China Bank was founded in 1920. China Bank is still one of the most reputable and reliable financial institutions in the Philippines, trusted by major businesspeople and Chinese traders.

With a stronger return on equity of 15.1%, the bank's 2022 net income climbed by 27% year over year and resulted in earnings of P19.1 billion. China Bank belongs to the SM Group's banking business division, just like BDO. A financial company in the Philippines that is supported by a sizable conglomerate has several opportunities to thrive.In 2009, the American consulting company Stern Stewart and Company named China Bank as one of the "top 100 ASEAN corporations in terms of producing shareholder value." In 2011, The Asset Magazine (HK) recognized it as the Philippines' best wealth management house. China Bank was recognized as one of the best-governed businesses in the Philippines at the 2012 Bell Awards of the Philippine Stock Exchange.

Founded: August 16, 1920

Headquarters: China Bank Building, 8745 Paseo de Roxas corner Villar Street, Makati City 1226, Philippines

Website: www.chinabank.ph

Screenshot via www.chinabank.ph

Screenshot via www.chinabank.ph -

In the Philippines, Security Bank Corporation (SBC) is a universal bank. It was the first privately owned bank in the post-World War II era and opened on June 18, 1951, under the name Security Bank and Trust Corporation. In 1995, Security Bank became a publicly traded company on the Philippine Stock Exchange (PSE: SECB). Retail, corporate, and commercial banking, as well as financial markets, are the bank's main business segments. Via its subsidiaries, it provides a wide range of services, including finance and leasing, foreign exchange and stock brokerage, investment banking, and asset management.

In order to increase consumer recognition of its complementary retail banking operation, Security Bank launched a rebranding initiative in 2014 under the name "BetterBanking." The Bank of Tokyo-Mitsubishi UFJ, the biggest bank in Japan, paid 36.9 billion yen in January 2016 to purchase a 20% minority holding in Security Bank. In total, Security Bank has 313 branches and 787 ATMs across the country as of 2021.Founded: June 18, 1951

Headquarters: Makati, Philippines

Website: securitybank.com

Screenshot via securitybank.com

Screenshot via securitybank.com -

The Philippines' first universal bank is PNB. It was founded in 1916 and is currently the Philippines' premier provider of superior financial services. One of the biggest privately held commercial banks in the nation today is PNB.

It is a member of the Lucio Tan Group of Companies' banking division (LT Group). With more than 71 branches, representative offices, remittance centers, and subsidiaries spread across Asia, Europe, the Middle East, and North America, PNB has the broadest worldwide presence among the other top banks in the Philippines.

In the first half of 2022, the net income of the Philippine National Bank soared. It revealed 11.1 billion in net income. People predict that PNB will maintain its dominant position and continue to be one of the country's top financial institutions.PNB currently has a total of 713 domestic branches and more than 1,400 strategically placed ATMs spread across the country. With more than 70 overseas branches, representative offices, remittance centers, and subsidiaries spread across Asia, Europe, the Middle East, and North America, PNB continues to hold its position as the Philippine bank with the broadest international reach.

Founded: July 22, 1916

Headquarters: Pasay, Philippines

Website: pnb.com.ph

Screenshot via pnb.com.ph

Screenshot via pnb.com.ph -

The greatest and youngest bank in the Philippines is EastWest Bank. Although it was just founded in 1994, according to market valuation, it is already one of the biggest banks in the nation. It ranks among the top 10 largest privately owned banks in terms of assets and is one of the Philippines' fastest-growing banks.

EastWest Bank reported a rise in net income of 16.6% in the third quarter of 2022 despite inflation. In spite of the economic difficulties, their assets, deposits, and capital also increased. We favor expanding businesses, and EastWest is well-positioned to maintain this momentum in the coming ten years. With the development of its online banking capabilities and the start of a comprehensive computerization effort, EastWest Bank has created a system that delivers bank products and services more effectively.Founded: 1994

Headquarters: The Beaufort, 5th Avenue corner 23rd Street, Bonifacio Global City, Taguig, Metro Manila, PhilippinesWebsite: www.eastwestbanker.com

Screenshot via www.eastwestbanker.com

Screenshot via www.eastwestbanker.com