Top 8 Largest Financial Service Companies in New Zealand

In this post, let's examine 8 of the largest financial services companies in New Zealand, ranked by market capitalization. Go directly to other related ... read more...articles on Toplist if you want to see more of the largest financial companies in other regions ranked by market capitalization.

-

Pushpay Holdings Limited, sometimes known as Pushpay, is a donor management platform used by American nonprofits. With the ticker symbol PPH, it is publicly traded on the Australian Securities Exchange ASX and the New Zealand Stock Exchange NZX. Pushpay entered the ASX All Ordinaries Index in March 2018 and the NZX50 Index in December 2017. When Pushpay launched in February 2020, it was immediately included in the S&P/ASX All Technology Index.

For a total cash consideration of US$87.5 million in December 2019, Pushpay purchased 100% of the ownership interests in Church Community Builder. This transaction was funded by a mix of cash on hand and the proceeds from an amortizing senior secured lending facility worth US$62.5 million. Pushpay purchased Bluebridge's church app-related company in November 2016.Pushpay Holdings' market capitalization as of April 2023 is $1.03 billion. Pushpay Holdings is now the 4588th most valuable company in the world, according to market valuation. The most recent financial filings for Pushpay Holdings indicate that the company's current revenue (TTM) is $0.15 billion. The company generated $0.15 billion in revenue in 2022, an increase from $0.13 billion in 2021.

Founded: 2011

Headquarter: Auckland, New Zealand | Redmond, Washington; Colorado Springs, Colorado, US

Website: https://pushpay.com/

Screenshot via https://pushpay.com/

Screenshot via https://pushpay.com/ -

Based and officially registered in New Zealand is The Co-operative Bank. It offers regular banking services, small business banking, deposits, savings, loans, insurance, and loans. The Co-operative Bank, which was founded in 1928 as the Public Service Investment Society before changing its name to PSIS, became a registered bank in October 2011.

In New Zealand, the bank had about 161,000 customers as of 2017. The bank is a cooperative, and as such, its members own it. The bank's primary goal is to serve its members. The Cooperative Bank returned $2.1 million in excess profit to its clients in July 2019. It has returned more than $12 million to its members since 2013.

Founded: 1928

Headquarter: Wellington, New Zealand

Website: www.co-operativebank.co.nz

Screenshot via www.co-operativebank.co.nz

Screenshot via www.co-operativebank.co.nz -

A group of rival banks in New Zealand formed Databank Systems Limited, a non-profit "off balance sheet" organization, to operate on what is now known as a "shared services agency" basis and provide computing resources (operational and development) for the consortium members. In just 12 years after its founding in 1967, the business, which serves more than 1,200 bank offices, became the largest non-government data processing organization in the Southern Hemisphere.

The 1969 Processing Agreement contained a list of obligations that contained the purpose of the database. The agreement, which was made between the consortium members, primarily dealt with the services and service levels that Databank would offer, as well as the restrictions that would be put in place to guarantee that the lead bank would retain ownership of any new application or system and bank competitiveness.

Founded: 2003

Headquarters: Global

Website: www.fnz.com

Screenshot via www.fnz.com

Screenshot via www.fnz.com -

Ron Brierley established Brierley Investments in 1961, and it was first listed on the Australian, English, and New Zealand stock exchanges in 1985. In the 1980s, it expanded to become one of the largest and, for a time, most prosperous and fashionable enterprises. At its height, Brierley Investments had roughly 150,000 New Zealanders as shareholders.

In Australia and Britain in the 1980s, Brierley Investments was a notorious corporate raider. Nevertheless, the company struggled after the 1987 stock market fall, and Brierley was ultimately removed in a boardroom coup. The company made subpar investments in the 1990s, mismanaged its foreign exchange risk, and suffered as a result on its balance sheet. The company relocated its headquarters to Singapore in 1999 and went public on the Singapore Exchange. BI was delisted in July 2002.Founded: 1961

Headquarters: Singapore

Website: www.gl-grp.com

Screenshot via www.gl-grp.com

Screenshot via www.gl-grp.com -

H.R.L. Morrison & Co. (Morrison & Co.) is an alternative asset management firm that operates out of New Zealand, Australia, the United Kingdom, the United States, and Singapore, with a primary focus on infrastructure, private equity, and property investment.

H. R. Lloyd Morrison established Morrison & Co. in 1988 to serve as an investment advisor to businesses and government agencies in New Zealand and Australia. In the early 1990s, as substantial privatizations occurred in Australia and New Zealand, Morrison & Co., headquartered in Wellington, New Zealand, shifted its focus to infrastructure investment and consulting services.

Morrison & Co., through its subsidiary Infratil, began actively investing in and advising on the privatization of airports, ports, and energy companies across Australasia in 1994. Morrison & Co. established New Zealand's first fund specifically for investing in public-private partnerships in 2009 with the launch of the Public Infrastructure Partnership Fund.

Founded: 8 August 1988

Headquarters: Wellington, New Zealand

Website: https://www.hrlmorrison.com

Screenshot via https://www.hrlmorrison.com

Screenshot via https://www.hrlmorrison.com -

Harmoney is an Australian and New Zealand-based online direct personal lender. The business was founded in 2014 with the intention of introducing P2P lending in New Zealand. As of March 2021, Harmoney had provided NZD $2 billion in loans, all of which were risk-priced, unsecured personal loans of up to $70,000.

When it launched in September 2014, Harmoney was the first licensed provider in New Zealand following the enactment of new financial legislation in the country that made peer-to-peer lending and crowdfunding possible on April 1, 2014.

Harmoney's primary focus has shifted from peer-to-peer lending to the funding of loans to borrowers through a combination of institutional financing and lending from its own balance sheet as of April 1, 2020. The Australian Securities and Investments Commission (ASIC) issued Harmoney a license to facilitate P2P lending, although the company never actively sought or accepted ordinary investors' money. The Australian company, like its New Zealand counterpart, uses a combination of institutional funding and lending from its own balance sheet to finance loans.Founded: 2013

Headquarters: NewmarketAuckland, New Zealand

Website: harmoney.co.nz - harmoney.com.au

Screenshot via https://www.harmoney.co.nz/

Screenshot via https://www.harmoney.co.nz/ -

The New Zealand-based firm Infratil Ltd. specializes in infrastructure investments. It operates in New Zealand, Australia, Asia, the United States, and Europe, and it owns assets in the renewable energy sector, digital infrastructure, airports, and healthcare. Lloyd Morrison, a merchant banker headquartered in Wellington, New Zealand, founded Infratil. Management and operations of Infratil are handled by Morrison's firm, H. R. L. Morrison & Co.

Infratil was founded in 1994 and immediately became one of the first listed infrastructure funds in the world, trading on the New Zealand Exchange. An initial investment was made in Trustpower for minority ownership. In 1998, it entered the airport ownership market by purchasing a 66% stake in Wellington Airport. Infratil has made recent investments in the healthcare and digital infrastructure industries.At the 2021 Deloitte Top 200 Awards, Infratil was honored as Amazon Web Services Company of the Year. The APAC Fund Performance of the Year award from the IJInvestor Awards was also given to Infratil. Throughout the 10-year period beginning April 1, 2012, and ending March 31, 2022, Infratil generated returns of 21.6% annually, which is much above the industry average.

Founded: 1994

Headquarters: Wellington, New Zealand

Website: infratil.com

Screenshot via infratil.com

Screenshot via infratil.com -

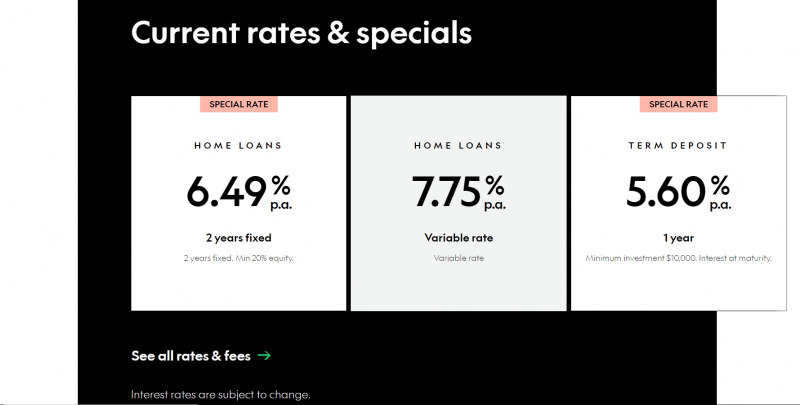

The New Zealand government owns the banking and financial services company Kiwibank Limited. As of 2023, they will have around 9% of the New Zealand banking market and rank as the country's fifth-largest bank by assets.

After a suggestion from then-Deputy Prime Minister Jim Anderton, the Fifth Labour Government of New Zealand launched Kiwibank in 2001 to create a locally owned bank that could compete with the Big Four Australian banks that dominated the domestic market at the time. Established as a spinoff of New Zealand Post, its initial locations were embedded within post offices to increase its reach across the country.Several aspects of Kiwibank are comparable to those of a previous government-owned bank that operated out of post offices in New Zealand. In 1867, the Post Office Bank of New Zealand was founded. PostBank was established as a distinct entity from New Zealand Post and Telecom New Zealand through corporatization in 1987. The government eventually sold PostBank to ANZ in 1989.

Founded: May 2001

Headquarters: Auckland, New Zealand

Website: www.kiwibank.co.nz

Screenshot via www.kiwibank.co.nz

Screenshot via www.kiwibank.co.nz