Top 5 Online Courses to Learn Accounting Software

Are you wondering which remote classroom to attend? You have spare time and want to broaden your horizon about a specific field of study whilst just staying at ... read more...home. Thus, to satisfy the burgeoning demand for online yet qualifying courses, Toplist has complied a rundown of the Online Courses to Learn Accounting Software offered by the prestigious universities, famous companies, top organizations across the globe for who in need!!!

-

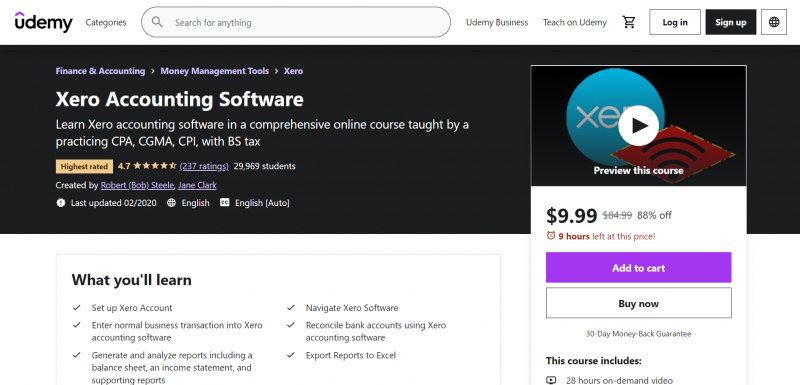

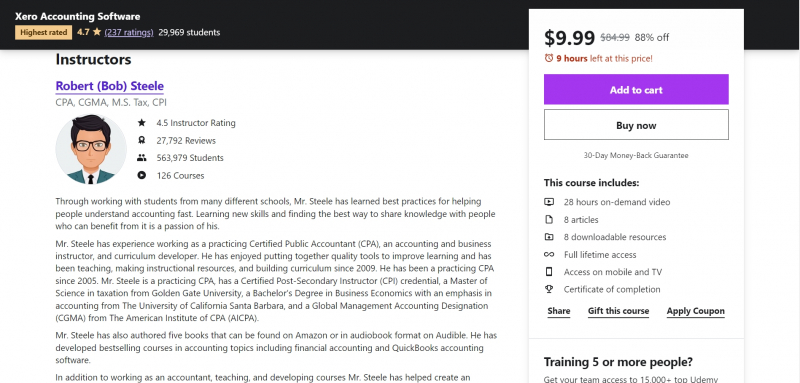

As one of the top Online Courses to Learn Accounting Software, Xero Accounting Software begins with the fundamentals, presuming you have no prior knowledge of the software or accounting. Following that, learners will go over the purchase, downloading, and installation procedures. Xero frequently offers a free 30-day trial, which is an excellent way to get started.

The first half of the course is be devoted to learning how to navigate the software, acquiring a sense for its major components, and the primary accounting cycles, such as the customer section or revenue cycle, the vendor section or payments cycle, and the employee section or payroll cycle.

Learners will study the forms and transactions inside each section after learning the key sections or accounting cycles, taking into mind the influence each has on the financial statements. Invoices, bills, pay bills, purchase orders, deposits, and other accounting forms will be used. The second half of the course will be structured around a complete problem that will be solved over the course of two months.

As learners work through the entire problem, learners will input every normal type of transaction. The detailed problem format will put the data entry procedure in context, allowing us to see how the data imputation fits into the accounting system.

A detailed problem also allows learners to perform more than just data entry, which is usually the most straightforward portion of the accounting process. We'll learn how to set up the system so that data entry is as simple as possible.

Learners will also be able to monitor the impact of each transaction on the financial accounts and double-check our work after each transaction.Who this course is for:

- Business owners

- Accounting professionals

- Accounting students

- Anybody who wants to learn accounting software

This course requirement:

- Xero accounting software is recommended

- Recommend trying Xero free 30 - day trial to get access to the software

Udemy Rating: 4.7/5

Enroll here: https://www.udemy.com/course/xero-accounting-software-2020/

https://www.udemy.com/

https://www.udemy.com/ -

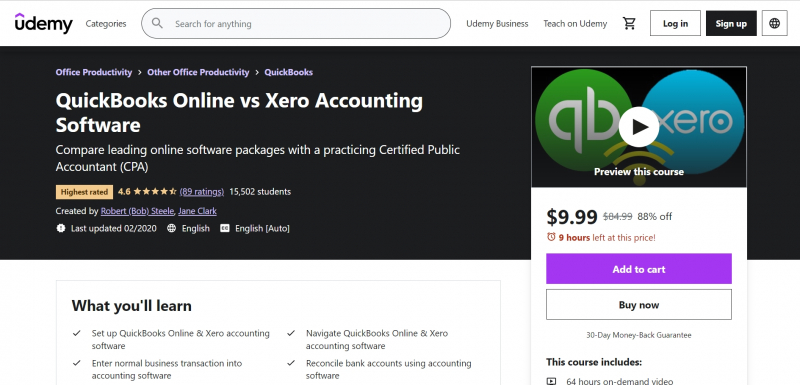

QuickBooks Online vs Xero Accounting Software will walk you through a step-by-step comparison of two popular online accounting software packages, QuickBooks Online and Xero. This is an in-depth accounting course. Learners will go over the different purchasing options and the best tools for learning various accounting software packages for the least amount of money.

Learners will be able to use each software program to create a new company file. The course will show you how to use each piece of software and how to create, analyze, and customize typical financial reports. Learners will go through how to make inventory and service items, as well as how to use them to make invoices, purchase orders, and sales receipts. The course will walk you through entering two months of data step by step, comparing the two accounting software systems at each stage. The training will show how to perform bank reconciliations as well as input modifying and reversing entries.

Learners will also learn about bank feeds. Bank feeds allow you to connect to your bank directly and download financial data into your accounting software. The training will give you practice data to help you understand how bank feeds work. Learners will also learn how to create bank rules in order to further automate the bookkeeping process.Who this course is for:

- Business owners

- Accounting professionals

- Accounting students

- Anybody who wants to learn accounting software

This course requirement:

- None

Udemy Rating: 4.6/5

Enroll here:https://www.udemy.com/course/quickbooks-online-vs-xero-accounting-software-2020/

https://www.udemy.com/

https://www.udemy.com/ -

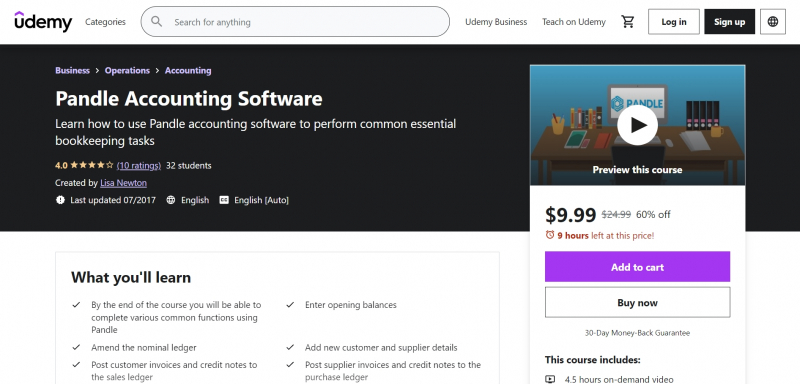

Pandle - Computerised Accounts is one of the top Online Courses to Learn Accounting Software for those who plan to utilize PANDLE for bookkeeping and accounting. Pandle is popular software because it's online and they have a free edition, so if you're searching for something that's free and better than pen and paper or a spreadsheet, this is worth considering.

The way instructors teach you how to use the software is for you to pretend to be a bookkeeper at a company where you have to apply it for a client. As a result, instructors show you how to set up the system right away, and no prior knowledge is assumed. Instructors want to be as practical as possible so that you can do it yourself.Instructors cover all of the basics that an independent bookkeeper should know in this course, which is based on the level 2 certified bookkeeping exam. Instructors go over all of the typical chores you'll encounter. How to create and pay an invoice. How to enter and pay a supplier bill. How to import transactions from a bank statement How to put the system together. How to run reports, and so forth. The course will last approximately 3-4 hours.

Who this course is for:

- Students who are going for jobs where the requirement is working knowledge of Pandle

- Those who have studied accounting, but want practical knowledge of how to use a popular accounting software which will help them find employment

- Previous knowledge of accounting is not presumed or required

- Bookkeepers and Accountants who will be using this for their clients

This course requirement:

- You will need access to Pandle in order to complete the assignment (We'll give you a link to a free version in lecture 1)

Udemy Rating: 4.5/5

Enroll here: https://www.udemy.com/course/pandle-accounting-software/

https://www.udemy.com/

https://www.udemy.com/ - Students who are going for jobs where the requirement is working knowledge of Pandle

-

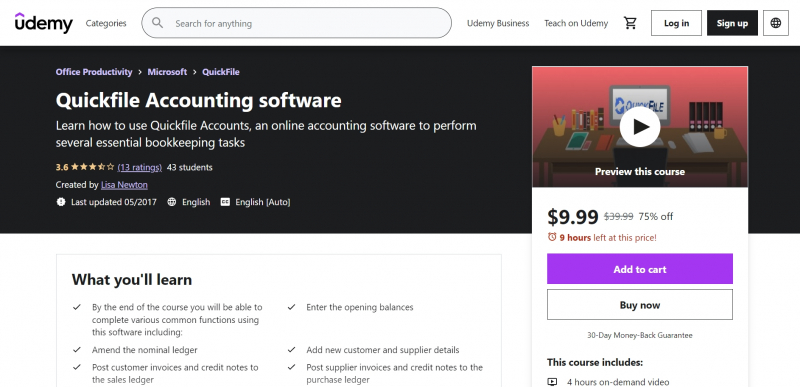

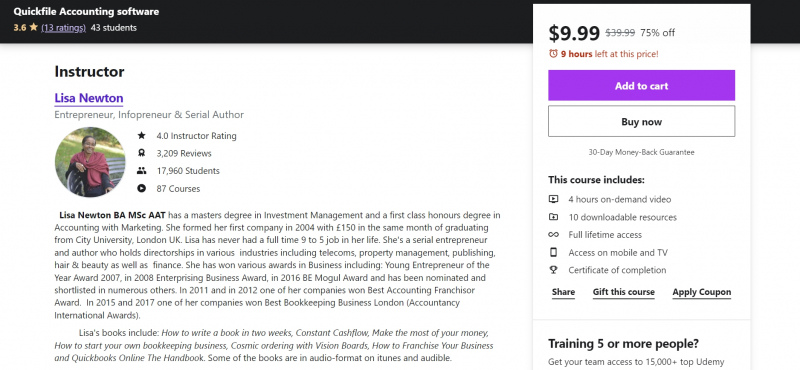

The Quickfile Accounts course teaches you how to use Quick File by focusing on the most common tasks that you, as a QuickFile operator, must be familiar with in order to be proficient with the software.

Learning is organized in a practical manner. A practical scenario assignment is given to you. Various duties must be completed. The assignment is provided to you to complete and try, and then the video answer is made available. It's recommended that you:- Read the task

- Watch the video

- Have a go at it yourself on your own system

- Rewatch the video (if necessary) - to reinforce the learning

You'll learn how to set up a QuickFile system from the ground up, as well as how to input opening balances, post customer invoices and credit notes, post supplier bills and credit notes, pay suppliers, prepare a VAT return, reconcile the bank, post journals, and run reports. You will require Quickfile Online access. We'll send you a link to the free online version. This should enough. Within hours, the lecturer is usually accessible to address student questions.

Who this course is for:

- Bookkeepers and Accountants who will be using this for their clients

- Those who have studied accounting, but want practical knowledge of how to use a popular accounting software which will help them find employment

- Students who are going for jobs where the requirement is working knowledge of Quickfile

- Previous knowledge of accounting is not presumed or required

This course requirement:

- You will need access to Quickfile Accounting software online in order to complete the assignment (we'll give you the link to get the free trial version of the software)

Udemy Rating: 3.6/5

Enroll here: https://www.udemy.com/course/quickfile-accounting-software/

https://www.udemy.com

https://www.udemy.com - Read the task

-

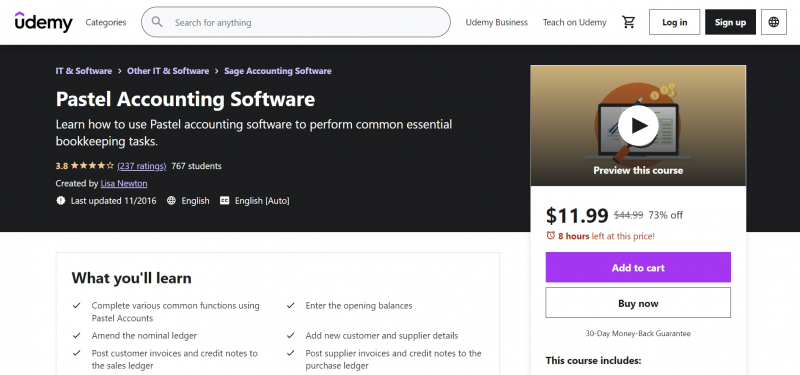

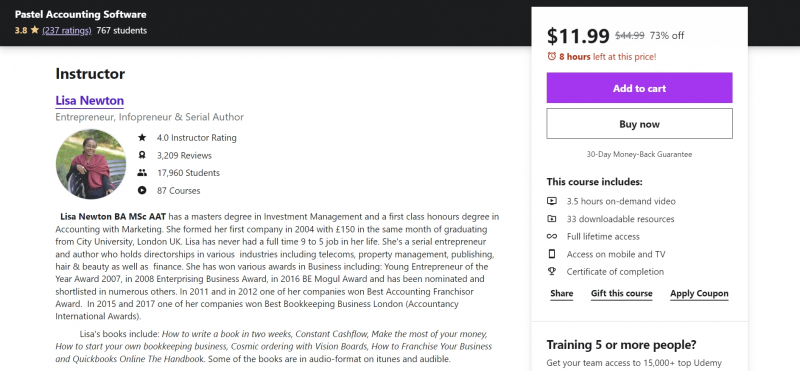

The Pastel Accounting Software course will teach you how to use Pastel Accounts based on the most common functionalities that you, as a Pastel Accounting operator, should be familiar with in order to be proficient with the software.

Learning is organized in a practical manner. A practical scenario assignment is given to you. Various duties must be completed. The assignment is provided to you to complete and try, and then the video answer is made available. It's recommended that you:- Read the task

- Watch the video

- Have a go at it yourself on your own system

- Rewatch the video (if necessary) - to reinforce the learning

You'll learn how to set up the Pastel accounting system from the ground up, as well as how to enter opening balances, post customer invoices and credit notes, post supplier bills and credit notes, pay suppliers, prepare a VAT return, reconcile the bank, publish journals, and run reports.

Because the link they provided no longer works, you'll need to obtain Pastel (search online for a free downloaded link). As an instructor who has evaluated numerous 'free' accounting software products, this was one of the simplest and most functional.

The handout for the assignment activity is included in the course materials. Successful completion of the course equates to a level 2 certificate in computerized accounting. The course will last approximately 3-4 hours.Who this course is for:

- Bookkeepers and Accountants who will be using Pastel for their clients

- Students who are going for jobs where the requirement is working knowledge of Pastel

- hose who have studied accounting, but want practical knowledge of how to use a free accounting software which will help them find employment

- Previous knowledge of accounting is not presumed or required

- Charities who are doing their own bookkeeping and are looking for a software to use and want help knowing how to use it properly

This course requirement:

- You'll need access to Pastel in order to complete the assignment

- Please research the net to find a free trial of this software first, because we no longer have a free trial link.

Udemy Rating: 3.8/5

Enroll here: https://www.udemy.com/course/pastel-accounting-software/

https://www.udemy.com/

https://www.udemy.com/ - Read the task