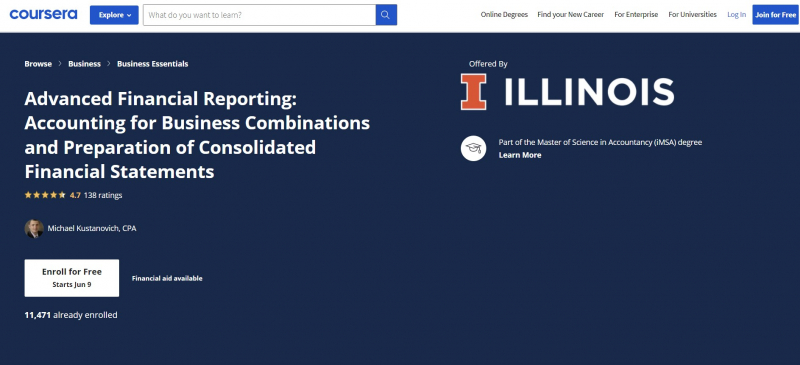

Advanced Financial Reporting: Accounting for Business Combinations and Preparation of Consolidated Financial Statements

This course covers business combination accounting (ASC 805), consolidated financial statement preparation (ASC 810), and other relevant subjects such as step-by-step acquisition, deconsolidation, segment reporting, and the goodwill impairment test. The breadth of ASC 805 is discussed first, as well as the differences between business combinations and asset purchases.

The seminar then delves into the acquisition method's measurement and recognition concepts in order to account for business combinations. The training then moves on to the process of consolidation. You'll learn how to generate consolidated financial statements as well as perform any necessary consolidation adjustments.

You may study about business control in Module 1. You will be exposed to the ideas of business control in this subject. You'll discover several accounting procedures for accounting for equity securities investments, the fundamentals of control, the extent of "Business Combination" (ACS 805), and the methods for recording a group acquisition under asset acquisition and business combination. You'll learn about the acquisition way of accounting for a company combination in Module 2: Acquisition Method. You'll learn how to calculate the goodwill or gain from a bargain purchase as a consequence of a business combination using the acquisition measurement principles and the goodwill equation.

This course offers:

- Flexible deadlines: Reset deadlines in accordance to your schedule.

- Certificate: Earn a Certificate upon completion

- 100% online

- Advanced Level

- Approx. 25 hours to complete

- Subtitles: French, Portuguese (European), Russian, English, Spanish

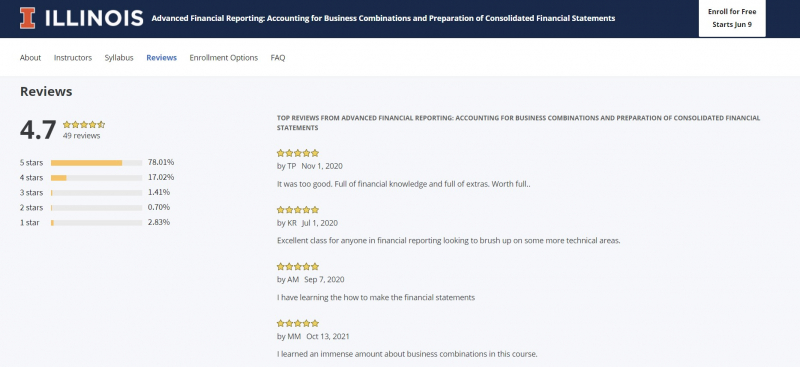

Coursera Rating: 4.7/5

Enroll here: https://www.coursera.org/learn/advanced-financial-reporting