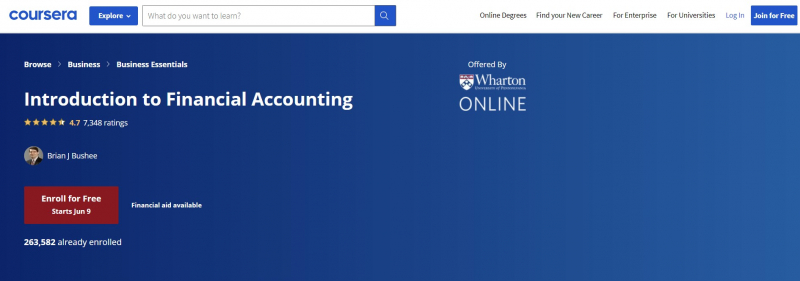

Introduction to Financial Accounting

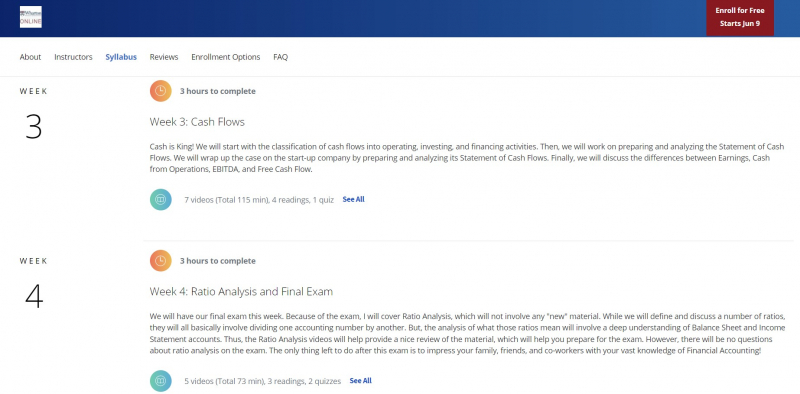

Learn how accounting rules and managerial incentives impact the financial reporting process, as well as the technical skills required to interpret financial statements and disclosures for use in financial analysis. By the end of this course, you'll be able to read the income statement, balance sheet, and statement of cash flows, which are the three most frequent financial statements.

Then, as part of the Wharton Business Foundations Specialization, you may apply these abilities to a real-world business problem. You may learn about the introduction and the balance sheet in Week 1. To learn a foreign language such as Accounting, you'll need a lot of practice with the fundamentals (grammar, syntax, idioms, etc.). This content is extremely necessary for reading and comprehending literature published in the language (in our case, financial statements.).

Let's begin with a general overview of financial reporting. What kinds of reports are necessary? Who is in charge of the rules? Who is in charge of enforcing the rules? The balance sheet equation will next be discussed, as well as the terms Assets, Liabilities, and Stockholders' Equity.

This course offers:

- Flexible deadlines: Reset deadlines in accordance to your schedule.

- Certificate: Earn a Certificate upon completion

- 100% online

- All Level

- Approx. 13 hours to complete

- Subtitles: Arabic, French, Portuguese (European), Chinese (Simplified), Italian, Vietnamese, German, Russian, English, Spanish, Japanese

Coursera Rating: 4.7/5

Enroll here: https://www.coursera.org/learn/wharton-accounting