Top 10 Best Online Corporate Accounting Courses

Accounting for corporations will address corporate accounting components that are specific to corporations, as well as aspects of corporate accounting that ... read more...differ from financial accounting for other business organizations such as a sole proprietorship or partnership. Because of the importance of this position in the business, Best Online Corporate Accounting Courses will help you to have a solid knowledge base before starting work.

-

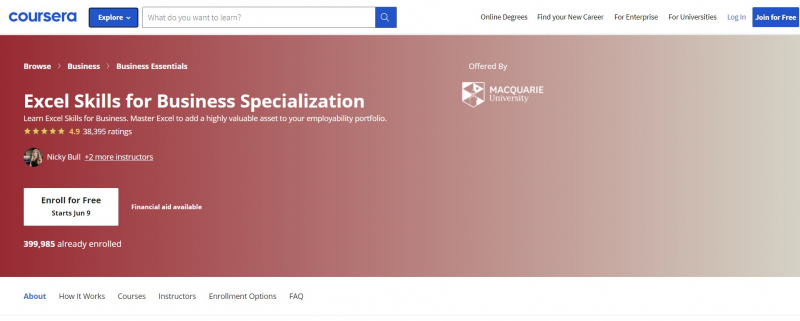

One of the Best Online Corporate Accounting Courses is Excel Skills for Business Specialization. This specialty is for anybody who wants to learn one of today's most important and essential digital skills. Spreadsheet software continues to be one of the most widely used pieces of software in offices throughout the world. Learning to use this program confidently will add a highly useful addition to your employability portfolio. Every day, millions of job adverts needing Excel abilities are placed in the United States alone.

According to research conducted by Burning Glass Technologies and Capital One, digital skills contribute to higher earnings and improved job chances. Completing this specialty will put you miles ahead of the competition at a time when digital skills occupations are increasing at a far higher rate than non-digital employment. Learners build advanced Excel skills for business in this Specialization.

Learners will be able to construct sophisticated spreadsheets, including professional dashboards, and execute complicated calculations using advanced Excel features and techniques after finishing the four courses in this Specialization. Learners have gained the ability to efficiently handle enormous datasets, extract useful information from datasets, display data, and extract information.

This course offers:

- Flexible deadlines: Reset deadlines in accordance to your schedule.

- Certificate: Earn a Certificate upon completion

- 100% online

- Beginner Level

- Approx. 6 months to complete

- Subtitles: English, Arabic, French, Portuguese (European), Italian, Vietnamese, German, Russian, Spanish, Hungarian

Coursera Rating: 4.9/5

Enroll here: https://www.coursera.org/specializations/excel

https://www.coursera.org/

https://www.coursera.org/ -

Managerial Accounting Fundamentals is among the Best Online Corporate Accounting Courses. This course, taught by top-ranked academics at the University of Virginia's Darden School of Business, will teach you the essentials of management accounting, including how to navigate the financial and related information managers need to make choices. You'll learn about cost behavior and cost allocation systems, as well as how to perform a cost-volume-profit analysis and assess if costs and benefits are important to your decisions.

You will be able to describe several sorts of expenses and how they are visually represented at the conclusion of this course. You will be able to do cost-volume-profit calculations to answer questions about breaking even and producing profit after completing this course. Furthermore, both traditional and activity-based cost allocation systems allow you to compute and assign overhead rates.

You may also distinguish between costs and benefits that are important and those that are irrelevant for a certain management choice. Also, you can identify a fair course of action for a specific management choice based on the financial impact.

This course offers:

- Flexible deadlines: Reset deadlines in accordance to your schedule.

- Certificate: Earn a Certificate upon completion

- 100% online

- Beginner Level

- Approx. 13 hours to complete

- Subtitles: English

Coursera Rating: 4.8/5

Enroll here: https://www.coursera.org/learn/uva-darden-managerial-accounting

https://www.coursera.org/

https://www.coursera.org/ -

You'll begin by answering the two "big questions" of accounting: "What do I have?" and "How did I do over time?" in this course. You'll learn how the two most important financial statements, the balance sheet and the income statement, are meant to answer these concerns, before moving on to how individual transactions combine to form these financial statements.

Accounting for Decision Making is also another course of the Best Online Corporate Accounting Courses. You'll begin to get a more nuanced grasp of certain components of running company, such as completing a sale or creating inventory, after you've gained a general understanding of accounting and financial statements. You will build your grasp of accounting by studying many of the most frequent operations of a firm, and you will explore these ideas by applying them to various sorts of transactions.

You'll be ready to return to the overall financial statements and use them as informational tools, including constructing ratios, once you've mastered these specific principles. You can take this course on its own or as part of the Finance for Strategic Decision-Making Executive Education program's residential component.

This course offers:

- Flexible deadlines: Reset deadlines in accordance to your schedule.

- Certificate: Earn a Certificate upon completion

- 100% online

- Intermediate Level

- Approx. 30 hours to complete

- Subtitles: Arabic, French, Portuguese (European), Italian, Vietnamese, German, Russian, English, Spanish

Coursera Rating: 4.8/5

Enroll here: https://www.coursera.org/learn/accounting

https://www.coursera.org/learn/accounting

https://www.coursera.org/learn/accounting -

You will experience completing each stage of the accounting cycle within Microsoft Excel in this hands-on Specialization, from assessing and documenting the initial financial transactions of the year to starting the new fiscal year. Recording in the diary, posting in the ledgers, creating financial statements, recording and posting closing entries, and preparing trial balances are among the skills taught in this course.

This Specialization program consists of three interrelated courses that cover each phase of the accounting cycle. A hands-on project is included in each Specialization. To complete the Specialization and receive your certificate, you must complete the project(s) satisfactorily. If your Specialization contains a separate course for the hands-on project, you must first complete all of the other courses before beginning it.

At the end of each session, you'll be able to put what you've learned in the video walkthroughs into practice by completing a graded assignment like publishing to the ledger accounts or creating your own financial statements in Microsoft Excel.

This course offers:

- Flexible deadlines: Reset deadlines in accordance to your schedule.

- Certificate: Earn a Certificate upon completion

- 100% online

- Beginner Level

- Approx. 3 months to complete

- Subtitles: English

Coursera Rating: 4.8/5

Enroll here: https://www.coursera.org/specializations/accounting

https://www.coursera.org/

https://www.coursera.org/ -

One of the Best Online Corporate Accounting Courses is Financial Accounting Fundamentals. This course, taught by top-ranked academics at the University of Virginia's Darden School of Business, will provide you the skills you'll need to comprehend the principles of financial accounting. Concise films, small business financial records, and "your turn" activities walk you through the three most regularly used financial statements: the Balance Sheet, Income Statement, and Statement of Cash Flows.

You'll learn how to generate financial statements, as well as how to interpret and evaluate them to make fundamental judgments about a company's financial health. You will be able to utilize journal entries to record transactions and generate and use t-accounts to summarize transactions recorded throughout an accounting period by the conclusion of this course.

You can also explain the three most popular financial statements and how they relate to one another. Also, these financial statements can be prepared based on transactions recorded within an accounting period. Finally, you will be able to draw fundamental inferences regarding a company's financial health after completing this course.

This course offers:

- Flexible deadlines: Reset deadlines in accordance to your schedule.

- Certificate: Earn a Certificate upon completion

- 100% online

- Beginner Level

- Approx. 14 hours to complete

- Subtitles: Arabic, French, Portuguese (European), Italian, Vietnamese, German, Russian, English, Spanish

Coursera Rating: 4.8/5

Enroll here: https://www.coursera.org/learn/uva-darden-financial-accounting

https://www.coursera.org/

https://www.coursera.org/ -

The Financial Reporting Specialization examines the role of financial accounting principles and processes in the preparation and presentation of financial statements for businesses. Learners who finish this specialty will be able to prepare and/or process financial statements for an organization using financial accounting principles, as well as evaluate financial statements to determine an organization's financial status.

The Financial Reporting Specialization involves a variety of projects and practice exercises, including peer-reviewed evaluations of statements and situations. The specialty also includes a capstone course that consists of a thorough case examination of a real company's financial statements. To begin, start with Accounting Analysis I. (The Role of Accounting as an Information System).

This is the first of five courses in the Financial Reporting Specialization, which includes the gathering, processing, and distribution of accounting information about economic organizations to interested parties (through financial reports) (i.e., managers and external stakeholders such as stockholders and creditors). Learners should have taken a basic accounting course before enrolling in this Specialization to get the most out of these courses.

This course offers:

- Flexible deadlines: Reset deadlines in accordance to your schedule.

- Certificate: Earn a Certificate upon completion

- 100% online

- Intermediate Level

- Approx. 9 months to complete

- Subtitles: English, Arabic, French, Portuguese (European), Italian, Vietnamese, German, Russian, Spanish

Coursera Rating: 4.7/5

Enroll here: https://www.coursera.org/specializations/financial-reporting

https://www.coursera.org/

https://www.coursera.org/ -

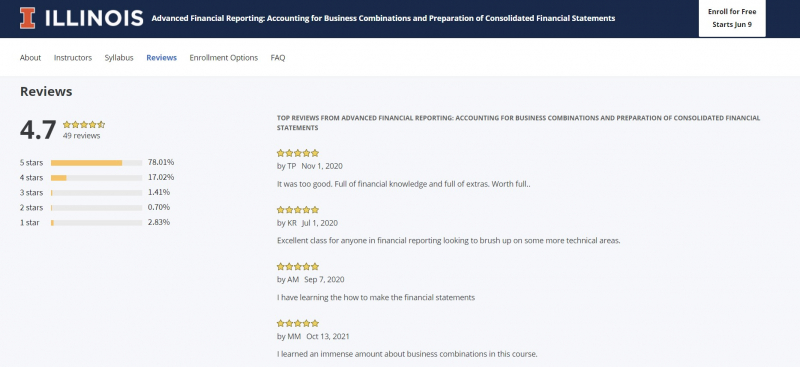

This course covers business combination accounting (ASC 805), consolidated financial statement preparation (ASC 810), and other relevant subjects such as step-by-step acquisition, deconsolidation, segment reporting, and the goodwill impairment test. The breadth of ASC 805 is discussed first, as well as the differences between business combinations and asset purchases.

The seminar then delves into the acquisition method's measurement and recognition concepts in order to account for business combinations. The training then moves on to the process of consolidation. You'll learn how to generate consolidated financial statements as well as perform any necessary consolidation adjustments.

You may study about business control in Module 1. You will be exposed to the ideas of business control in this subject. You'll discover several accounting procedures for accounting for equity securities investments, the fundamentals of control, the extent of "Business Combination" (ACS 805), and the methods for recording a group acquisition under asset acquisition and business combination. You'll learn about the acquisition way of accounting for a company combination in Module 2: Acquisition Method. You'll learn how to calculate the goodwill or gain from a bargain purchase as a consequence of a business combination using the acquisition measurement principles and the goodwill equation.

This course offers:

- Flexible deadlines: Reset deadlines in accordance to your schedule.

- Certificate: Earn a Certificate upon completion

- 100% online

- Advanced Level

- Approx. 25 hours to complete

- Subtitles: French, Portuguese (European), Russian, English, Spanish

Coursera Rating: 4.7/5

Enroll here: https://www.coursera.org/learn/advanced-financial-reporting

https://www.coursera.org/

https://www.coursera.org/ -

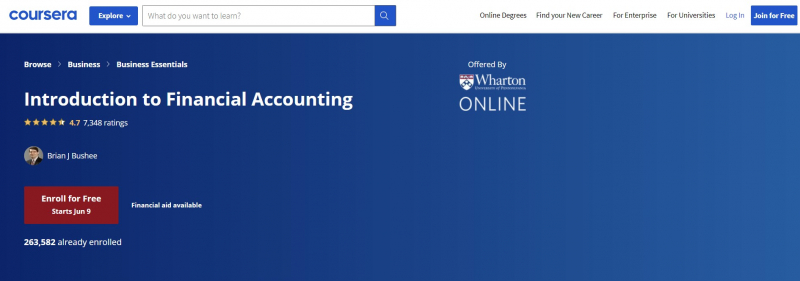

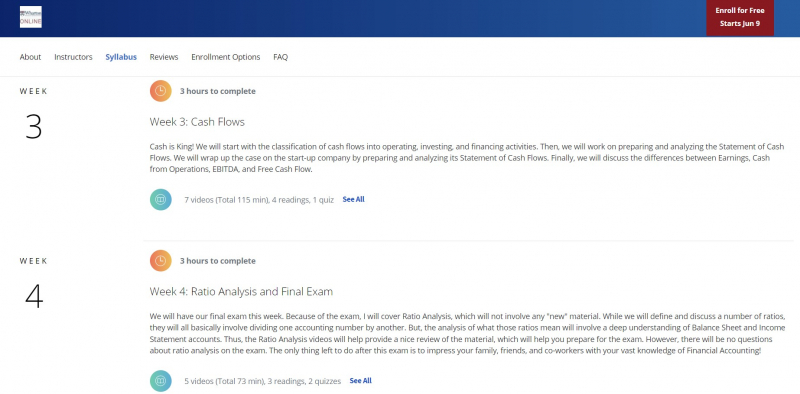

Learn how accounting rules and managerial incentives impact the financial reporting process, as well as the technical skills required to interpret financial statements and disclosures for use in financial analysis. By the end of this course, you'll be able to read the income statement, balance sheet, and statement of cash flows, which are the three most frequent financial statements.

Then, as part of the Wharton Business Foundations Specialization, you may apply these abilities to a real-world business problem. You may learn about the introduction and the balance sheet in Week 1. To learn a foreign language such as Accounting, you'll need a lot of practice with the fundamentals (grammar, syntax, idioms, etc.). This content is extremely necessary for reading and comprehending literature published in the language (in our case, financial statements.).

Let's begin with a general overview of financial reporting. What kinds of reports are necessary? Who is in charge of the rules? Who is in charge of enforcing the rules? The balance sheet equation will next be discussed, as well as the terms Assets, Liabilities, and Stockholders' Equity.

This course offers:

- Flexible deadlines: Reset deadlines in accordance to your schedule.

- Certificate: Earn a Certificate upon completion

- 100% online

- All Level

- Approx. 13 hours to complete

- Subtitles: Arabic, French, Portuguese (European), Chinese (Simplified), Italian, Vietnamese, German, Russian, English, Spanish, Japanese

Coursera Rating: 4.7/5

Enroll here: https://www.coursera.org/learn/wharton-accounting

https://www.coursera.org/learn/wharton-accounting

https://www.coursera.org/learn/wharton-accounting -

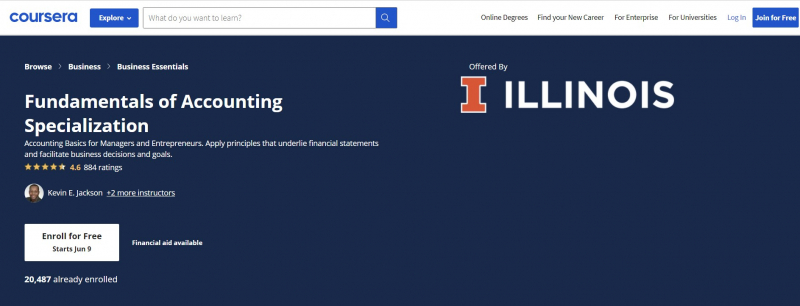

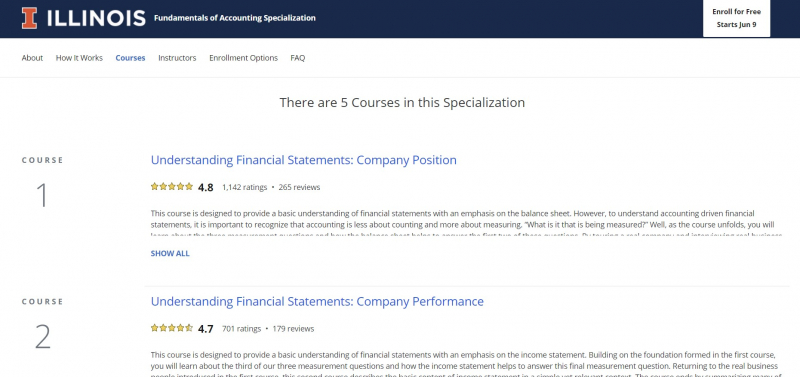

The "language of business" is accounting. Individuals both inside and outside of an organization may participate in the "conversation" about how the organization is performing and how it might enhance future performance by understanding this language. Financial accounting is concerned with the reports that managers create to present an overview of the firm's financial situation and activities to interested third parties. Managerial accounting is concerned with the data and analytical tools and processes that assist managers and staff in making sound company choices.

You will master the principles of each of these accounting purposes in this Specialization. More particular, you will be able to comprehend the financial statements that managers prepare and interpret and evaluate these statements in order to assess the organization's financial status. You will apply these fundamentals to a new business through the capstone, including developing a business plan, forecasts and budgets, and anticipated information needs for decisions made by you as the owner and manager, your employees, and external parties such as future shareholders, creditors, and other constituents.

This course offers:

- Flexible deadlines: Reset deadlines in accordance to your schedule.

- Certificate: Earn a Certificate upon completion

- 100% online

- Beginner Level

- Approx. 6 months to complete

- Subtitles: English, Arabic, French, Portuguese (European), Italian, Vietnamese, German, Russian, Spanish

Coursera Rating: 4.6/5

Enroll here: https://www.coursera.org/specializations/accounting-fundamentals

https://www.coursera.org/

https://www.coursera.org/ -

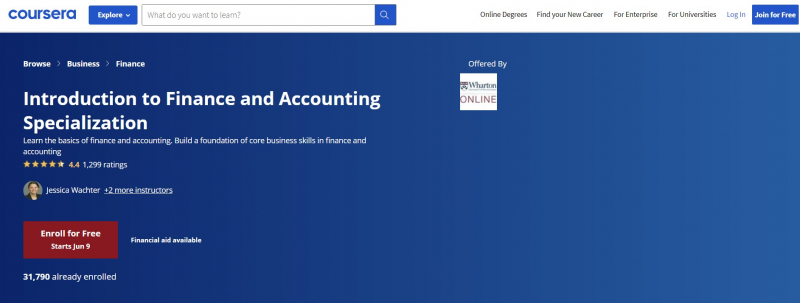

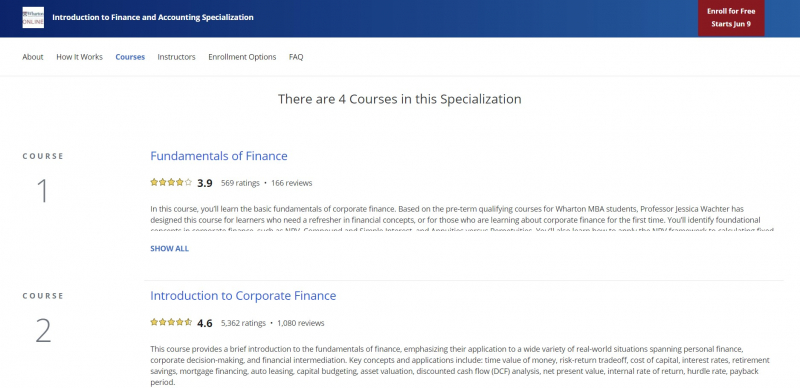

This specialization introduces corporate finance and accounting, with an emphasis on their application to a wide range of real-world situations, including personal finance, corporate decision-making, financial intermediation, and how accounting standards and managerial incentives affect the financial reporting process.

It starts with ideas and applications like as time value of money, risk-return tradeoff, retirement savings, mortgage finance, vehicle leasing, asset valuation, and so on. Excel is used in this specialization to make the learning experience more hands-on and to help learners comprehend the ideas more clearly. The curriculum gives a solid foundation in corporate finance, including topics such as valuing claims and making financing decisions, as well as parts of a basic financial model.

The focus then shifts to financial accounting, allowing students to interpret financial accounts and comprehend accounting terminology and grammar. The course covers bookkeeping basics, accrual accounting, and cash flow analysis, among other topics. Finally, the specialization teaches learners how to understand and analyze key information that companies provide in their financial statements, such as types of assets and liabilities, longer-term investments and debts, and the difference between tax reporting and financial reporting, using the foundational knowledge of accounting.

This course offers:

- Flexible deadlines: Reset deadlines in accordance to your schedule.

- Certificate: Earn a Certificate upon completion

- 100% online

- Beginner Level

- Approx. 5 months to complete

- Subtitles: English

Coursera Rating: 4.4/5

Enroll here: https://www.coursera.org/specializations/finance-accounting

https://www.coursera.org/

https://www.coursera.org/