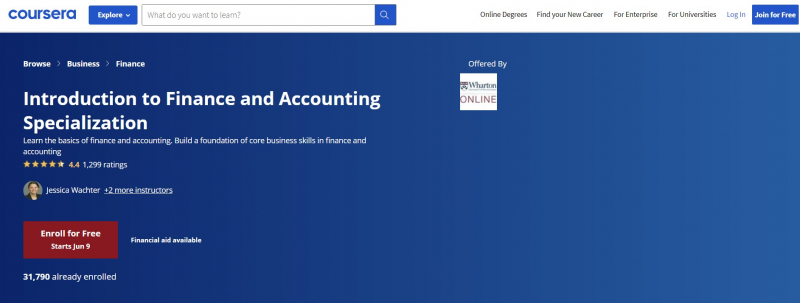

Introduction to Finance and Accounting Specialization

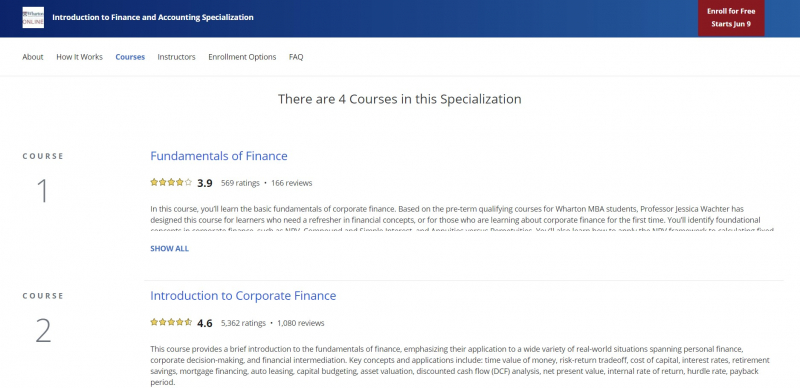

This specialization introduces corporate finance and accounting, with an emphasis on their application to a wide range of real-world situations, including personal finance, corporate decision-making, financial intermediation, and how accounting standards and managerial incentives affect the financial reporting process.

It starts with ideas and applications like as time value of money, risk-return tradeoff, retirement savings, mortgage finance, vehicle leasing, asset valuation, and so on. Excel is used in this specialization to make the learning experience more hands-on and to help learners comprehend the ideas more clearly. The curriculum gives a solid foundation in corporate finance, including topics such as valuing claims and making financing decisions, as well as parts of a basic financial model.

The focus then shifts to financial accounting, allowing students to interpret financial accounts and comprehend accounting terminology and grammar. The course covers bookkeeping basics, accrual accounting, and cash flow analysis, among other topics. Finally, the specialization teaches learners how to understand and analyze key information that companies provide in their financial statements, such as types of assets and liabilities, longer-term investments and debts, and the difference between tax reporting and financial reporting, using the foundational knowledge of accounting.

This course offers:

- Flexible deadlines: Reset deadlines in accordance to your schedule.

- Certificate: Earn a Certificate upon completion

- 100% online

- Beginner Level

- Approx. 5 months to complete

- Subtitles: English

Coursera Rating: 4.4/5

Enroll here: https://www.coursera.org/specializations/finance-accounting