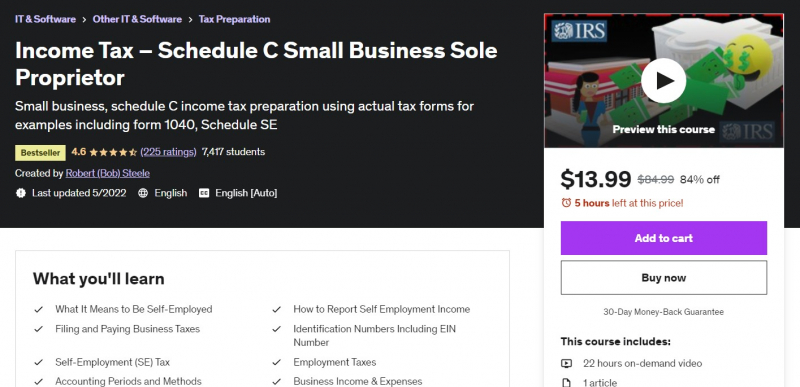

Income Tax – Schedule C Small Business Sole Proprietor

This course will concentrate on tax preparation for taxpayers with self-employment income, which is commonly reported on Schedule C. They will examine each new idea from several perspectives, beginning with a lecture on the topic and then moving on to examples to better comprehend the principles in action. In the example part, learners will utilize tax forms to solve issues and an accounting equation approach in Excel to comprehend the impact on the actual tax return and depict the principles using a tax formula.

The inclusion of sole proprietorship revenue on Schedule C complicates income tax preparation significantly. This course will begin by explaining the complexities of Schedule C to the tax return, as well as highlighting the major areas that will change via the use of practical examples. Learners will grasp how the self-employment tax is computed when there is schedule C income and how a portion of the self-employment tax may be included as an income adjustment.

The course will go through the many accounting periods and procedures that may be used based on the demands of the firm. They will go through how to record company income, as well as how to compute cost of goods sold and gross profit, if appropriate. Learners will comprehend the definition of a business expenditure, how to record business expenses, and the most prevalent types of company expenses. They will provide several examples to help you understand the principles. They'll go through how to record costs for business usage of your home, which can be a big tax break for many companies. This is one of the best online taxes courses.

Who this course is for:

- Anybody who wants to save on taxes & has a small business

- Tax professionals

Requirements:

- Some understanding of US income tax law

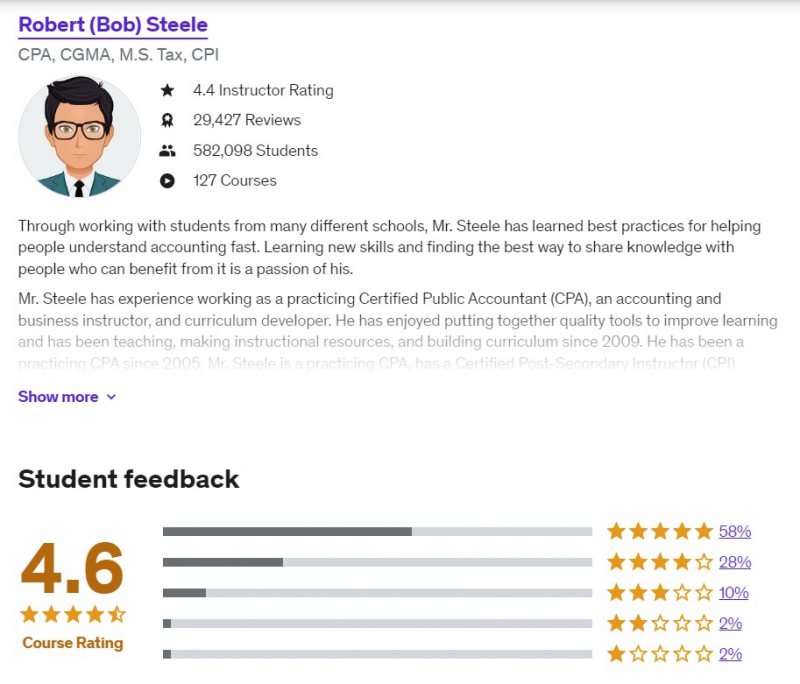

Udemy rating: 4.6/5

Enroll here: https://www.udemy.com/course/income-tax-schedule-c-small-business-sole-proprietor-2018/