Tax Preparation and Law 2022, 2021, 2020, 2019 & 2018

Income tax preparation and comprehension for 2022, 2021, 2020, 2019, and 2018, including presentations, downloadable PDF files, practice problems, and detailed problems with step-by-step directions, solution keys, and resources. The course will cover the basics of income tax, tax legislation, and how it is structured. They will present real examples at each phase of the process, providing learners with images of how the system works as well as practice questions to apply the principles. The course will lead you through the procedures for filling out a tax form. The tax forms are similar to an income statement or a tax formula. They shall break down the formula into its constituent parts so that they may digest each tiny piece at a time.

This course will go over the notion of filing status and dependents, as well as how they affect the tax calculation. The course will go through what is and isn't included in gross income for tax purposes. Items included in the computation of gross income may be taxed. Items that are not included in gross income for tax purposes will not be taxed. They'll go through adjustments for adjusted gross income, sometimes known as above-the-line deductions. The course will cover the fundamental above-the-line deductions and present actual math examples.

The course will go over itemized deductions as they are reported on Schedule A. They will go over the main itemized deductions and present examples of each. They will go through how to submit self-employment taxes using Schedule C, as well as other associated concerns such as self-employment taxes (social security and Medicare), and the new 20% deduction that many small firms will be qualified for. The course will go through how to calculate capital gains using Schedule D. They will show you how to calculate capital gains in practice. They will go through how to report rental property using Schedule E and present examples of how to report rental property.

The course will examine and present instances of different credits, such as the child tax credit, earned income credit, and education credit. The course will have comprehensive problems allowing learners to work through the process of filling out a full tax return in a step-by-step process. Learners can use PDF tax forms provided in the course and available at the IRS website. They also solve the problem using the accounting equation and provide learners with a pre-formatted Excel worksheet to follow along with this process.

Who is this course for?

- Anybody who wants to learn tax law can

- Anybody who wants to understand how to fill out taxes should

- Tax and accounting students who want better explanations and practical examples of tax concepts using software, forms, and worksheets instead of just words

Requirements:

- None

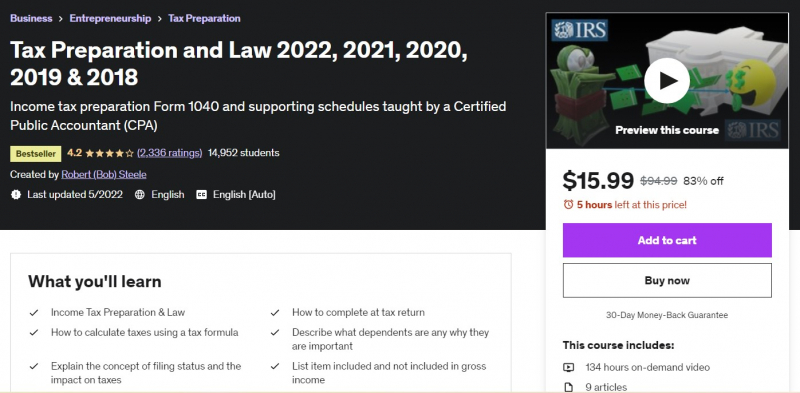

Udemy rating: 4.2/5

Enroll here: https://www.udemy.com/course/tax-preparation-and-law-2018-2019-income-tax/?persist_locale=&locale=en_US