Top 6 Best Online Taxes Courses

Whether you’re interested in preparing personal or business income tax returns, several online tax preparation certification and training courses cover ... read more...everything you need to know in record time. These offerings are also ideal for tax professionals at all skill levels and can be purchased for a fee that won’t break the bank. Here are some best online taxes courses listed by Toplist.

-

This is the first of five courses in the US Federal Tax Specialization. It covers and concentrates on the federal tax system in the United States as it applies to individuals, workers, and sole proprietors. Gross income and the things that are statutorily included or omitted from it; personal and company costs that qualify as tax deductions; and the differences in tax treatment for workers and self-employed taxpayers are among the key ideas discussed. Unlike many other beginning tax courses, learners will gain real and concrete experience reporting both income and spending on the main individual tax return used in the United States, Form 1040, as part of the course's complete wrap-up.

If you liked this course, you could think about enrolling in their online graduate accounting program. The University of Illinois at Urbana-Champaign, routinely regarded as one of the top three accounting programs in the country, now offers an online master's degree in accounting at a relatively low tuition rate. The iMSA is a comprehensive Master of Accountancy program, and students graduate with a highly regarded MS. Try an open course or two before applying for credit-bearing admission, since you may be qualified to attend credit-bearing courses throughout the application process. If you lack any requirements for the full degree, you can complete Coursera courses to demonstrate your preparedness and boost your iMSA application. This is one of the best online taxes courses.

This course offers:

- Flexible deadlines

- Shareable Certificate

- 100% online

- Intermediate Level

- Approx. 30 hours to complete

- Subtitles: Arabic, French, Portuguese (European), Italian, Vietnamese, German, Russian, English, Spanish

Coursera rating: 4.9/5

Enroll here: https://www.coursera.org/learn/federal-taxation-individuals

https://www.coursera.org/

https://www.coursera.org/ -

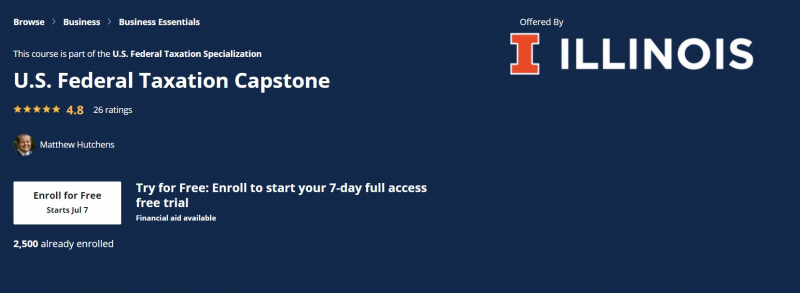

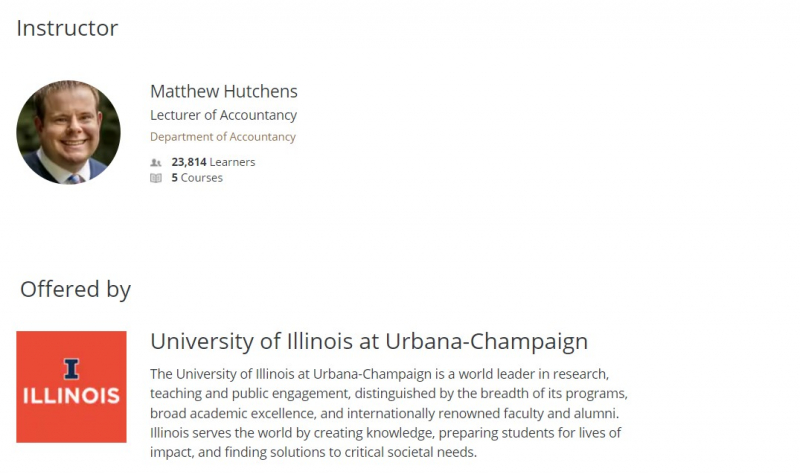

The Capstone project is the last project in the US Federal Tax Specialization. You will be able to apply the concepts and techniques learned in this specialization's courses (Federal Taxation I: Individuals, Employees, and Sole Proprietors; Federal Taxation II: Property Transactions of Business Owners and Shareholders; Taxation of Business Entities I: Corporations; and Taxation of Business Entities II: Pass-Through Entities) to a real-world tax project. The capstone project will last three weeks. After completing all of the previous courses in this specialization, you must take the capstone project class.

The first module will introduce you to the course, your teacher, your classmates, and learning environment. This orientation will also assist you in acquiring the technical skills needed to navigate and succeed in this course. This session will teach you about the big tax legislation known as the Tax Cuts and Jobs Act, which was enacted by Congress and signed by President Trump at the end of 2017. In their course project, you will also reflect on and assess how these regulatory changes may affect the family's tax status. In final module, you will evaluate the future business demands of their project's taxpayers. Specifically, you should be able to discuss the costs and benefits of alternative entity possibilities. This is one of the best online taxes courses.

This course offers:

- Flexible deadlines

- Shareable Certificate

- 100% online

- Intermediate Level

- Approx. 6 hours to complete

- Subtitles: English

Coursera rating: 4.8/5

Enroll here: https://www.coursera.org/learn/us-federal-tax-capstone?

https://www.coursera.org/

https://www.coursera.org/ -

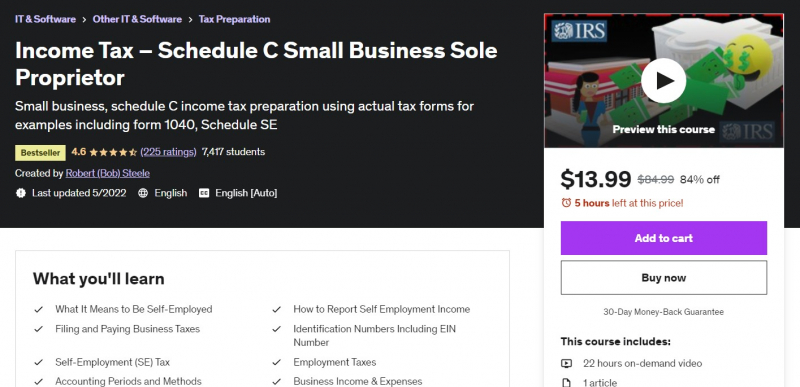

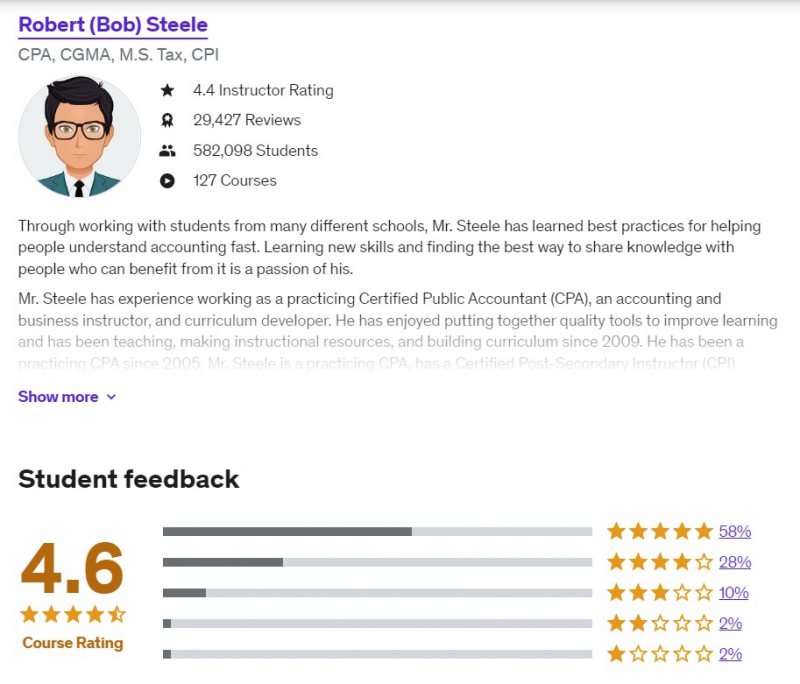

This course will concentrate on tax preparation for taxpayers with self-employment income, which is commonly reported on Schedule C. They will examine each new idea from several perspectives, beginning with a lecture on the topic and then moving on to examples to better comprehend the principles in action. In the example part, learners will utilize tax forms to solve issues and an accounting equation approach in Excel to comprehend the impact on the actual tax return and depict the principles using a tax formula.

The inclusion of sole proprietorship revenue on Schedule C complicates income tax preparation significantly. This course will begin by explaining the complexities of Schedule C to the tax return, as well as highlighting the major areas that will change via the use of practical examples. Learners will grasp how the self-employment tax is computed when there is schedule C income and how a portion of the self-employment tax may be included as an income adjustment.

The course will go through the many accounting periods and procedures that may be used based on the demands of the firm. They will go through how to record company income, as well as how to compute cost of goods sold and gross profit, if appropriate. Learners will comprehend the definition of a business expenditure, how to record business expenses, and the most prevalent types of company expenses. They will provide several examples to help you understand the principles. They'll go through how to record costs for business usage of your home, which can be a big tax break for many companies. This is one of the best online taxes courses.Who this course is for:

- Anybody who wants to save on taxes & has a small business

- Tax professionals

Requirements:

- Some understanding of US income tax law

Udemy rating: 4.6/5

Enroll here: https://www.udemy.com/course/income-tax-schedule-c-small-business-sole-proprietor-2018/

https://www.udemy.com/

https://www.udemy.com/ -

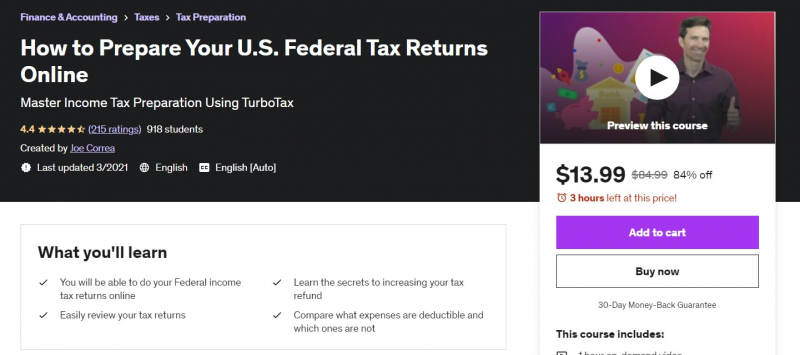

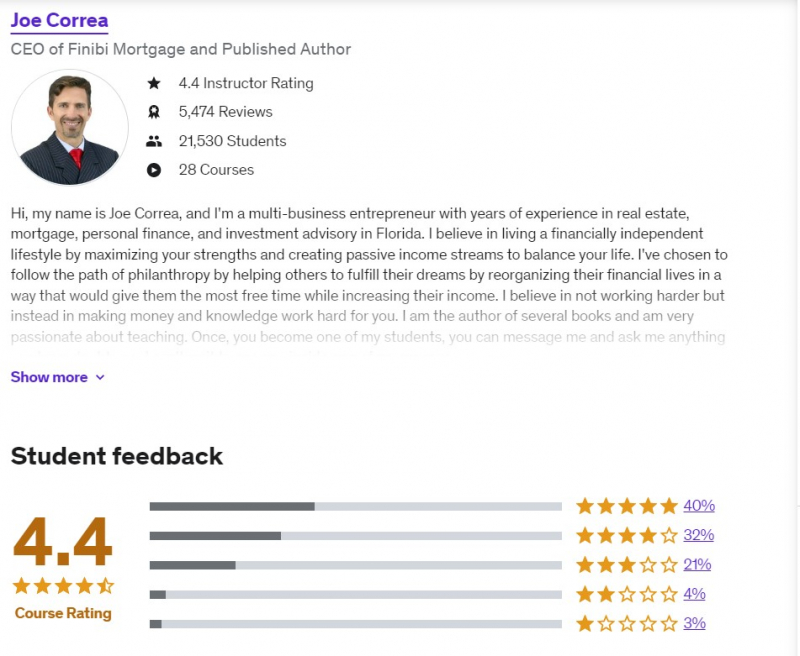

Learn how to do your personal tax returns fast and efficiently online in a short amount of time. With the knowledge you will obtain in this course, you will be able to file your federal tax returns on your own and receive the maximum refund possible. Doing it yourself saves you time and money. Most software has an audit review built in, which will spare you from dealing with the IRS. This course will cover several important elements that will help you succeed once you complete it.

The first portion of this course will teach you what it means to E-file, as well as what tax deadlines are and why you should submit your tax returns electronically rather than by mail. The second and third portions of this course will cover a wide range of critical subjects. You will learn which tax forms are required and how to fill them out. You will also learn how to walk through each stage of the process by witnessing a live example of tax returns being filled out so that you are ready to do them yourself when the time comes.

Joe Correa is the creator and CEO of multiple firms, and he has successfully taught people how to operate a business and prepare tax returns through his classes. The first and most crucial step is to find someone who has done this before and can show you the technique in a simple and practical manner. Remember, this course has a 30 day money back guarantee, so there is zero risk on your part. Don't forget that you will receive your certificate of completion when you finish this course.

Who is this course for?

- Anyone who wants to learn how to do their own personal tax returns can

- Anyone who wants to increase their tax refund

Requirements:

- You will need access to a PC.

- You will need access to the internet.

Enroll here: https://www.udemy.com/course/how-to-prepare-your-us-federal-tax-returns-online/

https://www.udemy.com/

https://www.udemy.com/ -

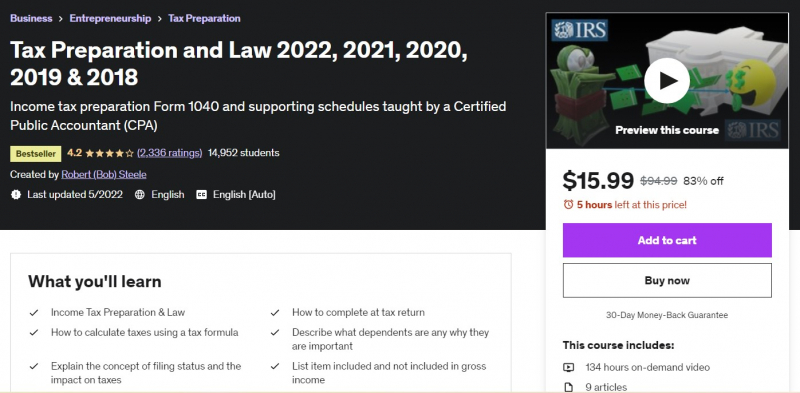

Income tax preparation and comprehension for 2022, 2021, 2020, 2019, and 2018, including presentations, downloadable PDF files, practice problems, and detailed problems with step-by-step directions, solution keys, and resources. The course will cover the basics of income tax, tax legislation, and how it is structured. They will present real examples at each phase of the process, providing learners with images of how the system works as well as practice questions to apply the principles. The course will lead you through the procedures for filling out a tax form. The tax forms are similar to an income statement or a tax formula. They shall break down the formula into its constituent parts so that they may digest each tiny piece at a time.

This course will go over the notion of filing status and dependents, as well as how they affect the tax calculation. The course will go through what is and isn't included in gross income for tax purposes. Items included in the computation of gross income may be taxed. Items that are not included in gross income for tax purposes will not be taxed. They'll go through adjustments for adjusted gross income, sometimes known as above-the-line deductions. The course will cover the fundamental above-the-line deductions and present actual math examples.

The course will go over itemized deductions as they are reported on Schedule A. They will go over the main itemized deductions and present examples of each. They will go through how to submit self-employment taxes using Schedule C, as well as other associated concerns such as self-employment taxes (social security and Medicare), and the new 20% deduction that many small firms will be qualified for. The course will go through how to calculate capital gains using Schedule D. They will show you how to calculate capital gains in practice. They will go through how to report rental property using Schedule E and present examples of how to report rental property.

The course will examine and present instances of different credits, such as the child tax credit, earned income credit, and education credit. The course will have comprehensive problems allowing learners to work through the process of filling out a full tax return in a step-by-step process. Learners can use PDF tax forms provided in the course and available at the IRS website. They also solve the problem using the accounting equation and provide learners with a pre-formatted Excel worksheet to follow along with this process.Who is this course for?

- Anybody who wants to learn tax law can

- Anybody who wants to understand how to fill out taxes should

- Tax and accounting students who want better explanations and practical examples of tax concepts using software, forms, and worksheets instead of just words

Requirements:

- None

Udemy rating: 4.2/5

Enroll here: https://www.udemy.com/course/tax-preparation-and-law-2018-2019-income-tax/?persist_locale=&locale=en_US

https://www.udemy.com/

https://www.udemy.com/ -

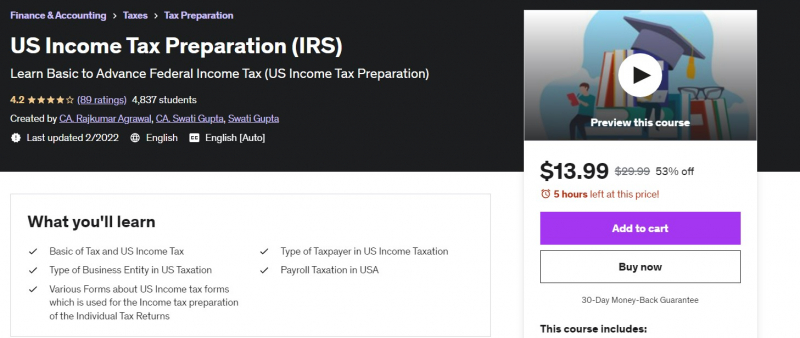

This course is meant to help students comprehend key provisions, tax forms, and payroll taxes in the United States. This course will assist you in growing your tax practice (in tax return preparation and tax counseling) as well as preparing for the CPA test and other federal income tax examinations. These courses are based on the most recent revisions to IRS regulations. This course includes lectures that will help you prepare your tax returns as an individual or self-employed person. The entire course has been created for hands-on learning.

It aids in CPA test preparation as well as government employment examinations such as Accounts Manager. This course is intended to assist students improve their knowledge in a short amount of time. They update their course over time and incorporate films on the other issue of taxation. Feedback and suggestions for course enhancement are also welcome. Keep in touch with their team as they update the course on a regular basis.

If you are dissatisfied with their course, you may seek a refund. You may also request a video/class on a specific topic in US taxation, which they will update in the course based on their judgment. Please ensure that the video material is minimal before enrolling in the course. Enroll in the course to expand your knowledge, and best wishes for the future. This is one of the best online taxes courses.Who this course is for:

- Who want to become US Tax Consultant, Tax Return preparer.

- Who want to become CPA

Requirements:

- None

Udemy rating: 4.2/5

Enroll here: https://www.udemy.com/course/us-income-tax-preparation-irs/

https://www.udemy.com/

https://www.udemy.com/