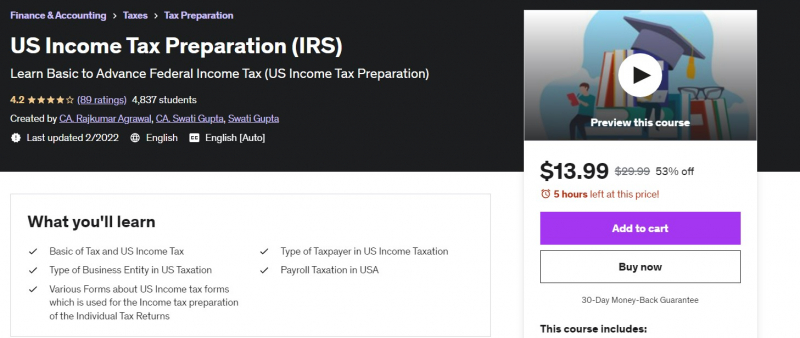

US Income Tax Preparation (IRS)

This course is meant to help students comprehend key provisions, tax forms, and payroll taxes in the United States. This course will assist you in growing your tax practice (in tax return preparation and tax counseling) as well as preparing for the CPA test and other federal income tax examinations. These courses are based on the most recent revisions to IRS regulations. This course includes lectures that will help you prepare your tax returns as an individual or self-employed person. The entire course has been created for hands-on learning.

It aids in CPA test preparation as well as government employment examinations such as Accounts Manager. This course is intended to assist students improve their knowledge in a short amount of time. They update their course over time and incorporate films on the other issue of taxation. Feedback and suggestions for course enhancement are also welcome. Keep in touch with their team as they update the course on a regular basis.

If you are dissatisfied with their course, you may seek a refund. You may also request a video/class on a specific topic in US taxation, which they will update in the course based on their judgment. Please ensure that the video material is minimal before enrolling in the course. Enroll in the course to expand your knowledge, and best wishes for the future. This is one of the best online taxes courses.

Who this course is for:

- Who want to become US Tax Consultant, Tax Return preparer.

- Who want to become CPA

Requirements:

- None

Udemy rating: 4.2/5

Enroll here: https://www.udemy.com/course/us-income-tax-preparation-irs/