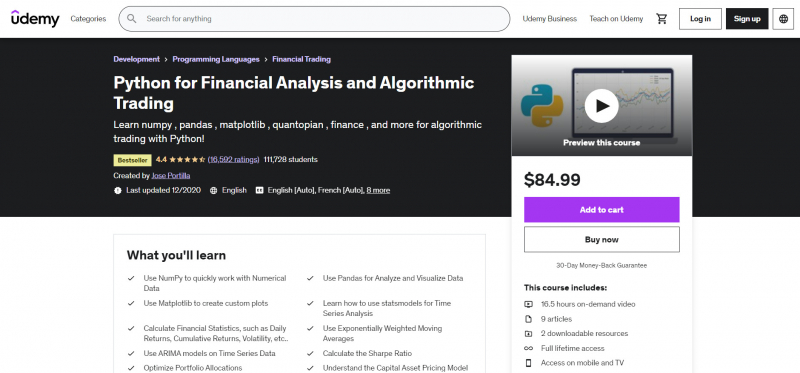

Python for Financial Analysis and Algorithmic Trading (Udemy)

This course provides a thorough introduction to financial analysis and how Python may be used to analyze financial data and perform algorithmic trading.

Jose Portilla, who has taught millions of students on Udemy in areas including programming, data science, and machine learning, designed this course. He works with Fortune 500 corporations, including some of the world's leading banks and financial institutions, as a corporate technical trainer. Jose created this course using the same technical training materials that he has used for personal corporate training at some of the world's most prestigious financial organizations.

The course's curriculum is comprehensive and well-organized. It begins with a basic crash course in Python for a quick study of the programming language before moving on to the core libraries utilized in the analysis, such as numpy, pandas, and matplotlib. The book then goes over how to use Python to work with time-series data, including how to use the statsmodels package. It also covers pandas-DataReader and the Quandl Python API, as well as how to utilize Python to get financial securities data. Quantopian, one of the greatest online platforms for algorithmic trading with Python, is also taught to students.

Students will receive a range of materials in this course, including video lectures, code and explanation notebooks, and extra material. Although the course is appropriate for students of various levels, it is required that they have a basic understanding of Python programming as well as some knowledge of fundamental statistics and linear algebra.

Key Highlights

- Use NumPy to work with numerical data fast.

- Pandas can be used to analyze and visualize data.

- Create custom plots with Matplotlib.

- Learn how to perform Time Series Analysis with Statsmodels.

- Financial statistics such as daily returns, cumulative returns, volatility, and so on can be calculated.

- Exponentially Weighted Moving Averages should be used.

- On-Time Series Data, Use ARIMA Models

- Determine the Sharpe Ratio.

- Allocations in the Portfolio Should Be Optimized

- Learn about the CAPM (Capital Asset Pricing Model).

- Find out what the Efficient Market Hypothesis is all about.

- Make algorithmic decisions. Quantopian is a platform for trading.

- Access to an online Q&A forum and Gitter chat rooms where students can interact with one another.

- Obtain a completion certificate to add to your LinkedIn profile and share with potential employers.

This course offers:

- 16.5 hours on-demand video

- 9 articles

- 2 downloadable resources

- Full lifetime access

- Access on mobile and TV

- Certificate of completion

Duration: 16.5 hours on-demand video

Rating: 4.4/5

Link: https://www.udemy.com/course/python-for-finance-and-trading-algorithms/