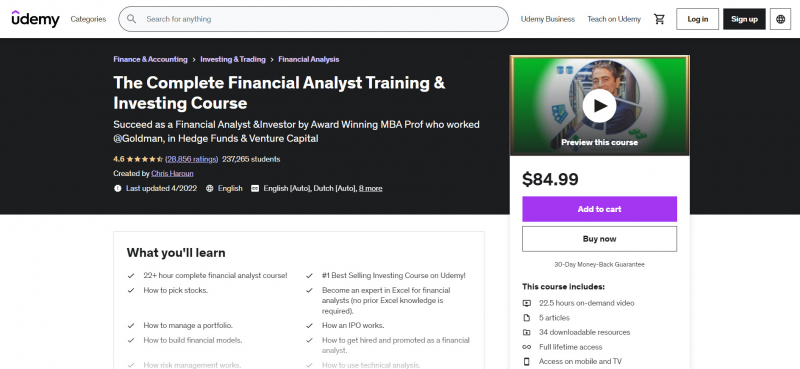

The Complete Financial Analyst Training & Investing Course (Udemy)

On Udemy, this is one of the most popular Financial Analyst courses. Chris Haroun, an award-winning business school professor, developed it. Chris is a former Goldman Sachs employee, hedge fund creator, venture capitalist, TEDx Talk speaker, author, and entrepreneur who has been featured in Forbes, Business Insider, Wired, and Venture Beat. He's also the #1 best-selling business teacher on Udemy, with a number of top-rated courses. Chris assures that this is the most comprehensive and best online financial analyst course available, as it is based on his own real-world experience.

This financial analyst certification is a comprehensive course that teaches students all they need to know about finance and investment, including how to buy stocks, perform financial statement analysis, value firms, apply technical analysis, and develop financial models, among other things. It explains how to succeed in 14 distinct financial analyst professions, as well as how to find out which one is right for them and how to get employed and promoted in the field. Students are also taught Excel abilities so that they can create their own financial statements and company valuations. There are various informative and interactive case studies available, such as how an IPO works, risk management, and portfolio management.

This course is for anyone who wants to learn how to be a better financial analyst, investor, stock picker, or portfolio manager. This training does not require any prior experience. The course includes 225 video lectures with a total duration of more than 22 hours, as well as four articles and 34 downloadable resources.

Key Highlights

- Learn about the 14 various types of financial analyst careers and how they relate to one another (including

- Investment Banking, Venture Capital, Private Equity, Equity Sales, Equity Capital Markets, Private Wealth Management, Mutual Fund, etc.)

- For financial analysts, become an Excel specialist.

- Learn the basics of risk management.

- Learn how to read and analyze an income statement.

- To assist you in creating financial statements from scratch, use and construct Excel-based templates (meaning income statements, balance sheets, cash flow statements, and more)

- Use and develop Excel-based templates to assist you in valuing companies using a variety of valuation approaches such as P/E, P/R, and Discounted Cash Flow (DCF)

- Learn how interest rates are modified and why it's important for successful financial analysts to grasp them.

- What are the Functions of Monetary and Fiscal Policy?

- To develop a financial model, you'll need to know where to gather data.

- To construct financial models, you must first understand and use modeling best practices.

- To add to your résumé, earn a certificate of completion.

This course offers:

- 22.5 hours on-demand video

- 5 articles

- 34 downloadable resources

- Full lifetime access

- Access on mobile and TV

- Certificate of completion

Duration: 22.5 hours on-demand video

Rating: 4.6/5

Link: https://www.udemy.com/course/the-complete-financial-analyst-training-and-investing-course/