Top 6 Best Free Credit Reports

Your credit report contains an almost complete record of your credit history. Whether you're approved for a new loan, credit card, or line of credit often ... read more...depends on your credit report, so you want to make sure the information on your credit report is accurate. You should check your credit report at least once a year to make sure there are no errors. The more often you can check it, the better. Fortunately, there are several ways to check your credit report for free. The best free credit reports don't require any credit card information to sign up and can be easily accessed online. Read on to see the best free credit reports you should be using.

-

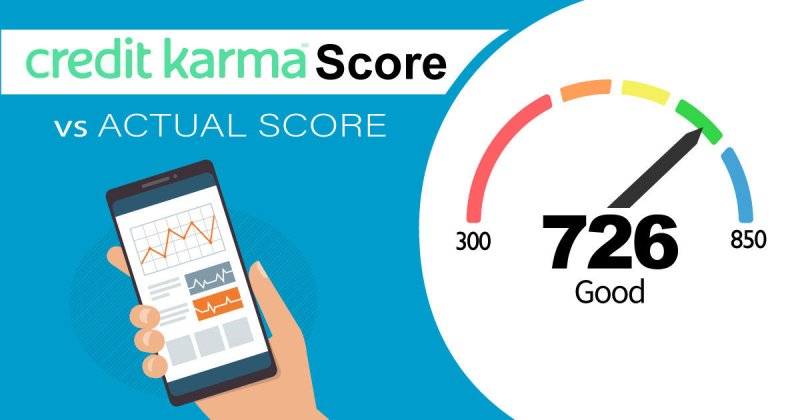

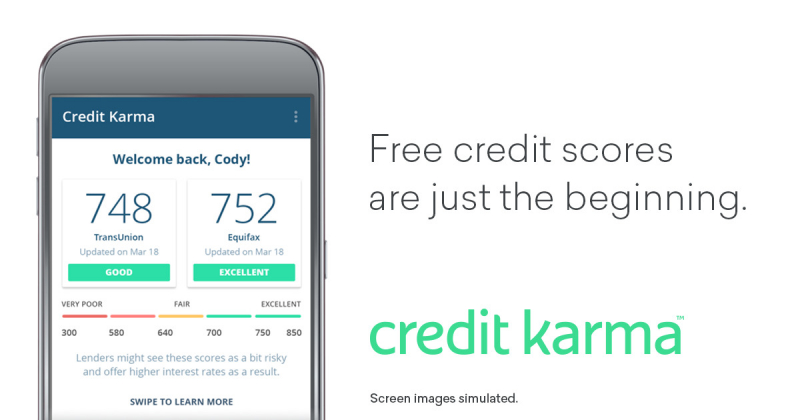

Credit Karma takes first place on the list of the best free credit reports. Credit Karma has been in business since 2007 and has partnered with two major credit bureaus, Equifax and TransUnion, to provide you with your free credit report. It's the best alternative to AnnualCreditReport.com because you can access two of your major credit reports. While you must create an account in order to use Credit Karma, you do not need to enter your credit card information or remember to cancel any free trial subscriptions. You can access your credit reports at any time by logging into your account via your web browser or their mobile app.

Your credit report information is updated to reflect changes in your credit history and activity, providing you with ongoing access to credit information changes. However, changes may take a few days to be reflected in what Credit Karma displays. You will have access to your credit report information as well as an explanation of the factors that are currently influencing your credit score. Credit Karma also uses your free credit report information to show you credit card and loan offers based on your credit score. You are not required to take advantage of these offers if you are not looking for a new credit card or loan product.

Pros

- Accessible anytime

- Updated to reflect changes in your credit

Cons

- Only offers reports from two credit bureaus

- Account required

Google rating: 4.8/5.0

Website: creditkarma.com

garrettsrealty.com

finivi.com -

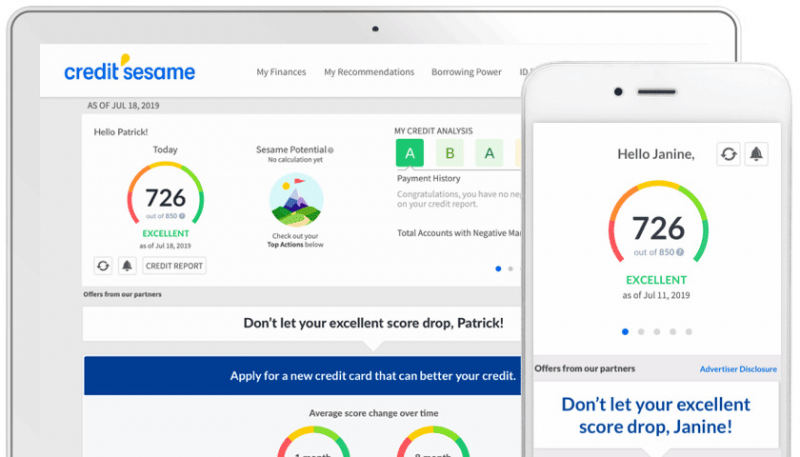

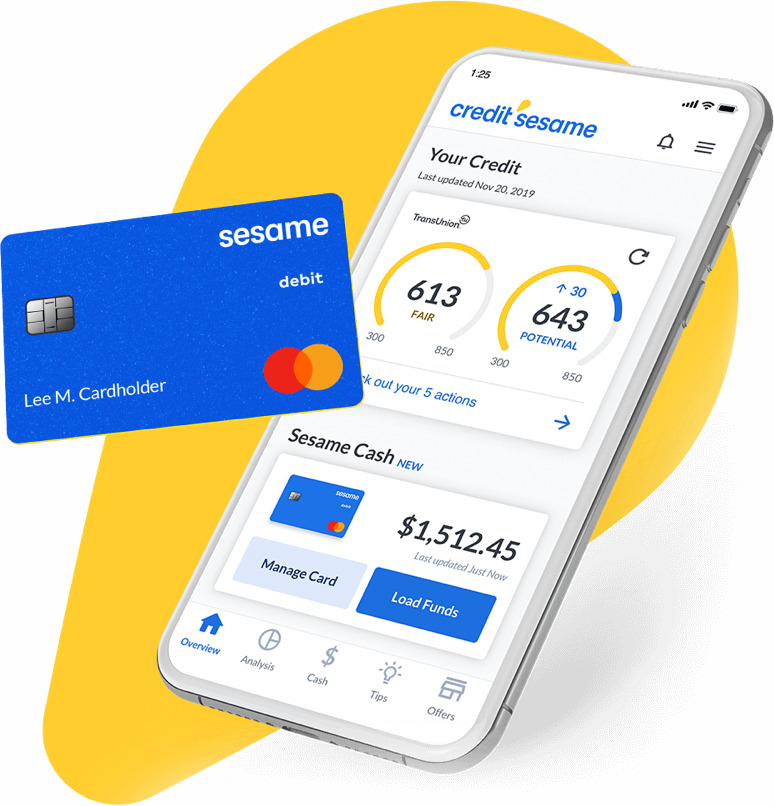

Credit Sesame allows you to access your TransUnion report and gain valuable insight into the factors affecting your credit. Credit Sesame provides your TransUnion credit report information as well as the factors that most affect your credit. You sign up by creating an account, just like Credit Karma, but you won't have to enter your credit card information. Your membership gives you access to a monthly update of your credit information once you've created an account, but you can access your account at any time.

In addition to your TransUnion credit report, you'll have access to your TransUnion credit score via the Credit Sesame mobile app or online. Examining your credit report can help you determine where your credit stands and whether you need to improve it. Credit Sesame analyzes your credit information to recommend credit cards, loans, and other financial products; however, you are not required to apply if you are not in the market for a new loan.

Pros

- Monthly updates of your credit report

- Credit information is accessible anytime

Cons

- Only offers access to TransUnion report

- Sign-up required

Google rating: 4.5/5.0

Website: creditsesame.com

creditsesame.com

creditsesame.com -

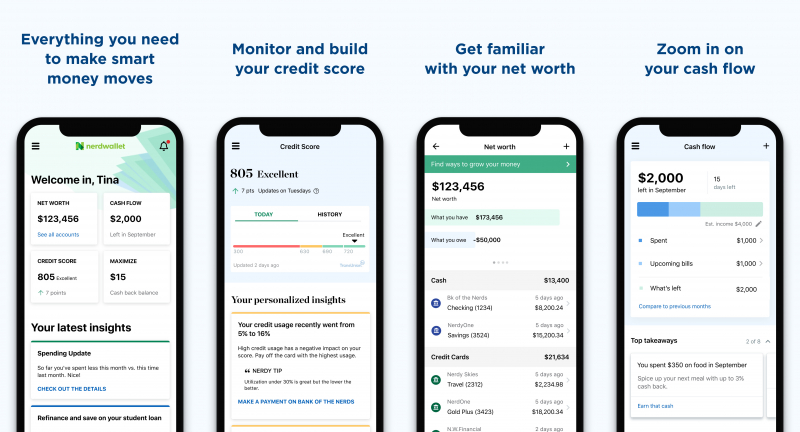

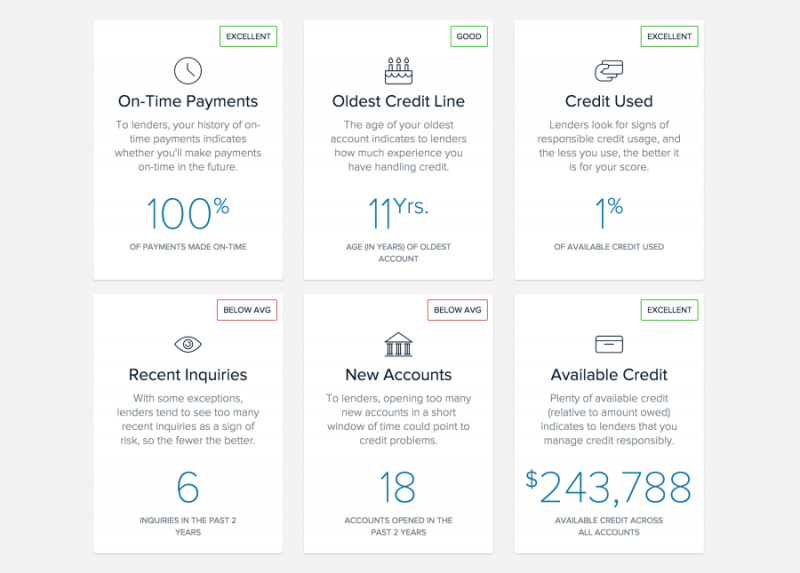

If you don't want to deal with the hassle of a lengthy and complicated sign-up process, NerdWallet is likely to meet your needs. Sign up for NerdWallet to get your free TransUnion credit report. Your credit report details are refreshed weekly with Nerdwallet, but you can log in at any time to check your credit report information.

In addition to your free credit report, you will be able to view your VantageScore 3.0 based on the information in your TransUnion credit report. Your credit score is also updated every week. It is fairly simple to register. You can use your existing Google account to create an account, and you only need to enter your birth date, address, and the last four digits of your social security number. You can also use the Nerdwallet mobile app to monitor your credit report and other aspects of your finances while you're on the go. NerdWallet also provides a free credit score so you can see how your actions are assisting you in building credit.

Pros

- Quick sign-up process

- Credit report information is accessible at any time

Cons

- TransUnion report access only

- Account required

Google rating: 4.6/5.0

Website: nerdwallet.com/l/free-credit-report

comparably.com

comparably.com -

CreditWise, a credit report and credit score tool from Capital One, allows you to check your TransUnion credit report and credit score. Credit Wise is available for free to anyone, even if they are not a Capital One customer. Signing up is simple and straightforward. There will be no credit card information required, no trial subscription to cancel, and your credit information will be updated weekly. To keep track of your credit score, visit Credit Wise online or download the mobile app.

CreditWise keeps you up to date on changes to your credit report and even sends you email or push notifications about important credit events, which is great if you're always on the go and forget to check your credit regularly. CreditWise includes a credit score simulator that you can use to determine how different actions will affect your credit score, allowing you to make more informed financial decisions. If you want to open a new credit card account, for example, you can use the simulator to estimate how it will affect your credit score.

Pros

- Timely notifications about credit report changes

- Credit score simulator available

Cons

- Only offers TransUnion report access

- Sign-up required

Google rating: 4.6/5.0

Website: creditwise.capitalone.com/home

thepointsguy.com

thepointsguy.com -

WalletHub provides daily credit report updates, as opposed to some other services that provide weekly or monthly updates. Your credit report information can change frequently as your creditors send updates to the credit bureaus. Weekly or monthly updates can leave you out of touch with your credit report information. WalletHub is the only site that offers free daily updates to your full credit report information, as well as a summary of significant changes to your credit information.

You'll have the most up-to-date information from your TransUnion credit report, allowing you to respond quickly to changes or suspicious activity on your credit report. WalletHub also offers personalized credit advice based on your credit information. Along with your free credit report, you'll have access to your free credit score (WalletHub uses Vantage Score 3.0), which will allow you to quickly see where your credit stands and how potential lenders may view your credit risk. There is no credit card required to sign up, and using the service will not harm your credit, even if you check your credit report every day.

Pros

- Suspicious activity is identified and flagged quickly

- Free credit score available

Cons

- Access to TransUnion report only

- Account required

Google rating: 4.6/5.0

Website: wallethub.com/free-credit-report/

fintastico.com

dyernews.com -

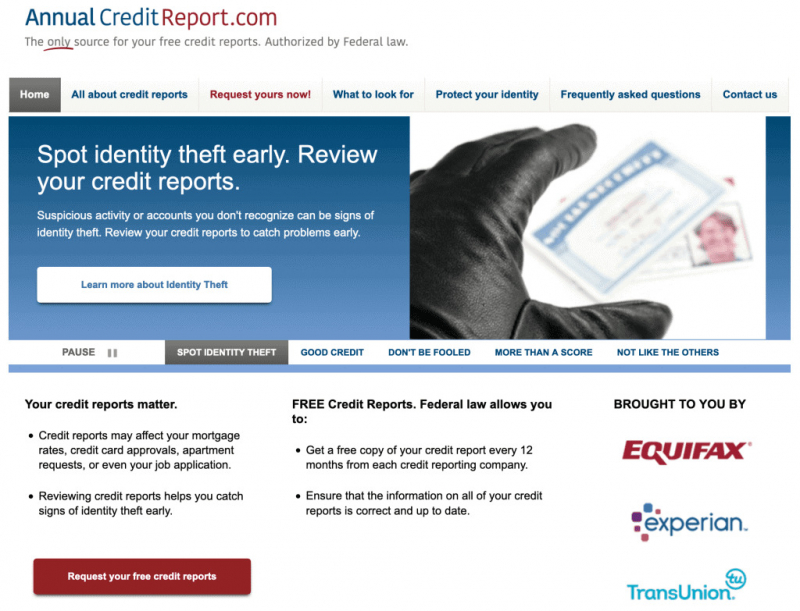

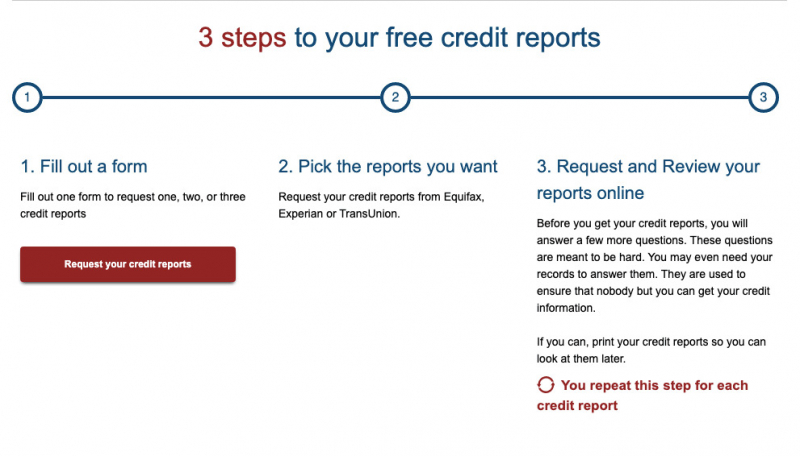

A federal law was passed in 2003 that gave every consumer the right to a free credit report from all credit reporting agencies once a year. 1 AnnualCreditReport.com is a centralized website where every consumer can access their free credit report as provided by federal law. The Consumer Financial Protection Bureau confirms that AnnualCreditReport.com is the official website for obtaining free credit reports from all three major credit bureaus — Equifax, Experian, and TransUnion.

AnnualCreditReport.com offers one free credit report every 12 months without requiring you to sign up, create an account, or enter your credit card information. You can also order your free credit report by calling 1-877-322-8228. Credit reports are available in PDF format for download, or you can have them mailed to you. The disadvantage is that you receive your full credit report, which has not been formatted for ease of use. Your credit reports can be dozens of pages long, depending on the length of your credit history and the number of accounts you've had. AnnualCreditReport.com will not provide you with a credit score along with your credit report.Pros

- Reports from three major bureaus available

- No account requirement

Cons

- Only accessible once a year

- No credit score access

Google rating: 4.1/5.0

Website: annualcreditreport.com

credit.org

investopedia.com