Top 10 Best Internet Banks

Without physical branches, PC and mobile banking services are provided by online banks and financial service providers. Online institutions can frequently ... read more...provide greater interest rates to their consumers because they don't have to cover the cost of operating branches. Online banks demand that their clients feel at ease using technology, but they also frequently offer extensive customer care options to assist clients in resolving any concerns. Here are some the best internet Banks, so you can choose the financial accounts that work best for you.

-

Ally Bank solely operates online, so it can pass along the cost savings to consumers in the form of high interest rates and low fees. For instance, there are no overdraft fees at the bank. For those who don't need access to a branch for their banking, it also offers handy customer service options.

The interest rate on Ally's savings account is 3.30%, which is significantly higher than the national average of 0.30%. Additionally, interest is compounded daily, so you will earn somewhat more interest than with accounts that compound monthly. Ally is temporarily refunding customers who are charged an excessive transaction fee for making more than six withdrawals or transfers per cycle in order to comply with changes to federal regulations.

Best for: People who don't need to deposit cash or use in-person services and want cheap rates, low fees, simple access to customer assistance.

Pros:

- No monthly maintenance fees or minimum balances on checking, savings or CDs.

- Access to over 43,000 free ATMs via checking or money market accounts.

- An above-average interest rate on savings.

- No overdraft fees.

Cons:

- No way to deposit cash.

- No branches available.

Website: https://www.ally.com/

NerdWallet rating: 5.0/5.0

https://www.campaignlive.com/

https://www.campaignlive.com/ -

When you make eligible debit card purchases each month with your Discover Bank® checking account, you can get cash back, and it also gives you free access to a large ATM network. Additionally, the online bank provides a reliable high-yield savings account. But the fact that Discover® only has one physical branch will annoy customers who want to bank in person. The yearly percentage yield of the Discover online savings account is competitive with the national average of 0.30%, and there are no account maintenance fees. Additionally, there is no minimum balance need to qualify for interest.

Information about Discover's online savings account: "Yield in Annual Percentage (APY). As of 12/21/2022, the Annual Percentage Yield (APY) is correct. only applies to individual accounts. Before or after the account is opened, the APY may change. No opening deposit is required." Details of Discover's bonus offer: "How to receive your $150 or $200 Bonus: Steps to take: Online, via the Discover App, or over the phone, submit an application for your first Discover Online Savings Account. When applying, enter Offer Code NW323. For a $150 bonus, deposit a minimum of $15,000 into your account; for a $200 bonus, deposit a minimum of $25,000 into your account. Within 30 days after the account opening date, the deposit must be posted to the account. The maximum bonus allowed is $200."

Best for: Clients that favor ATM access over branch locations, competitive rates, and checking benefits and who occasionally overdraw their accounts.Pros:

- No monthly fees on checking and savings accounts.

- Cash back rewards checking account.

- Solid rate on savings.

- Large ATM network.

- Paychecks available up to two days early with direct deposit.

Cons:

- Only one physical branch location.

- Doesn't accept cash deposits.

Website:https://www.discover.com/online-banking/

NerdWallet rating: 5.0/5.0

https://ralingo.com/ -

With no monthly fees and the best rates available, Synchrony offers certificates of deposit and online savings accounts. There are no checking accounts or budgeting tools offered by the online-only bank; instead, it concentrates on accounts intended for savings. A money market account offers greater withdrawal options—including the ability to write checks—in exchange for a lower interest rate than a typical savings account. The credit cards that Synchrony also provides are not taken into account in this analysis.

No monthly cost and a strong rate. With a 3.50% annual percentage yield, Synchrony's high-yield savings account offers one of the highest rates on the market without any fees. To start an account or be eligible for the interest rate, there is no minimum balance requirement. Free use of ATMs. For ATMs with the Plus or Accel brands that accept Synchrony's optional ATM card, there are no costs. However, the proprietors of ATMs may impose a fee. Synchrony Bank gives a $5 monthly refund for such fees from domestic ATMs.

Best for: Customers of digital banking who are primarily interested in high savings rates but do not require customized savings tools or a checking account with the same bank.

Pros:

- High rates on savings and CDs.

- No monthly fees.

- Reimburses $5 per month for out-of-network ATM access.

Cons:

- No personalized savings tools, such as for tracking goals.

Website: https://www.synchronybank.com/

NerdWallet rating: 5.0/5.0

https://www.mysynchrony.com/

https://www.mysynchrony.com/ -

Capital One Financial Corp.'s banking division provides checking, savings, and certificates of deposit. In 1988, Richard Fairbank and Nigel Morris began constructing Capital One, which was then a division of Signet Bank. Capital One launched a credit card division under its own brand in 1994. Capital One bought ING Direct in 2012 and changed the lender's name to Capital One 360. For customers searching for a full-service bank with access to physical branches and a large network of fee-free ATMs, Capital One is the best option. In Louisiana, Maryland, New Jersey, New York, Texas, Virginia, and Washington, D.C., Capital One runs about 300 locations.

According to assets, Capital One Bank is one of the top 10 American banks. Customers can access their accounts online from virtually anywhere, despite the fact that it has branches in seven Eastern and two Southern states. The bank provides free checking accounts that earn interest along with high rates on savings and certificate of deposit accounts. There are no minimum balance requirements, monthly charges, or overdraft fees to be concerned about.

Pros:

- The 360 Performance Savings account has no monthly services fees.

- The Capital One app allows you to make mobile deposits and set up an automated savings plan.

- No minimum balance is required to open or maintain an account.

Cons:

- The 360 Performance Savings account doesn’t include a debit card or an ATM card.

Website: https://www.capitalone.com/

Bankrate Score Rating: 5.0/5.0

https://vnailnews.com/

https://vnailnews.com/ -

BrioDirect is one of the the best internet banks to think about if you're looking for low deposit requirements and attractive deposit rates. It provides high-yield savings accounts, high-yield money market accounts, and high-yield CDs in a range of terms. Furthermore, there are no ongoing maintenance costs. It also provides a checking account with interest. Customers of all income levels can open a BrioDirect account.

A CD can be opened for just $500, a money market account for just $100, and a savings or checking account for just $25. Both the money market and savings accounts at BrioDirect provide competitive interest rates. CD rates are also good. Earnings can easily be eaten up by fees, but not with BrioDirect. Because there are no monthly fees associated with the high-yield money market account or savings account with BrioDirect, your savings can grow at a rapid rate.

Pros:

- The account pays a competitive yield.

- The $25 minimum requirement is attainable to almost anyone.

- There’s no monthly service fee.

Cons:

- There may be some higher-yielding options available at other online banks.

- Some accounts don’t require a minimum deposit when opening.

- You need to maintain a minimum collected balance of $25 in order to earn interest in this account.

Website: https://www.briodirectbanking.com/

Bankrate Score Rating: 4.8/5.0

https://www.finance-monthly.com/

https://www.finance-monthly.com/ -

Bread Savings (formerly Comenity Direct) does not offer checking accounts, but it does provide certificates of deposit and high-yield savings accounts. With no monthly fees and a respectable 3.50% annual percentage rate, the high-yield savings account has a $100 minimum opening deposit requirement. Bread SavingsTM CDs have strong APYs as well, and a $1,500 initial balance is required. CDs don't have monthly fees, but if a consumer withdraws money before the CD's term is up, there will be a penalty for the early withdrawal.

Although Bread Savings is an online-only bank without any physical locations, its customer support phone line is open every day of the week. Since frequent withdrawals aren't considered when designing the high-yield savings account, the only way clients can withdraw money is by transferring to a connected account. Longer customer wait times could result from tech migration: Bread Financial switched to a new third-party source for their core processing technology in June 2022. Some customers have been experiencing longer than usual hold times due to the increase in customer service calls.

Best for: You're looking for a web-only account with a respectable APY.Pros:

- Solid rate on high-yield savings account.

- No monthly fees on savings or CDs.

- Online-friendly services.

Cons:

- No checking accounts available.

- Relatively high minimum opening balance for CDs.

- No ATMs or branches.

Website: https://savings.breadfinancial.com/

NerdWallet rating: 4.5/5.0

https://www.businesswire.com/

https://www.businesswire.com/ -

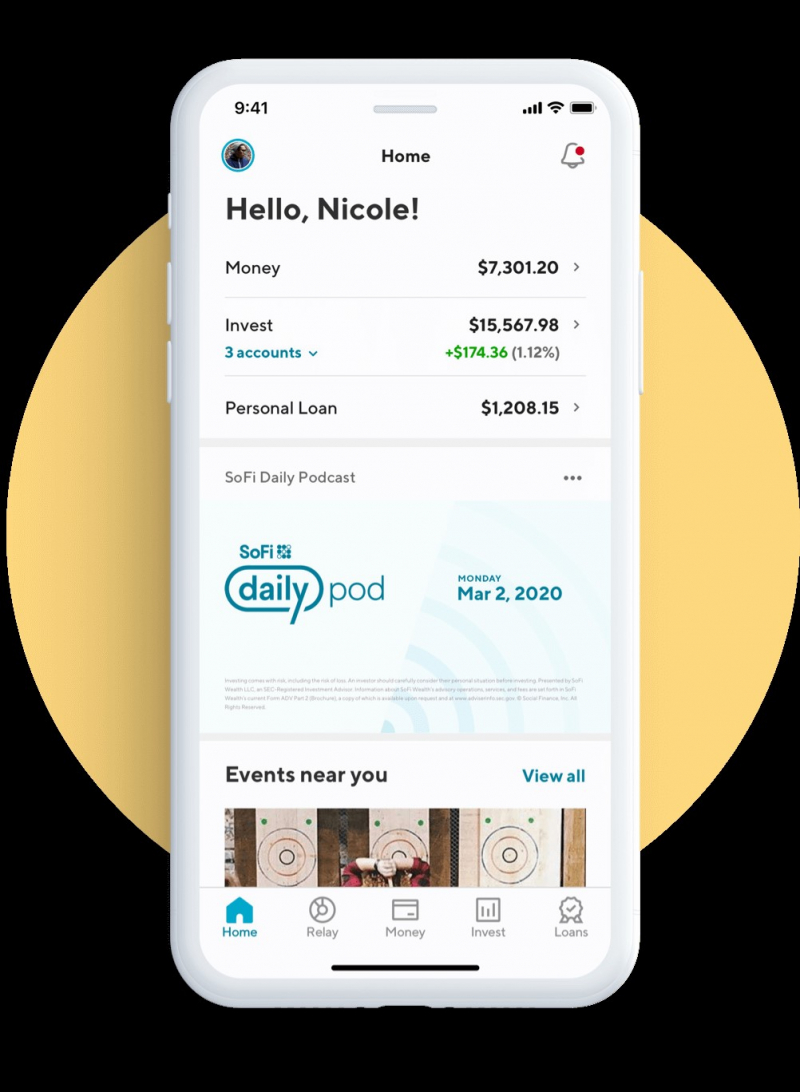

SoFi, a brokerage and financial services company, obtained its bank charter in 2022 and introduced a joint checking and savings account. For customers who meet the requirements, the account offers competitive rates, no monthly fees, and an effective free overdraft coverage program. Despite the fact that this account is a combo account, we've discussed the checking and savings sections separately because the APYs earned on the various elements of the account vary. Even after accounting for its customer complaints in relation to asset size (more details below), SoFi still receives high marks.

Although SoFi's Checking and Savings account is a combined account, if you set up direct deposit, the place in the account where you put your money determines the APY you will receive. Your savings account balance will earn 3.50% APY, while your checking account will earn 2.50% APY (APY is variable and subject to change). You will receive 1.20% on all balances if you don't have direct deposit.

Customers who set up direct deposit might receive their paychecks two days earlier and benefit from a greater APY. Both benefits can be obtained with no minimum direct deposit requirement, although overdraft protection requires a minimum direct deposit of $1,000 per month.Best for: Individuals who are willing to use remote customer assistance in place of bank branches and who want to earn high interest rates.

Pros:

- High rate if you set up direct deposit.

- No monthly maintenance fees or overdraft fees.

- Fee-free access to more than 55,000 Allpoint ATMs.

- Two-day early direct deposit.

Cons:

- Cash deposits cost up to $4.95 and are available only through third-party retailers.

Website:https://www.sofi.com/

NerdWallet rating: 4.5/5.0

https://www.sofi.com/

https://www.sofi.com/ -

One Finance, sometimes known as "One," is one of the the best internet banks and is an online-only nonbank financial organization that depends on a partner bank with FDIC protection. One of its distinguishing characteristics is the capability to allocate funds among various sub-accounts, which One refers to as "pockets," whether to pay particular bills or save for objectives. Customers of One begin with three pockets—SSpend, Save, and Auto-Save—aand are able to add more for no additional cost.

Although One does not have its own ATMs and is not a member of an ATM network, interest rates on Save and Auto-Save Pockets are higher than normal. Additionally, even though the institution may waive ATM fees if you meet its direct deposit requirements, the ATM owner will still charge you.Best for: Tech-savvy shoppers who want assistance setting up many sub-accounts for their finances, want to earn interest on their savings, and don't frequently need to deposit cash or use ATMs.

Pros:

- No monthly maintenance fees or minimum balances.

- Good rate on Save Pocket balances if direct deposit requirement is met.

- Excellent rate on auto-saving pocket balances.

- Customers can open multiple pockets to save toward different goals.

Cons:

- Cash deposits aren’t accepted.

- No physical branches.

- No certificates were deposited.

- No ATM network; all ATM withdrawals are subject to ATM owner fees.

Website: https://www.oneaccount.com/

NerdWallet rating: 4.5/5.0

https://www.nerdwallet.com/

https://www.nerdwallet.com/ - No monthly maintenance fees or minimum balances.

-

Although the rates on Alliant's share certificates are above average, opening one does cost money: A $1,000 starting deposit is required. Longer durations and higher balances result in higher rates; APYs range from 4.20% to 4.25%. Utilizing our CD comparison tool, contrast the share certificates of Alliant with those of other financial institutions.

The Ultimate Opportunity Savings Account from Alliant is comparable to its High-Rate Savings Account and did count toward the institution's overall rating. If you want to receive e-statements instead of paper statements, it pays a competitive rate and is free. That is one of the the best internet banks. Customers can set up as many as 19 additional accounts to save for particular objectives. For making 12 consecutive monthly contributions of at least $100 each, new customers to the Ultimate Opportunity Savings Account are also eligible for a $100 bonus. In our list of the top bank bonuses, you can find more information about this offer as well as other special offers.

Alliant's High-Rate Savings account yields an above-average rate and doesn't charge a monthly fee if you choose e-statements. This account was not taken into account when determining the credit union's overall rating. Alliant also offers a special savings account for parents who wish to teach their children about money management. Members can open up to 19 different supplemental accounts, each with a unique pseudonym.Pros:

- More than 80,000 free ATMs.

- Interest rates on checking and savings are well above average.

- No overdraft fees

Cons:

- No branches

Website: https://www.alliantcreditunion.org/

NerdWallet rating: 4.5/5.0

https://www.gobankingrates.com/

https://www.gobankingrates.com/ -

An online bank called Bask Bank offers two different kinds of savings accounts: one that pays a respectable annual percentage yield and the other that rewards customers with American Airlines miles. Bask Bank, which launched in January 2020, is a division of Texas Capital Bank, just like its sister institution, BankDirect.

It might be challenging to decide which financial institutions to trust when there are so many options. The ever-expanding list of bank and credit union reviews on Bankrate is updated frequently. With regard to deposit products including savings accounts, checking accounts, certificates of deposit (CDs), and money market accounts, our editorial staff evaluates and analyzes each institution (MMAs). Important criteria are used to grade banks, including interest rates, costs, minimum balance requirements, access to funds, and more.

Two savings accounts are available from Bask Bank. Customers who open an Interest Savings Account with the company can take advantage of a competitive rate, no minimum balance limitations, and no monthly maintenance fees. To keep the account open, a first deposit must be made within 60 days. Additionally, Bask Bank has a Mileage Savings Account that, depending on the monthly value, enables account holders to accrue American Airlines miles. At the high end of what most banks charge for domestic wire transfer costs, Bask Bank charges a $35 outgoing wire transfer fee.

Pros:

- The Interest Savings Account pays one of the highest yields available.

- The Mileage Savings Account offers customers a rare opportunity to earn miles with a savings account.

Cons:

- Whether Bask Bank continues to offer highly competitive yields remains to be seen, since it just started offering an interest savings account in February 2022.

Website: https://www.baskbank.com/

Bankrate Score Rating: 3.4/5.0

https://time.com/

https://time.com/