Top 10 Best Life Insurance Companies

Life insurance is a must if you have someone in your life who relies on your income. We make purchasing for life insurance as simple as possible for you by ... read more...conducting research and ranking the best life insurance companies. Continue reading to find out which firms made our Best Life Insurance Companies of 2021 list.

-

Northwestern Mutual was established in 1857 and has been in the financial services market for many years. The firm takes a conventional approach to life insurance, with a wide range of coverage options and a low-tech yet customized manner of evaluating coverage requirements. Northwestern provides a variety of financial planning services, such as estate, life insurance, and retirement planning, and other types of insurance. The company offers four different forms of life insurance: term, whole life, and universal life.

Northwestern Mutual provides a term life insurance policy that may be changed to a permanent policy with bespoke conditions. For most policy types, riders are available to modify coverage. Automatic premium payments, an insurance calculator, estimates for several policy types, and customer assistance are all available online. Customers can look for an agent by name when studying Northwestern Mutual life insurance products on the company's website. They can also fill out a brief form to be matched with an agent who suits their requirements. If you want to figure out if the products and riders you are interested in are available in your state, financial advisors at Northwestern Mutual can help you. All goods are not accessible in every state.

Northwestern Mutual does not publish life insurance coverage with upper limitations; however, your financial advisor can assist you with this. While Northwestern Mutual does not allow online applications for life insurance plans, it does provide online account access for life insurance policies.Headquarters: Milwaukee, Wisconsin

Revenue: $31.1 billion USD

Website: https://www.northwesternmutual.com/

prnewswire.com

zippia.com -

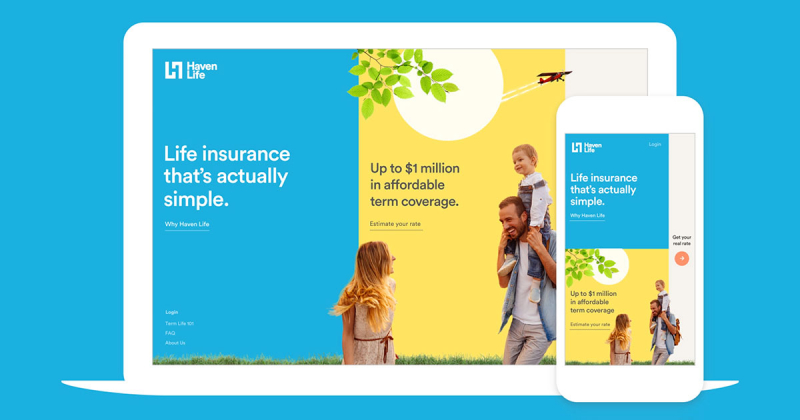

The Haven Life Insurance Agency website was co-founded by Yaron Ben-Zvi in 2014 and the website was released in the following year. Haven is backed and entirely owned by MassMutual, a life insurance company with over 160 years of experience. Haven Life's mission is to take away the difficulties of shopping for insurance by providing affordable and simple-to-manage term life insurance products online.

The Haven Life's strength stems from its user-friendly internet interface. The insurance provider offers a commission-free term life insurance policy that is straightforward to apply for and administer instead of dealing with an agent. Because of Haven Life's uncomplicated methodology, even the most complex insurance policy decisions are very simple. Furthermore, some advantages and riders aren't available in every state. Haven Life Plus, for example, which is only accessible in a few places, includes digital wills, CVS and Target MinuteClinic savings, and an online safe deposit box.

Haven Life accepts exclusively online payments, which are deducted from the policyholder's checking account on a monthly basis. Before each payment is debited, the firm sends a reminder. Other online resources include a calculator to help you figure out which coverage options are best for you, online customer service, document storage, and the Haven Life Plus rider, which allows you to create a will. Haven Life also offers a number of apps, including Aaptiv, a fitness app with hundreds of audio-based workouts, and Timeshifter, a jet lag prevention tool. Customers with the Haven Life Plus rider are eligible for free annual memberships to both apps.

Headquarters: New York, the U.S

Revenue: $37.3 million

Website: https://havenlife.com/

havenlife.com

investopedia.com -

State Farm began as an auto insurance company in 1922 and now operates as a mutual corporation with 83 million active policies and accounts. Life insurance, house and property insurance, auto and specialty vehicle insurance, and health, liabilities, and disability insurance are among the existing services offered. Home and automobile loans, checking and savings accounts, credit cards, and a variety of investments and other financial services are all available through the organization. Its headquarters are in Bloomington, Illinois.

State Farm's plethora of product options under the umbrellas of term life insurance, whole life insurance, and worldwide life insurance is one of the strategic goals of the company. Customers of all ages will be able to select a policy that meets their needs, and they will be able to tailor their plans to meet their individual requirements. State Farm's survivorship universal life insurance policy, which is only offered by around half of the insurance firms in our rating, is also reassuring to families. Having so many alternatives, however, may be a disadvantage for customers who want simple, clear coverage options, so bear that in mind when selecting a provider. Except for Rhode Island and Massachusetts, State Farm Life Insurance is currently accessible in all states.

Headquarters: Illinois, the U.S

Revenue: $78,898 million

Website: https://www.statefarm.com/

glassdoor.com

rockrapids.com -

Legal & General America possesses Banner Life Insurance Company, which provides two types of life insurance: term and universal life insurance with limited customizing possibilities. If you want to keep the process of getting life insurance as easy as possible, this may appeal to you. However, in case you are looking for any customizable life insurance options, it might not be the greatest one. Banner doesn't have a wide choice of items, but what it does have is simple to grasp. Customers could choose between term life and universal life coverage with Banner Life Insurance. Clients can personalize their plans with a few simple riders, such as an accelerated death benefit.

Banner Life Insurance doesn't have many web services or other convenience options to provide. Banner Life offers term and universal life insurance quotes online, but it does not have a life insurance calculator service to help clients find out what coverage they need. Besides, the universal life insurance offers a variety of bill payment alternatives. Through Banner Life's APPcelerate accelerated underwriting process, some customers may be qualified for coverage that does not require a medical exam.

Headquarters: Maryland, United States

Revenue: $82.5 million

Website: https://www.lgamerica.com/

insurist.com

cnet.com -

Principal began as an insurance company in 1879 and has since expanded its offerings to include personal investing and retirement products as well as benefit-offering solutions for businesses. Principal is headquartered in Des Moines, and has subsidiaries and partnerships all over the world. Principal had 19 million subscribers globally as of 2018, and while it is headquartered in Iowa, it has offices throughout South America and Asia.

Principal's simple policies and easy-to-use online calculators are just a few of the features that make it a great choice for potential life insurance customers. The company offers both term and universal life insurance products, which appeal to consumers of all ages. Other benefits include an accelerated underwriting policy, which allows you to register without having to undergo medical checks if you qualify. Principal has representatives in 25 countries, making it a viable alternative for a large number of people.

To figure out how much anything will cost, go to Principal's website and use the calculator. Annual income, the number of years you intend to work, total indebtedness (including mortgages, student loans, and other obligations), projected last expenses, predicted education fees for dependents, present assets, and other life insurance policies are all elements in Principal's life insurance calculator.

Headquarters: Des Moines, Iowa, United States

Revenue: 14.74 billion USD

Website: https://www.principal.com/

desmoinesregister.com

logowik.com -

In 1868, the Pacific Mutual Life Insurance Company of California became a member of the insurance sector. The company relocated from Sacramento to San Francisco after a few years. Accident insurance, annuity pensions, an investment management subsidiary known as PIMCO, mutual funds, commercial real estate, and numerous investment products and retirement solutions have all been added to the company's financial services portfolio throughout the years.

Pacific Mutual Life Insurance Company is based in Newport Beach, California today. The Pacific Life Foundation, the company's charitable arm, focuses on issues that are important to its employees.

Pacific Life is perfectly equipped to meet the demands of most potential consumers, as it offers a wide choice of life insurance products. With long-term care coverage, the company offers term life, whole life, universal life, variable universal life, and indexed universal life. Customers will appreciate that most of these policies come with a selection of riders to allow for easy customization. Pacific Life, on the other hand, does not provide some of the internet facilities that most large competing insurance firms do, such as online applications for all types of life insurance plans or quick online quotes. Pacific Life does provide consumers with online tools to help them examine their life insurance and other financial asset needs and goals.

Headquarters: California, United States

Revenue: $11,450 million

Website: https://www.pacificlife.com/

businesswire.com

waremalcomb.com -

Individual life insurance, investment management, disability and planning for retirement, and other types of insurance are provided by this New York City-based mutual corporation, which was founded in 1860. Business insurance and perks, such as 401(k) plans, are also available from Guardian Life Insurance Company.

When it comes to insurance, Guardian is a wonderful choice because it offers a variety of policies, including term, whole, and universal life insurance. If you're looking for term life insurance, you have the option of selecting a term of 10, 15, 20, or 30 years. Guardian also has an online price calculator that can help you figure out how life insurance fits into your budget. The organization also offers a variety of different types of insurance, ranging from dentistry to hospital indemnity policies, so you can get all of your coverage from one place. Customers are generally pleased with the responsiveness and attentiveness of the company's customer service representatives. Consider your benefits of owning life insurance when looking for the best Guardian coverage for you. Whole and universal life insurance, despite their higher cost, is a better choice for building more value and providing greater coverage. A financial advisor from Guardian can assist you in making these selections.

Headquarters: New York, United States

Revenue: 11,681 million USD

Website: https://www.guardianlife.com/

law.com

pinterest.com -

Nationwide was formed in 1925 in Ohio and has since grown to become one of the world's leading financial services firms. It provides a diverse range of services, including life and other sorts of personal insurance. Potential clients can choose from a variety of life insurance alternatives, including personalized policies to meet their unique needs. Most Nationwide policies are simple to create, and you can select policy types such as survivorship insurance, no-lapse policies, and policies with various investment possibilities. A children's rider, a spouse rider, an estate protection rider, and a rider that protects against a policy lapse are all popular possibilities for riders.

Premiums can be paid in a variety of ways, including direct debit or withdrawal from a card or bank account, as well as online or text payments. A coverage calculator, online estimates, and online document processing are among the other resources available.To purchase Nationwide life insurance, you must speak with a representative. Nationwide will provide a term life insurance quote online, but you must call Nationwide or an agent for rates on all other types of coverage, as well as to purchase any policy. You can contact a Nationwide agent directly if you know his or her name and would like to work with him or her. Otherwise, you can hunt for a local agent or have Nationwide found one for you.

Headquarters: Columbus, Ohio, the U.S

Revenue: 41.9 billion USD

Website: https://www.nationwide.com/

wealthmanagement.com

law.com -

Primerica Life Insurance Company claims. A.L. Williams & Associates was founded in 1977 and is currently provided through a multiple-level marketing structure and was meant to appeal to middle-class American families. Investments such as mutual funds, vehicle and house insurance, pre-paid legal assistance, and identity theft protection are among Primerica's other financial goods.

After its IPO in 2010, the company was renamed Primerica Financial Services and then Primerica, Inc. Citigroup held Primerica throughout this time, however, Citigroup sold its remaining interests in 2011. The stock of Primerica is now traded on the New York Stock Exchange. Primerica, like many other financial services firms, engages in community engagement and philanthropy through its Primerica Foundation, which aspires to assist people in metro Atlanta and around Georgia in becoming financially self-sufficient.Primerica's insurance plan offers are straightforward when compared to those of other life insurance firms. While many other life insurance firms offer a variety of whole and universal life policies, Primerica only offers one type of term life insurance coverage. That means Primerica may not be the best option for someone who isn't sure what kind of life insurance they want, but it may be a decent fit for someone who has already settled on a simple term life insurance policy. Primerica does not provide the same number of online tools or easy-to-find information as many of its competitors, thus it is a better option for customers who like to deal closely with a representative.

Headquarters: Georgia, United States

Revenue: $654.7 million

Website: https://www.primerica.com/

businesswire.com

pinterest.com -

MassMutual is situated in Springfield, Massachusetts, and was founded in 1851. MassMutual offers retirement planning, investment management services, and financial wellness knowledge on topics including estate planning and college savings, in addition to a choice of life insurance plans. MassMutual can help business owners manage their insurance and employee benefits packages, including group life insurance and pensions.

MassMutual offers a variety of insurance options that span a wide range of pricing points and features. There should be a policy for practically everyone, with the term, entire, universal, and variable universal coverage options. If you already know you want a term life insurance coverage, MassMutual provides a Term Direct policy that you may purchase through its website. All other policy types will require you to work with an insurance agent to look over the various policies, riders, and other alternatives in order to limit down your selections to those that best meet your needs and budget.

MassMutual's website, in comparison to the other companies on our list, only provides extremely basic information on its policies and does not provide information on specific policies or riders. The organization does, however, give calculators to assist you in determining the appropriate type and amount of coverage for you.Headquarters: Massachusetts, United States

Revenue: 29.6 billion USD

businesswire.com

coin68.com