Top 9 Best Insurance Companies for Motorcycles

Riding a motorcycle can be exhilarating, but it also comes with inherent risks. To ensure that you and your motorcycle are protected on the road, it's ... read more...important to have the right motorcycle insurance coverage from a reputable and reliable insurance company. In this article, we'll explore the best insurance companies for motorcycles.

-

One of the biggest motorbike insurance providers in the United States is Progressive. In reality, according to the company, one out of every three riders is insured. Progressive has risen to the top of the pack for a variety of good reasons, beginning with the benefits it provides as a standard for all policies.

Cost comes first. Motorcycle insurance plans from Progressive start as low as $79 a year. It does note that the premium is only for basic liability and that it is not offered in all jurisdictions. Every policy includes complete replacement cost coverage with no depreciation. That is, if your motorbike is totaled, Progressive will not simply give you the value of your bike before the accident. Instead, it goes a step further and provides you with the funds required to buy a new bike of the same model. You can also include coverage for equipment and personal items.

Progressive also promises that it will pay for OEM parts if your bike is damaged in an accident. When you buy collision and comprehensive insurance, the business automatically includes $3,000 in coverage. You may use this coverage for personalized items and accessories, such as riding apparel, and you may add more coverage if necessary. Other companies typically charge extra for these choices, but Progressive includes them as a standard component of its coverage.

The Progressive mobile app also allows you to manage your account and submit a claim no matter where you are, which makes it a particularly useful tool for long road journeys.Pros

- Track day coverage and replacement cost with Plus and Elite packages

- First-accident forgiveness and helmet and safety apparel covered

- Long list of discounts, including lay-up, locked storage and preferred operator

- Covers legal all-terrain vehicles (ATVs) and trailers

Highlights

- J.D. Power Customer Satisfaction Score: 861/1000 (Above average)

- A.M. Best Financial Strength Rating: A+ (Superior)

Website: https://www.progressive.com

Photo on Flickr (https://live.staticflickr.com/7217/7202272402_bcce75603f_b.jpg) Progressive Insurance -

Markel is the best motorbike insurance company for mechanical breakdowns because it is the only insurer on our list that covers repairs to failed components even if the failure was not caused by a collision.

Markel's accident forgiveness (which includes the option of covering your first at-fault loss after four years accident-free) and diminishing deductible (get 25% off each year and pay nothing after four years) programs stick out. In addition, the company provides all of the standard motorcycle coverage options that most bigger insurers provide, such as collision, comprehensive, and medical payments, as well as some unique extras.

An agreed-value settlement for custom motorcycles, coverage for mechanical issues, trailers, and funeral costs resulting from a motorcycle mishap are additional perks and add-ons. For any insured individual riding an insured bike, both the agreed-value settlement and funeral expenditures provide coverage for final expenses up to a predetermined amount.

Pros

- Covers mechanical breakdowns unrelated to crashes

- Includes $1,000 in accessories coverage with comprehensive and collision

- Accident forgiveness option for first at-fault loss after four years accident-free

- Added coverage for funeral expenses and trailers

- Rental reimbursement

Highlights

- J.D. Power Customer Satisfaction Score: N/A

- A.M. Best Financial Strength Rating: A (Excellent)

Website: https://www.markel.com

Screenshot of www.markel.com Markel -

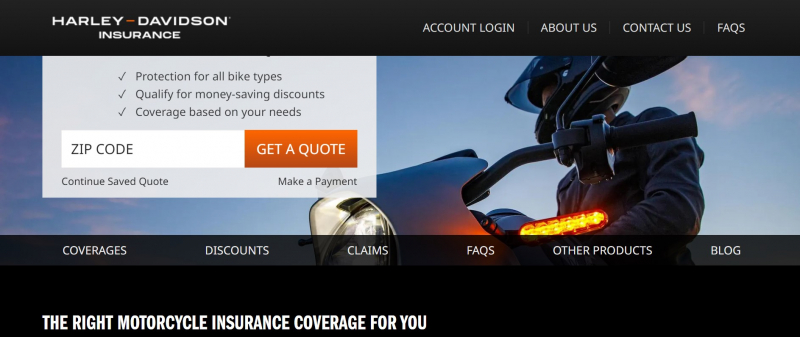

Harley-Davidson is the best motorbike insurance provider for first-time riders. If you're looking for a one-stop store for insurance, bike loans, and extended service plans, Harley-Davidson is the place to go.

Harley-Davidson offers motorcycle insurance and associated goods such as parts, bike loans, and planned maintenance insurance. New riders can save even more money by combining these goods and services with the company's motorcycle safety course discount.

The company's coverage options and discounts are among the finest on our list, rivaled only by Progressive.

- Aside from the standard coverage choices, Harley-Davidson offers a wide range of add-ons:

- Full replacement cost coverage in the case of a total loss

- Equipment replacement cost coverage for lesser accidents

- Rental reimbursement coverage in case you need to rent another bike or car while your main vehicle is out of commission

Pros

- Financing and extended service plans

- Extensive list of covered motorcycle types

- Optional equipment replacement cost for total losses

- Discounts for military members, law enforcement and experienced riders

Highlights

- J.D. Power Customer Satisfaction Score: N/A

- A.M. Best Financial Strength Rating: A+ (Superior)

Website: https://www.insurance.harley-davidson.com

Screenshot of www.insurance.harley-davidson.com Harleysite -

It stands to reason that Geico, one of the top providers of auto insurance, would also be a pioneer in the field of motorbike insurance. Almost all types of motorcycles, including some custom bikes, are covered by Geico.

There are many additional optional coverages available in addition to the usual standard coverages you would find in a basic motorcycle insurance policy. It includes coverage for accessories and helmets in addition to the standard array of medical payments, personal injury protection, emergency roadside assistance, and towing and labor.

And the business is especially strong when it comes to discounts; for example, you'll get a 20% discount just for switching to Geico from another carrier, and once you're on board, you can save up to 10% just by renewing your policy with them.

One of the main benefits of using a large car insurance company is that you may already have coverage for your car or other vehicles with Geico, and adding your motorbike to the same policy will save you even more money.Pros

- Some of the industry’s lowest rates

- Outstanding reputation

- Easy-to-attain discounts

- Superior financial health

Highlights

- J.D. Power Customer Satisfaction Score: 874/1000 (Above average)

- A.M. Best Financial Strength Rating: A++ (Superior)

Website: https://www.geico.com

Screenshot of www.geico.com GEICO Insurance -

Dairyland provides some of the best motorcycle insurance for high-risk riders because it is renowned for giving customers with poor driving records affordable prices. However, Dairyland motorcycle insurance is not offered everywhere, so before requesting an estimate, you must make sure it is offered in your state. Compared to the providers mentioned above, Dairyland is much less well-known, but it has received an A+ rating from the BBB and an A+ financial strength rating from AM Best.

Dairyland offers a comprehensive selection of motorcycle insurance coverage choices. Whether you want to insure optional equipment or protect your passengers on the open road, the business has you covered. Dairyland motorbike insurance coverages include Bodily injury liability coverage, Property damage liability coverage, Collision coverage, Comprehensive coverage, Medical payments coverage, Personal injury protection, Uninsured/underinsured motorist coverage, Special equipment coverage, Replacement cost coverage, Passenger liability coverage, Physical damage plus coverage, Roadside assistance and towing, Rental reimbursement.

Dairyland motorcycle insurance rates are usually quite reasonable, particularly for high-risk drivers. Because the business focuses on insuring those who may have difficulty getting coverage with other providers, it understands how to negotiate a deal for risky riders. Dairyland's website offers a few discounts for motorcycle riders, including:

- Transfer discount

- Multi-cycle discount

- Homeownership discount

- Loyalty discount

- Harley Owners Group (H.O.G.) discount

- Rider group discount

- Rider course discount

Pros

- Affordable average premiums

- Extensive added coverage options

- Positive financial strength rating

- Many discount opportunities

Highlights

- J.D. Power Customer Satisfaction Score: N/A

- A.M. Best Financial Strength Rating: A+ (Superior)

Website: https://www.dairylandinsurance.com

Screenshot of www.dairylandinsurance.com/motorcycle Dairyland -

The only insurer on this list that will ensure these specific customers is our top choice for the best motorcycle insurance provider for track riders. If a motorcycle is damaged or needs to be replaced due to an accident on the racecourse, track day coverage will cover the costs. Foremost, a Farmers Insurance subsidiary provides many of the same coverages but with a superior online user experience and more favorable terms for its insurance products. As an illustration, Farmers only provides up to $7,500 in coverage for your transport trailer, whereas Foremost offers up to $10,000.

The business offers three coverage packages - Saver, Plus, and Elite - that can be tailored to your specific needs. All three plans include first-accident forgiveness as well as coverage for helmets and safety apparel in varying quantities. Track-day coverage, replacement cost coverage, and roadside help with towing and travel interruption are included in the Plus and Elite packages. The Elite plan has a lower deductible and improved permissive use (allowing others to drive your bike) rental advantages. This package also includes coverage for vintage, custom, and low-speed vehicles.

Pros

- Track day coverage and replacement cost with Plus and Elite packages

- First-accident forgiveness and helmet and safety apparel covered

- Long list of discounts, including lay-up, locked storage and preferred operator

- Covers legal all-terrain vehicles (ATVs) and trailers

Highlights

- J.D. Power Customer Satisfaction Score: N/A

- A.M. Best Financial Strength Rating: A (Excellent)

Website: https://www.foremost.com

Image by Tumisu from Pixabay Foremost Insurance -

Nationwide is the top choice for the best motorcycle insurer due to its high coverage maximums and the ability to include up to 12 specialty motorcycles on a single policy. Nationwide provides free annual insurance reviews in addition to some of the highest coverage limits. Only it and Progressive provide bodily injury liability and uninsured/underinsured motorist coverage of $500,000 per person, per mishap.

With Nationwide's collision and comprehensive plans, there is a vanishing or diminishing deductible feature that allows your deductible to decrease by $100 for every year you go without making a claim, up to a maximum of $500. Unlike other insurers, Nationwide allows you to insure up to 12 vehicles under one insurance for a maximum coverage amount of $30,000 for custom parts and $50,000 per bike, plus trailer coverage.

Reviews of Nationwide's customer care, however, are conflicting. According to the National Association of Insurance Commissioners (NAIC), the business receives fewer complaints from customers than other businesses of a similar scale. However, Nationwide received a below-average rating from J.D. Power in its annual claims satisfaction poll, which means it might take longer for riders to resume driving after an accident.

Pros

- Up to $50,000 in coverage per bike for vintage or custom bikes/trikes (up to 12)

- Vanishing deductible included collision and comprehensive coverage

- Coverage for original parts for many manufacturers

- Motorcycle apparel coverage included with vintage motorcycle package

Highlights

- J.D. Power Customer Satisfaction Score: 831/1000 (Below average)

- A.M. Best Financial Strength Rating: A+ (Superior)

Website: https://www.nationwide.com

Photo on Wikimedia Commons Nationwide -

Safeco is the best motorcycle insurance business for homemade and kit motorcycles because it is the only insurer that covers certain bikes.

Safeco is a Liberty Mutual company that provides all of the usual motorcycle insurance choices, including coverage for homemade and kit bikes. It also includes roadside help and guaranteed manufacturer components repair with comprehensive and collision coverage with all of its plans.

Safeco also provides a limited number of discounts and extra coverage options in addition to these benefits. The Safety Apparel Coverage, for example, reimburses the replacement cost of your protective gear, whereas the Harley Davidson Replacement Cost Provision pays the real cash value of your Harley if it is involved in a total loss accident.

You must call in if you want a quote or more information because the business is primarily agent-based.

Pros

- Covers some homemade and kit bikes

- Manufacturer parts included comprehensive and collision

- Offers a Harley Davidson replacement cost provision

- Discount for experienced riders

Highlights

- J.D. Power Customer Satisfaction Score: 871/1000 (Below average)

- A.M. Best Financial Strength Rating: A (Excellent)

Website: https://www.safeco.com

Screenshot of www.safeco.com/products/motorcycle-insurance Safeco Insurance & Liberty Mutual Small Commercial -

USAA is known for its high customer service scores and commitment to military service members. Members of the United States Armed Forces and their dependents are not eligible for USAA insurance.

USAA does not immediately provide motorcycle insurance. It recommends Progressive, one of the finest companies for low-cost motorcycle insurance. Despite this detour, those who sign up for USAA motorcycle insurance through Progressive receive military-specific discounts, making a Progressive policy even more reasonable.

Another advantage of purchasing motorcycle insurance from USAA is that it provides motorcycle loans and financing for up to 100% of the worth of your new motorcycle. As a result, it functions as a one-stop shop for people looking to buy a new motorcycle.

Aside from insurance for bikes, USAA also offers coverage for ATVs, mopeds, and scooters. But many riders are unable to purchase USAA motorbike insurance. Only active-duty military personnel, survivors, and members of their families are eligible for it.

Pros

- Highly rated customer service

- Military-specific discounts

- Offers loan financing for bikes

- Issued by Progressive

Highlights

- J.D. Power Customer Satisfaction Score: 890/1000 (Above average)

- A.M. Best Financial Strength Rating: A++ (Superior)

Website: https://www.usaa.com

Photo on Flickr (https://live.staticflickr.com/3132/5748736994_09fb921006_b.jpg) USAA