Top 10 Best Online Financial Markets Courses

Are you wondering which remote classroom to attend? You have spare time and want to broaden your horizon about a specific field of study whilst just staying at ... read more...home. Thus, to satisfy the burgeoning demand for online yet qualifying courses, Toplist has complied a rundown of the Best Online Financial Markets Courses for who in need!!!

-

The institutions that make up the current monetary system have undergone a significant transformation during the last three or four decades. The financial crisis of 2007-2009 served as a wake-up call that the analytical apparatus and theories we use to comprehend that system need to evolve as well. This course, produced and supported by the Institute for New Economic Thinking, is an attempt to start the process of new economic thinking by resurrecting and updating certain neglected but increasingly relevant traditions in monetary philosophy.

The new system has three main features:Most importantly, the fusion of previously independent capital and money markets has resulted in a system with new dynamics and vulnerabilities. The financial crisis exposed those flaws for everyone to see. The result was two years of desperate experimentation by central bankers as they tried one thing after another to stop the collapse.

Second, the global nature of the crisis has revealed the system's global nature, which is novel in postwar history but not at all novel in a longer time frame. The cooperation of central banks was crucial in averting the collapse, and the specifics of that cooperation point to the beginnings of a new international monetary order on the horizon.Third, the operation of significant derivative contracts, particularly credit default swaps and foreign exchange swaps, was absolutely fundamental to the crisis. Contemporary money cannot be understood without understanding modern finance, and modern monetary theory cannot be formed without understanding modern finance. That is why this course positions dealers at the very center of the picture, as profit-seeking suppliers of market liquidity to the new system of market-based credit, in both capital and money markets.

This course offers:

- Shareable Certificate: Earn a Certificate upon completion

- 100% online courses: Start instantly and learn at your own schedule.

- Flexible Schedule: Set and maintain flexible deadlines

- Approx. 33 hours to complete

- Subtitles: Arabic, French, Portuguese (European), Italian, Vietnamese, German, Russian, English, Spanish, Japanese

Coursera Rating: 4.9/5

Enroll here: https://www.coursera.org/learn/money-banking

coursera.org

sites.columbia.edu -

The first online course Toplist would like to introduce to you in this list of the Best Online Financial Markets Courses is the Financial Markets course. This course is an overview of the concepts, methods, and structures that allow human civilization to control risks while also encouraging enterprise. The need for financial leadership abilities is also emphasized in this course. Understanding the real-world functioning of the securities, insurance, and banking industries require an introduction to risk management and behavioral finance principles. The ultimate purpose of this course is to successfully use such industries in order to improve society.

This course is offered by Yale University. Yale University has been inspiring the brains that inspire the globe for over 300 years. Yale University, based in New Haven, Connecticut, brings people and ideas together to make a good difference around the world. Yale is a place for connection, creativity, and innovation among cultures and disciplines. It is a research university that focuses on students and fosters learning as a way of life. Keep reading to discover more Best Online Financial Management Courses.

This course offers:

- Shareable Certificate: Earn a Certificate upon completion

- 100% online courses: Start instantly and learn at your own schedule.

- Flexible Schedule: Set and maintain flexible deadlines.

- Beginner Level

- Approx. 33 hours to complete

- Subtitles: Arabic, French, Portuguese (European), Italian, Portuguese (Brazilian), Vietnamese, Korean, German, Russian, English, Spanish, Japanese

Coursera Rating: 4.8/5

Enroll here: https://www.coursera.org/learn/financial-markets-global

coursera.org

coursera.org -

This course will teach you about the major financial markets, their features, and how they are related to the economy.

A diverse team of specialists will begin by teaching you how stock and bond prices are calculated and why they change, while also enhancing your understanding of risk and why it is important when evaluating an investment's performance. The focus will next shift to markets that are less well-known, such as gold, emerging markets, real estate, hedge funds, and private equity. These will be examined with a focus on their unique risks and return prospects, as well as how they might assist in the development of effective portfolios. Finally, you will learn about central bank policies and how they affect financial markets, as well as the relationship between the economy and the price of financial assets.

Throughout these several steps, specialists from UBS, the corporate partner, will demonstrate how the concepts you've just learned are put into practice at a leading worldwide bank. With a focus on pragmatism, you'll not only comprehend what's going on in global financial markets, but you'll also start to figure out how to use them to help clients or yourself reach financial goals.This course offers:

- Shareable Certificate: Earn a Certificate upon completion

- 100% online courses: Start instantly and learn at your own schedule.

- Flexible Schedule: Set and maintain flexible deadlines

- Course 1 of 5 in the: Investment Management Specialization

- Beginner Level

- Approx. 11 hours to complete

- Subtitles: Arabic, French, Portuguese (European), Chinese (Simplified), Italian, Vietnamese, German, Russian, English, Spanish

Coursera Rating: 4.8/5

Enroll here: https://www.coursera.org/learn/understanding-financial-markets

coursera.org

kzhu.ai -

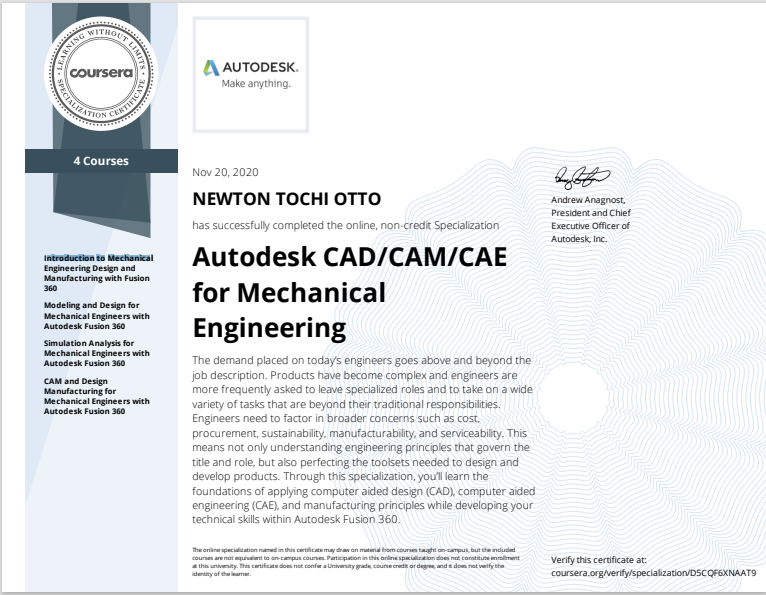

Engineers are in high demand now for reasons that go beyond their job description. Engineers are increasingly being expected to abandon their specialized jobs and take on a wide range of duties that are outside of their customary responsibilities as products have become more complicated. The focus of these jobs is on form, fit, and function. Cost, procurement, sustainability, manufacturability, and serviceability are all issues that engineers must consider. Their responsibilities have shifted from being solely individual to work as part of a collaborative engineering team, executing compromises with both engineering and business partners to reach project objectives. To be successful, today's engineers must widen their skill set to keep up with these changes.

Engineers must be on the cutting edge of design innovation nowadays. This entails mastering not only the engineering concepts that govern the title and function but also the toolkits required to create and develop things. You'll master the fundamentals of applying computer-aided design (CAD), computer-aided engineering (CAE), and manufacturing techniques while honing your technical abilities in Autodesk Fusion 360 with this specialization.

This course offers:

- Shareable Certificate: Earn a Certificate upon completion

- 100% online courses: Start instantly and learn at your own schedule.

- Flexible Schedule: Set and maintain flexible deadlines

- Intermediate Level: Some related experience required.

- Approximately 4 months to complete: Suggested pace of 2 hours/week

- Subtitles: English, Arabic, French, Portuguese (European), Italian, Vietnamese, German, Russian, Spanish

Coursera Rating: 4.8/5

Enroll here: https://www.coursera.org/specializations/autodesk-cad-cam-cae-mechanical-engineering

coursera.org

freelancer.com -

This Specialization will teach you how to use investing methods to achieve financial goals in a global setting. You'll study the theory behind sound investment decisions, as well as practical, real-world skills you may use while discussing investment recommendations with your advisor, managing your personal assets, or managing the financial portfolios of your clients. You'll begin by gaining a broad understanding of financial markets and the implications of rational and irrational conduct in finance at both the micro and macro levels. After that, you'll learn how to properly create and manage a portfolio with a long-term perspective, as well as get an understanding of new research achievements in finance and related fields, as well as future trends that are impacting the investment management sector.

You will design a smart 5-year investment plan in the final Capstone Project that takes into consideration an investor's goals and restrictions in a dynamic economic landscape. Our corporate partner, UBS, will contribute to this specialization by providing you with practical insights gleaned from years of experience working for the world's largest asset manager.

This course offers:

- Shareable Certificate: Earn a Certificate upon completion

- 100% online courses: Start instantly and learn at your own schedule.

- Flexible Schedule: Set and maintain flexible deadlines

- Beginner Level: No prior experience required.

- Approximately 5 months to complete: Suggested pace of 2 hours/week

- Subtitles: English, Arabic, French, Portuguese (European), Chinese (Simplified), Italian, Vietnamese, German, Russian, Spanish

Coursera Rating: 4.8/5

Enroll here: https://www.coursera.org/specializations/investment-management

coursera.org

unige.ch -

You'll learn the fundamental concepts and abilities that financial managers need to make informed decisions in Introduction to Finance: The Role of Financial Markets. You'll gain critical skills for making capital investment decisions by understanding the structure and behavior of financial markets and regularly utilized financial instruments. You'll be able to comprehend how to quantify returns and risks, as well as the link between the two, with these skills. This course focuses on fundamental concepts and skill sets that will have a direct influence on real-world financial challenges. The course will help you comprehend the role of financial markets as well as the type of main securities traded on them. Furthermore, you will learn how to harness financial markets to produce value in the face of uncertainty.

This course offers:

- Shareable Certificate: Earn a Certificate upon completion

- 100% online courses: Start instantly and learn at your own schedule.

- Flexible Schedule: Set and maintain flexible deadlines

- Approx. 19 hours to complete

- Subtitles: French, Portuguese (European), Russian, English, Spanish

Coursera Rating: 4.7/5

Enroll here: https://www.coursera.org/learn/introduction-to-finance-the-role-of-financial-markets

coursera.org

illinois.edu -

Good management is equal parts knowing and doing. A basic understanding of financial, marketing, and decision-making principles, as well as other management fundamentals, will help you achieve your professional goals, whether it's getting promoted at your current job, preparing for an MBA program, or starting your own business, regardless of what industry you work in or where you are in your career.

This Specialization will provide you with a thorough understanding of management practice via the lenses of four essential disciplines: accounting, finance, marketing, and organizational behavior. You'll examine real business scenarios from these four angles in each course. In the Capstone Project, you'll use what you've studied to create a comprehensive solution to a real-world business problem.This course offers:

- Shareable Certificate: Earn a Certificate upon completion

- 100% online courses: Start instantly and learn at your own schedule.

- Flexible Schedule: Set and maintain flexible deadlines

- Beginner Level: No prior experience required.

- Approximately 6 months to complete: Suggested pace of 3 hours/week

- Subtitles: English, Arabic, French, Portuguese (European), Italian, Vietnamese, German, Russian, Spanish, Chinese (Traditional), Persian

Coursera Rating: 4.7/5

Enroll here: https://www.coursera.org/specializations/foundations-management

coursera.org

kisovboris.com -

You'll master the fundamentals of portfolio management and personal investing in this four-course Specialization. From the greatest pension funds to the tiniest individual investors, all investors face the same challenges when it comes to investing: how to satisfy their obligations, where to invest, and how much risk to take on. You will learn how to think about, discuss, and propose solutions to these investment concerns in this Specialization. You'll learn the theory as well as the practical skills required to plan, implement, and evaluate investment proposals that satisfy financial goals. You'll start with a review of global financial markets and products that define today's investment options.

After that, you'll discover how to build optimal portfolios that successfully manage risk, as well as how to take advantage of behavioral biases and irrational behavior in financial markets. You'll learn about portfolio management and performance evaluation best practices, as well as current investment methods. You will have mastered the analytical tools, quantitative abilities, and practical knowledge required for long-term investment management success by the end of your Capstone Project.

This course offers:

- Shareable Certificate: Earn a Certificate upon completion

- 100% online courses: Start instantly and learn at your own schedule.

- Flexible Schedule: Set and maintain flexible deadlines.

- Beginner Level: No prior experience required.

- Approximately 6 months to complete: Suggested pace of 4 hours/week

- Subtitles: English, Arabic, French, Portuguese (European), Italian, Vietnamese, German, Russian, Spanish

Coursera Rating: 4.5/5

Enroll here: https://www.coursera.org/specializations/investment-portolio-management

coursera.org

ybox.vn -

You will learn how to compute the value at risk for an investment portfolio using the Treynor Ratio by the end of the assignment. It is noticed that you must be familiar with basic financial risk management concepts in order to participate in this course. Take the guided project Compare Stock Returns using Google Sheets to learn how to get them. The material of this course is not intended to be investment advice, and it does not constitute an offer to engage in any financial market operations, regulated or unregulated. This is one of the Best Online Financial Markets Courses.

In this Free Guided Project, you will:

- Quantify risk-to-reward using the Treynor Ratio in this free guided project

- Calculate the value at risk for a portfolio of investments.

- In an interview, talk about your hands-on experience.

This course offers:

- 1 hour

- Intermediate

- No download needed

- Split-screen video

- English

- Desktop only

Coursera Rating: 4.5/5

Enroll here: https://www.coursera.org/projects/investment-risk-management

coursera.org -

Consider this scenario: you're an experienced oil trader who has been observing global market volatility and wants to hedge your risk using commodities futures, or you've been trading equities and want a more diverse portfolio. This concentration is for students who are already well-versed in one aspect of the capital markets but want to gain a greater grasp of how money moves around the globe.

Participants will be able to use their financial market knowledge to investigate how a parallel market might influence, or be influenced by, the asset class with which they are familiar.

Students interested in learning about the mechanics of capital markets, as well as investors whose strengths are limited to their existing trading knowledge, will be able to see the intertwining of numerous capital markets by the end of this specialization. Students can deepen their understanding of the topic by opening a Paper Trading account, which allows them to get hands-on experience in a safe, simulated trading environment while learning the principles of the capital markets. Keep reading to discover more Best Online Financial Markets Courses.This course offers:

- Shareable Certificate: Earn a Certificate upon completion

- 100% online courses: Start instantly and learn at your own schedule.

- Flexible Schedule: Set and maintain flexible deadlines

- Beginner Level: Previous investment experience is helpful although not required

- Approximately 4 months to complete: Suggested pace of 4 hours/week

- Subtitles: English

Coursera Rating: 4.4/5

Enroll here: https://www.coursera.org/specializations/financial-instruments-trading-investing

coursera.org