Top 8 Best Online Financial Modeling Courses

Financial modeling is a required skill. Whether you're looking to switch careers, seek a promotion, or have started your own business, you can use financial ... read more...modeling to forecast future business performance and compare factors. This is a list of the top 8 best online financial modeling courses and is rated based on the content, cost, and reputation of the institution behind it.

-

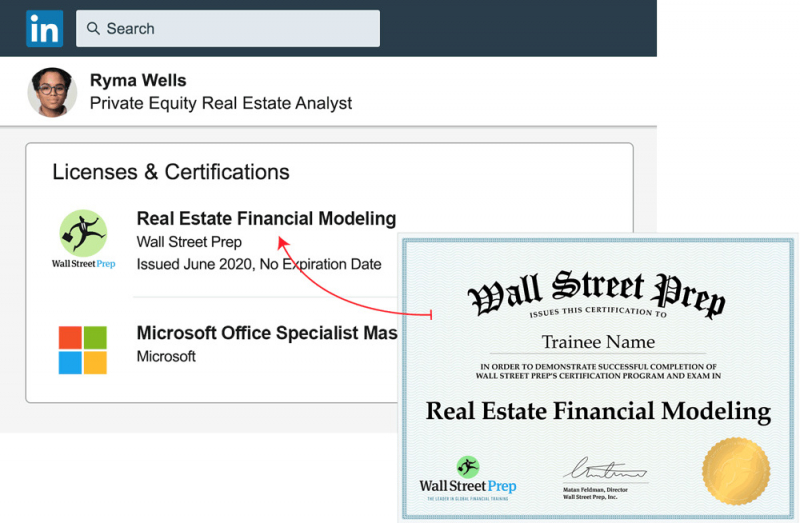

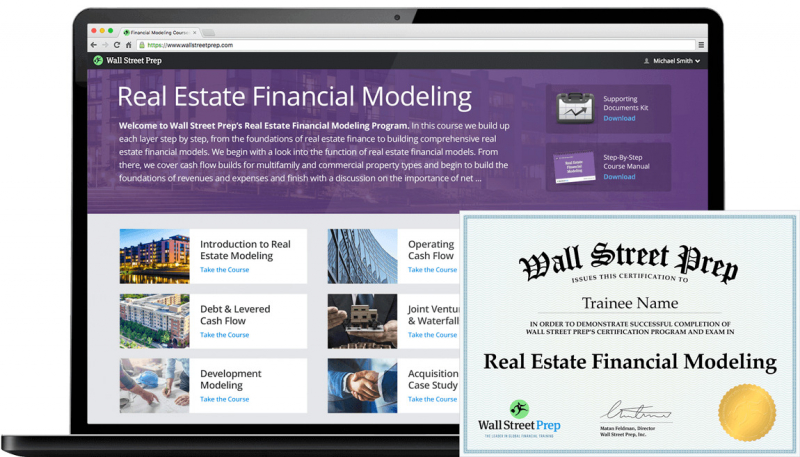

Real Estate Financial Modeling from Wall Street Prep ranks first in the list of best online financial modeling courses. Wall Street Prep, founded in 2004 by investment bankers, provides online and instructor-led courses. Investment banks, private equity firms, and business schools are among its clients. Its Real Estate Financial Modeling course is self-paced and contains over 20 hours of video content delivered in nine parts, as well as reusable real estate Excel modeling templates. The course will teach you real estate and development theory, as well as how to create a real estate development model. You can earn Continuing Professional Education (CPE) credits by taking the course, which is required for Certified Professional Accountants (CPAs).

The course costs $499 and includes unlimited access to Wall Street Prep's online support center, where you can ask questions, download additional resources, and receive updates. If you require additional assistance, tutoring is available online at an additional cost per tutoring session. After completing the course, you can earn a certificate, but you must first pass an exam. You have 24 months from the time you enroll to take the test.

Be aware that this is a fairly advanced program before enrolling. You should already be familiar with accounting principles and proficient in Excel. If you lack that experience, you should consider taking Wall Street Prep's crash courses for an additional fee before enrolling in the Real Estate Financial Modeling course.

The course distinguishes itself from other courses that teach students more general financial modeling principles because it is so comprehensive and tailored to real estate professionals. Those pursuing real estate careers will find its in-depth modules most useful in comparing and contrasting investment decisions.Why should you choose it:

- Wall Street Prep’s Real Estate Financial Modeling course is the best program for those interested in real estate investments. Its curriculum is specifically designed for professionals who want to learn financial modeling for buying property, developing land, acquiring office buildings, or developing multifamily buildings.

Pros

- Course qualifies for CPE credit

- Specifically designed for professionals and students pursuing careers in real estate private equity

- Unlimited access to support center

Cons

- Students may have to take prerequisite courses.

- Must pass exam to qualify for a certificate

- Private tutoring is an added cost.

Rating: 5.0/5.0

Enroll here: wallstreetprep.com/self-study-programs/real-estate-financial-modeling/

wallstreetprep.com

wallstreetprep.com -

Financial Modeling Foundations by LinkedIn Learning ranks 2nd in the list of best online financial modeling courses. If you're new to financial modeling, LinkedIn Learning's online Financial Modeling Foundations class is a great place to start. This course will teach you how to create financial models in Microsoft Excel that can be used in a variety of careers (e.g., commercial banking, investment banking, corporate finance). You'll also receive a certificate of completion.

To register for this class, you must first sign up for a LinkedIn Learning subscription, which ranges from $26.99 per month (if paid annually) to $39.99 per month (if you pay monthly). If you're new to LinkedIn Learning, you can sign up for a free seven-day trial when you subscribe.

This course usually takes three hours to complete. When you sign up, you'll gain access to on-demand videos that you can watch whenever you want. In addition, you will be provided with Microsoft Excel exercise files that you can download and save to your personal library. The course also includes a Q&A section where you can post questions to content experts and your fellow learners. The ability to interact with others when taking an online class is a great feature.

LinkedIn is a professional networking company launched in 2003 and headquartered in Sunnyvale, California. Almost 740 million people use this social media platform in more than 200 countries and territories worldwide. The LinkedIn Learning division was designed to help people upskill to advance in their careers.Why should you choose it:

- The online Financial Modeling Foundations class from LinkedIn Learning teaches beginners how to build various financial models using Microsoft Excel and even comes with downloadable exercise files, at a cost as low as $26.99 a month.

Pros

- Subscriptions cost $26.99 to $39.99 a month

- Only takes three hours to complete this class

- Access to downloadable resources

Cons

- Must sign up for a subscription to take the course

- No one-on-one interaction with the course instructo

Rating: 4.6/5.0

Enroll here: linkedin.com/learning/financial-modeling-foundations/using-excel-for-financial-modeling

answersq.com

slideshare.net -

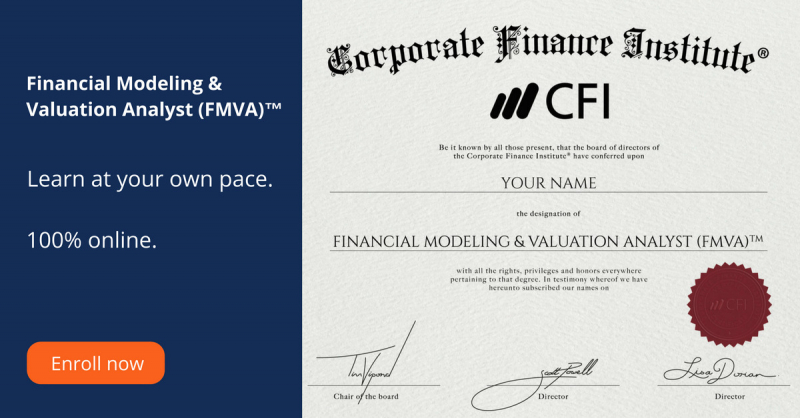

Certified Financial Modeling & Valuation Analyst by the Corporate Finance Institute ranks 3rd in the list of best online financial modeling courses. If you want to be a financial analyst but didn't learn about financial modeling in your degree program, the Corporate Finance Institute's (CFI) Certified Financial Modeling & Valuation Analyst (FMVA) program is a great way to fill this skill gap. This program will teach you financial modeling and business valuations, advanced spreadsheet skills in Microsoft Excel, and accounting and financial analysis.

For a one-time fee of $497, you can complete this self-paced course entirely online. After completing the course, you will receive the FMVA Certification, which you can include on your resume and share with your network. Plus, you’ll get lifetime access to the entire CFI library of courses, which includes:- Six optional preparation courses to help you review the financial modeling basics

- 11 required core financial modeling and valuation courses

- Nine elective finance courses (you must take a minimum of three)

If you want more resources and support, the price of this course rises to $847. You'll get six months of PitchBook data user account access, additional case studies, personalized weekly feedback on your financial models from qualified financial analysts, a monthly comprehensive review of your resume and cover letters, and more with this option.This self-paced course typically takes about six months to complete, though this will vary depending on the individual. All course participants will have access to recorded video lectures, application exercises, quizzes, and assessments.

To earn the FMVA Certification, you must receive at least an 80 percent on each course assessment and pass a final exam. After that, the blockchain-verified FMVA Certification will be sent to the email address the CFI has on file for you. The Corporate Finance Institute, established in 2016, is a global leader in online financial modeling and business valuation courses. CFI is based in Vancouver, Canada.

Why should you choose it:

- The Certified Financial Modeling & Valuation Analyst program offered by the Corporate Finance Institute (CFI) is a great way for professionals who want to become financial analysts to fill skill gaps so they can enter into this exciting career.

Pros

- Earn a Financial Modeling & Valuation Analyst (FMVA) Certification

- Lifetime access to the CFI’s entire library of financial modeling course materials

- CFI has a great reputation

Cons

- Program is expensive, ranging from $497 to $847

- Must purchase the costliest tier to access live assistance

- Will take at least six months to complete

Rating: 4.6/5.0

Enroll here: corporatefinanceinstitute.com/certifications/financial-modeling-valuation-analyst-fmva-program/

onlinecourseing.co

onlinecourseing.co -

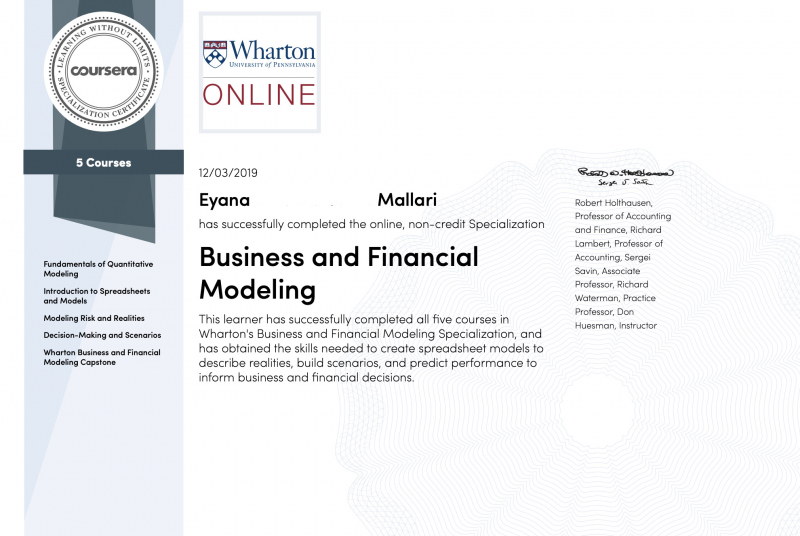

Business and Financial Modeling from Wharton Online ranks 4th in the list of best online financial modeling courses. If you're looking for a financial modeling program from a well-known university, consider this Coursera course from The Wharton School. The University of Pennsylvania's Wharton School of Business is widely regarded as the best business school in the country. Over 50,000 students have completed the Business and Financial Modeling Specialization program, which has received a 4.5 rating from over 6,800 reviews. The program consists of five distinct courses:

- Fundamentals of Quantitative Modeling

- Introduction to Spreadsheets and Models

- Modeling Risk and Realities

- Decision-Making and Scenarios

- Wharton Business and Financial Modeling Capstone

You will learn how to build scenarios and predict future performance using your own data in the program. If you sign up for Coursera, you can enroll in the Business and Financial Modeling Specialization program for a seven-day free trial. You can cancel during the trial period without incurring any fees. After the trial period ends, you can continue taking the courses for $79 per month. Because most students will need six months to complete this program, your total cost will most likely be around $474. Although prior accounting experience is not required, it is recommended that you have knowledge of high school-level math through pre-calculus.

While the courses are self-paced, they begin on set dates, so you have to wait for the next enrollment period. But each course is offered at least once per month. All of the content is prerecorded, so there is no way to interact with instructors if you need personalized assistance. While you can earn a certificate upon completing the program, the certificate is issued by Coursera, not The Wharton School, which may be less impressive to employers.

Despite its drawbacks, they chose this program as the best overall financial modeling class because of the reputation of the university behind it and the thoroughness of its materials. And, because the course charges a monthly fee rather than a fixed price, you can save money by completing the course faster.Why should you choose it:

- They selected the Business and Financial Modeling Specialization program from Wharton Online because of the university’s outstanding reputation and the class’s cost, content, and self-paced format.

Pros

- Low monthly fee

- No prior experience required

- Seven-day free trial

Cons

- Certificate issued by Coursera, not The Wharton School

- Courses start on set dates

- Personalized instruction not available

Rating: 4.5/5.0

Enroll here: coursera.org/specializations/wharton-business-financial-modeling

http://eyana.me/

http://eyana.me/ -

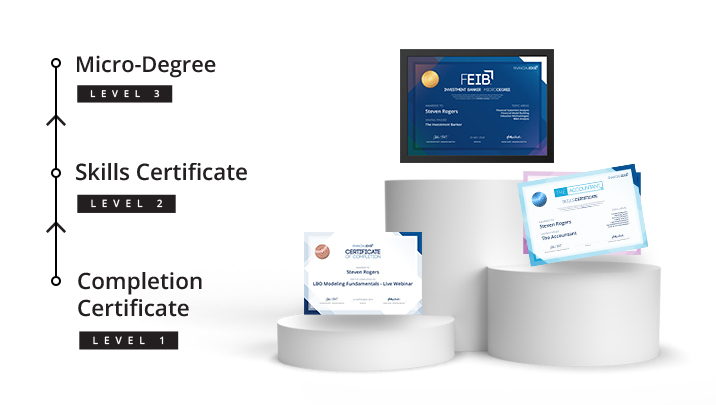

The Investment Banker by Financial Edge ranks 5th in the list of best online financial modeling courses. With Financial Edge's The Investment Banker online course, aspiring financial analysts with a business degree can learn financial modeling practices used in investment banking. The material covered in the course is similar to that taught to new hires at some of the world's largest investment banks. Accounting, financial modeling, business valuations, merger and acquisition (M&A) analysis, and leveraged buyout (LBO) analysis are all covered in this course. This self-paced course lasts approximately 43.5 hours and costs $499.

You will have access to over 260 practice exercises delivered through four self-paced online courses. If you have any questions, you will be able to contact your instructors directly. After passing each online class, you'll receive a skills certificate or a certificate of completion. After completing the program, you will receive a micro-degree certificate demonstrating your subject matter expertise in investment banking.

Financial Edge is a training company that provides in-person corporate training as well as online courses. The team includes trainers with real-world banking industry experience. Financial Edge created The Investment Banker online class based on training materials it delivered to real investment banks. Although a review of various sources suggests Financial Edge has a good reputation, this micro-degree certificate program isn’t an accredited degree program.

Why should you choose it:

- You can learn the same financial modeling concepts as those taught to new analysts at some of the top investment banks.

Pros

- Direct access to course instructors

- Learn the same financial modeling concepts taught to new analysts at investment banks

- Earn completion certificates and a micro-degree

- Lifetime access to course materials

Cons

- Expensive

- No course guarantee offered

Rating: 4.5/5.0

Enroll here: fe.training/product/online-courses/corporate-finance/the-investment-banker/

fe.training

fe.training -

Business and Financial Modeling Specialization from Coursera ranks 6th in the list of best online financial modeling courses. The Wharton School of the University of Pennsylvania, well-known for its business programs, offers Coursera's Business and Financial Modeling Specialization program. You'll learn how to create quantitative models, use spreadsheets to their full potential, measure and manage risk, and optimize the tools you use to make informed business and financial decisions in this self-paced online financial modeling course. After completing this course, you will be able to use data to explain what is going on in a company, evaluate various scenarios, and make predictions about a firm's performance. There are no prerequisites for enrollment, but a solid understanding of high school math, including pre-calculus, will be beneficial.

This course provides a good value among the online financial modeling classes, costing $79 per month. You're also automatically enrolled in five robust financial modeling courses that will take you from fundamental to advanced topics. You will receive a certificate of completion at the end of each course. It is entirely up to you how many courses you complete, in what order, and how long it takes you to complete them. The entire program should take six months, but it could take less or more time depending on your availability and how quickly you want to complete it.

Videos and readings, practice quizzes, graded assignments with peer feedback, graded quizzes with feedback, and other graded assignments are all part of the course materials. If you have any questions, you can ask your classmates or the course instructors. Coursera, which was founded in 2012 and is headquartered in Mountain View, California, collaborates with colleges and universities to provide affordable world-class online learning resources to learners worldwide.

Why should you choose it:

- Coursera's Business and Financial Modeling Specialization program is offered by the Wharton School of the University of Pennsylvania, includes five classes that move you from basic to more advanced financial modeling concepts, and only costs the Coursera subscription fee of $79 a month.

Pros:

- Completely self-paced

- Moves from basic to more advanced financial modeling concepts

- Earn a shareable certificate of completion for each course

Cons:

- Must maintain a Coursera subscription

- Takes about six months to complete

Rating: 4.5/5.0

Enroll here: coursera.org/specializations/wharton-business-financial-modeling

-

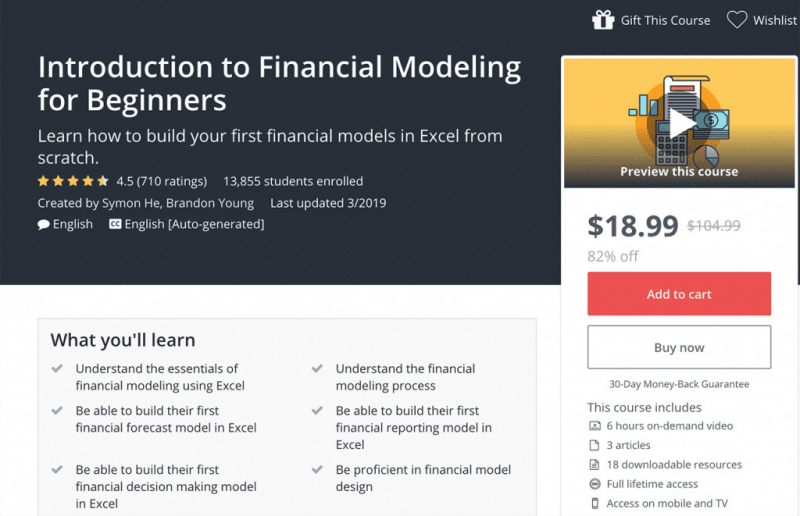

Introduction to Financial Modeling by Udemy ranks 7th in the list of best online financial modeling courses. If you want to learn the fundamentals of financial modeling on a budget, Udemy's Introduction to Financial Modeling class is a great place to start. You'll learn how to create a basic financial model in Microsoft Excel and gain an understanding of how the three primary financial statements are related. There are no prerequisites, but having a basic understanding of Microsoft Excel may be useful.

When you register for this free class, you will gain access to six hours of on-demand video. There are no additional resources (such as worksheets or articles) included with the course, and you will not be able to interact with the instructor. You will be able to obtain a completion certificate. Despite the disadvantages, you will learn the fundamentals of financial modeling for free. Paid courses include instructor Q&As and direct messaging, as well as a certificate of completion. These paid courses are usually around $99. Udemy was founded in 2009 and is based in San Francisco, California. With over 175,000 courses and 46 million learners, the company is one of the world's leading online learning marketplaces.

Why should you choose it:

- You can learn all the basics of financial modeling, including how to prepare a simple financial model using Excel for a low fee.

Pros

- Free access to video content

- Learn how to build a basic financial model using Excel

- Offered from one of the global leaders for online education

Cons

- No certificate of completion

- No access to a course instructor

- No additional resources are provided

Rating: 4.3/5.0

Enroll here: udemy.com/course/financial-modeling-asimplemodel/

venturelessons.com

venturelessons.com -

Entrepreneurs who want to learn how to create financial models and forecasts for their businesses will appreciate Udemy's Financial Modeling for Startups & Small Businesses course. This course costs $129.99 for a one-time fee of $16.99, which includes 11.5 hours of on-demand videos, 92 downloadable resources, 13 articles, and lifetime access to the course materials. You'll also receive a certificate of completion.

You should have access to Microsoft Excel (version 2011 or later), a working knowledge of spreadsheet functionality, formulas, and cell references, and a basic understanding of algebra to succeed in this course. This financial modeling course does not require any other formal education or training. In the Financial Modeling for Startups & Small Businesses course offered by Udemy, some of the things you’ll learn how to do include:- Creating financial models for your small business

- Developing models to estimate user growth, expenses, revenue, and more

- Building models for businesses in various industries (e.g., tech, businesses with physical locations)

- Forecasting your business's cash needs

- Determining how much capital or funding you need to start a business

If you have any questions after enrolling in an Udemy class, you can send a direct message to your instructor. In addition, if your question hasn't already been answered, you can search for it in the course's Q&A section or ask it yourself. The ability to ask questions is a feature that not all online courses provide. Udemy is one of the world's leading online learning marketplaces, with over 150,000 courses and 40 million learners. In addition, Udemy has been recognized as one of the top companies dedicated to making the world a better place.

Why should you choose it:

- Udemy's Financial Modeling for Startups & Small Businesses course teaches entrepreneurs how to build financial models that can be applied to improve and monitor their businesses’ financial condition.

Pros

- Lifetime access to downloadable resources and articles

- Provides training on basic financial modeling skills

Cons

- Non-discounted price of $129.99 is higher than other courses

- Requires basic knowledge of Excel and algebra

Rating: 4.0/5.0

Enroll here: udemy.com/course/financial-modeling-for-startups-small-businesses

venturelessons.com

venturelessons.com