Top 10 Best Online Financial Management Courses

Are you wondering which remote classroom to attend? You have spare time and want to broaden your horizon about a specific field of study whilst just staying at ... read more...home. Thus, to satisfy the burgeoning demand for online yet qualifying courses, Toplist has complied a rundown of the Best Online Financial Management Courses for who in need!!!

-

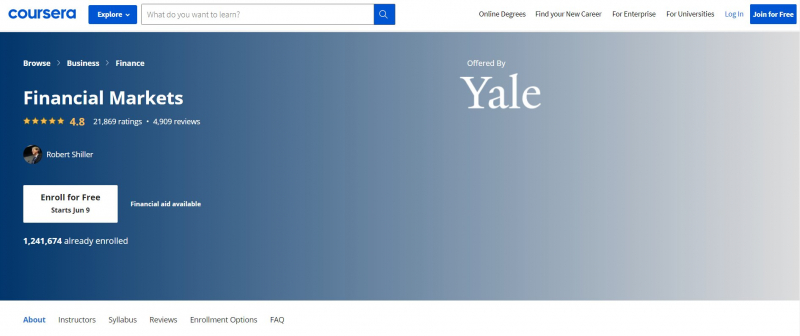

The first online course Toplist would like to introduce to you in this list of the Best Online Financial Management Courses is the Financial Markets course. This course is an overview of the concepts, methods, and structures that allow human civilization to control risks while also encouraging enterprise. The need for financial leadership abilities is also emphasized in this course. Understanding the real-world functioning of the securities, insurance, and banking industries require an introduction to risk management and behavioral finance principles. The ultimate purpose of this course is to successfully use such industries in order to improve society.

This course is offered by Yale University. Yale University has been inspiring the brains that inspire the globe for over 300 years. Yale University, based in New Haven, Connecticut, brings people and ideas together to make a good difference around the world. Yale is a place for connection, creativity, and innovation among cultures and disciplines. It is a research university that focuses on students and fosters learning as a way of life.

This course offers:

- Shareable Certificate: Earn a Certificate upon completion

- 100% online courses: Start instantly and learn at your own schedule.

- Flexible Schedule: Set and maintain flexible deadlines.

- Beginner Level

- Approx. 33 hours to complete

- Subtitles: Arabic, French, Portuguese (European), Italian, Portuguese (Brazilian), Vietnamese, Korean, German, Russian, English, Spanish, Japanese

Coursera Rating: 4.8/5

Enroll here: https://www.coursera.org/learn/financial-markets-global

coursera.org

coursera.org -

This short course covers all of the important concepts covered in a full semester MBA finance course, but in a more accessible way at a very high conceptual level. The purpose is to provide you with a plan and structure for making financial decisions.

The fundamentals of financial valuation, including the time value of money, compounding returns, and discounting the future, will be covered in this course. You'll learn about discounted cash flow (DCF) valuation and how it differs from other approaches. The course also takes you inside the thoughts of a corporate financial manager and teaches you how to use capital budgeting's core tools. It will look at how, when, and where money is spent, as well as how to make decisions between investment, growth, and dividends, and how to maintain solid fiscal discipline. This course then combines our risk discussion with our valuation framework and incorporates it into a number of practical applications.

This course does not require any prior knowledge of money. Rather, it is meant to serve as a starting point for anyone interested in learning more about stock markets, valuation, or corporate finance. It will go over all of the tools and quantitative analysis in detail, as well as build a roadmap to help people understand the seemingly complex judgments that financial experts make.By the end of the course, you'll have a better knowledge of the primary conceptual levers that influence financial decision-making and how they relate to other business sectors. The course should also serve as a roadmap for where you can continue your financial education, and it would be a fantastic introduction for any students considering an MBA or a Finance emphasis but who have no prior experience in the field.

This course offers:

- Shareable Certificate: Earn a Certificate upon completion

- 100% online courses: Start instantly and learn at your own schedule.

- Flexible Schedule: Set and maintain flexible deadlines.

- Beginner Level

- Approx. 14 hours to complete

- Subtitles: Arabic, French, Portuguese (European), Italian, Vietnamese, German, Russian, Turkish, English, Spanish

Coursera Rating: 4.8/5

Enroll here: https://www.coursera.org/learn/finance-for-non-finance

coursera.org

educba.com -

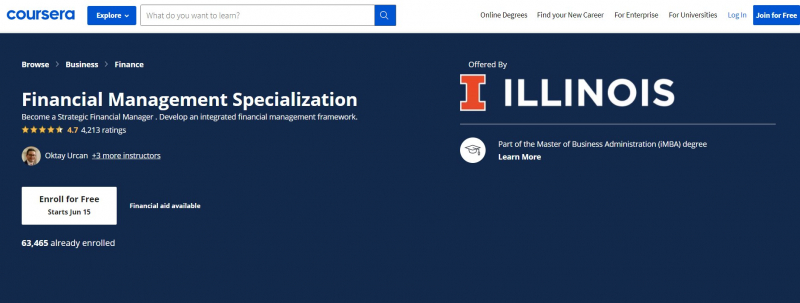

The essentials of strategic financial management, such as financial accounting, investments, and corporate finance, are covered in this Specialization. You will establish an integrated framework for value-based financial management and individual financial decision-making, as well as learn to analyze important strategic corporate and investment decisions and understand capital markets and institutions from a financial viewpoint. Keep reading to discover more Best Online Financial Management Courses.

The University of Illinois iMBA Program offers a Financial Management Specialization. Each course in this Specialization also fulfills a portion of the criteria for a University of Illinois course for which you can receive college credit.

After completing the Financial Management Specialization, you'll be able to:

- Develop an integrated framework for strategic financial decision-making based on a solid foundation.

- Be able to critically examine and interpret cash flow statements and have a thorough understanding of financial statements and the financial information they convey.

- Become familiar with portfolio management and evaluation, as well as firm valuation tools.

- Understand how risk and uncertainty are factored into investment decisions, as well as how businesses make financing and investment decisions.

This course offers:

- Shareable Certificate: Earn a Certificate upon completion

- 100% online courses: Start instantly and learn at your own schedule.

- Flexible Schedule: Set and maintain flexible deadlines.

- Intermediate Level: Some related experience required.

- Approximately 8 months to complete: Suggested pace of 4 hours/week

- Subtitles: English, Arabic, French, Portuguese (European), Italian, Vietnamese, German, Russian, Spanish, Chinese (Traditional), Korean

Coursera Rating: 4.7/5

Enroll here: https://www.coursera.org/specializations/financial-management

coursera.org

illinoisnewsroom.org -

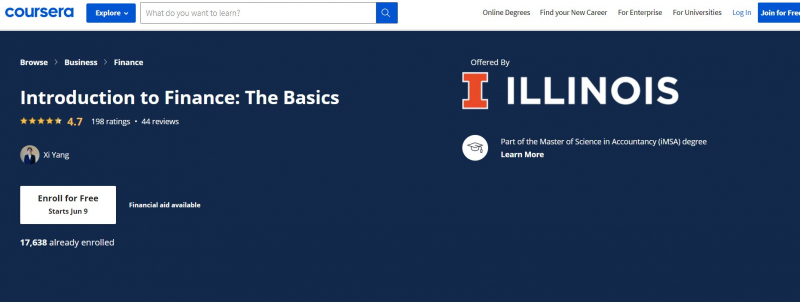

The core principles needed to comprehend the financial manager's decision-making process will be introduced in the Introduction to Finance I: The Basics course. To do so, you'll study the many types of businesses and what the finance manager's role is. You'll also study the basics of financial statements and how to use financial ratios to assess a company's financial health. You'll also learn how to allocate capital over time to build value. You should be conversant with significant subjects in modern finance and be able to speak with others both inside and outside of the business sector after completing the course. You will be in a better position to make educated decisions and plan for the future if you have a thorough understanding of the financial side of the organization.

This course is offered by the University of Illinois. The University of Illinois at Urbana-Champaign is a world leader in research, teaching, and public engagement, distinguished by the breadth of its programs, broad academic excellence, and internationally renowned faculty and alumni. Illinois serves the world by creating knowledge, preparing students for lives of impact, and finding solutions to critical societal needs.

This course offers:

- Shareable Certificate: Earn a Certificate upon completion

- 100% online courses: Start instantly and learn at your own schedule.

- Flexible Schedule: Set and maintain flexible deadlines.

- Beginner Level

- Approx. 19 hours to complete

- Subtitles: Arabic, French, Portuguese (European), Italian, Vietnamese, German, Russian, English, Spanish

Coursera Rating: 4.7/5

Enroll here: https://www.coursera.org/learn/introduction-the-basics

coursera.org

coursera.org -

The first section of this course will cover basic accounting principles and terminology so that you may comprehend how a firm keeps track of its finances and reports on its performance. These fundamental ideas will aid in the understanding of financial reports issued by businesses. It will teach you how to read and interpret balance sheets, income statements, and financial statements.

The course will also cover the fundamentals of management accounting, including how to use techniques like break-even analysis and net present value (NPV) to help managers make short- and long-term decisions like "Is it more cost-effective to sell a production machine and buy a new one?" or "How many products should the company sell to break-even?"

The course will include examples and case studies to assist students in better grasping how basic accounting principles and practices are applied in practice. Students will be able to read, understand, and analyze financial papers by the end of the course, as well as use simple approaches to analyze costs and evaluate capital investment decisions.

This course offers:

- Shareable Certificate: Earn a Certificate upon completion

- 100% online courses: Start instantly and learn at your own schedule.

- Flexible Schedule: Set and maintain flexible deadlines.

- Beginner Level: No prerequisite knowledge is required.

- Approx. 12 hours to complete

- Subtitles: Arabic, French, Portuguese (European), Italian, Vietnamese, German, Russian, English, Spanish

Coursera Rating: 4.7/5

Enroll here: https://www.coursera.org/learn/financial-accounting-polimi

coursera.org

discoradio.it -

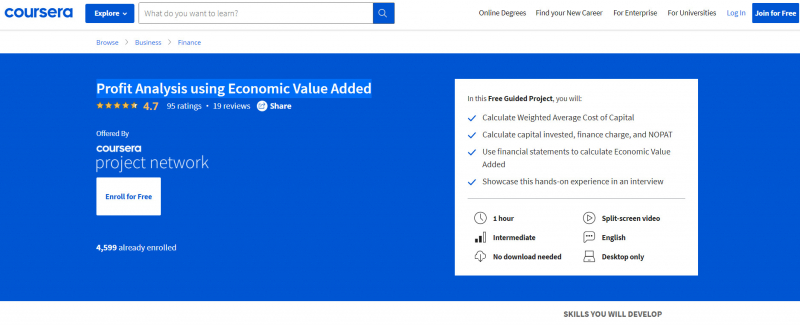

In this course, you will learn how to compute the Weighted Average Cost of Capital, capital invested, finance charge, and NOPAT, as well as how to use financial statements to calculate Economic Value Added, in a 1-hour project-based course. Economic Value Added (EVA) is a key indicator in financial modeling and analysis, and it is used to assess project profitability and management effectiveness. It is advised that you start with the projects Introduction to Valuation with WACC and Analyzing Company Performance using Ratios. This is one of the Best Online Financial Management Courses.

Learn step-by-step: Your instructor will lead you through these steps in a video that plays on a split-screen with your work area:

- Calculate Weighted Average Cost of Capital

- Calculate capital invested, finance charge, and NOPAT

- Use financial statements to calculate Economic Value Added

- Showcase this hands-on experience in an interview

This course offers:

- 1 hour

- Intermediate

- No download needed

- Split-screen video

- English

- Desktop only

Coursera Rating: 4.7/5

Enroll here: https://www.coursera.org/projects/profit-analysis-economic-value-added

coursera.com -

Interest rates are one of the most prevalent and fundamental components of the financial system, and they are the starting point for markets. You'll discover why interest rates have always been a key indicator of everything's worth. The impact of interest rates on consumption, investment, and economic growth, as well as the strange realities of negative interest rates, will all be discussed. Markets examine how interest rates affect the value of all financial assets, with a focus on the bond and stock markets, which have overthrown empires.

This course delves deeper into the global equity pricing models and markets, covering everything from the first stock ever issued – by the Dutch East India Company – to the little-understood but powerful derivative securities market. You will have gained insight into the linkages of financial markets with the worlds of policy, politics, and power by the end of the course. You'll have exhibited that expertise by explaining a key financial idea and translating a financial product or transaction to someone who will obviously benefit from your recommendations.

This course offers:

- Shareable Certificate: Earn a Certificate upon completion

- 100% online courses: Start instantly and learn at your own schedule.

- Flexible Schedule: Set and maintain flexible deadlines.

- Course 2 of 5 in the: Finance for Everyone Specialization

- Beginner Level

- Approx. 11 hours to complete

- Subtitles: Arabic, French, Portuguese (European), Italian, Vietnamese, German, Russian, English, Spanish

Enroll here: https://www.coursera.org/learn/finance-markets

coursera.org

dailynews.mcmaster.ca -

Personal and Family Financial Planning is an academic program that leads to a career as a financial planner. You will learn to assess and advise in all core areas of personal financial planning as part of the curriculum. This course will cover a variety of important personal financial management topics in order to assist you in developing sound financial habits while in school and throughout your life.

This course is offered by the University of Florida. On campus and online, the University of Florida (UF) is regarded as a national and international leader in academic excellence. The University of Florida is the state's oldest university and has a long history of academic success. It is ranked among the top ten public universities in the country.

This course offers:

- Shareable Certificate: Earn a Certificate upon completion

- 100% online courses: Start instantly and learn at your own schedule.

- Flexible Schedule: Set and maintain flexible deadlines.

- Approx. 15 hours to complete

- Subtitles: Arabic, French, Portuguese (European), Italian, Vietnamese, German, Russian, English, Spanish

Enroll here: https://www.coursera.org/learn/family-planning

coursera.com

studyabroad.shiksha.com -

This specialization introduces corporate finance and accounting, with an emphasis on their application to a wide range of real-world situations, including personal finance, corporate decision-making, financial intermediation, and how accounting standards and managerial incentives affect the financial reporting process.

It starts with ideas and applications like time value of money, risk-return tradeoff, retirement savings, mortgage financing, auto leasing, asset valuation, and so on. Excel is used in this specialization to make the learning experience more hands-on and to help learners understand the ideas more clearly. The curriculum gives a solid foundation in corporate finance, including topics such as valuing claims and making financing decisions, as well as parts of a basic financial model.

The specialization then shifts to financial accounting, allowing students to interpret financial statements and comprehend accounting terminology and grammar. The course covers bookkeeping basics, accrual accounting, and cash flow analysis, among other topics. Finally, the specialization teaches learners how to understand and analyze key information that companies provide in their financial statements, such as types of assets and liabilities, longer-term investments and debts, and the difference between tax reporting and financial reporting, using the foundational knowledge of accounting.This course offers:

- Shareable Certificate: Earn a Certificate upon completion

- 100% online courses: Start instantly and learn at your own schedule.

- Flexible Schedule: Set and maintain flexible deadlines.

- Beginner Level: basic high school-level of mathematics

- Approximately 5 months to complete: Suggested pace of 2 hours/week

- Subtitles: English, Arabic, French, Portuguese (European), Italian, Vietnamese, German, Russian, Spanish, Korean, Chinese (Simplified), Japanese

Enroll here: https://www.coursera.org/specializations/finance-accounting

coursera.org

upenn.edu -

You will be able to create a financial statement with Microsoft Excel that includes a transactions page, profit and loss statement, and balance sheet by the end of this assignment. You'll learn how to enter business transactions and understand data in the profit and loss statement. You'll also learn about the components of a balance sheet and how to utilize a financial statement to track and present financial data for your organization. This is one of the Best Online Financial Management Courses.

Learn step-by-step: Your instructor will lead you through these steps in a video that plays on a split-screen with your work area:

- Create a blank spreadsheet with Microsoft Excel Online.

- Create a Transactions page to track the financial statement's assumptions.

- Make a profit and loss statement that includes a summary of all monthly transactions.

- To populate the Profits and Losses categories with transactions, use the SUMIFS formula.

- Completing the Assets portion of a Balance Sheet requires understanding the components of a Balance Sheet.

- Complete the Balance Sheet's Liabilities and Owner's Equity sections and run a final balance check.

This course offers:

- 2 hours

- Intermediate

- No download needed

- Split-screen video

- English

- Desktop only

Enroll here: https://www.coursera.org/projects/create-financial-statement-using-microsoft-excel

coursera.org