Top 10 Best Online Corporate Bond Courses

If you're searching for a higher-yielding fixed-income bond, a corporate bond might be a good choice. This bond is a lower-risk investment since it is a loan ... read more...that protects your money. Corporate bonds have a term ranging from one to four years. Understanding this field through the Best Online Corporate Bond Courses will help you a lot.

-

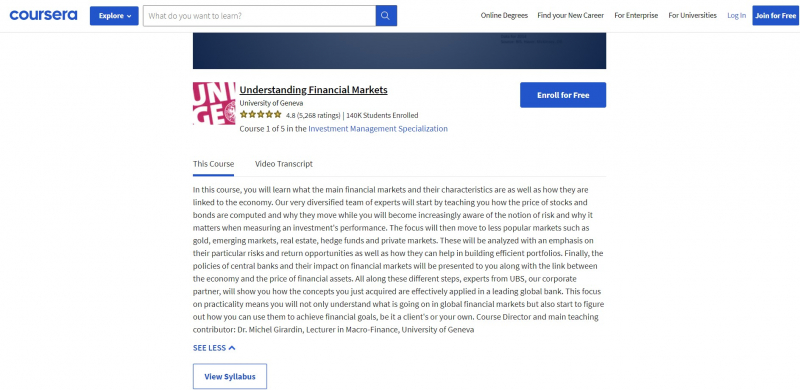

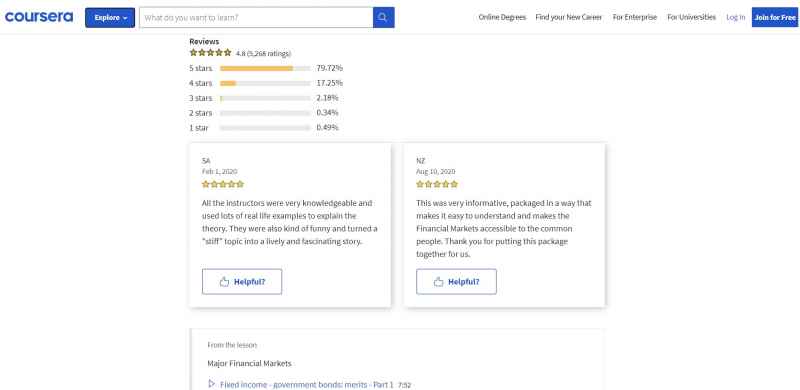

One of the Best Online Corporate Bond Courses is Fixed income - corporate bonds and high yield - UBS guest lecturer. This course will teach you about the major financial markets, their features, and how they are related to the economy. The diverse team of specialists will begin by teaching you how stock and bond prices are calculated and why they change, while also enhancing your understanding of risk and why it is important when evaluating an investment's performance.

The focus will next shift to markets that are less well-known, such as gold, developing markets, real estate, hedge funds, and private equity. These will be examined with a focus on their unique risks and return prospects, as well as how they might assist in the development of effective portfolios. Finally, you will learn about central bank policies and how they affect financial markets, as well as the relationship between the economy and the price of financial assets.

Throughout these several phases, specialists from UBS, the corporate partner, will demonstrate how the principles you've just learned are put into practice at a prominent worldwide bank. With a focus on pragmatism, you'll not only comprehend what's going on in global financial markets, but you'll also start to figure out how to use them to help clients or yourself reach financial goals. Dr. Michel Girardin, Lecturer in Macro-Finance at the University of Geneva, is the course director and key teaching contributor.

This course offers:

- 100% online

- Beginner Level

- Approx. 1 hour to complete

- Subtitles: English

Skills You'll Learn:

- Bond Market, Interest Rate, Stock, Financial Markets

Coursera Rating: 4.8/5

Enroll here: https://www.coursera.org/lecture/understanding-financial-markets/fixed-income-corporate-bonds-and-high-yield-ubs-guest-lecturer-6BOOK

https://www.coursera.org/

https://www.coursera.org/ -

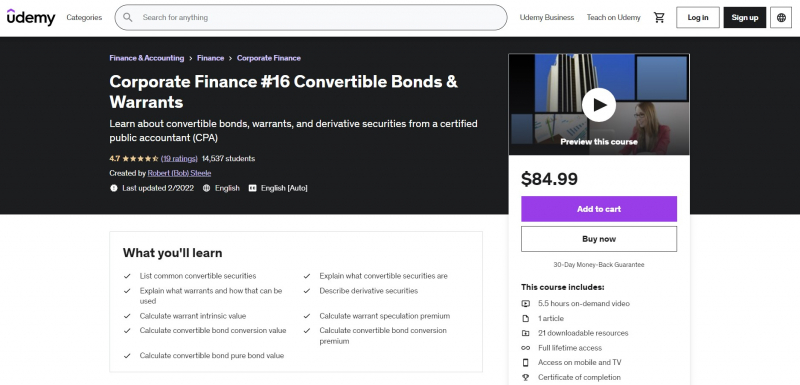

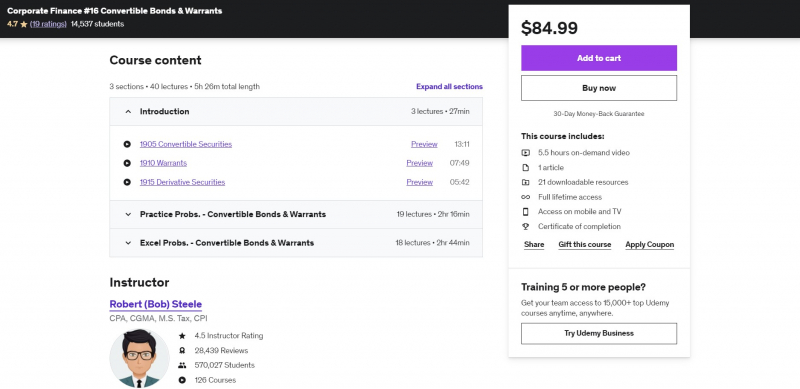

Corporate Finance #16 Convertible Bonds & Warrants is among the Best Online Corporate Bond Courses. Convertible securities will be covered in this course. Convertible bonds, warrants, and derivative instruments are discussed in this course. It provides a variety of issue examples, both in the form of PowerPoint presentations and Excel worksheets. The Excel worksheet presentations will contain a downloaded Excel workbook with at least two tabs, one with the solution and the other with a preformatted worksheet that may be filled together with the instructional videos in a step-by-step approach.

Securities that may be converted from one asset type to another are known as convertible securities. One of the most prevalent forms of convertible securities is convertible bonds. Convertible bonds provide bondholders the choice, but not the duty, to convert the bond into a certain number of stocks. Convertible securities are more difficult to appraise than conventional securities due to their conversion feature.

You can try to evaluate a convertible bond by estimating the value of the relevant stock it could be converted into or valuing bonds of a comparable class that don't have a conversion option. Warrants are a type of option that allows you to acquire a specific number of shares of common stock at a specific price over a predetermined period of time. Financial instruments whose value is based on the value of another asset are known as derivative securities. Futures, forwards, options, and swaps are all types of derivative securities.

This course offers:

- 100% online

- Approx. 5.5 hours to complete

- Subtitles: English

Requirements:

- Understanding the fundamentals of corporate finance

Who this course is for:

- Business students

- Business professionals

Udemy Rating: 4.7/5

Enroll here: https://www.udemy.com/course/corporate-finance-16-convertible-bonds-warrants/

https://www.udemy.com/

https://www.udemy.com/ -

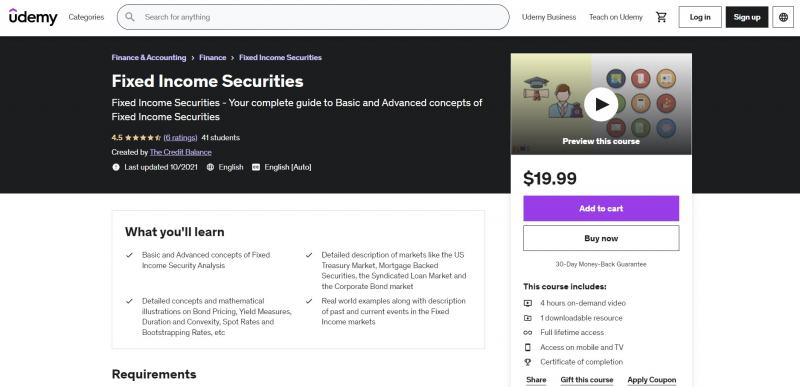

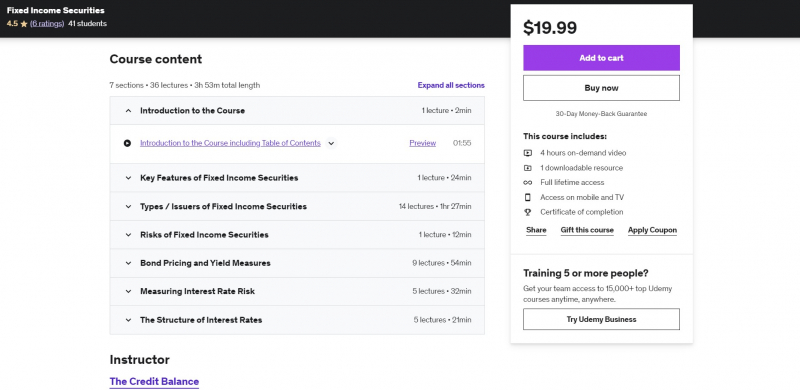

This Fixed Income Securities course seeks to educate the audience by delivering fundamental and advanced ideas of Fixed Income Securities in a simple yet effective manner. The following six parts make up the course. Firstly, it is characteristics of Fixed-Income Securities. The next one is types of Fixed-Income Securities Issuers and fixed-Income Securities Risks, bond Yield Measures and Pricing, Interest Rate Risk Assessment, and lastly, The Interest Rate Structure.

The audience will have a thorough comprehension of these important ideas at the end of this course. Apart from presenting and explaining ideas, the course uses numerous real-life examples and highlights current developments in the fixed-income securities market to make the material more relevant and intellectually engaging to the audience.

Furthermore, the primary goal is to educate the public so that they may make informed investment decisions. Even if you are a student, investing even a little amount in a Fixed Income ETF or bond while studying Fixed Income can give you a far better understanding of how theoretical information is used in practice. As a result, the course looks into several Fixed Income investing options on a regular basis.

This course offers:

- 100% online

- Approx. 4 hours to complete

- Subtitles: English

Requirements:

- No prerequisites

Who this course is for:

- Finance students, CFA Level 1, 2, and 3 students, and anybody interested in learning the fundamentals of investing should attend

Udemy Rating: 4.5/5

Enroll here: https://www.udemy.com/course/fixed-income-securities-analysis/

https://www.udemy.com/

https://www.udemy.com/ -

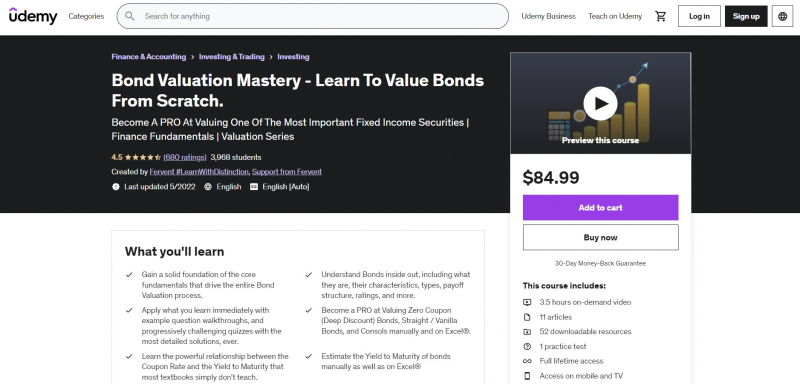

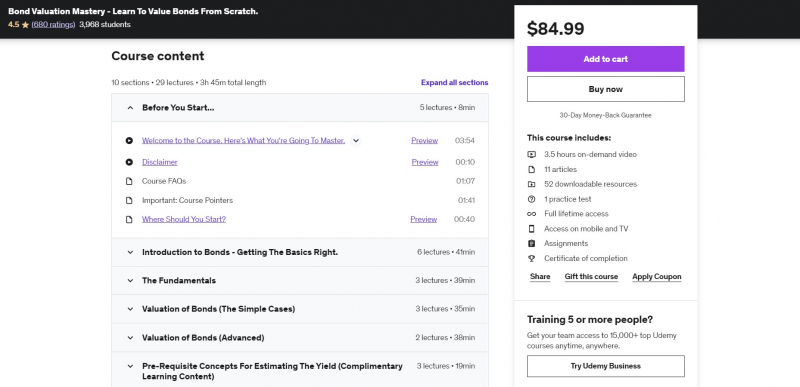

Learn how to evaluate one of the most flexible fixed income instruments from the ground up. From start, value Straight / Vanilla Bonds, Consols, and Zero-Coupon ("Deep Discount") Bonds, as well as their Yields, using rock solid finance fundamentals. Carry out this task manually, as well as using Excel® and Google Sheets.

This course will take you from zero to PRO in one of the most critical parts of contemporary finance, with no prior knowledge necessary and a curriculum tailored for distinction. And start from the ground up with your financial foundations, which will serve you well for the rest of your life.

You may participate in well planned, clutter-free, and entertaining study materials that concentrate on the 20% of financial basics that drive 80% of the results. In addition, rather than memorizing formulae without understanding them, you may simply follow through with complicated concepts using beautiful images that don't overdo it, or investigate why ties are valued the way they are. There is always a good explanation for everything.

This course offers:

- 100% online

- Approx. 4 hours to complete

- Subtitles: English

Requirements:

- There is no need to have any prior expertise

Who this course is for:

- Students at a university or a college

- Students studying for the ACA, ACCA, CFA, and other professional designations

- Investors who are finance managers, particularly those with a non-finance background

- Aspiring Investment Bankers and Analysts

Anybody interested in learning how to value bonds

Udemy Rating: 4.5/5

Enroll here: https://www.udemy.com/course/bond-valuation-mastery/

https://www.udemy.com/

https://www.udemy.com/ -

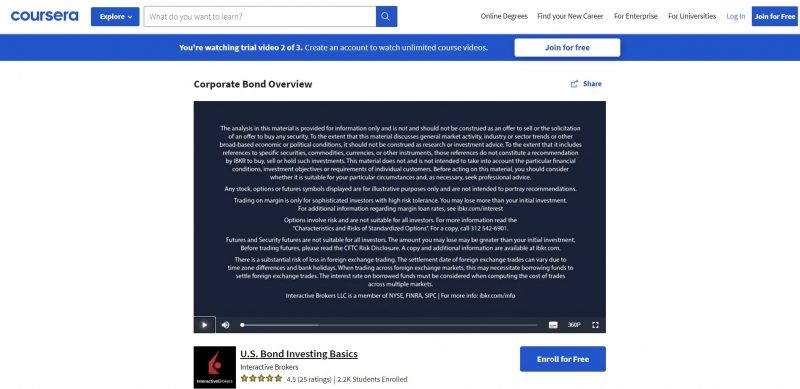

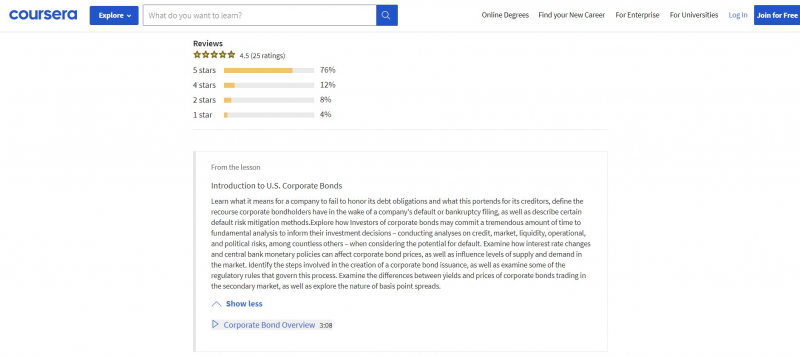

Corporate Bond Overview is also one of the Best Online Corporate Bond Courses. You will learn to distinguish between different types of US dollar-denominated corporate and municipal debt issuance, identify corporate and municipal bonds available for purchase and sale on an online trading platform, understand the market mechanics underlying each type of fixed income instrument, conduct basic analyses, and identify critical investment risks in this fixed income course.

By the end of the course, you should be able to describe the various types of corporate and municipal bond products available for purchase and sale, as well as some of the risks that you, as an investor, are likely to face and how to mitigate them. You should also be able to use an online trading platform to identify available securities to invest in, conduct due diligence, and much more.

Examine how changes in interest rates and central bank monetary policies affect corporate bond prices, as well as supply and demand levels in the market. Examine some of the regulatory requirements that govern the establishment of a corporate bond issuance, as well as the procedures involved in the process. Investigate the disparities between corporate bond yields and prices in the secondary market, as well as the nature of basis point spreads.

This course offers:

- 100% online

- Approx. 3 hours to complete

- Subtitles: English

Skills You'll Learn:

- Interest Rate, municipal bonds, Corporate Bond, bond analysis, Credit Rating

Coursera Rating: 4.5/5

Enroll here: https://www.coursera.org/lecture/fixed-income/corporate-bond-overview-zaG5t

https://www.coursera.org/

https://www.coursera.org/ -

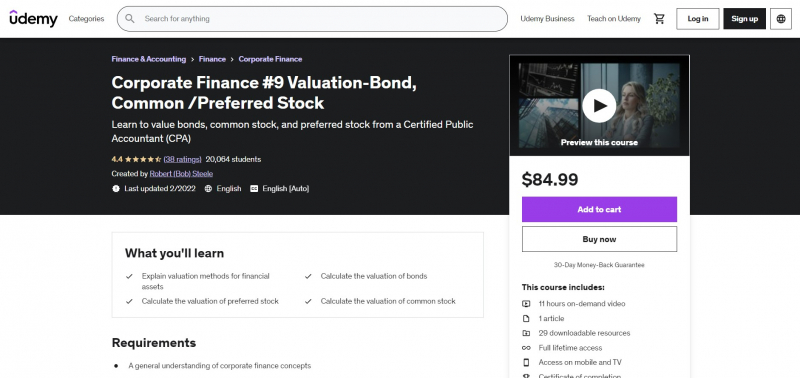

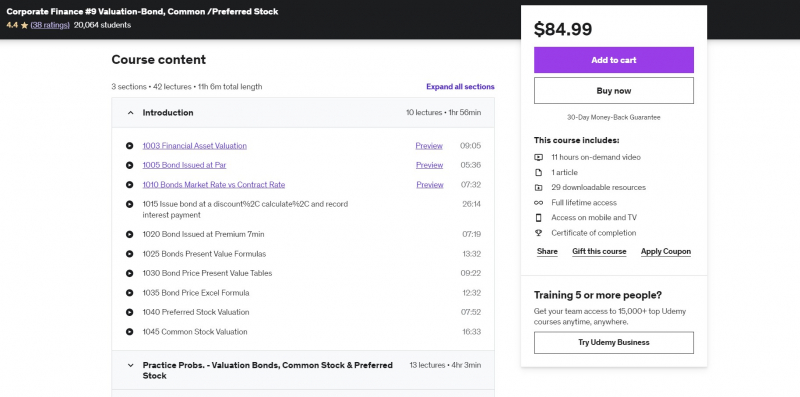

Corporate Finance #9 Valuation-Bond, Common /Preferred Stock is among the Best Online Corporate Bond Courses. The valuation of financial assets such as bonds, ordinary stock, and preferred stock will be covered in this course. Many examples issues are included in the course, both in the form of presentations and Excel worksheet problems. Along with the instructional films, the Excel worksheet presentations will contain a downloaded Excel workbook with at least two tabs, one with the solution and the other with a preformatted worksheet that may be filled in a step-by-step manner.

The present value of future cash flows from the financial asset is the broad idea utilized to appraise financial assets. As a result, it must employ present-value notions and computations. Bond cash flow is typically made up of a series of interest payments and a principal payment at the bond's maturity. The present value of interest payments is calculated using annuity calculations, while the present value of principal at maturity is calculated using one calculation. The payments on preferred stock are frequently standardized, comparable to those on bonds.

This course offers:

- 100% online

- Approx. 11 hours to complete

- Subtitles: English

Requirements:

- A basic familiarity of corporate finance fundamentals is required

Who this course is for:

- Business students

- Business professionals

Udemy Rating: 4.4/5

Enroll here: https://www.udemy.com/course/corporate-finance-9-valuation-bond-common-preferred-stock/

https://www.udemy.com/

https://www.udemy.com/ -

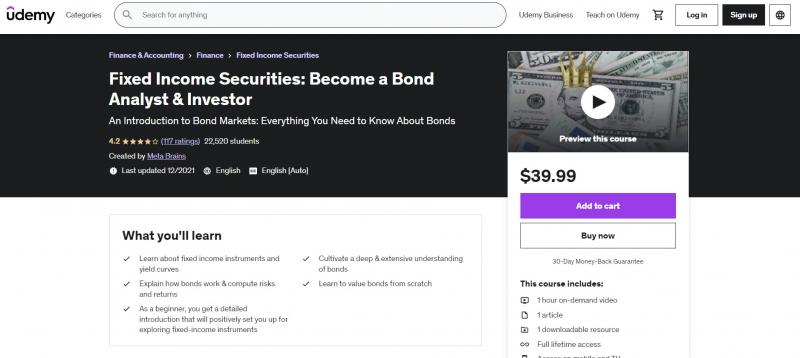

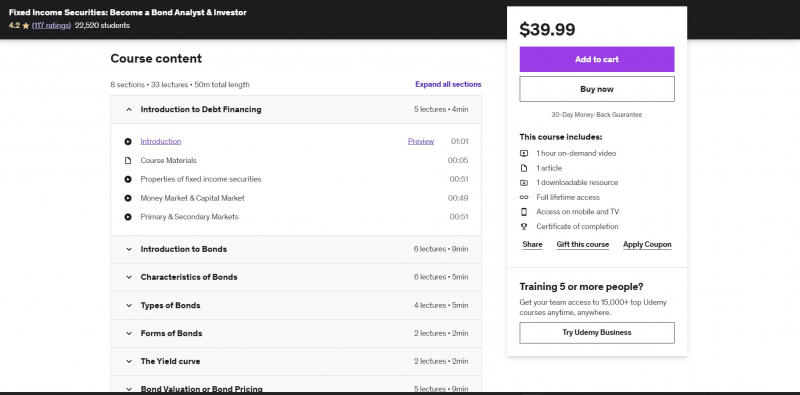

Bond investing provides a number of financial advantages for investors. It provides a consistent source of income while also diversifying their financial portfolio. Bonds have a low level of market volatility. It's a risk-free investing strategy that allows individuals to protect and grow their money. Investing in high-quality government bonds does not expose investors to the risk of default.

This course is for investors and individuals who want to learn more about the basics of fixed-income instruments as well as the market's structures and characteristics. This course is for you if you want to learn about a variety of subjects and sections related to bond analysis and valuation. If you are hesitant to put your time and money into the correct means, dealing with fixed-income securities might be challenging. The goal of this course is to make the seemingly difficult fixed-income securities easy to understand. It is available to everyone, regardless of their place of employment or schedule.

It doesn't matter if you're a novice or a seasoned pro when it comes to fixed-income securities. The course is set out so that you may start at the beginning and work your way up as you gain experience with the fundamentals. This course will teach you the essentials and items you might need to get started with bonds, in addition to teaching you the principles of fixed-income instruments.

This course offers:

- 100% online

- Approx. 50 mins to complete

- Subtitles: English

Requirements:

- Willingness to learn and a desire to do so

- Financial markets and bond instruments piqued his interest

- There is no requirement for prior financial experience

Who this course is for:

- Anyone

Udemy Rating: 4.2/5

Enroll here: https://www.udemy.com/course/introduction-to-bonds/

https://www.udemy.com/

https://www.udemy.com/ -

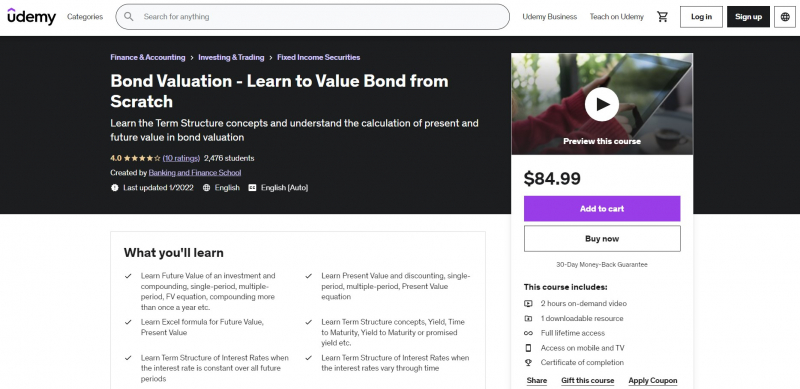

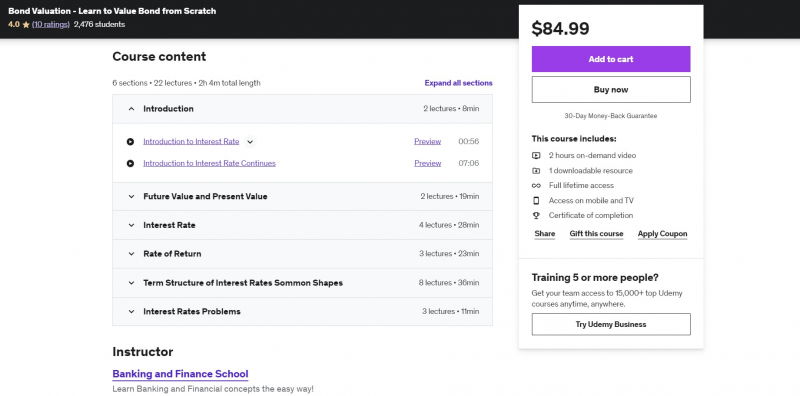

Fixed Income (Bond) valuation and analysis is a method or procedure that the government or businesses use to identify the accurate market value of an instrument. You can learn how to calculate current and future value in bond valuation as well as Term Structure ideas through these courses. Learn about Future Value and Compounding, including single-period, multiple-period, FV equation, compounding more than once a year, and more. Learn about Present Value and Discounting, as well as the single-period and multi-period Present Value equations. Learn the Future Value and Present Value Excel formulas.

Learn about Term Structure, Yield, Time to Maturity, and Yield to Maturity or Promised Yield, among other things. This course will take you from basic to advanced in one of the most crucial parts of contemporary finance, with no prior knowledge necessary and a curriculum that is built for distinction. And start from the ground up with your financial foundations, which will serve you well for the rest of your life.

This course offers:

- 100% online

- Approx. 2 hours to complete

- Subtitles: English

Requirements:

- Knowledge of the Foreign Exchange Market at a Basic Level

- Learn and implement fixed income trading techniques with zeal

- The desire to learn about insurance topics is contagious

Who this course is for:

- Students in finance

- Traders who specialize in fixed-income securities

- Anyone who wants to learn more about fixed income trading

Udemy Rating: 4.0/5

Enroll here: https://www.udemy.com/course/bond-valuation-basics-term-structure-of-interest-rates/

https://www.udemy.com/

https://www.udemy.com/ -

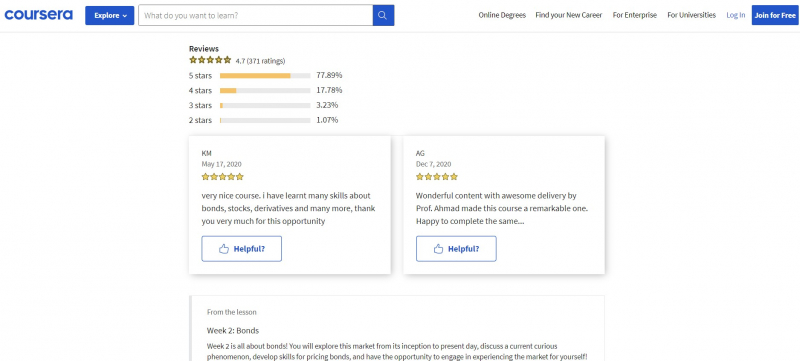

Interest rates are one of the most prevalent and crucial components of the financial system. You'll discover why interest rates have always been a vital indicator of what something is worth. You'll look at how interest rates change over time, how they affect consumption, investment, and economic development, and the strange reality of negative interest rates. Markets examines how interest rates affect the value of all financial assets, with a focus on the bond and stock markets, which have helped to fall empires.

You may look into the equity pricing models and equity markets that have an impact all over the world, from the first stock ever issued – by the Dutch East India Company – to the little-known but significant derivative securities market. You will have gained insight into the linkages of financial markets with the worlds of policy, politics, and power by the end of the course. You'll have exhibited that expertise by explaining a key financial idea and translating a financial product or transaction to someone who would obviously benefit from your recommendations.

This course offers:

- Course 2 of 5 in the Finance for Everyone Specialization

- 100% online

- Beginner Level

- Approx. 1 hours to complete

- Subtitles: English

Coursera Rating: 4.7/5

Enroll here: https://www.coursera.org/lecture/finance-markets/bonds-part-i-introduction-BIMGB

https://www.coursera.org/

https://www.coursera.org/ -

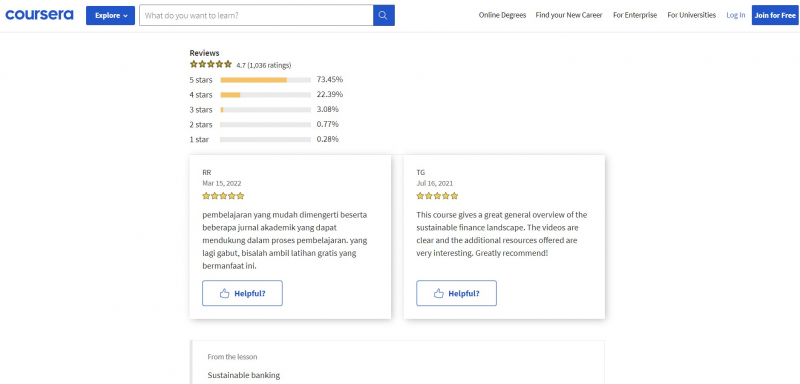

Finance is commonly regarded as a roadblock to a brighter future. The book Principles of Sustainable Finance discusses how the financial industry may be used to combat this problem. You will learn about the United Nations Sustainable Development Goals, how social and environmental aspects should not be considered externalities, sustainable banking and asset management, effective participation, sustainable scenario analysis, and long-term value generation throughout this course. You will learn how to utilize sustainable finance as a tool to guide the sustainability transition at the conclusion of this course.

This course begins with explaining the significance of debt and equity in a company's capital structure, as well as identifying the major bond issuers and the various types of bonds they issue. The price and yield of a bond are calculated using examples (IRR). You'll learn how to tell the difference between different yield curve forms and what they mean for the economy and economic cycle.

This course offers:

- Flexible deadlines: Reset deadlines in accordance to your schedule.

- Certificate: Earn a Certificate upon completion

- 100% online

- Beginner Level

- Approx. 1 hours to complete

- Subtitles: English

Udemy Rating: 4.7/5

Enroll here: https://www.coursera.org/lecture/sustainable-finance/corporate-bonds-vu8zJ

https://www.coursera.org/

https://www.coursera.org/