Top 9 Largest Financial Service Companies in Germany

In this post, let's examine some of the largest financial services companies in Germany, ranked by market capitalization. Go directly to other related articles ... read more...on Toplist if you want to see more of the largest financial companies in other regions ranked by market capitalization.

-

The Deutsche Börse AG is the parent company of the Deutsche Börse Group, a global marketplace operator based in Germany. It also offers transaction services for its customers. It opens up the world's capital markets to corporations and investors. It was established in 1992 as a joint stock corporation. Frankfurt is home to the main office. The United Nations Sustainable Stock Exchanges program welcomed Deutsche Börse AG as its fourteenth member on October 1.

The company has over 3,200 people who provide assistance to consumers across Europe, the Americas, and Asia. Deutsche Börse operates in Germany, Luxembourg, Switzerland, the Czech Republic, and Spain, with additional offices in Beijing, London, Paris, Chicago, New York, Hong Kong, and Dubai serving as representative offices. The Frankfurt Stock Exchange is a major financial marketplace. It is the largest of Germany's stock exchanges, accounting for over 90% of all trading volume. The Frankfurt Stock Exchange is run by Deutsche Börse AG.Founded: 1992; 31 years ago

Headquarters: Frankfurt am Main, GermanyWebsite: https://deutsche-boerse.com/dbg-en/

Screnshot via https://deutsche-boerse.com/dbg-en/

Screnshot via https://deutsche-boerse.com/dbg-en/ -

Commonly abbreviated to "Porsche SE," Porsche Automobil Holding SE (or "Porsche") is a German multinational corporation best known for its holding company status within the Volkswagen Group and its investments in the automobile industry. The Austrian-German Porsche-Pich family owns the controlling stake in Porsche SE, which has its headquarters in the Zuffenhausen neighborhood of Stuttgart, Baden-Württemberg. In 1931, Ferdinand Porsche (1875–1951) and his son-in-law Anton Pich (1894–1952) established the corporation in Stuttgart under the name Dr. Ing. h.c. F. Porsche GmbH.

The original Dr. Ing. h.c. F. Porsche AG was renamed Porsche SE in June 2007 to serve as a holding company for the families' 50.1% share of Porsche Zwischenholding GmbH (which owned 100% of the original Porsche AG) and their current 31.3% stake in Volkswagen AG (with 53.1% of the voting rights). Simultaneously, Dr. Ing. h.c. F. Porsche AG (Porsche AG) was established as a separate entity to handle the automaker's production operations.

Founded: 1931

Headquarters: Stuttgart, Germany

Website: https://www.porsche-se.com/

Screnshot via https://www.porsche-se.com/

Screnshot via https://www.porsche-se.com/ -

German universal bank Commerzbank AG has its official headquarters in Frankfurt. The Hamburg-based financial organization has total assets of €534 billion as of the end of September 2022, placing it among Germany's top credit institutions. The German government is the bank's largest stakeholder, with a stake of approximately 15%.

As of the year 2018, Commerzbank had a global footprint of over 50 countries and was responsible for about a third of all trade financing in Germany. During that same year, it served 13 million customers in Germany and 5 million in CEE. The bank declared in 2021 that by 2024, it will cut 10,000 positions (almost a third of its German employees) and reduce the number of branches in Germany from 790 to 450.Founded: 26 February 1870

Headquarters: Kaiserplatz, Frankfurt am Main, Germany

Website: https://www.commerzbank.com/

Screnshot via https://www.commerzbank.com/

Screnshot via https://www.commerzbank.com/ -

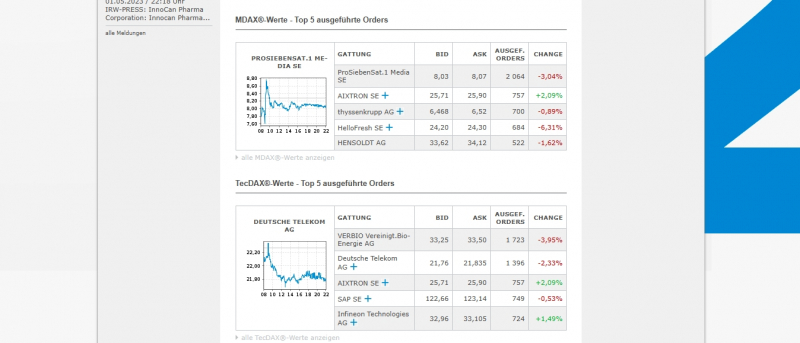

The Tradegate market, established in 2009 in Berlin, Germany, is a private investor-focused stock market. Deutsche Börse AG (Frankfurt) owns 42.84 percent of Tradegate Exchange GmbH (also Berlin), while Tradegate AG Wertpapierhandelsbank owns 14.32 percent. The Verein Berliner Börse e. V. owns the remaining 1.01 percent of the GmbH's share capital.

Tradegate AG Wertpapierhandelsbank launched its online trading platform on May 2, 2001. Together, the Internet-based information hub and the German electronic OTC trading system for equities represented a first for the country of Germany. Tradegate was designated as a multilateral trading facility (MTF) by the European Union's Markets in Financial Instruments Directive on November 1, 2007.

The Tradegate Exchange received stock exchange approval from the State of Berlin's stock exchange supervisory authority on May 20th, 2009. In 1861, the Stuttgart Stock Exchange opened for business, making this the first time in Germany that a new stock exchange had been legalized. The Exchange Council's founding meeting took place on December 1st, 2009, and trading began on January 4th, 2010. Since then, Tradegate Exchange has maintained Tradegate as a "regulated market" under the Markets in Financial Instruments Directive. Tradegate is an electronic trading system.Founded:2001

Headquarters: Kurfürstendamm 119, 10711 Berlin, Germany

Website: https://www.tradegate.de

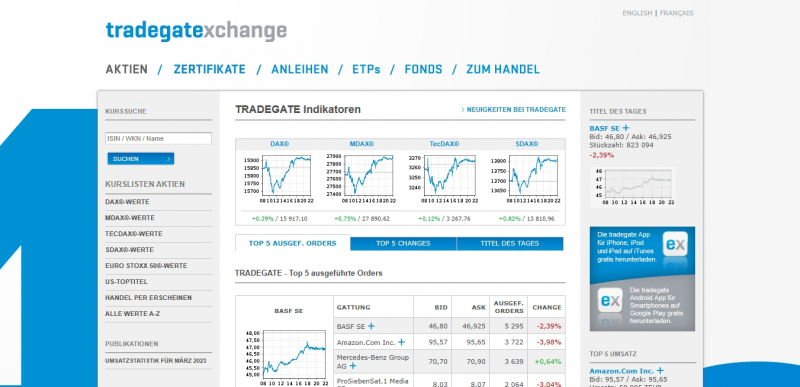

Screnshot via https://www.tradegate.de

Screnshot via https://www.tradegate.de -

Until 2002, Aareal Bank AG was known as DePfa Deutsche Bau- und Boden Bank AG, but since then, it has changed its name to Aareal Bank AG and joined the MDAX index under its new name. Across more than 20 countries, Aareal Bank handles property financing. The bank has offices in Europe, North America, and the Asia-Pacific region. Since 2002, Aareal Bank AG has been publicly traded in Germany.

The Preußische Landespfandbriefanstalt (established in 1922) and Deutsche Wohnstättenbank AG (established in 1923) in Berlin might be considered the company's genesis institutions. In 1926, the Deutsche Wohnstättenbank AG changed its name to the German Construction and Land Bank.Founded: 1922

Headquarters: Wiesbaden, Germany

Website: https://www.aareal-bank.com/

Screnshot via https://www.aareal-bank.com/

Screnshot via https://www.aareal-bank.com/ -

Printers, photocopiers, telephone systems, servers, and laptop computers are just some of the office communication products that Grenke AG, a German manufacturer-independent leasing firm, specializes in. Grenke generates substantial income not just from leasing but also through factoring. In 2009, the firm acquired a banking license after purchasing the German private bank Hesse Newman. The European markets of Germany, France, and Italy are crucial to the company's success.

In 1978, Wolfgang Grenke started the business. The internationalization process was accelerated, especially in the new millennium. Grenke has been part of the MDAX index at the Frankfurt Stock Exchange since June 2019. Grenke Bank was founded in 2009 after the firm received its banking license by purchasing the former private bank Hesse Newman. Grenkeleasing AG's shareholders voted to become Grenke AG during their annual meeting on May 3. The rising significance of factoring and banking necessitated this action.Founded: 1978

Headquarters: Baden-Baden, Germany

Website: https://www.grenke.de/

Screnshot via https://www.grenke.de/

Screnshot via https://www.grenke.de/ -

Deutsche Pfandbriefbank AG is a German financial institution that focuses on financing for public buildings and real estate. As of the end of 2016, it was included in the German small-cap stock market index SDAX. It is headquartered in Garching, a Bavarian town close to Munich. Pfandbriefe are bonds issued in Germany for the purpose of financing real estate.

PBB belonged to Hypo Real Estate (HRE), which the German government nationalized in the midst of the financial crisis of 2008. Since state aid to banks is illegal under EU law, it was spun off in 2015. Moody's gave it a rating through June of 2015.The German government sold off a large portion of its investment in PBB to institutional investors through HRE in an expedited bookbuilding in May 2018, reducing its ownership from 20% to 3.5%. The sale brought in about 287 million euros ($339.7 million). The RAG Foundation, a German public sector trust, has acquired a 4.5% share.

Founded:

Headquarters: Garching, Munich (district), Upper Bavaria, Germany

Website: https://www.pfandbriefbank.com

Screnshot via https://www.pfandbriefbank.com

Screnshot via https://www.pfandbriefbank.com -

Today, flatexDEGIRO boasts over 2 million customers across 16 countries, making it the largest and fastest-growing online broker in Europe. After completing the acquisition of DEGIRO, we now process over 91 million transactions annually for our customers, totaling over EUR 350 billion.

They plan to have 7-8 million customers and at least 250–350 million transactions executed annually by 2026, establishing flatexDEGIRO as an independent European financial supermarket. flatex, a product of flatexDEGIRO, was the first completely independent internet broker in Germany and Austria when it launched in 2006. Our innovative brokerage approach (products, platform, price) is used by hundreds of thousands of consumers now. How are we distinct from others? Our vertically integrated value chain and platform allow us to handle every step of the process in-house.Founded: 1997

Headquarters: flatexDEGIRO AG Omniturm, Große Gallusstrasse 16-18 60312 Frankfurt am Main, Germany

Website: https://flatexdegiro.com/en

Screenshot via https://flatexdegiro.com/en

Screenshot via https://flatexdegiro.com/en -

The Hypoport Group employs around 2,500 people throughout its network of finance, real estate, and insurance industry technology firms. There are four main parts to it: insurance platform, real estate platform, private client credit platform

Within the Hypoport Group, Hypoport SE serves as the holding company for both strategic and management decisions. Hypoport SE's goals are the development and growth of the companies that make up its group. Hypoport SE is one of the 160 largest publicly traded businesses in Germany, and its stock is traded on the Prime Standard section of the Frankfurt Stock Exchange (Deutsche Börse).Founded: N/A

Headquarters: Heidestr. 8, 10557 Berlin

Website: https://www.hypoport.com

Screnshot via https://www.hypoport.com

Screnshot via https://www.hypoport.com