Top 13 Largest Financial Service Companies in South Africa

In this post, let's examine some of the largest financial services companies in South Africa, ranked by market capitalization. Go directly to other related ... read more...articles on Toplist if you want to see more of the largest financial companies in other regions ranked by market capitalization.

-

FirstRand Limited, or FirstRand Group, is a South African financial services firm and the parent company of FirstRand Bank. The Reserve Bank of South Africa, the country's central bank, has approved it as a financial services provider.

Rand Merchant Bank (RMB), the corporate and investment bank; First National Bank (FNB), the retail and commercial bank; WesBank, the instalment finance provider; and Ashburton Investments, the group's asset management business, all contribute to FirstRand's execution of its strategy. The organization is headquartered in the South African city of Johannesburg. When it comes to financial institutions in South Africa and the rest of sub-Saharan Africa, FirstRand is among the top five.

In April 2023, the value of FirstRand had risen to $21.12 billion. As a result of this market capitalization, FirstRand is the 830th most valuable company in the world. FirstRand has reported TTM revenue of $7.07 billion as of the end of the most recent reporting period. The company's revenue in 2022 was $7.07 billion, down from the $7.56 billion it made in 2021.

Founded: 1838

Headquarters: Johannesburg, South Africa

Website:www.firstrand.co.za

Screenshot via www.firstrand.co.za

Screenshot via www.firstrand.co.za -

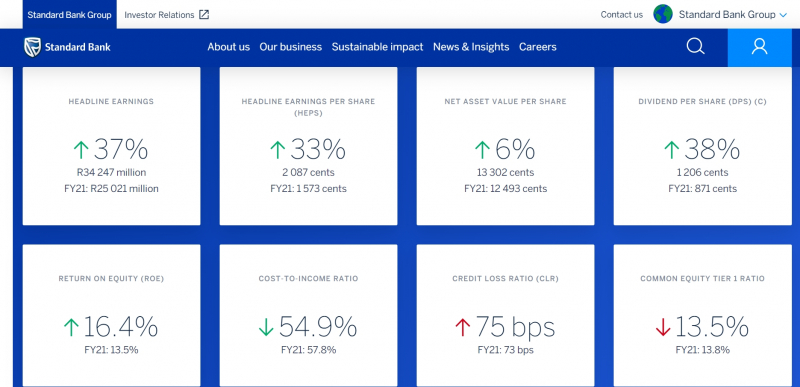

One of the largest financial institutions in South Africa is Standard Bank Group Limited. It has more assets than any other African bank. Standard Bank Centre, the company's headquarters, can be found on Simmonds Street in Johannesburg. When Standard Bank made the switch to Amazon Web Services in March 2019, it was the first African financial institution to do so.

The bank stated in March 2019 that they would be closing 91 locations and laying off 1200 employees. The decision was made because of the declining importance of the branch network and the increasing popularity of self-service options. Standard Bank, a South African financial institution, declared in July 2021 that it will invest $594 million to enhance its 54% ownership in Liberty Holdings, a South African insurance provider.Standard Bank Group is worth $16.50 billion as of April 2023. Based on its current market capitalization, Standard Bank Group is the 1017th most valuable corporation in the world. Standard Bank Group's current revenue (TTM) is $8.35 billion, as shown in the most recent financial reports. The company's sales in 2021 were $8.35 billion, up from $8.25 billion in the previous year.

Founded: 15 October 1862

Headquarters: Standard Bank Centre, Johannesburg, South Africa

Website: www.standardbank.com

Screenshot via www.standardbank.com

Screenshot via www.standardbank.com -

The South African retail banking institution Capitec Bank With 120,000 new accounts opened each month as of August 2017, the bank was the second largest retail bank in South Africa. The bank provides its customers with the Global One account, which serves as both a transactional/savings account and a line of credit.

South African Customer Satisfaction Index (SAcsi) data from 2015 places Capitec Bank #1 in terms of customer satisfaction, with an index score of 82.2. International banking consultancy firm Lafferty has released its first-ever Bank Quality Rankings, and the winner is... Capitec Bank.

Over 5.5 million Capitec customers paid less than R50 in monthly bank fees in February 2017. Capitec Bank is worth $11.98 billion as of April 2023. Based on its current market capitalization, Capitec Bank is the 1299th most valuable corporation in the world. Capitec Bank's current revenue (TTM) is $1.75 billion, as of the most recent financial reports. The company's revenue of $1.75 billion in 2022 was up from the $1.52 billion it made in 2021.Founded: 1 March 2001

Headquarters: 5 Neutron Street, Techno Park, Stellenbosch, Western Cape, South Africa

Website: www.capitecbank.co.za

Screenshot via www.capitecbank.co.za

Screenshot via www.capitecbank.co.za -

In addition to traditional banking activities, including wholesale and retail banking, the Nedbank Group also provides services in the areas of insurance, asset management, and wealth management. Nedbank Limited operates independently but is completely owned by Nedbank Group.

Cape Town is home to a Nedbank branch. Nedbank serves primarily the South African market. Nedbank has branches in Angola and Kenya in addition to its main location, as well as subsidiaries and banks in Eswatini, Lesotho, Malawi, Mozambique, Namibia, and Zimbabwe. Nedbank has offices in Guernsey, the Isle of Man, Jersey, the United Kingdom, and the United Arab Emirates to serve clients situated in Africa who require international banking services.

Johannesburg is the home of Nedbank. In April 2023, Nedbank was worth $6.24 billion on the stock market. With this market capitalization, Nedbank is the 2062nd most valuable corporation in the world. Nedbank has reported a TTM profit of $3.38 billion in its most recent financial statements. Revenue for the year 2021 was $3.38 B, down from $3.44 B in 2020.Founded: 1 March 1888

Headquarters: Sandton, South Africa

Website: www.nedbank.co.za

Screenshot via www.nedbank.co.za

Screenshot via www.nedbank.co.za -

Old Mutual Limited operates across the financial sectors of the African continent. It is traded on the Johannesburg Stock Exchange as well as those of Zimbabwe, Namibia, and Botswana. In 1845, John Fairbairn established it in South Africa; by 1999, it had been demutualized and listed on the London Stock Exchange and other stock markets.

In 2018, it adopted a new strategy known as "managed separation," which involved the spin-off of four of its businesses: Old Mutual Emerging Markets, Nedbank, Old Mutual Wealth (located in the United Kingdom), and Old Mutual Asset Management (based in Boston). Because of this, Quilter plc (previously Old Mutual Wealth) split off from its parent company and unbundled its shares in Nedbank. The company, which has primarily relocated to South Africa, contributes to bursaries and other forms of financial aid at schools there.

As of April 2023, Old Mutual was worth $3.30 billion on the stock market. With this market capitalization, Old Mutual ranks as the 3032nd most valuable corporation in the world. The most recent financial reports reveal TTM revenue of $37.43 billion for Old Mutual. The company's revenue of $15.49 billion in 2021 was up from the $9.90 billion it made in 2020.Founded: 17 May 1845

Headquarters: Johannesburg, South Africa

Website: www.oldmutual.com

Screenshot via www.oldmutual.com

Screenshot via www.oldmutual.com -

The financial services investment holding company Rand Merchant Investment Holdings (RMI Holdings) owns insurance brands in South Africa, Australia, China, Mauritius, New Zealand, the Republic of Ireland, Singapore, the United Kingdom, and the United States of America.

RMI Holdings is a JSE-listed provider of insurance and investment services to consumers, small and medium-sized businesses, large corporations, and government agencies. Sandton, South Africa, is home to the organization's administrative hub.

Rand Merchant Investment is worth $2.63 billion as of April 2023. Market capitalization-wise, this places Rand Merchant Investment at #3362 among all companies around the globe. Rand Merchant Investment has reported $1.29 billion in revenue for the last twelve-month period. The company's revenue in 2022 was $1.29 billion, down from $1.32 billion the year before.Founded: 2010

Headquarters: Rosebank, South Africa

Website: https://www.rmih.co.za/

Screenshot via https://www.rmih.co.za/

Screenshot via https://www.rmih.co.za/ -

Ninety One is a London and Cape Town–based asset management firm that is also publicly traded on the Johannesburg Stock Exchange. The FTSE 250 index includes it as a component. [Ninety One] is a London- and Cape Town-based, London Stock Exchange- and Johannesburg Stock Exchange-listed asset management firm. The FTSE 250 index includes it as a component.

Founded in 1991 under the name Investec Asset Management, the company rebranded as Ninety One in the spring of 2020 to honor its roots as a South African investment firm founded in 1991. In March 2020, the company was spun out of Investec. Market factors led to Investec deciding to retain 25% of the stock instead of only 15% as had been intended for the first public offering.

In April 2023, the market value of Ninety One Group was $2.06 billion. Market capitalization-wise, this places Ninety One Group at #3,710. Ninety One Group reported TTM revenue of $1.04 billion as of the most recent quarter. The company's revenue of $1.04 billion in 2022 was up from the $1.03 billion it made in 2021.

Founded: 1991

Headquarters: London, United Kingdom Cape Town, South Africa

Website: https://ninetyone.com/

Screenshot via https://ninetyone.com/

Screenshot via https://ninetyone.com/ -

Santam is a financial services provider headquartered in South Africa with international operations in Malawi, Tanzania, Uganda, Zimbabwe, and Zambia. Bellville, in the Western Cape of South Africa, is home to Santa's headquarters. The company is the largest short-term insurer in South Africa and is traded on the Johannesburg Stock Exchange (JSE).

The South African National Trust and Assurance Company Limited (Santam) was founded on May 1, 1918, as the Sud-Afrikaanse Nasionale Trust and Assuransie Maatskappy. After focusing on short-term insurance for a period, Santam spun off the South African Life Assurance Company (Sanlam) as a wholly-owned subsidiary a month later. Sanlam, a South African financial services conglomerate, owns 62.3% of Santam's stock and operates as a wholly owned subsidiary. On March 2, 2023, Santander announced its fiscal year 2022 annual results.Santam is worth $1.85 billion as of April 2023, according to market cap data. Based on its current market capitalization, Santam is the 3856th most valuable company in the world. Santander has reported TTM revenue of $1.93 billion as of the end of the most recent reporting period. The company posted sales of $1.93 billion in 2021, down from 2021 sales of $1.93 billion.

Founded: May 1, 1918

Headquarters: Tyger Valley, Bellville, City of Cape Town, South Africa

Website: www.santam.co.za

Screenshot via www.santam.co.za

Screenshot via www.santam.co.za -

The Johannesburg Stock Exchange is home to the shares of Momentum Metropolitan Holdings Limited, formerly known as MMI Holdings Limited, a South African financial services conglomerate. Through its numerous brands, Momentum Metropolitan Holdings Limited provides services in the areas of long- and short-term insurance, asset management, savings, investments, and employee benefits. Botswana, Ghana, Gibraltar, Guernsey, Kenya, Lesotho, Mauritius, Namibia, Nigeria, the UK, South Africa, and Zambia are all home to Group affiliates.

In April 2023, the market value of Momentum Metropolitan was $1.45 billion. Based on its current market capitalization, Momentum Metropolitan is the 4178th most valuable company in the world. The most recent annual report shows that Momentum Metropolitan's revenue is $4.29 billion. The company's revenue of $4.29 billion in 2022 was down from the $7.42 billion it made in 2021.

Founded: 2010

Headquarters: Centurion, City of Tshwane Metropolitan Municipality South Africa

Website: momentummetropolitan.co.za

Screenshot via momentummetropolitan.co.za

Screenshot via momentummetropolitan.co.za -

Private equity, renewable energy, transportation infrastructure, and commercial real estate are where Actis's attention is most keenly focused. Actis has committed to the UN Global Compact and the UN Environment Programme Finance Initiative (UNEP FI) Principles for Responsible Investment (UNPRI). Actis seeks to provide long-term, better returns across asset classes, benefiting investors, customers, and communities economically and socially. Investments in developing economies like those in Africa, China, India, Latin America, and Southeast Asia are the main focus.

The UK government established CDC Group plc (then known as the Commonwealth Development Corporation) in 1948 to invest in emerging economies in Africa, Asia, and the Caribbean. Actis was formed in July 2004 as a spinoff of CDC Group plc. The management team at Actis now owns the majority stake in the developing markets investment vehicle CDC.Transaction Capital is valued at $0.57 billion as of April 2023. Based on its current market capitalization, Transaction Capital is the 5240th most valuable company in the world. The most recent annual report shows that Transaction Capital's revenue is $1.43 billion. The company's 2022 revenue of $1.43 billion was significantly higher than 2021's revenue of $0.28 billion.

Founded: 2004

Headquarters: London, SE1United Kingdom

Website: www.act.is

Screenshot via www.act.is

Screenshot via www.act.is -

Previously known as Net 1 UEPS Technologies, Lesaka Technologies is now a publicly traded company on the Johannesburg Stock Exchange (JSE: NT1) and the NASDAQ (Nasdaq: UEPS). The firm has handled the social grant payment system in Botswana and South Africa. Johannesburg is home to the company's administrative offices. Net1 provided over 2.5 million South African Social Security Agency (SASSA) debit MasterCards to people receiving social grants by the end of July 2012.

Lesaka Technologies is worth $0.24 billion as of April 2023. In terms of market capitalization, this places Lesaka Technologies at number 5963. Lesaka Technologies' current revenue (TTM) is $0.41 billion, as shown in the company's most recent financial statements. The company's revenue in 2021 was $0.12 billion, down from the $0.13 billion it made in 2020.

Founded: 1997

Headquarters: Johannesburg, South Africa

Website: lesakatech.com

Screenshot via lesakatech.com

Screenshot via lesakatech.com -

Absa Bank Limited (ABL) is a commercial bank in South Africa. It was formerly known as the Amalgamated Banks of South Africa. South Africa's primary banking authority, the Reserve Bank of South Africa, has issued a license for the company.

The bank's main office is at 15 Troye Street, 7th Floor, Absa Towers West, Johannesburg, South Africa. One of South Africa's largest commercial banks is Absa Bank Limited. The bank had a total asset value of ZAR 1,289,000,000,000 as of December 31, 2018 (equivalent to approximately US$73,691,500,000). Absa Bank Limited is wholly owned by Absa Group Limited, a South African-based pan-African financial services conglomerate with operations in 12 African countries and assets in excess of US$91 billion as of October 2019. Absa Group Limited's stock is traded on the JSE Limited under the ticker symbol AGL.The value of Absa Bank's shares has decreased to $0.20 billion as of April 2023. With this market capitalization, Absa Bank is the 6118th most valuable corporation in the world. The most recent financial reports reveal annual revenues (TTM) of $3.59 billion for Absa Bank. The firm's 2018 earnings of $3.59 billion were lower than the $4.06 billion it earned in 2017.

Founded: 1986

Headquarters: 7th Floor, Absa Towers West15 Troye Street, Johannesburg, South Africa

Website: www.absa.co.za

Screenshot via www.absa.co.za

Screenshot via www.absa.co.za -

Financial services are offered by Afristrat Investment Holdings. The company's operational divisions include commercial lending, investment management, stock trading, and corporate. The company's credit operations offer two types of credit financing to corporate customers, supply chain and/or enterprise development solutions that attempt to incorporate suppliers into the supply chain, as well as medium-term loans to businesses with enough security.

The services provided by the investing industry help people make sound financial investments. Its stock holdings allow it to make long-term investments in companies with a focus on making a profit. The corporate segment includes the company's headquarters and the shared services it provides to the other business units.

Afristrat Investment is worth $3.52 million as of April 2023. The current market cap positions Afristrat Investment at #7274 among all companies globally. The most recent financial records reveal TTM revenue of $3.61 million for Afristrat Investment. The company earned $3.61 million in 2021.

Founded: 1998

Headquarters: South AfricaWebsite: https://www.afristrat.co.za/

Screenshot via https://www.afristrat.co.za/

Screenshot via https://www.afristrat.co.za/