Top 14 Largest Financial Service Companies in Asia

In this post, let's examine 14 of Asia's largest financial services companies ranked by market capitalization. Go directly to other related articles on Toplist ... read more...if you want to see more of the largest financial companies in other regions ranked by market capitalization.

-

Chinese transnational bank Industrial and Commercial Bank of China Ltd. ICBC is a state-owned commercial bank that was established on January 1st, 1984, as a limited company. The bank's Tier 1 capital in 2013 was the largest of 1,000 worldwide banks thanks to funding from the Chinese Ministry of Finance, making it the first bank with its headquarters in China to hold this distinction in modern times. ICBC was subsequently ranked first in The Banker's Top 1000 World Banks ranking, every year from 2012, and first (2019) on the Forbes Global 2000 list of the largest public companies in the world.

ICBC was ranked as the largest bank in the world in 2017 and 2018 by total assets (as of December 31, 2020, US$4.324 trillion). ICBC is also regarded as one of the most profitable businesses in the world, ranking fourth, according to Forbes. The Financial Stability Board views this bank as one of systemic importance.

ICBC's market cap was $221.79 billion as of April 2023. ICBC is now the 42nd-most valuable firm in the world according to market cap. The most recent financial reports from ICBC show that the company's current revenue (TTM) is $141.81 billion. The corporation generated $145.30 billion in revenue in 2021, a rise from $128.20 billion in revenue in 2020.

Founded: 1984

Headquarters: Beijing, China

Website: www.icbc-ltd.com

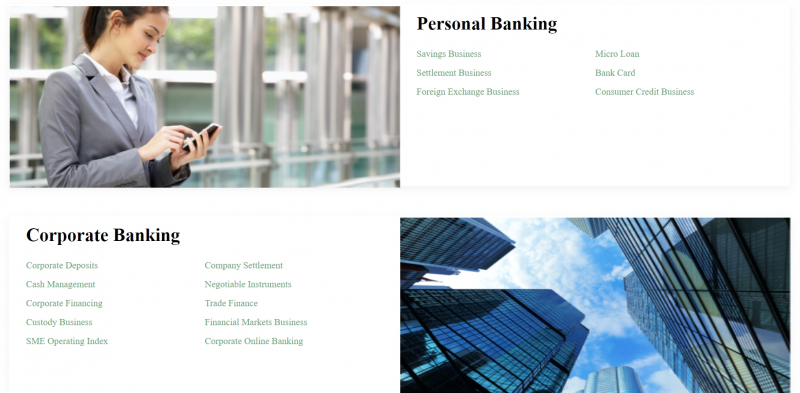

Screenshot via www.icbc-ltd.com

Screenshot via www.icbc-ltd.com -

Of China's "big four" banks, China Construction Bank Corporation (CCB) is one of them. By market capitalization, CCB was the second-largest bank and sixth-largest firm in the world in 2015. [3][4] There are roughly 13,629 domestic branches for the bank. Furthermore, it operates wholly owned subsidiaries in London, Barcelona, Frankfurt, Luxembourg, Hong Kong, Johannesburg, New York City, Seoul, Singapore, Tokyo, Melbourne, Kuala Lumpur, Santiago de Chile, Brisbane, Sydney, and Auckland, in addition to overseas branches in each of those cities. The Financial Stability Board classifies it as a systemically important bank due to its total assets of CN $8.7 trillion in 2009. Its main office is in Beijing's Xicheng District.

China Construction Bank's market cap as of April 2023 is $164.43 billion. By market cap, China Construction Bank is now the 65th most valuable firm in the world. The most recent financial reports from China Construction Bank show that the company's current revenue (TTM) is $125.47 billion. The corporation generated $127.14 billion in revenue in 2021, a rise from $109.77 billion in revenue in 2020.

Founded: 1 October 1954

Headquarters: Beijing, China

Website: ccb.com

Screenshot via ccb.com

Screenshot via ccb.com -

One of China's "Big Four" banks is the Agricultural Bank of China (ABC). It was established on July 10, 1951, and is based in Beijing's Dongcheng District. It has locations in Hong Kong, London, Tokyo, New York, Frankfurt, Sydney, Seoul, and Singapore, in addition to mainland China.

ABC has almost 24,000 branches, 320 million retail consumers, and 2.7 million corporate clients. By assets, it is the third-largest lender in China. When ABC went public in the middle of 2010, it raised the most money in a single initial public offering (IPO) in history. Saudi Aramco has subsequently surpassed ABC in terms of IPO size. It was placed eighth among the Top 1000 World Banks in 2011, third on Forbes' 13th annual Global 2000 list in 2015, and fifth among all banks in 2017.The market capitalization of Agricultural Bank of China as of April 2023 is $156.64 billion. By market cap, this places Agricultural Bank of China as the 71st most valuable firm in the entire world. The most recent financial reports from Agricultural Bank of China show that the company's current revenue (TTM) is $111.84 Billion. The corporation generated $111.19 billion in revenue in 2021, a rise from $95.58 billion in revenue in 2020.

Founded: 10 July 1951

Headquarters: Beijing, China

Website: abchina.com

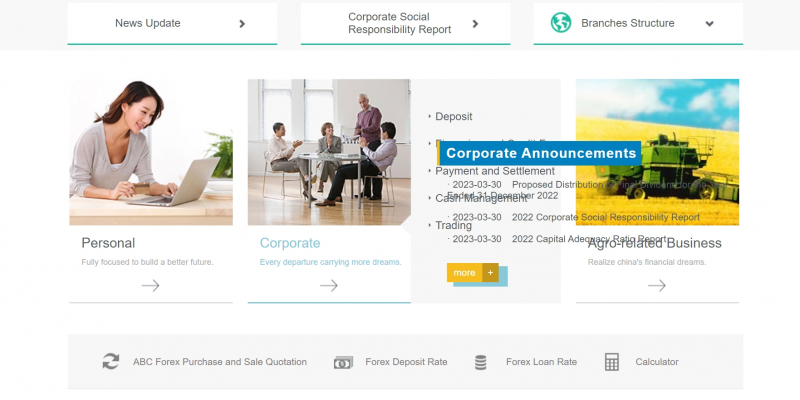

Screenshot via abchina.com

Screenshot via abchina.com -

The fourth-largest bank in the world, the Bank of China is a mainly Chinese state-owned commercial bank with its headquarters in Beijing. The Ta-Ching Government Bank of the Qing Dynasty was replaced by the Bank of China, which was established in 1912 by the Republican government to serve as China's central bank.

Since the 1908 founding of the Bank of Communications, it has been China's second-oldest bank still in operation. It was one of the "Big Four" banks of the era, along with the Farmers Bank of China, Bank of Communications, and Central Bank of the Republic of China, that printed banknotes on behalf of the government from its founding until 1942. The newly constituted People's Bank of China continued to be known as its central bank.

The market capitalization of the Bank of China was $136.49 billion as of April 2023. By market cap, this places Bank of China as the 86th most valuable firm in the entire globe. The most recent financial reports from the Bank of China indicate that the company's current revenue (TTM) is $93.10 billion. The corporation generated $93.37 billion in revenue in 2021, a rise from $82.23 billion in revenue in 2020.

Founded: 1912

Headquarters: Beijing, China

Website: boc.cn

Screenshot via boc.cn

Screenshot via boc.cn -

China Merchants Bank (CMB) is a Chinese bank with its headquarters in Shenzhen, Guangdong, China's Futian District. It was established in 1987 and is the country's first share-holding commercial bank that is entirely owned by corporate legal entities.

CMB has one branch in Hong Kong and more than 500 locations on the Chinese mainland. It received a federal license to establish a branch in New York City in November 2007 as part of a strategy for international expansion. China's Shenzhen is home to the headquarters of the China Merchants Bank. Early in the new millennium, the city began to modernize and grow. The Shenzhen Citizen's Center, the core building, and the central city layout were also created by architects Lee and Timchula.The market capitalization of CM Bank was $126.08 billion as of April 2023. By market cap, this places CM Bank as the 98th most valuable corporation in the entire world. The most recent financial reports from CM Bank indicate that the company's current revenue (TTM) is $51.21 B. The corporation generated $50.23 billion in revenue in 2021, an increase above the $41.62 billion it generated in revenue in 2020.

Founded: 1987

Headquarters: China Merchants Bank Tower, Futian District, Shenzhen, Guangdong, China

Website: https://www.cmbchina.com/

Screenshot via https://www.cmbchina.com/

Screenshot via https://www.cmbchina.com/ -

Indian banking and financial services provider HDFC Bank Ltd., often known as HDB, is based in Mumbai. As of April 2021, it was the largest private sector bank in India by assets and the tenth-largest bank in the world by market capitalization. With a $127.16 billion market capitalization on the Indian stock exchanges, it is the third-largest firm overall. With about 150,000 employees, it ranks as India's fifteenth largest employer.

The market capitalization of HDFC Bank as of April 2023 is $123.96 billion. By market cap, HDFC Bank is now the 100th most valuable corporation in the world. The most recent financial reports from HDFC Bank indicate that the company's current revenue (TTM) is $14.07 billion. The corporation generated $12.43 billion in revenue in 2020, an increase over the $10.86 billion it generated in revenue in 2019.

Founded: August 1994

Headquarters: Mumbai, Maharashtra, India

Website: www.hdfcbank.com

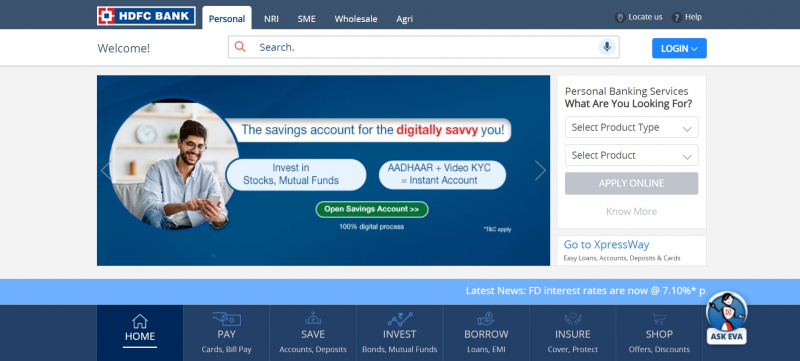

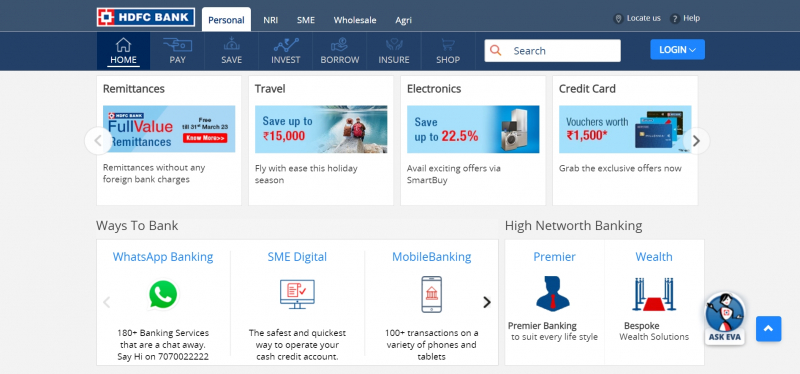

Screenshot via www.hdfcbank.com

Screenshot via www.hdfcbank.com -

A bank holding and financial services firm with its headquarters in Chiyoda, Tokyo, Japan, is Mitsubishi UFJ Financial. One of the "three big houses" of the Mitsubishi Group, along with Mitsubishi Corporation and Mitsubishi Heavy Industries, MUFG had assets of around US$3.1 trillion as of 2016. As of March 2011, it was the second-biggest bank holding company in the world and the largest financial group in Japan, with deposits totaling around US$1.8 trillion (JP148 trillion). United Financial of Japan and Mitsubishi are represented by the initials MUFG.

Mitsubishi UFJ Financial's market value was $77.83 billion as of April 2023. By market capitalization, Mitsubishi UFJ Financial is now the 178th most valuable corporation in the world. The most recent financial reports from Mitsubishi UFJ Financial show that the company's current revenue (TTM) is $45.03 billion. The company's revenue in 2021 was $41.64 billion, down from $43.13 billion in revenue in 2020.

Founded: October 1, 2005

Headquarters: 2-7-1 Marunouchi, Chiyoda, Tokyo, Japan

Website: www.mufg.jp

Screenshot via www.mufg.jp

Screenshot via www.mufg.jp -

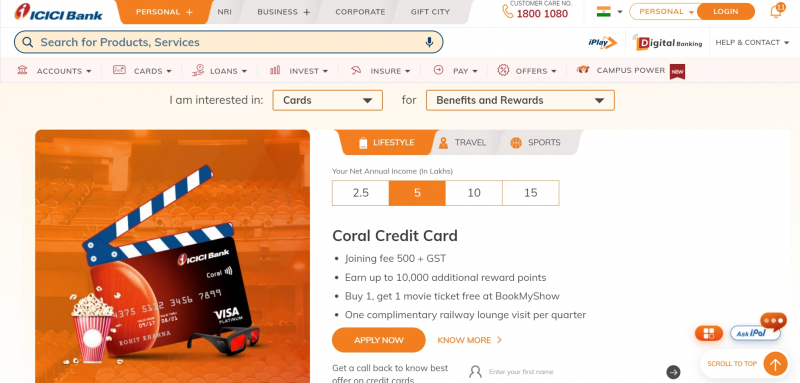

ICICI Bank Ltd. is a Mumbai-based international bank and provider of financial services. With a variety of delivery channels and specialist subsidiaries in the fields of investment banking, life and non-life insurance, venture capital, and asset management, it provides a broad range of banking products and financial services for corporate and retail customers. This development finance institution is present in 17 countries and has a network of 5,275 branches and 15,589 ATMs throughout India.

The bank maintains subsidiaries in the UK and Canada, branches in the US, Singapore, Bahrain, Hong Kong, Qatar, Oman, the Dubai International Financial Centre, China, and South Africa, and representative offices in the UAE, Bangladesh, Malaysia, and Indonesia. Belgian and German subsidiaries of the business have also been created by its UK subsidiary.

ICICI Bank's market capitalization as of April 2023 is $75.33 billion. By market cap, this places ICICI Bank as the 187th most valuable corporation in the entire world. The most recent financial reports from ICICI Bank indicate that the company's current revenue (TTM) is $16.09 billion. The corporation generated $16.37 billion in revenue in 2021, a rise from $15.32 billion in revenue in 2020.Founded: 5 January 1994

Headquarters: Mumbai, Maharashtra, India

Website: www.icicibank.com

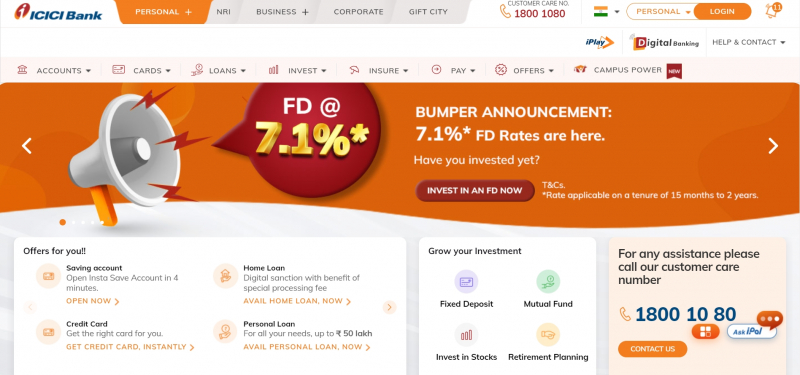

Screenshot via www.icicibank.com

Screenshot via www.icicibank.com -

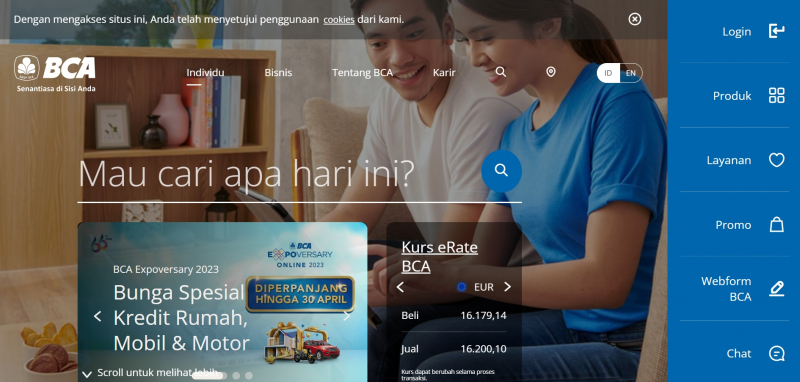

On February 21, 1957, PT Bank Central Asia Tbk, also known as Bank Central Asia (BCA), was established. It is regarded as Indonesia's biggest privately owned bank. The whole banking system in Indonesia was severely impacted by the 1997 Asian financial crisis. In particular, it had an impact on BCA's cash flow and perhaps put its existence in danger.

BCA was obliged to request aid from the Indonesian government and then be nationalized due to a bank rush. The bank was taken over by the Indonesian Bank Restructuring Agency in 1998. After that year, a complete recovery was achieved. Third-party funds had returned to their pre-crisis level by December 1998. In comparison to December 1997, when BCA's assets were Rp 53.36 trillion, they were now Rp 67.93 trillion. When the public's trust in BCA was fully recovered, IBRA released BCA to BI in 2001.

The market capitalization of Bank Central Asia as of April 2023 is $71.25 billion. By market cap, this places Bank Central Asia as the 202nd most valuable firm in the entire world. The company's current revenue (TTM) is $5.97 Billion, according to Bank Central Asia's most recent financial filings. The company generated $5.53 billion in revenue in 2021, an increase from $5.16 billion in revenue in 2020.

Founded: 1955

Headquarter: BCA Tower, Central Jakarta, Jakarta, Indonesia

Website: www.bca.co.id

Screenshot via www.bca.co.id

Screenshot via www.bca.co.id -

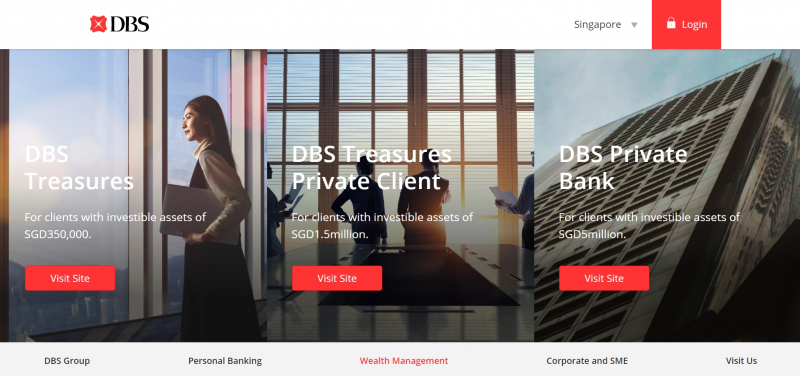

DBS Bank Limited, also referred to as DBS, is a worldwide banking and financial services company with its headquarters in Singapore's Marina Bay neighborhood. The Development Bank of Singapore Ltd., from which "DBS" was formed, was the bank's prior name before its current abbreviated name was adopted on July 21, 2003, to better reflect its status as a worldwide bank. Together with OCBC Bank and United Overseas Bank, it is one of Singapore's "Big Three" banks (UOB).

The bank, which is listed on the Singapore Exchange, was established by the Singaporean government on July 16, 1968, to take over the Economic Development Board's industrial finance operations. Now, the nation is home to more than 150 of its branches. With assets of roughly US$501 billion (S$650 billion) as of December 31, 2019, DBS is the largest bank in Southeast Asia and one of the largest banks in Asia. In addition to Singapore, it also enjoys market-leading positions in China, Hong Kong, Taiwan, Indonesia, and South Korea in the areas of Treasury and Markets, Asset Management, Securities Brokerage, and Equity and Debt Fund-Raising.DBS Group's market capitalization as of April 2023 is $64.34 billion. DBS Group is now the 230rd most valuable corporation in the world according to market cap. The most recent financial reports from DBS Group indicate that the company's current revenue (TTM) is $10.54 Billion. The company generated $10.58 billion in revenue in 2021, which is a decline from the $10.58 billion in revenue in 2020.

Founded: 16 July 1968

Headquarters: 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982

Website: dbs.com.sg

Screenshot via dbs.com.sg

Screenshot via dbs.com.sg -

PSBC, or Postal Savings Bank of China Co., Ltd., is a Beijing-based commercial retail bank that was established in 2007. It offers fundamental financial services, particularly to customers who are low-income, rural [1], and small and medium-sized businesses. PSBC had 39,798 branches as of December 31, 2017, and they were spread throughout China.

The State Post Bureau provided the founding funding of RMB 20 billion for the establishment of PSBC in 2007. After the Agricultural Bank of China, it currently has the second-largest number of branches and deposits totaling RMB 1.5 trillion.

The government took a number of steps during the Global Financial Crisis to explicitly target rural communities with its national economic stimulus plan. This includes utilizing the Postal Savings Bank's microfinance offerings as a weapon for both national development and poverty eradication. With its incredibly extensive reach, the bank also supports China's credit cooperatives' microcredit programs.The market capitalization for Postal Savings Bank of China as of April 2023 is $63,000,000,000. By market cap, this places Postal Savings Bank of China as the 237th most valuable corporation in the world. The most recent financial reports from Postal Savings Bank of China show that the company's current revenue (TTM) is $33.96 billion. The corporation generated $33.96 billion in revenue in 2021, a rise from $31.83 billion in revenue in 2020.

Founded: March 6, 2007

Headquarters: No. 3 Financial Street, Xicheng District, Beijing, PRCWebsite: psbc.com

Screenshot via psbc.com

Screenshot via psbc.com -

With its headquarters in Minato, Tokyo, SoftBank Group Corp. is a Japanese multinational holding company with a concentration on investment management. The Group typically invests in technology-related businesses that provide products and services to clients across a variety of markets and sectors, from the internet to automation. The largest technology-focused venture capital fund in the world at its founding, SoftBank's Vision Fund had over $100 billion in capital. Middle Eastern sovereign wealth funds were among the investors in the fund.

The corporation is renowned for the management style of Masayoshi Son, its contentious founder and main shareholder. Several unprofitable unicorns are among its investee companies, subsidiaries, and divisions, which work in robotics, artificial intelligence, logistics, transportation, proptech, real estate, hospitality, broadband, fixed-line telecommunications, e-commerce, information technology, finance, and media, etc.SoftBank's market capitalization as of April 2023 is $62.29 billion. By market cap, this places SoftBank as the 241st most valuable corporation in the world. The most recent financial reports from SoftBank indicate that the company's current revenue (TTM) is $49.04 billion. The corporation generated $54.21 billion in revenue in 2021, an increase from $32.50 billion in revenue in 2020.

Founded: 3 September 1981

Headquarters: Tokyo PortCity Takeshiba, Minato-ku, Tokyo, Japan

Website: group.softbank

Screenshot via group.softbank

Screenshot via group.softbank -

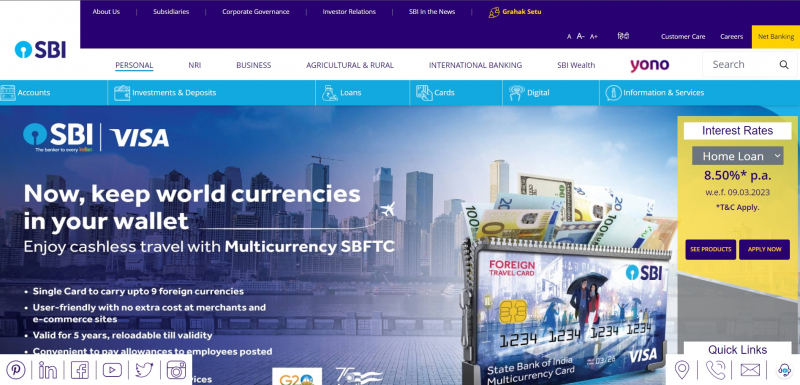

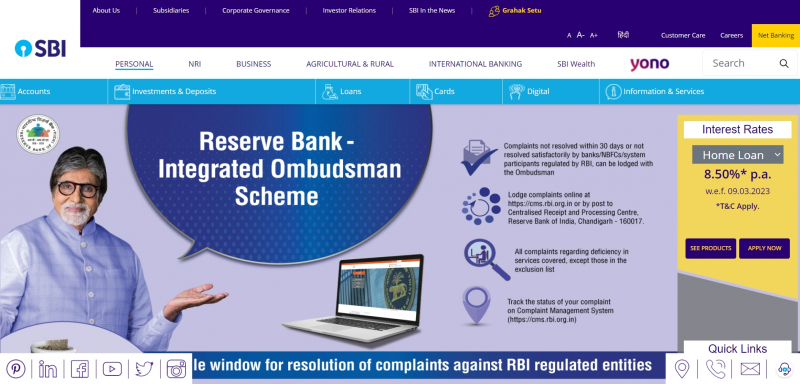

The State Bank of India (SBI) is a statutory organization for financial services and a multinational public sector bank with its headquarters in Mumbai, Maharashtra. SBI, the sole Indian bank on the 2020 Fortune Global 500 list of the largest firms in the world, is the 49th-largest bank in the world by total assets and is rated 221st overall. It is a public sector bank, the biggest bank in India, and holds a 25% portion of the market for loans and deposits, as well as a 23% market share for assets.

With approximately 250,000 workers, it ranks as India's fifth-largest employer. The State Bank of India crossed the $5 trillion market capitalization threshold on the Indian stock exchanges for the first time on September 14, 2022, becoming the third lender (after HDFC Bank and ICICI Bank) and seventh Indian corporation to do so.

The market capitalization of State Bank of India was $57.67 billion as of March 2023. By market cap, this places State Bank of India as the 264th most valuable firm in the entire world. The most recent financial reports from the State Bank of India show that the company's current revenue (TTM) is $30.01 billion. The corporation generated $33.42 billion in revenue in 2021, an increase from $29.12 billion in revenue in 2020.

Founded: 1 July 1955

Headquarters: State Bank Bhawan, M.C. Road, Nariman Point, Mumbai, Maharashtra, India

Website: bank.sbi

Screenshot via bank.sbi

Screenshot via bank.sbi -

With its fully owned subsidiaries, The Stock Exchange of Hong Kong Limited (SEHK), Hong Kong Futures Exchange Ltd (HKFE), and London Metal Exchange, Hong Kong Exchanges and Clearing Limited runs a variety of equities, commodities, fixed income, and currency markets (LME).

HKEX is the sixth-largest stock exchange in terms of market capitalization of listed businesses, with a total market value of approximately US$6 trillion as of 2021. On the securities market of HKEX, there were 2,538 companies [3] listed as of the end of December 2020. In seven of the last 11 years, HKEX has been the top listing venue in the world in terms of IPO capital raised.Hong Kong Exchanges & Clearing's market capitalization as of April 2023 is $56.53 billion. Hong Kong Exchanges & Clearing is now the 277th most valuable corporation in the world according to market cap. The most recent financial reports from Hong Kong Exchanges & Clearing show that the company's current revenue (TTM) is $2.16 billion. The company generated $2.50 billion in revenue in 2021, an increase from $2.17 billion in revenue in 2020.

Founded: March 6, 2000

Headquarters: Exchange Square, Central, Hong Kong

Website: hkexgroup.com

Screenshot via hkexgroup.com

Screenshot via hkexgroup.com