Top 7 Largest Financial Service Companies in Israel

In this post, let's examine some of the largest financial services companies in Israel , ranked by market capitalization. Go directly to other related articles ... read more...on Toplist if you want to see more of the largest financial companies in other regions ranked by market capitalization.

-

Israel's national bank is known as Bank Leumi (lit. National Bank; Arabic: On February 27, 1902, members of the Zionist movement in London established the Jewish Colonial Trust Limited (p. 19) as the Anglo Palestine Company in Jaffa to advance the development of industry, construction, agriculture, and infrastructure in the area that would later become Israel. Bank Leumi is the largest bank in Israel as of 2015 (in terms of total assets), having branches in the United States, Luxembourg, Switzerland, the United Kingdom, Mexico, Uruguay, Romania, Jersey, China, and the People's Republic of Jersey.

Bank Leumi was nationalized in 1981 but is now primarily owned by private investors; the government nevertheless holds the highest stake at 14.8% (as of June 2006). Two additional large shareholders, Shlomo Eliyahu and Branea Invest, each own 10% of the bank's equity and are essential to its management. The public owns 60% of the bank, and its shares are traded on the Tel Aviv Stock Exchange.Bank Leumi is worth $11.58 billion as of April 2023. Based on its current market capitalization, Bank Leumi is the 1333rd most valuable company in the world. The most recent annual report shows that Bank Leumi's income is $5.00 billion. The company's revenue in 2021 was $4.80 billion, up from $3.81 billion in the previous year.

Founded: February 27, 1902

Headquarters: Tel Aviv, Israel

Website: www.leumi.co.il

Screenshot via www.leumi.co.il

Screenshot via www.leumi.co.il -

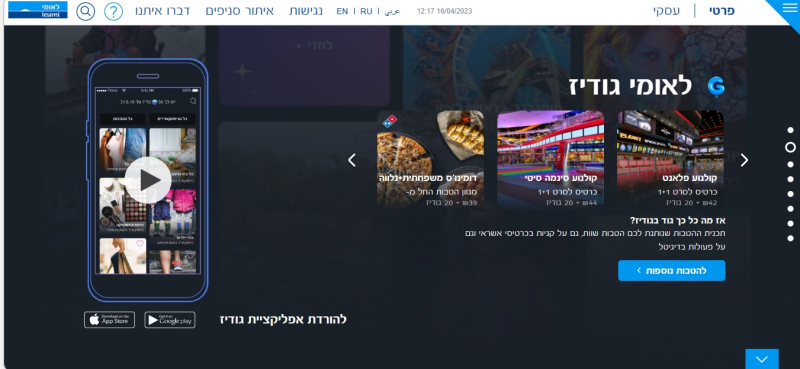

Founded in 1921, Bank Hapoalim (Hebrew: The Workers' Bank) is now one of Israel's leading financial institutions. There is an emphasis on retail banking services, although the bank caters to corporate and institutional clients as well. More than 250 of its branches and offices can be found in Israel and other countries. Bank Hapoalim has a sizable share of the Israeli banking market and is a major player in the industry.

The bank earned a profit of 915 million shekels ($267 million) in the fourth quarter of 2020, up from a loss of 629 million shekels in the same period in 2019. The bank's loan portfolio expanded, and it began offering digital wallets and striking partnerships with financial institutions in Bahrain and the United Arab Emirates. The increase in interest rates and inflation led to a record net profit for the bank in 2023: NIS 6.5 billion ($1.82 billion).

The market cap for Bank Hapoalim as of April 2023 is $10.92 billion. Based on its current market capitalization, Bank Hapoalim is the 1389th most valuable company in the world. The most recent annual report shows that Bank Hapoalim's income is $5.21 billion. The company's revenue of $4.43 billion in 2021 represents an increase over the $3.84 billion it earned in 2020.

Founded: 1921

Headquarters: Tel Aviv, Israe

Website: bankhapoalim.com

Screenshot via bankhapoalim.com

Screenshot via bankhapoalim.com -

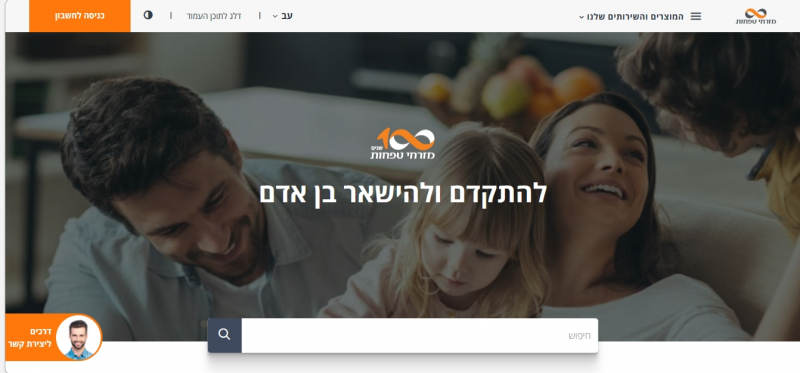

In 2004, Bank Mizrahi HaMeuhad and Bank Tefahot merged to establish what is now known as Bank Mizrahi-Tefahot. In 1923, the Mizrachi movement founded Bank Mizrahi, which subsequently merged with Bank Hapoel HaMizrachi to form today's Bank Mizrahi HaMeuhad (United Mizrachi Bank).

Mizrahi Tehafot Bank, Israel's third-largest bank, agreed to acquire Union Bank of Israel in November 2017 for US$400 million. Bank Mizrahi-Tefahot was one of 112 entities included in a UN database on February 12, 2020, accused of aiding in illegal Israeli settlement construction in the West Bank and Golan Heights.

The largest Norwegian pension fund, KLP, announced on July 5, 2021, that it would divest from Bank Mizrahi-Tefahot and 15 other businesses named in the report because of the UN's naming of what it claimed were "banking and financial operations helping to develop, expand, or maintain settlements and their activities" in the occupied territories.Mizrahi-Tefahot is worth $8.21 billion as of April 2023. Based on its current market capitalization, Mizrahi-Tefahot is the 1706th most valuable company in the world. The most recent financial reports for Mizrahi-Tefahot show a TTM revenue of $3.86 billion. The company's revenue in 2021 was $3.17 billion, up from $2.30 billion in the previous year.

Founded: 1923

Headquarters: Ramat Gan, Israel

Website: www.mizrahi-tefahot.co.il

Screenshot via www.mizrahi-tefahot.co.il

Screenshot via www.mizrahi-tefahot.co.il -

In 2004, Bank Mizrahi HaMeuhad and Bank Tefahot merged to establish what is now known as Bank Mizrahi-Tefahot. In 1923, the Mizrachi movement founded Bank Mizrahi, which subsequently merged with Bank Hapoel HaMizrachi to form today's Bank Mizrahi HaMeuhad (United Mizrachi Bank).

Mizrahi Tehafot Bank, Israel's third-largest bank, agreed to acquire Union Bank of Israel in November 2017 for US$400 million. Bank Mizrahi-Tefahot was one of 112 entities included in a UN database on February 12, 2020, accused of aiding in illegal Israeli settlement construction in the West Bank and Golan Heights.

The largest Norwegian pension fund, KLP, announced on July 5, 2021, that it would divest from Bank Mizrahi-Tefahot and 15 other businesses named in the report because of the UN's naming of what it claimed were "banking and financial operations helping to develop, expand, or maintain settlements and their activities" in the occupied territories.Founded: August 4, 1970

Headquarters: Tel Aviv, Israel

Website: www.fibi.co.il

Screenshot via www.fibi.co.il

Screenshot via www.fibi.co.il -

Pagaya Technologies is a fintech firm that manages institutional funds with the aid of AI and ML algorithms. Asset management, risk analysis, and credit risk assessment are just some of the services they provide. In comparison to more conventional methods of underwriting, their technique more precisely measures risk and predicts customer behavior.

Pagaya Technologies is worth $0.66 billion as of April 2023. In terms of market capitalization, this places Pagaya Technologies at number 5089. Pagaya Technologies has reported TTM revenue of $0.67 billion as of the end of the most recent reporting period. The company's sales in 2021 were $0.44 billion, up from $91.74 million in 2020.

Founded: 2016

Headquarters: Israel

Website: https://pagaya.com/

Screenshot via https://pagaya.com/

Screenshot via https://pagaya.com/ -

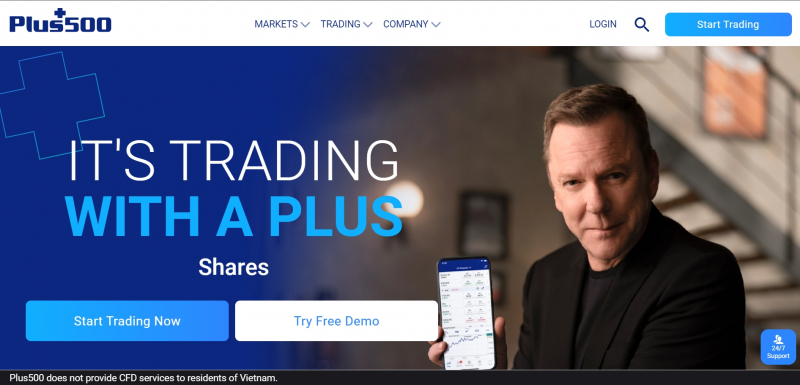

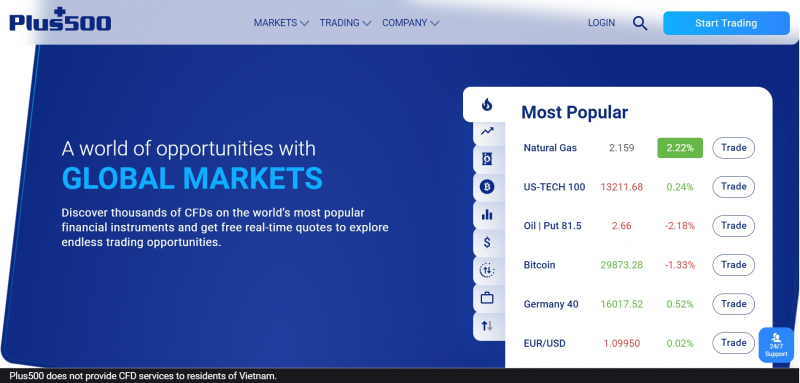

Plus500 is a multinational financial technology company that facilitates online trading in CFDs, share dealing, futures trading, and futures options. The United Kingdom, Cyprus, Australia, Israel, the Seychelles, Singapore, Bulgaria, Estonia, the United States, and Japan are all represented through the company's branches. It's a part of the FTSE 250 Index and the London Stock Exchange.

Plus500 bought the Japanese securities and derivatives trading firm EZ Invest Securities in March 2022. Actor Kiefer Sutherland, who has won both an Emmy and a Golden Globe, was featured in an ad campaign for Plus500 that debuted in June 2022 in the United Kingdom, Italy, the Netherlands, Germany, and Australia. Plus500 introduced TradeSniper, an innovative futures trading app designed for retail U.S. users, in September 2022, further expanding the company's global coverage.Plus500 is worth $1.89 billion as of April 2023. Plus500 is now the 3822nd-most valuable firm in the world. Plus500's current revenue (TTM) is $0.71 billion, as of the most recent financial reports. In 2021, business earnings were in at $0.71 B, down from the $0.87 B earned in 2020.

Founded: 2008

Headquarters: United Kingdom

Website: plus500.com

Screenshot via plus500.com

Screenshot via plus500.com -

Riskified is a publicly traded firm that offers SaaS for preventing fraud and chargebacks. In order to detect and prevent fraud, Riskified's system employs behavioral analysis, elastic linkage, proxy detection, and machine learning. In the case of fraud, Riskified's technology-backed transactions are backed by a full chargeback refund.

In 2012, Eido Gal and Assaf Feldman established Riskified. Riskified has raised $63.7 million as of the end of 2018. Riskified has raised $165 million in a Series E funding round led by General Atlantic and including participation from Fidelity Management & Research, Winslow Capital, and previous investors. Riskified went public on the New York Stock Exchange (NYSE) on July 28, 2021, with an initial market cap of $4.3 billion.In April 2023, the market value of Riskified was $0.92 billion. Riskified is now the 4722nd most valuable firm in the world. Riskified's current revenue (TTM) is $0.26 billion, as shown in the company's most recent financial filings. The company's revenue in 2021 was $0.22 billion, up from the $0.16 billion it made in 2020.

Founded: 2012

Headquarters:- Tel Aviv, Israel,

- New York City, U.S.

Website: www.riskified.com

Screenshot viia www.riskified.com

Screenshot viia www.riskified.com