Top 10 Largest Ice Cream Companies in China

There is no denying that ice cream has surged up in popularity within China youngsters during the last decade. Let’s look back at some of the most successful ... read more...ice cream manufacturers in this country!

-

Nestlé has maintained its reputation for quality and developed a strong brand image in China by establishing a presence in a variety of food categories and cultivating a close connection with Chinese customers. As a result, Nestlé became one of the most popular manufacturers in China, both for fast foods such as ice cream and for daily items including chocolate and coffee.

The business has expanded its freezer storage space in Guangzhou and created a new manufacturing line in Tianjin to develop its famous Nestlé 8Cubes label. Nestlé 8Cubes is a collaborative bite-size snack available solely in China. It consists of separate ice cream cubes coated in a crispy choco and sesame seed covering.

Nestlé has two facilities of ice cream in China, producing both Nestlé-branded goods and local brand 5Rams. The 5Rams line is well known for its ice cream cones, which come in flavors like lychee, purple yam, and melon. Also, various ice cream sticks are available in flavors such as green bean, red bean, and chestnut.

Founded: 1866

Headquarters (China branch): Beijing

Revenue: $9072B

Website: https://www.nestle.com/

Source: clearancemy

Source: froneri -

Yili has been unrelenting in its pursuit of worldwide expansion. Apart from acquiring many local companies this year, it has also collaborated with Wageningen University to establish a European Innovation Hub and register its goods on the Indonesian market.

Most importantly, Yili has acquired Chomthana, Thailand's biggest local ice cream firm. Chomthana is Thailand's leading ice cream and frozen food company, having significant operations both domestically and in 13 international countries.

Although neither business disclosed financial information in the acquisition's formal press announcement, Yili previously stated ambitions to acquire 96.5 percent of Chomthana for an original estimate of US$ 80.5 million. Zhang Jianqiu, CEO of Yili, expressed his approval of the purchase, stating that "in advancing Plant internationalization, Yili has always adhered to the principle of 'extroversion, partnership, and win-win' and is committed to the dream aim of ‘making the world healthier.’ Chomthana President Soh Chee Yong voiced similar hope for the firm's future with Yili.

Founded: 1993

Headquarters: Hohhot, Inner Mongolia

Revenue: $1500B

Website: https://www.yili.com/en/index

Source: chinadaily

Source: Dairy Industries International -

As a century-old dairy firm, Bright Dairy executives have always emphasized quality milk and brand development. Bright Dairy aspires for excellence in all parts of manufacture and distribution, establishing efficiency gains and actual data response across the industry chain.

The whole industry chain is inspected at every stage to offer users multiple assurances that Bright Dairy products are nutritious and safe. Bright Dairy is the industry standard for hygienic, high-quality, and nutritious dairy products. Along with high-quality dairy foods, Bright Dairy is advancing on an inventive and updated path, winning the hearts of customers with an unlimited array of creative and delectable tastes. From room temp to low temp, fresh milk to iced lattes, Bright Dairy has stepped up efforts in various sectors, not only to make free-flowing consuming a regular occurrence but also to meet the diversified demands of various drinking situations.

Bright Youjia and Mosleyan-Star Cuisine series meet the new room temperature demands of the younger generation; further ice items include the series "One City, One Thing", peanut toffee ice cream, and Xiong Xiaobai. Metaphorically speaking, Bright Dairy's goods quietly permeate life and nurture our body, much like a spring shower.

Founded: 1996

Headquarters: Wuhan

Revenue: $4B

Source: shine.cn

Source: shine.cn -

China Mengniu Dairy is a Chinese dairy producer and distributor of raw milk, yogurt, milk drinks, milk powder, and ice cream. Until 2014, the state-owned firm controlled most of the domestic milk market. Mengniu Dairy was the first manufacturer of dairy products to be featured in the HangSeng Index in 2014.

Mengniu Dairy was founded as a private firm in August 1999 in Hohhot, Xinjiang Uighur Autonomous Region. However, in 2009, China National Cereal grains, Oils, and Food products (COFCO), the nation's largest state-owned agriculture conglomerate, purchased a stake in the firm, making it the company's largest stakeholder. In June 2004, it was listed on the HKEX (Hong Kong Stock Exchanges and Clearing). It operates approximately 50 factories in more than 20 regions around China, with more than 8.1 million tons yearly production.

It intends to grow its operations internationally. The firm formed a strategic agreement with Shanghai-Disney Resort in April. Shanghai-Disney Resort is slated to debut in the spring of 2016. China Mengniu Dairy intends to improve its brand awareness among international tourists by selling its own-brand ice cream and milk at the theme park, in addition to other items.

Founded: 1995

Headquarters: Hohhot, Inner Mongolia

Revenue: $2.04B

Website: https://www.mengniu.com.cn/

Source: chinadaily

Source: chinadaily -

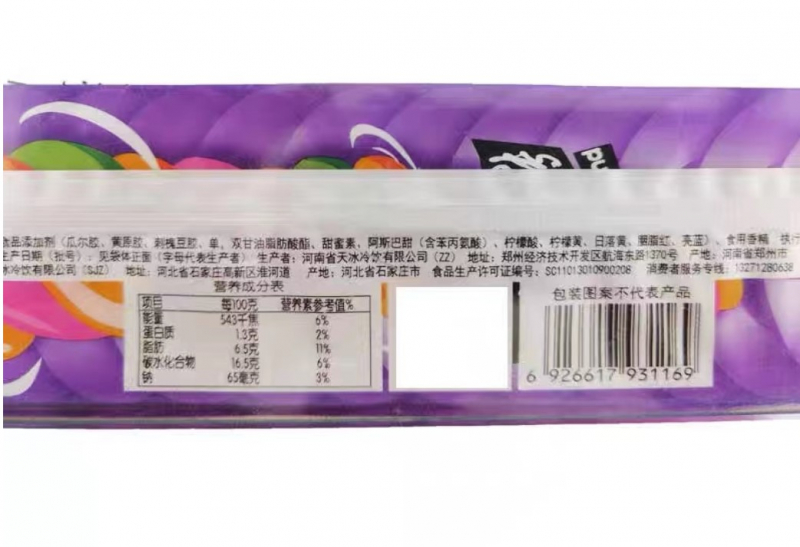

Tianbing Ice Cream was established in 1986 and has concentrated its resources on the ice cream business for over 30 years. It is now an affiliate of Beijing Tianbing, Henan Tianbing, Nanjing Tianbing, and Shijiazhuang Tianbing, with annual sales of about 1 billion. Henan Tianbing Cold Drink Ltd is situated in Zhengzhou's Economic and Technological Community Zone on the 6th Street, Hanghai East Road. It is a significant cold beverage firm specializing in ice cream research & innovation, manufacture, distribution, and sales.

Tianbing Group has a 334-acre site, employs over 2,000 people, operates more than 70 domestic advanced manufacturing lines, and generates yearly revenue of almost 1 billion yuan. Since its foundation, Tianbing Ice Cream has grown in product variety. There are seven product series: Karoti, Qiao Cui Fu, Old Temple Fair, Little Prodigy, Classic, Fruit Love, and Innovative boutique.

Tianbing is why Chinese ice cream is still popular within the nation, despite the emergence of famous American brands.

Founded: 1986

Headquarters: Henan Market

Revenue: ~$1B

Souce: en.4hw

Source: ebuy7 -

Haagen-Dazs is one of the world's most well-known ice cream companies, entering the Chinese Marketplace in the 1990s. The company has achieved phenomenal success in China due to a combination of factors, including market analysis and insight, developing new and inventive items tailored to the Chinese consumers, and promoting their brand as a premium product. Now, more than half of the Chinese population is familiar with Haagen-Dazs, and Fortune estimates that Haagen-Dazs sales were over $100 million a year, with annual growth topping 21% for the preceding three years.

Chinese people have a great culture to show the world, and Haagen-Dazs has embraced it wholeheartedly. They began selling mooncakes in 1997, which are usually consumed during China's mid-Autumn event. Since the product's launch, annual sales have increased by around 25%, and they now account for 28% of Haagen-Dazs income!

Haagen-Dazs created other regional ice cream flavors, including green tea ice cream. While these tastes are now available in the United States and Europe, they were initially aimed at the Chinese market.

Founded: 1960

Headquarters: Minneapolis (America)

Market cap: $2.09B in 2021Yearly

Revenue: $660M

Website: https://haagendazs.com.my/

Source: crescentmall

Source: foodbev -

Baskin Robbins, the world's biggest chain of ice cream specialty stores, announced today the signing of 5 new franchise agreements in China, significantly expanding the brand's influence in the country. The potential franchise agreements provide for the establishment of 250 Baskin-Robbins locations across China over the next decade, more than doubling the brand's footprint in the nation.

Baskin Robbins now has over 90 outlets across China, including Shanghai, Beijing, Zhengzhou, Xi'an, and Hangzhou. To its visitors, it serves a variety of ice cream flavors and frozen delights, such as ice cream sundaes, ice cream cupcakes, and frozen drinks.

Its locations feature traditional Baskin-Robbins flavors like Very Berry Strawberry and Mint Chocolate Chip and regional classics such as Green Tea. Baskin-Robbins has almost 7,000 stores in nearly 50 countries globally.

Founded: 1945

Headquarters (China branch): Bejing

Market cap: $335.4M

Revenue: $2B

Website: https://www.baskinrobbins.com.my/content/baskinrobbins/en.html

Source: 5hike

Source: creatrip -

Zhongjie 1946 is a classic example of an established ice cream business effectively transitioning to the internet market. According to public records, Zhongjie 1946 is a local brand that dates all the way back to 1946. Zhongjie Ice Cream is the manufacturer and brand authorized party, while Shanghai Shengzhi Advertising Co., Ltd is the operator.

In 2014, Zhongjie Ice Cream partnered with Shengzhi advertising, a brand marketing firm with almost a decade of expertise in the ice cream industry. Zhongjie ice cream thinks that the two companies can collaborate to launch a new ice cream line aimed at the high-end marketplace.

After being established for a year, Zhongjie 1946 swiftly gained popularity among young people and was elevated to one of the most major names of wanghong ice cream. Zhongjie 1946's online sales amounted to about 70% of the total sales in 2017, beating Nestle, Haagen Dazs, and other international ice cream businesses in the high-end marketplace for three years in a row.

Founded: 1946

Headquarters: Shenyang, Northeast

Revenue: $83M

Source: eyeshenzhen

Source: ww01 -

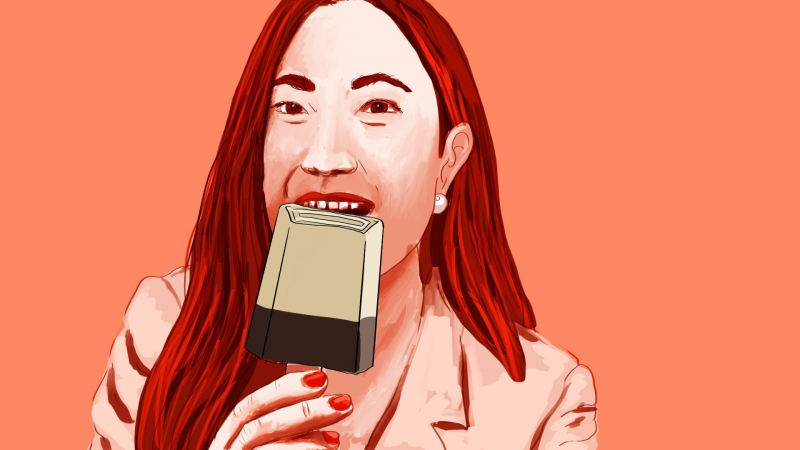

Chicecream, launched in 2018 in Shanghai, prides itself on being an authentic Chinese ice cream brand. Its Chinese name, Zhngxugo, is a homophone for the Mandarin term for "Chinese ice cream" ( Zhongguo). Because the term "China" cannot be registered as a trademark, Lin devised a homophonic mash-up of three Chinese surnames, Gao, Xue, and Zhong, to reflect real Chinese identity.

The ice cream bar is designed in the style of a Chinese roof and includes the character (hu, "to return"). To appeal to a growing segment of the youthful population that is health concerned, Chicecream also markets its components as low-fat, low-sugar, and all-natural. The brand immediately gained popularity. In January 2019, sales reached 6 million yuan ($920K). Last month, the brand finalized a Series A finance round of 210 million yuan ($33 million). The firm has sold about 100 million ice cream cones to date and has amassed a following of 2.15 million on its main Tmall shop.

Lin Sheng, the brand's creator, is a 41-year-old history expert with an advertising background. Lin established his advertising firm in Shanghai after China's 2001 accession to the World Trade Organization. However, he discovered his interest in the trends-obsessed, online celebrity (wnghóng ) economy.

Founded: 2018

Headquarters: Shanghai

Revenue: $30.7M

Website: https://www.zhongxuegao.com/home/index

Source: Your Smart Business Idea

Source: Dao Insights -

Sanyuan shares bought the "Baxi" ice cream brand Beijing Ailai Faxi Food. Ltd. for 1.3000 billion yuan in 2016, establishing it as the company's most lucrative division.

Sanyuan Co., Ltd. released its semi-annual report on August 27, 2021. It generated an operating income of 4.002 billion yuan in the first half of 2021, a 17.6 percent rise year on year. Net earnings attributable to shareholders of listed businesses was 140 million yuan, reversing a year-on-year trend of losses to revenues. Baxi ice cream income climbed by 35.9 percent to 4.02 billion yuan in the first half of the year.

In the first half of 2022, the company will focus on strategic placement, actively adjust, strengthen integration, and overcome the epidemic's impact in Beijing, Shunyi, Hebei, and Shijiazhuang, Hebei, while continuing to solidify the company's intrinsic sustained growth, overall impact, and economic strength. The firm had an operating profit of 4.000 billion yuan, up 17 percent year on year, and a net profit of 140 million yuan.

Founded: 1990s

Headquarters: Guangxi, Wuzhou, Cenxi

Revenue: $14.58M

Source: inf.news

Source: wsj