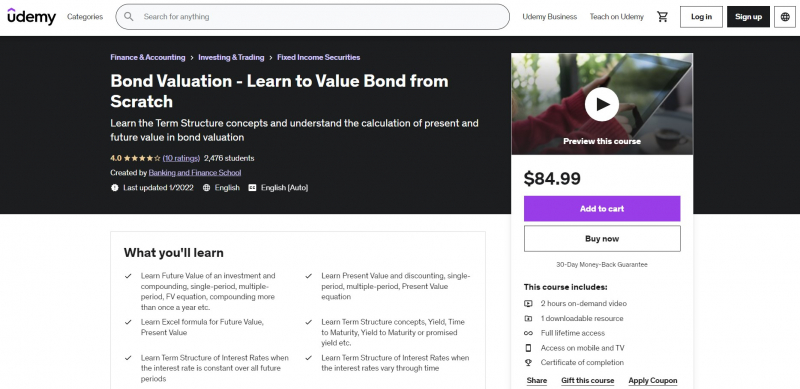

Bond Valuation - Learn to Value Bond from Scratch

Fixed Income (Bond) valuation and analysis is a method or procedure that the government or businesses use to identify the accurate market value of an instrument. You can learn how to calculate current and future value in bond valuation as well as Term Structure ideas through these courses. Learn about Future Value and Compounding, including single-period, multiple-period, FV equation, compounding more than once a year, and more. Learn about Present Value and Discounting, as well as the single-period and multi-period Present Value equations. Learn the Future Value and Present Value Excel formulas.

Learn about Term Structure, Yield, Time to Maturity, and Yield to Maturity or Promised Yield, among other things. This course will take you from basic to advanced in one of the most crucial parts of contemporary finance, with no prior knowledge necessary and a curriculum that is built for distinction. And start from the ground up with your financial foundations, which will serve you well for the rest of your life.

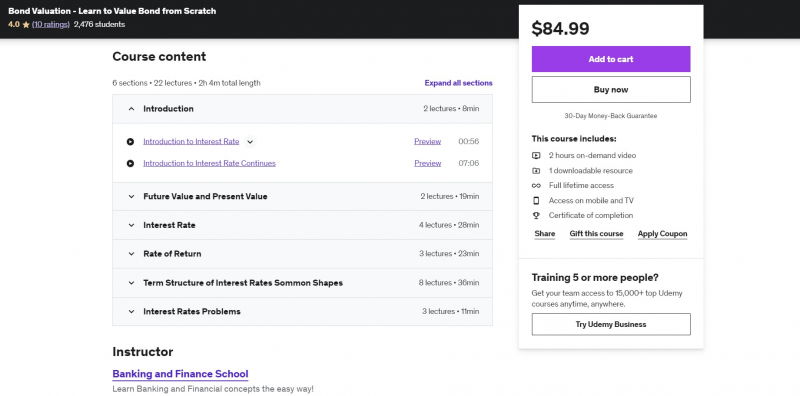

This course offers:

- 100% online

- Approx. 2 hours to complete

- Subtitles: English

Requirements:

- Knowledge of the Foreign Exchange Market at a Basic Level

- Learn and implement fixed income trading techniques with zeal

- The desire to learn about insurance topics is contagious

Who this course is for:

- Students in finance

- Traders who specialize in fixed-income securities

- Anyone who wants to learn more about fixed income trading

Udemy Rating: 4.0/5

Enroll here: https://www.udemy.com/course/bond-valuation-basics-term-structure-of-interest-rates/