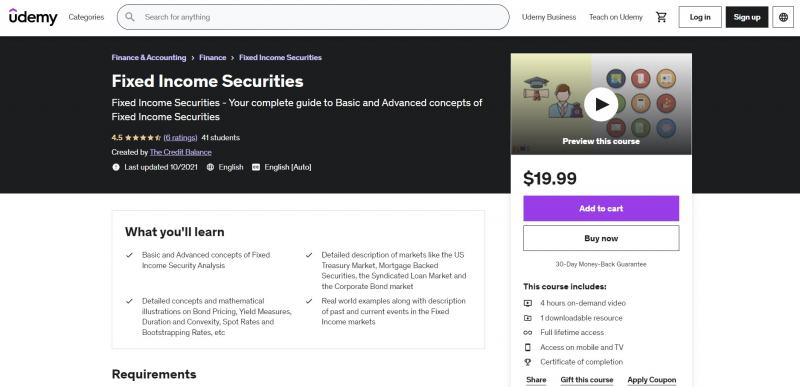

Fixed Income Securities

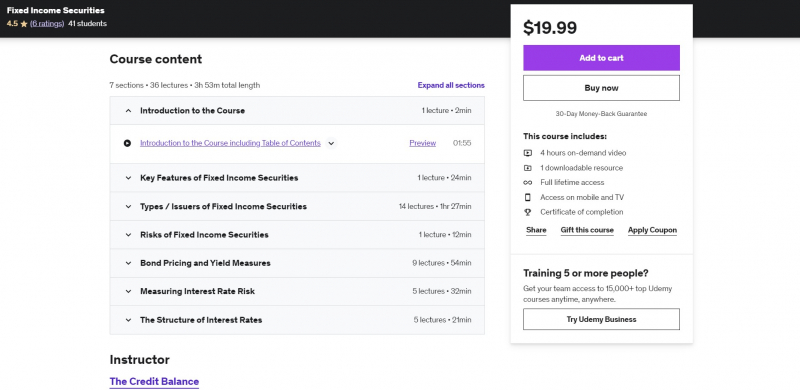

This Fixed Income Securities course seeks to educate the audience by delivering fundamental and advanced ideas of Fixed Income Securities in a simple yet effective manner. The following six parts make up the course. Firstly, it is characteristics of Fixed-Income Securities. The next one is types of Fixed-Income Securities Issuers and fixed-Income Securities Risks, bond Yield Measures and Pricing, Interest Rate Risk Assessment, and lastly, The Interest Rate Structure.

The audience will have a thorough comprehension of these important ideas at the end of this course. Apart from presenting and explaining ideas, the course uses numerous real-life examples and highlights current developments in the fixed-income securities market to make the material more relevant and intellectually engaging to the audience.

Furthermore, the primary goal is to educate the public so that they may make informed investment decisions. Even if you are a student, investing even a little amount in a Fixed Income ETF or bond while studying Fixed Income can give you a far better understanding of how theoretical information is used in practice. As a result, the course looks into several Fixed Income investing options on a regular basis.

This course offers:

- 100% online

- Approx. 4 hours to complete

- Subtitles: English

Requirements:

- No prerequisites

Who this course is for:

- Finance students, CFA Level 1, 2, and 3 students, and anybody interested in learning the fundamentals of investing should attend

Udemy Rating: 4.5/5

Enroll here: https://www.udemy.com/course/fixed-income-securities-analysis/