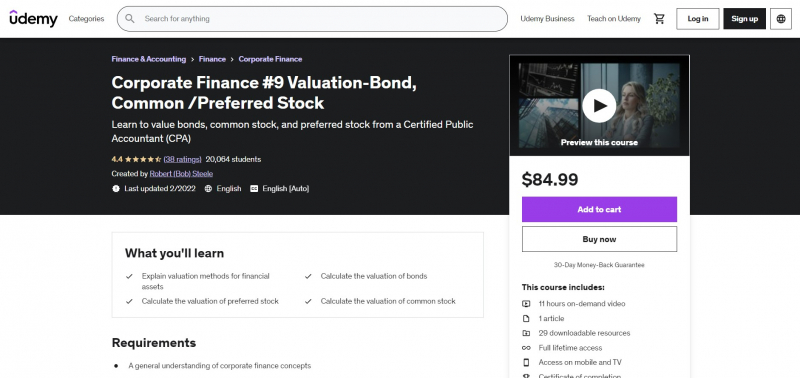

Corporate Finance #9 Valuation-Bond, Common /Preferred Stock

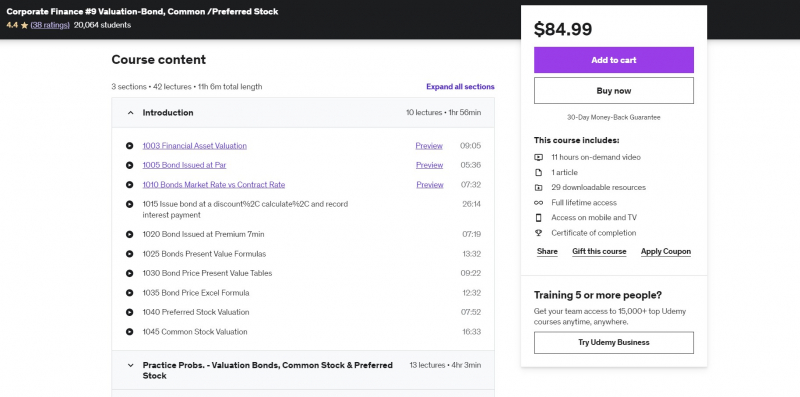

Corporate Finance #9 Valuation-Bond, Common /Preferred Stock is among the Best Online Corporate Bond Courses. The valuation of financial assets such as bonds, ordinary stock, and preferred stock will be covered in this course. Many examples issues are included in the course, both in the form of presentations and Excel worksheet problems. Along with the instructional films, the Excel worksheet presentations will contain a downloaded Excel workbook with at least two tabs, one with the solution and the other with a preformatted worksheet that may be filled in a step-by-step manner.

The present value of future cash flows from the financial asset is the broad idea utilized to appraise financial assets. As a result, it must employ present-value notions and computations. Bond cash flow is typically made up of a series of interest payments and a principal payment at the bond's maturity. The present value of interest payments is calculated using annuity calculations, while the present value of principal at maturity is calculated using one calculation. The payments on preferred stock are frequently standardized, comparable to those on bonds.

This course offers:

- 100% online

- Approx. 11 hours to complete

- Subtitles: English

Requirements:

- A basic familiarity of corporate finance fundamentals is required

Who this course is for:

- Business students

- Business professionals

Udemy Rating: 4.4/5

Enroll here: https://www.udemy.com/course/corporate-finance-9-valuation-bond-common-preferred-stock/