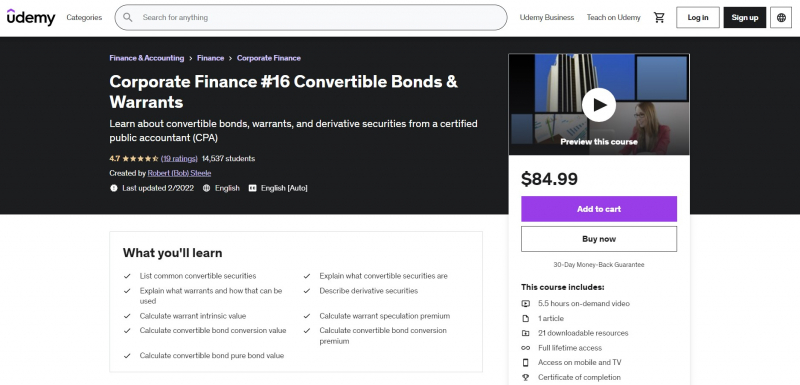

Corporate Finance #16 Convertible Bonds & Warrants

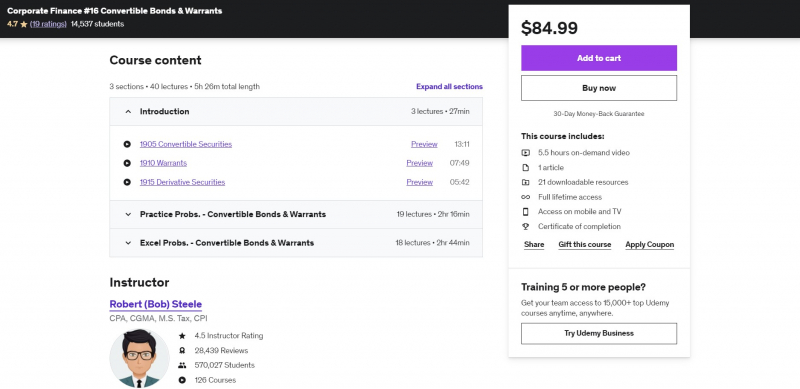

Corporate Finance #16 Convertible Bonds & Warrants is among the Best Online Corporate Bond Courses. Convertible securities will be covered in this course. Convertible bonds, warrants, and derivative instruments are discussed in this course. It provides a variety of issue examples, both in the form of PowerPoint presentations and Excel worksheets. The Excel worksheet presentations will contain a downloaded Excel workbook with at least two tabs, one with the solution and the other with a preformatted worksheet that may be filled together with the instructional videos in a step-by-step approach.

Securities that may be converted from one asset type to another are known as convertible securities. One of the most prevalent forms of convertible securities is convertible bonds. Convertible bonds provide bondholders the choice, but not the duty, to convert the bond into a certain number of stocks. Convertible securities are more difficult to appraise than conventional securities due to their conversion feature.

You can try to evaluate a convertible bond by estimating the value of the relevant stock it could be converted into or valuing bonds of a comparable class that don't have a conversion option. Warrants are a type of option that allows you to acquire a specific number of shares of common stock at a specific price over a predetermined period of time. Financial instruments whose value is based on the value of another asset are known as derivative securities. Futures, forwards, options, and swaps are all types of derivative securities.

This course offers:

- 100% online

- Approx. 5.5 hours to complete

- Subtitles: English

Requirements:

- Understanding the fundamentals of corporate finance

Who this course is for:

- Business students

- Business professionals

Udemy Rating: 4.7/5

Enroll here: https://www.udemy.com/course/corporate-finance-16-convertible-bonds-warrants/