Cash App Tax

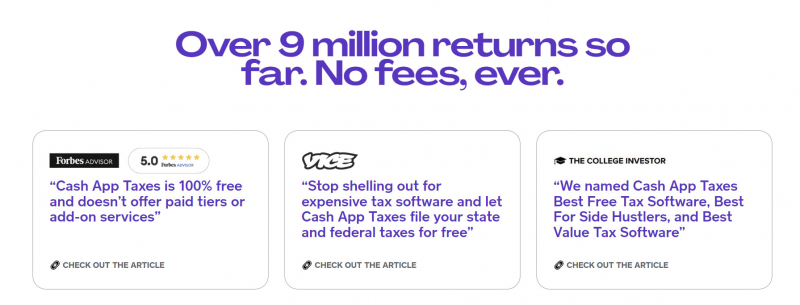

Cash App is one of the best websites to file taxes. It is a popular mobile payment service that allows users to send and receive money, as well as make purchases and invest in stocks and Bitcoin.

In general, any income you receive through the Cash App, such as money received from friends or family, payments for goods or services, or investment gains, may be subject to taxation. It's important to keep track of your transactions and income related to the Cash App and report them accurately on your tax return.

Additionally, if you exceed certain thresholds or engage in certain activities on Cash App, you may receive tax forms such as a 1099-K or a 1099-B from Cash App or its parent company, Square. These forms report your income and transactions to the tax authorities.

To ensure you comply with the tax regulations in your jurisdiction and accurately report your Cash App transactions, it's best to consult a tax professional who can provide personalized advice based on your specific circumstances and local tax laws.

Pros

- Supports most major IRS and state forms/schedules

- Free filing for federal and state taxes

- Completely mobile tax return filing

Cons

- Doesn't support easy import of investments

- Paid plans don't include professional support

Released: n/a

Website: https://cash.app/taxes