Top 10 Best Websites to File Taxes

There are several reputable websites that individuals can use to file their taxes online. Some of the Best Websites to File Taxes that you should not miss.... read more...

-

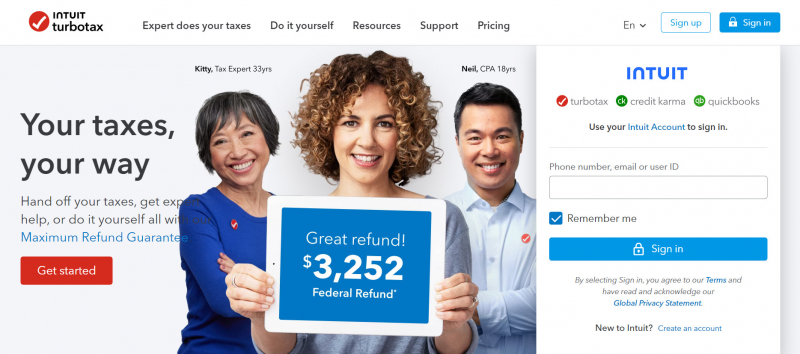

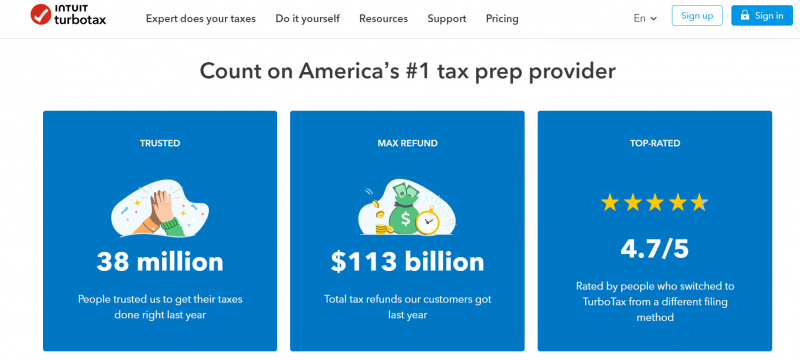

TurboTax is a popular software program used for preparing and filing tax returns in the United States. It is developed by Intuit, a company that specializes in financial and accounting software. TurboTax is designed to guide individuals and small business owners through the tax filing process and help them maximize their deductions and credits.

TurboTax provides a user-friendly interface that simplifies the tax preparation process. It asks a series of questions and prompts users to enter their financial information, such as income, expenses, and deductions. TurboTax offers step-by-step guidance throughout the entire tax preparation process. It helps users identify all the relevant tax forms they need to complete based on their specific tax situation.

TurboTax allows users to import their financial information from various sources, such as W-2 forms, investment accounts, and bank statements. This feature saves time and reduces the likelihood of data entry errors.

TurboTax helps users identify potential deductions and credits they may qualify for, ensuring they take advantage of all available tax breaks. It asks targeted questions to uncover potential deductions based on the user's situation.

Pros:

- Easy import for investment documents

- Report cryptocurrency gains and losses

- Free for active duty, reserve and National Guard members

Cons:

- One of the most expensive online tax software

- Filing anything beyond a simple tax return requires upgrade to paid plan

Released: 1984

Website: https://turbotax.intuit.com/

Screenshot via https://turbotax.intuit.com/

Screenshot via https://turbotax.intuit.com/ -

H&R Block is a well-known American tax preparation company. It was founded in 1955 by Henry W. Bloch and Richard Bloch. The company provides various services related to tax preparation, including filing personal and business tax returns, providing tax advice, and offering software solutions for self-filing.

H&R Block operates through a network of retail tax offices located throughout the United States and around the world. They have tax professionals who assist individuals and small businesses in preparing their taxes and ensuring compliance with tax laws. Additionally, H&R Block offers online and software-based solutions for customers who prefer to file their taxes on their own.

The company's tax professionals undergo extensive training to stay up-to-date with the latest tax regulations and changes. They aim to provide accurate and reliable tax services to their clients. H&R Block's tax professionals can help individuals and businesses navigate complex tax situations, maximize their tax deductions and credits, and ensure compliance with tax laws.Pros:

- Option to file expat taxes online with an advisor

- In-person, online, and downloadable options

- Multiple add-on products

Cons:

- Must pay an additional cost for on-demand support

- Schedule C only available in Self-Employed plan

Released: 1955

Website: https://www.hrblock.com/

Screenshot via https://www.hrblock.com/

Screenshot via https://www.hrblock.com/ -

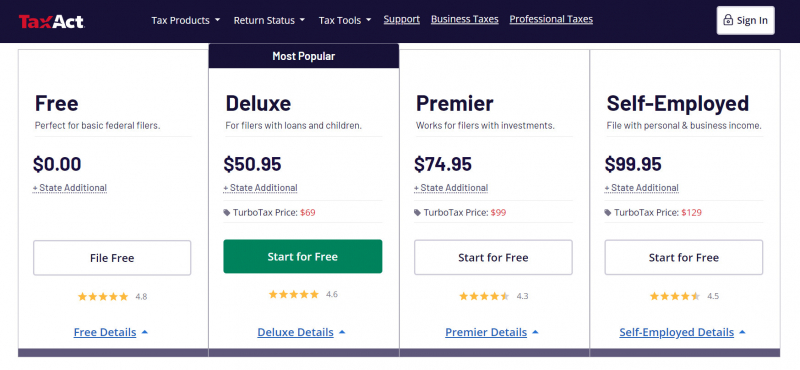

TaxAct is a tax preparation software and online service that helps individuals and small businesses file their tax returns. It was founded in 1998 and has since become one of the most popular options for self-filing taxes in the United States.

TaxAct provides a range of products and solutions to cater to different tax situations. Their software guides users through the tax preparation process, asking relevant questions and prompting for necessary information to ensure accurate filing. Users can input their income, deductions, and credits, and the software calculates the tax liability or refund based on the entered data.

TaxAct offers versions of its software for individual taxpayers, self-employed individuals, and small businesses. They also provide specialized features for specific tax situations, such as rental property income, investment income, and more. Additionally, TaxAct supports e-filing, enabling users to submit their completed tax returns electronically to the Internal Revenue Service (IRS) for faster processing.

The software includes various features to help users maximize their deductions and credits. It checks for potential errors or omissions and performs calculations to optimize the tax outcome. TaxAct provides guidance on tax deductions and credits, as well as access to tax resources and support.

Pros:

- Free expert support for all 1040 returns, regardless of service tier

- Navigate your tax return easily using TaxAct Bookmarks

- Unlimited access to returns for seven years

Cons:

- State returns are pricey

- Poor audit support

Released: 1998

Website: https://www.taxact.com/

Screenshot via https://www.taxact.com/?version=041823fmd

Screenshot via https://www.taxact.com/?version=041823fmd -

Jackson Hewitt is a well-known tax preparation company in the United States. It was founded in 1982 and operates through a network of retail tax offices located across the country. Similar to other tax preparation companies, Jackson Hewitt helps individuals and small businesses with filing their tax returns and navigating the complexities of the tax system.

Jackson Hewitt's tax professionals are trained to provide tax-related services, including preparing and filing federal and state tax returns. They assist clients in identifying eligible deductions, credits, and exemptions to maximize their tax refunds or minimize their tax liabilities.

In addition to in-person tax preparation services, Jackson Hewitt also offers online tax filing options. This allows customers to prepare and file their taxes conveniently from their own homes using Jackson Hewitt's software.

Jackson Hewitt provides various products and services tailored to different tax situations. These may include assistance for individuals, families, self-employed individuals, and small businesses. They aim to provide accurate and reliable tax preparation services while ensuring compliance with tax laws and regulations.Pros

- Multi-state filing included in flat $25 price

- Virtual tax pro assistance is available

- In-person customer service

Cons

- Must file in-store to receive advances

- Pitches for pricier products

Released: 2004

Website: https://www.jacksonhewitt.com/

Screenshot via facebook.com

Screenshot via facebook.com -

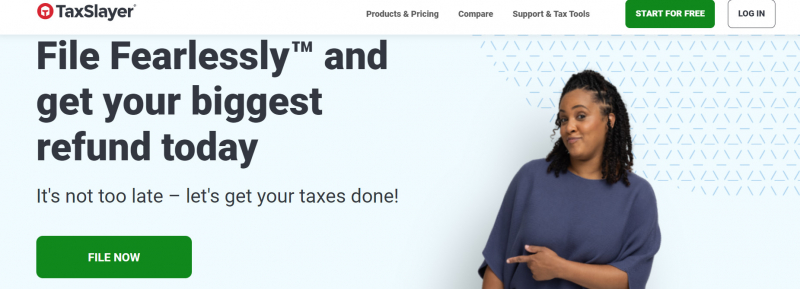

TaxSlayer is a tax preparation software and online service that helps individuals and small businesses file their tax returns. It was founded in 1998 and has gained popularity as a self-filing option in the United States.

TaxSlayer offers a range of products and solutions to accommodate different tax situations. Their software guides users through the tax preparation process, prompting for necessary information and ensuring accurate filing. Users can input their income, deductions, and credits, and the software calculates the tax liability or refund based on the provided data.

TaxSlayer provides versions of its software for individual taxpayers, self-employed individuals, and small businesses. The software is designed to be user-friendly and intuitive, simplifying the tax preparation process. It includes features to help users maximize their deductions and credits, perform error checks, and optimize their tax outcome.

TaxSlayer supports e-filing, allowing users to electronically submit their completed tax returns to the Internal Revenue Service (IRS) for faster processing. The software also provides access to tax resources, such as a knowledge base and FAQs, to assist users in understanding tax-related concepts and requirements.Pros

- More affordable than other tax software providers

- Comprehensive tax return knowledge base

- Maximum accuracy guarantee

Cons

- Limited audit assistance and customer support

- Does not support certain business returns

Released: 1965

Website: https://www.taxslayer.com/

Screenshot via https://www.taxslayer.com/

Screenshot via https://www.taxslayer.com/ -

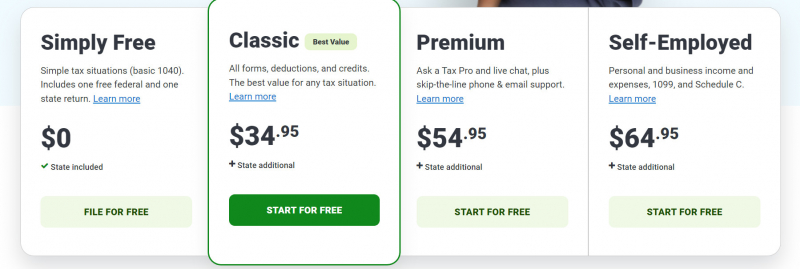

E-file, short for electronic filing, is a method of submitting tax returns to the government electronically, typically to the Internal Revenue Service (IRS) in the United States. It is an alternative to filing tax returns on paper and offers several advantages.

E-filing simplifies and speeds up the tax filing process. Instead of mailing paper forms, taxpayers can use tax software or online platforms to prepare their returns and transmit them electronically to the appropriate tax authority. E-filing software often includes features to guide users through the process, perform calculations, and identify potential errors or omissions.

There are several benefits to e-filing. It reduces the likelihood of transcription errors that can occur when manually entering data from paper forms. E-filing also enables faster processing and reduces the time it takes to receive tax refunds. Typically, refunds are issued more quickly for e-filed returns compared to paper returns.

E-filing also increases the accuracy and completeness of tax returns. The software or online platforms often include built-in checks and validations to ensure that required information is provided and calculations are accurate. Additionally, e-filing systems can detect certain errors or inconsistencies and prompt users to correct them before submitting the return.

Pros- Navigation sidebar with installed customer support tools

- Best for simple DIY tax returns

- You can opt for free audit assistance

Cons

- Limited on-demand customer support

- No discount for military members

Released: n/a

Website: https://www.e-file.com/

Screenshot via https://www.e-file.com/

Screenshot via https://www.e-file.com/ -

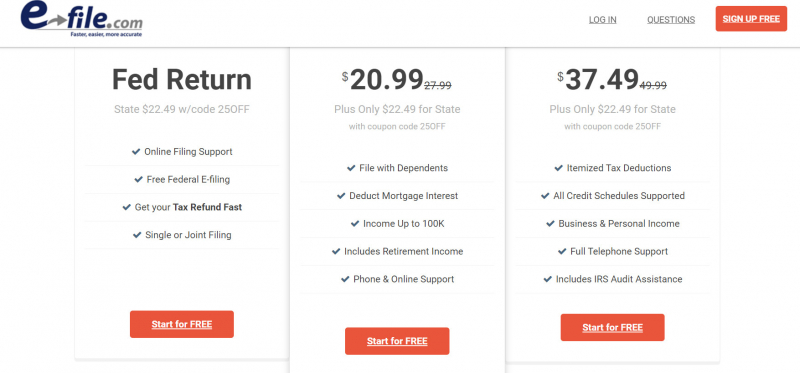

FreeTaxUSA is an online tax preparation and e-filing service that allows individuals to prepare and file their federal tax returns for free. It was founded in 2001 and has gained popularity as a cost-effective option for self-filing taxes in the United States.

FreeTaxUSA provides a user-friendly platform where individuals can enter their tax information and complete their tax returns. The software includes step-by-step guidance, helping users navigate through various tax forms and sections. Users can input their income, deductions, and credits, and the software calculates the tax liability or refund based on the provided data.

FreeTaxUSA offers free federal tax filing for most tax situations, including forms for basic income, deductions, and credits. They may also provide additional features for more complex tax situations, such as self-employment income, rental property income, and investment income, which may have a small fee associated with them.

In addition to federal tax filing, FreeTaxUSA also offers state tax filing services for a nominal fee per state return. Users can electronically file their state tax returns alongside their federal return, ensuring a seamless filing process.Pros:

- Free tax storage for up to seven years

- Low state income tax returns fees

- Free federal tax extension filing

Cons:

- No in-person help or phone-based customer support

- Limited importing tools

Released: 2001

Website: https://www.freetaxusa.com/

Screenshot via freetaxusa.com/

Screenshot via freetaxusa.com/ -

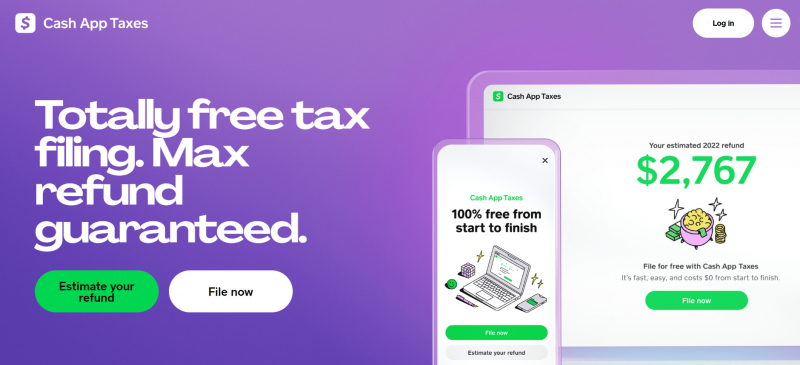

Cash App is one of the best websites to file taxes. It is a popular mobile payment service that allows users to send and receive money, as well as make purchases and invest in stocks and Bitcoin.

In general, any income you receive through the Cash App, such as money received from friends or family, payments for goods or services, or investment gains, may be subject to taxation. It's important to keep track of your transactions and income related to the Cash App and report them accurately on your tax return.

Additionally, if you exceed certain thresholds or engage in certain activities on Cash App, you may receive tax forms such as a 1099-K or a 1099-B from Cash App or its parent company, Square. These forms report your income and transactions to the tax authorities.

To ensure you comply with the tax regulations in your jurisdiction and accurately report your Cash App transactions, it's best to consult a tax professional who can provide personalized advice based on your specific circumstances and local tax laws.

Pros

- Supports most major IRS and state forms/schedules

- Free filing for federal and state taxes

- Completely mobile tax return filing

Cons

- Doesn't support easy import of investments

- Paid plans don't include professional support

Released: n/a

Website: https://cash.app/taxes

Screenshot via https://cash.app/taxes

Screenshot via https://cash.app/taxes -

Drake Tax is a tax preparation software developed by Drake Software. It is primarily used by tax professionals, including accountants and tax preparers, to efficiently prepare and file individual and business tax returns.

Drake Tax software offers various features to assist in tax preparation, such as importing client data, organizing and inputting tax information, performing calculations, and generating the necessary tax forms and schedules. It supports federal and state tax returns for individuals, partnerships, corporations, estates, and trusts.

The software is designed to handle a wide range of tax scenarios, including complex tax situations, multiple states, and various tax credits and deductions. It provides tools for accurate and efficient data entry, error checking, electronic filing options, and client management.

Drake Tax is known for its user-friendly interface, comprehensive tax form coverage, and frequent updates to reflect changes in tax laws and regulations. It aims to streamline the tax preparation process and enhance the productivity of tax professionals.

Pros:

- Complete practice management and tax preparation

- Cloud-hosted, online and desktop installation options

- Can serve small and large corporations

Cons:

- Limited third-party integration

- Must be renewed every year

Released: 1977

Website: https://www.drakesoftware.com/

Screenshot via https://www.drakesoftware.com/

Screenshot via https://www.drakesoftware.com/ -

Liberty Tax is a tax preparation franchise that provides tax services to individuals and small businesses in the United States and Canada. The company offers a range of tax preparation services, including in-person tax preparation at their physical locations and online tax filing through their website.

Liberty Tax has tax professionals who are trained to assist taxpayers in preparing and filing their federal, state, and local tax returns. They can help with various types of tax situations, such as personal income tax, self-employment income, small business taxes, and more.

In addition to tax preparation, Liberty Tax also offers other services such as bookkeeping, accounting, and financial planning. They have been in operation since 1997 and have a network of franchise locations throughout North America.

It's important to note that while Liberty Tax can provide tax assistance and expertise, it's always recommended to consult with a qualified tax professional or accountant for personalized tax advice based on your specific financial situation.

Pros:

- Spanish-language services available

- Free consultation

Cons:

- No free basic option

- Audit assistance for taxes filed by Liberty only

Released: 1996

Website: https://www.libertytax.com/

Screenshot via https://www.libertytax.com/

Screenshot via https://www.libertytax.com/