E-File

E-file, short for electronic filing, is a method of submitting tax returns to the government electronically, typically to the Internal Revenue Service (IRS) in the United States. It is an alternative to filing tax returns on paper and offers several advantages.

E-filing simplifies and speeds up the tax filing process. Instead of mailing paper forms, taxpayers can use tax software or online platforms to prepare their returns and transmit them electronically to the appropriate tax authority. E-filing software often includes features to guide users through the process, perform calculations, and identify potential errors or omissions.

There are several benefits to e-filing. It reduces the likelihood of transcription errors that can occur when manually entering data from paper forms. E-filing also enables faster processing and reduces the time it takes to receive tax refunds. Typically, refunds are issued more quickly for e-filed returns compared to paper returns.

E-filing also increases the accuracy and completeness of tax returns. The software or online platforms often include built-in checks and validations to ensure that required information is provided and calculations are accurate. Additionally, e-filing systems can detect certain errors or inconsistencies and prompt users to correct them before submitting the return.

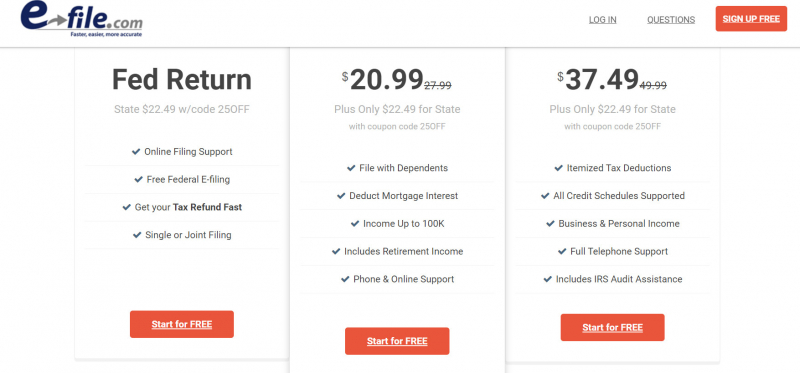

Pros

- Navigation sidebar with installed customer support tools

- Best for simple DIY tax returns

- You can opt for free audit assistance

Cons

- Limited on-demand customer support

- No discount for military members

Released: n/a

Website: https://www.e-file.com/