TurboTax

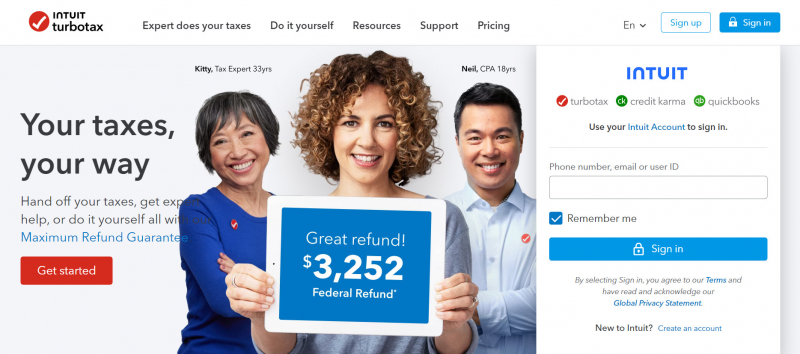

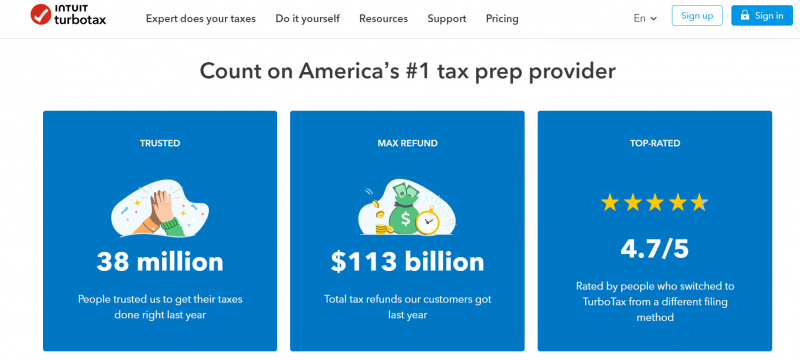

TurboTax is a popular software program used for preparing and filing tax returns in the United States. It is developed by Intuit, a company that specializes in financial and accounting software. TurboTax is designed to guide individuals and small business owners through the tax filing process and help them maximize their deductions and credits.

TurboTax provides a user-friendly interface that simplifies the tax preparation process. It asks a series of questions and prompts users to enter their financial information, such as income, expenses, and deductions. TurboTax offers step-by-step guidance throughout the entire tax preparation process. It helps users identify all the relevant tax forms they need to complete based on their specific tax situation.

TurboTax allows users to import their financial information from various sources, such as W-2 forms, investment accounts, and bank statements. This feature saves time and reduces the likelihood of data entry errors.

TurboTax helps users identify potential deductions and credits they may qualify for, ensuring they take advantage of all available tax breaks. It asks targeted questions to uncover potential deductions based on the user's situation.

Pros:

- Easy import for investment documents

- Report cryptocurrency gains and losses

- Free for active duty, reserve and National Guard members

Cons:

- One of the most expensive online tax software

- Filing anything beyond a simple tax return requires upgrade to paid plan

Released: 1984

Website: https://turbotax.intuit.com/